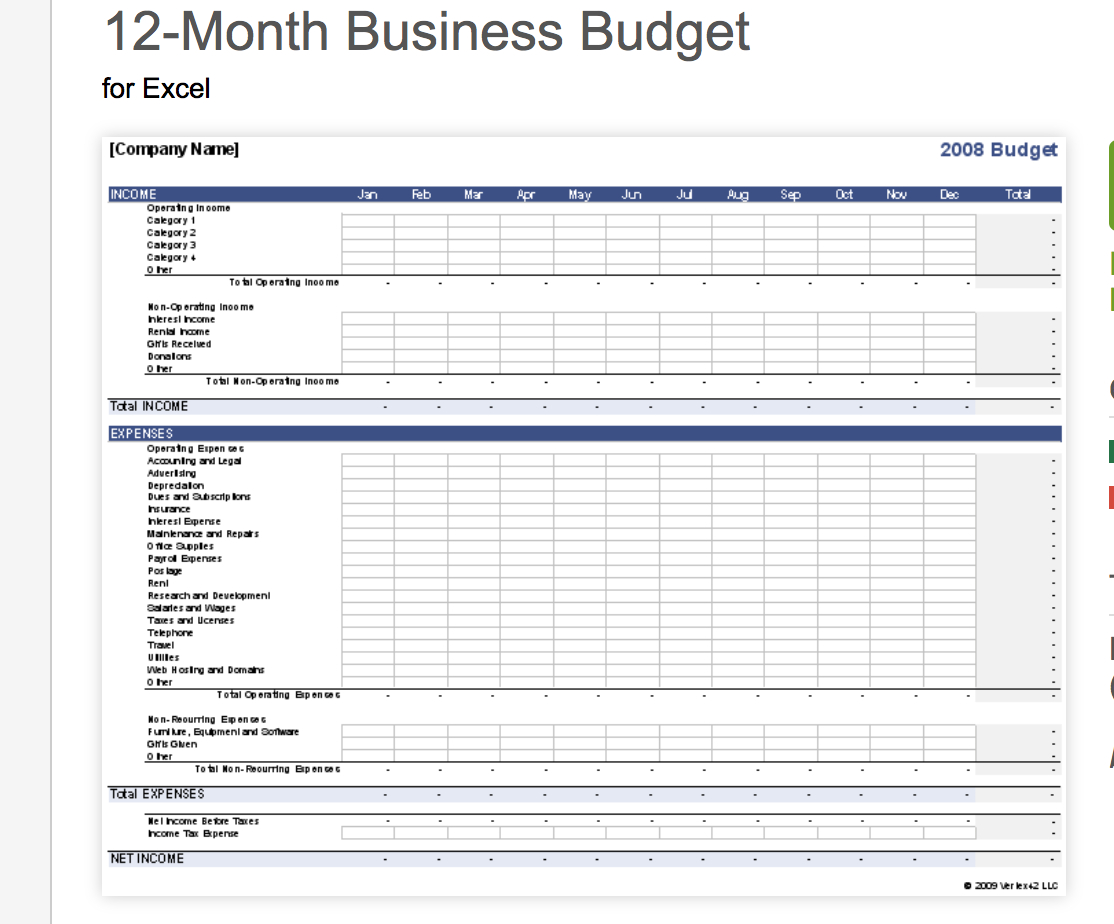

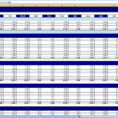

Business Budget Planner Sheets

A business budget planner spreadsheet can be a powerful tool in providing your company with the time, budget, and resources needed to stay on top of the game. Now that everyone is focused on finding the lowest cost option, it makes sense to gather all the information you need to make the best decision on the type of plan for your business. This includes not only the cost but also the amount of time that the plan takes to put together and how it would impact your business.

When compiling your business plan, take into consideration the style and format of the information you will be using, the size of your company, the type of business and function of the company, and the kind of relationships you have with other businesses and suppliers. You may find that depending on these factors, you need to customize the spreadsheet.

Use the budget planner spreadsheet to break down the type of information you are collecting, by subcategory, to provide you with specific categories of expenses and budgets. Once you have narrowed down your research to those categories, it’s time to start gathering data on each one.

If your company generates money from all types of sources, it’s important to remember that you are starting from scratch. Even though there may be several sources of income, the one that generates the most profit will likely dominate the budget plan, especially if the costs associated with these sources are paid for through the company. It’s important to use your budget planner spreadsheet to verify this assumption.

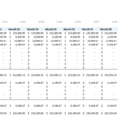

The next important point to consider is that the information will be related to a company’s income or sales. Having this information available will help you determine the most appropriate order to buy products and services. Also, it may help you track the costs associated with purchasing new products as well as the costs associated with replacing ones that become obsolete. Your business budget planner spreadsheet should include this information.

With new products becoming more expensive, it may be prudent to purchase them as a way to offset the higher cost of goods. This can be done by determining the average cost per unit over the current plan, with the purpose of adjusting it. However, this may also mean that new products that the company sells will be on sale. The key to avoiding this pitfall is to first determine the average cost per unit across all product types before making any adjustments.

After you have determined the average cost per unit for each product, you’ll want to determine the company’s goal for revenue. While this may seem obvious, you may find that some companies set their goal based on a certain metric. Others may look to increase overall profits for a period of time. The plan should then account for both the desired goal and the revenue that the company needs to generate for this period.

You’ll also want to determine the method you are going to use to implement your price strategy. While it may seem obvious that you will sell the products at a price that’s lower than its expected profit, you may find that many companies choose to sell them at a discount. Again, this is based on the average cost per unit and will likely include some adjustments as the price drops.

One factor that is often overlooked is the pricing structure used for product and service purchases. Depending on the specific product and the type of business, the price could be higher than the cost per unit. Your budget planner spreadsheet can provide information on this, as well as the pricing structure for the vendor you’re working with.

If you are raising money from investors, you’ll want to consider the various options you have, including the option of selling the products at different prices, for different periods of time, with different pricing structures. The point is to come up with a solution that will provide you with the best return on investment, while still meeting the goals set forth by your investors.

Use the budget planner spreadsheet to consolidate your information and make decisions for the future. While this may seem overly simplistic, it can really help you make your decisions and create a strategic plan that can help your company maintain or even improve the level of profitability. YOU MUST READ : business activity statement spreadsheet template