Save Money When You File Your Business Expense Form

This article will discuss ways to save money while filing your business expense forms. You don’t have to pay high taxes or fees to file a business expense form. If you follow these tips, you can save money and get rid of paper.

When you begin to file your business expense forms, always keep a copy for yourself. When the documents arrive at the office, you can review the paper or photocopy it and save money. You should not do this unless you are totally comfortable with the paper you are printing.

Every year, every business has to have some receipts for these services done at the main office. This can be the time to mail them to the accounting department or the staff. You may have even saved yourself a lot of trouble by mailing them to your main office!

It is easy to print all the old business expense forms so that you have only one copy. Many offices have the ability to print receipts so that you don’t have to make copies. Make sure you have enough paper on hand for the number of receipts that you need to print.

When you send the receipts to the accounting department, you should always send them postmarked. This is especially important if they have to be faxed. Faxing receipts is just a hassle.

Send the receipts to the accounting department at least four weeks before you expect them to be received. During the week that you are expected to pay them, it can take an hour or more to get the paperwork filled out. The last thing you want is for something to go wrong. This will give you time to complete the paperwork and make sure you send everything in on time.

When you have completed the paperwork, you should know that you have your original receipts in your file. Now it is time to find out the income tax that you owe on them. You should be able to calculate how much you need to pay tax on them.

There are a few ways to save money when you get ready to file your business expense form. One of them is to calculate the number of refunds you need and to assign a credit on the tax return for them.

Many business owners like to receive the extra tax and use it to help with their day-to-day expenses. These expenses can include: office supplies, office chairs, and the most expensive of them all, gasoline.

If you are good with math, you can figure out the amount of money you can spend on certain amounts of things. This can be helpful in taking care of your needs while not having to pay taxes.

There are many ways to save money while you file your business expense form. With the information you will find here, you will be able to save a great deal of money in the long run. PLEASE SEE : business expense form template

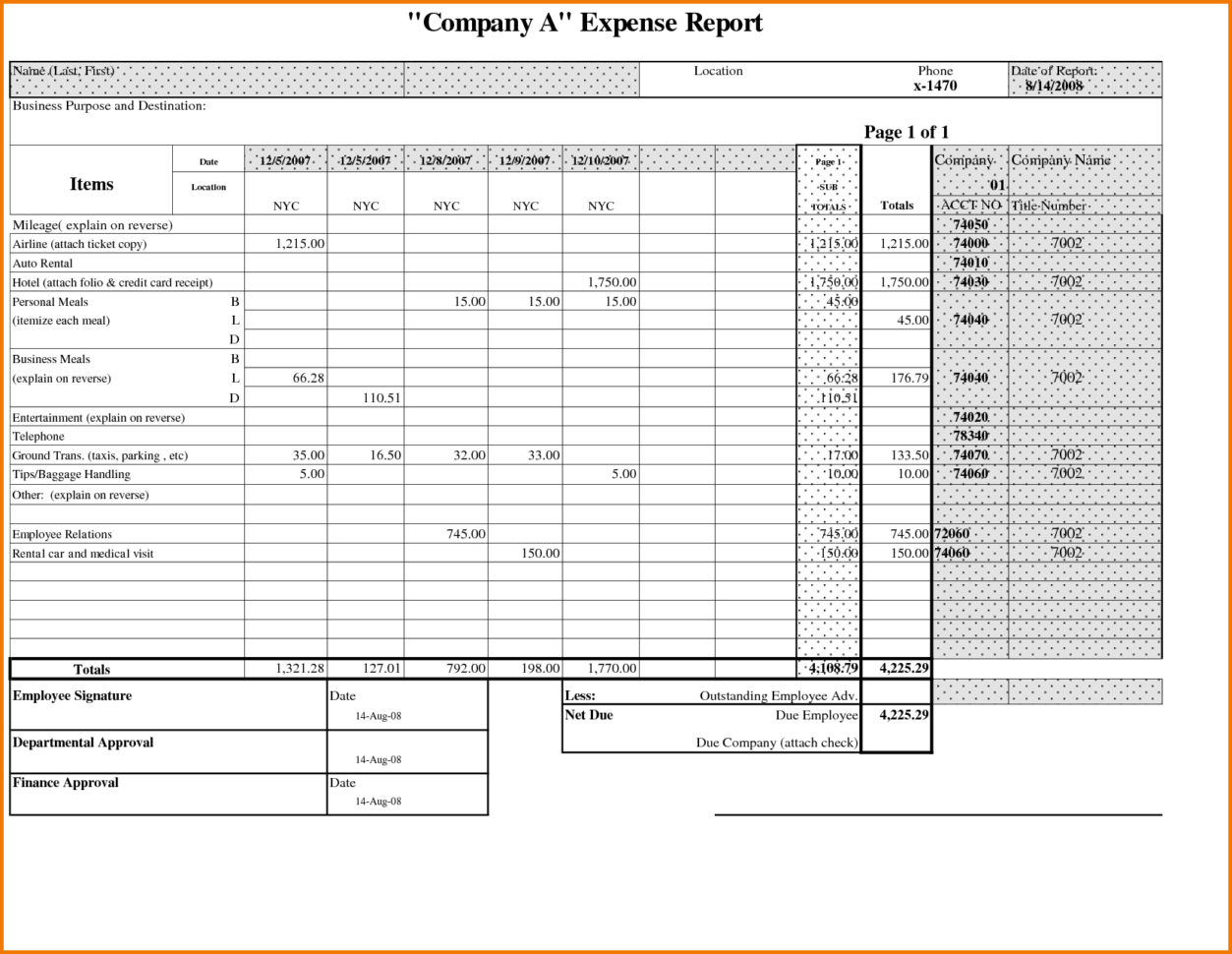

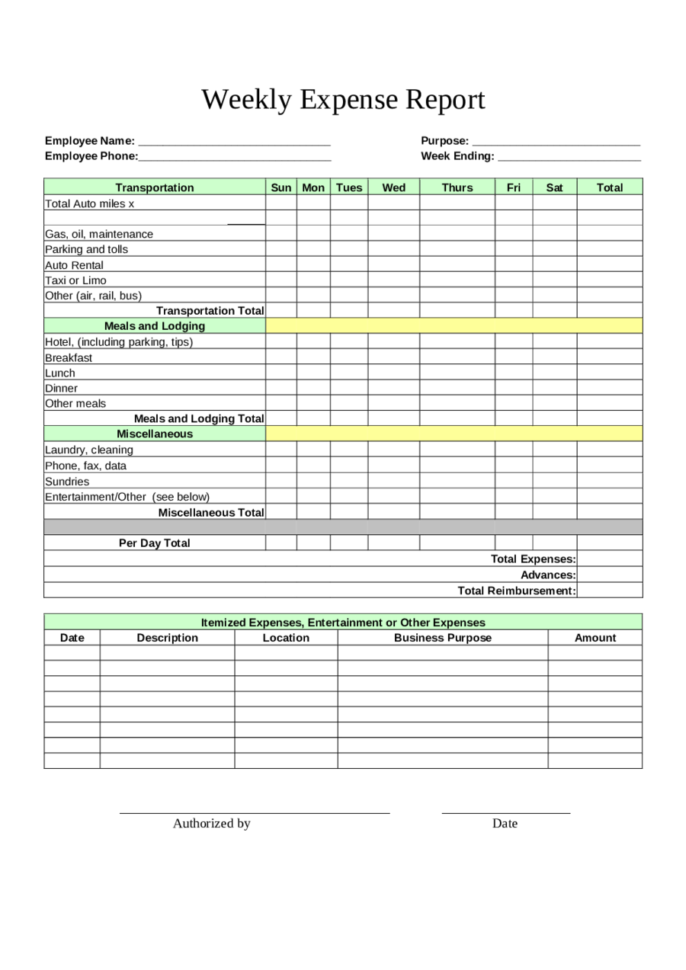

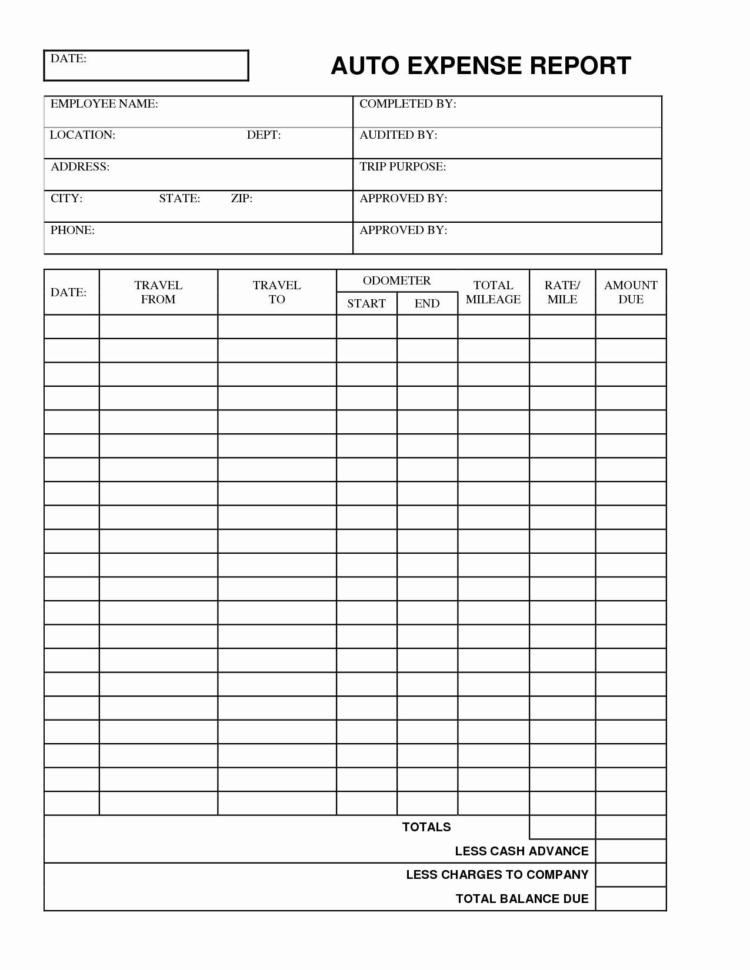

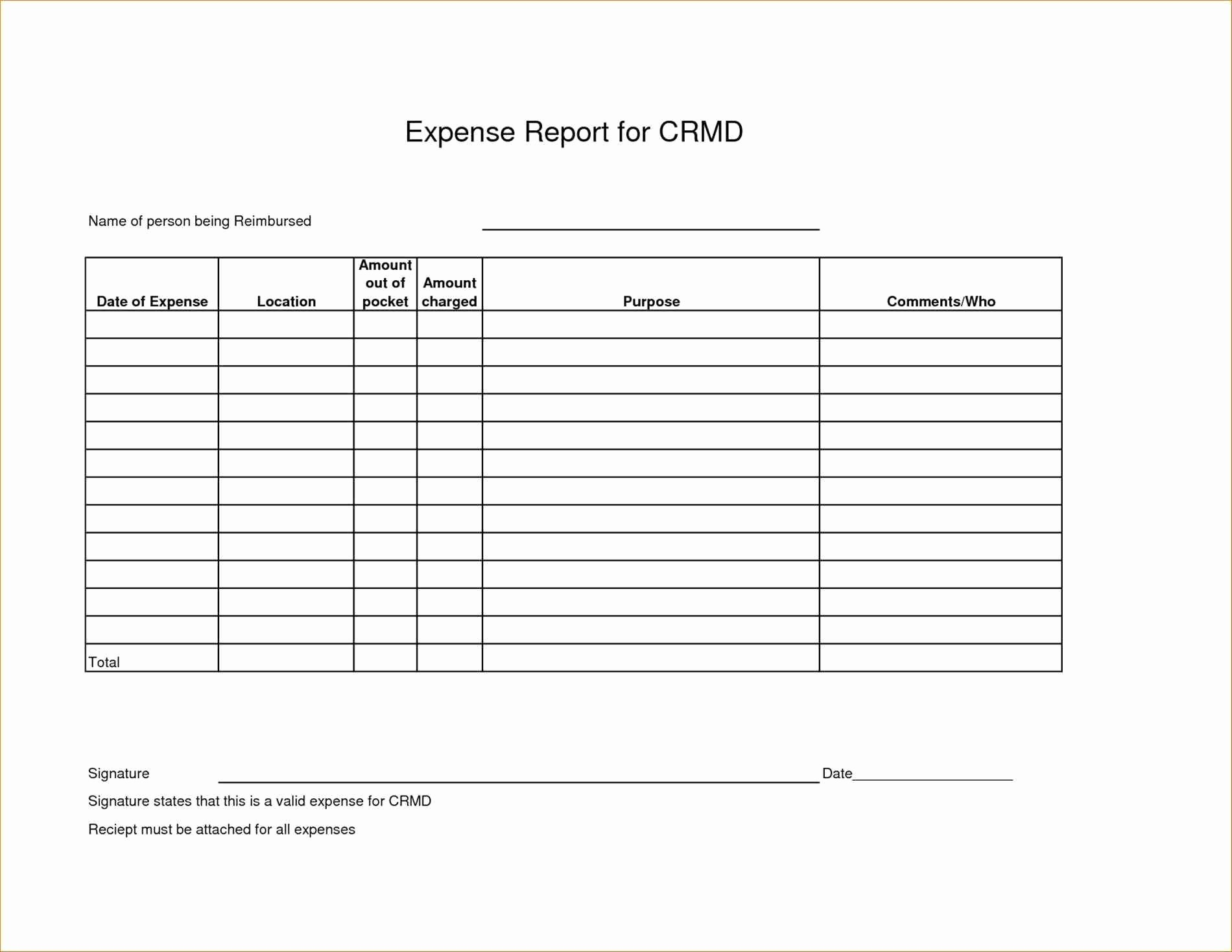

Sample for Business Expense Form Template Free