Whispered Budgeting Spreadsheet Template Secrets

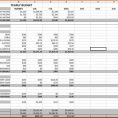

Budgeting Spreadsheet templates aren’t the ideal solution for everybody, but they are able to help you better your finances so long as you are devoted to using a budget and pick a template that’s simple to work with. Even though the template is quite easy to comprehend, people will need to work it on regular basis. You are able to go through our well documented templates before selecting the most suitable one for your enterprise. There are an assortment of completely free budget templates accessible to fit your requirements, while it’s for college students, parents with children in daycare, single-income households, and so on. If you’re searching for a fast and efficient solution, you may download a completely free budget spreadsheet template to get you started then, you can simply fill in your numbers. To begin, you may use my completely free personal budget spreadsheet template in Excel to track your earnings and expenses utilizing a frequent set of budget categories.

How to Get Started with Budgeting Spreadsheet Template?

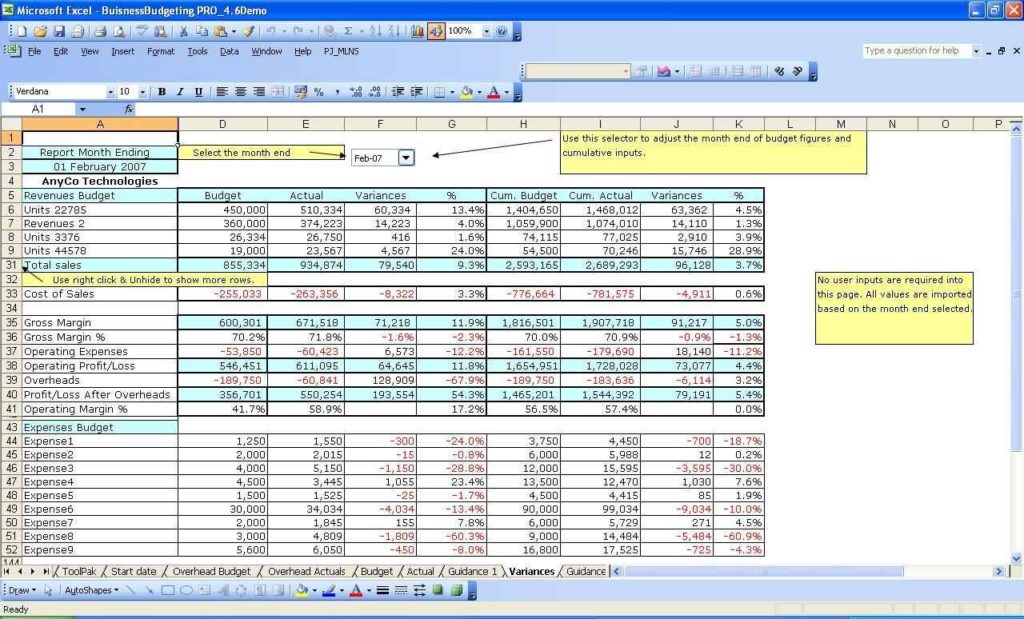

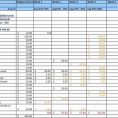

The spreadsheet makes it possible to in setting some savings goal too. It should have plenty of room to add expenses as necessary. The highend spreadsheets are designed professionally to fulfill your organization needs and be used for a variety of assignments. By the way, as you could be on the lookout for a personal budget spreadsheet, you might wish to consider reading a book on personal finance.

If you’re going to begin employing a spreadsheet, get into the practice of active budgeting and produce a system which ensures you may keep your numbers updated and accurate. If your spreadsheet has any sort of self-promotion, you are going to be banned. To consider whether budgeting spreadsheets are correct for you, you want to thoroughly weigh the advantages and disadvantages of using them. Employing a budgeting spreadsheet to receive organized and enhance your finances may sound like a good option to some folks, while others might be apprehensive.

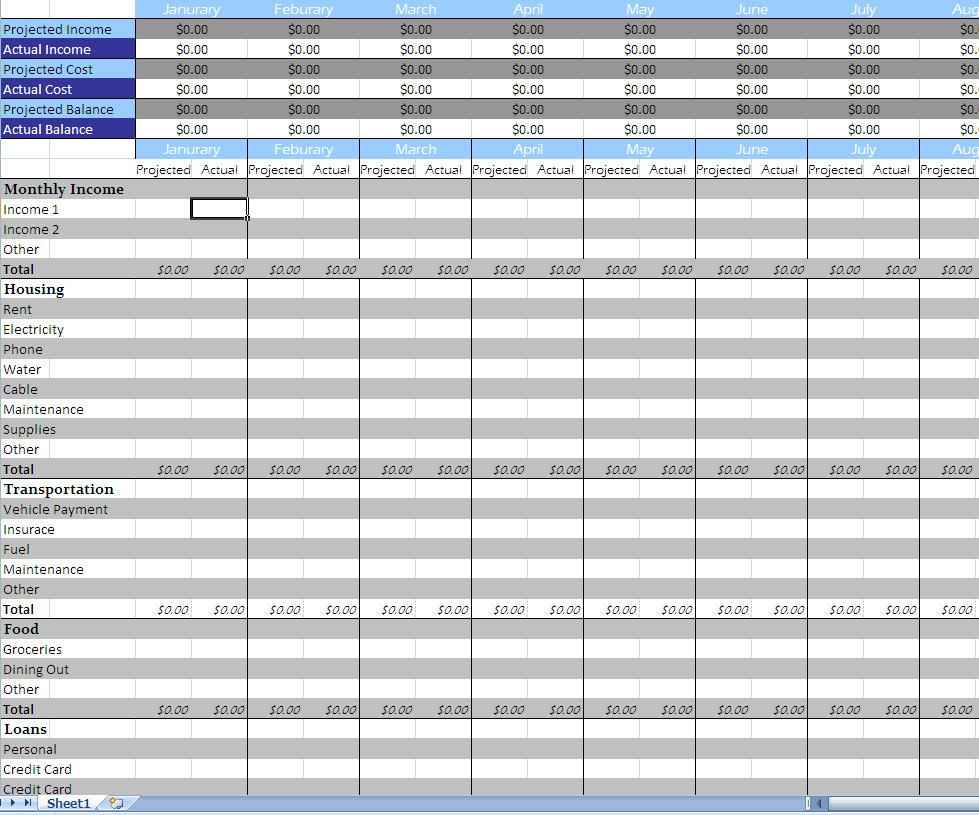

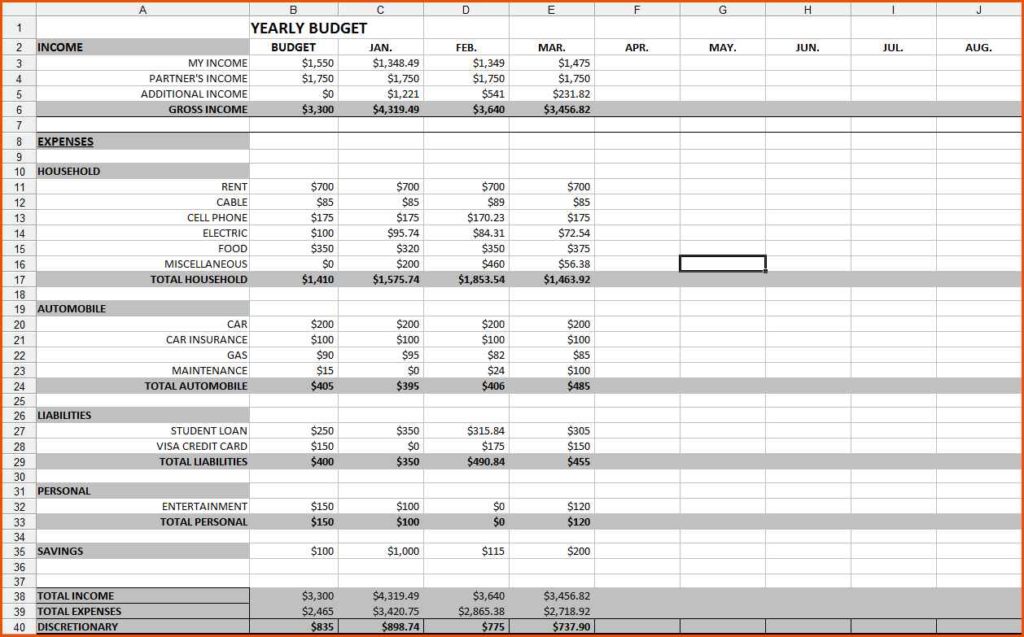

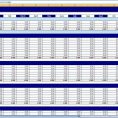

If you would like to plan, track and graph spending as time passes, you may want to use the EVM template. A yearly budget program is designed dependent on the organization’s necessity. A blank yearly budget program is a plan which is made by institutions regarding all the expenses that are anticipated to happen in the upcoming year at the onset of every year.

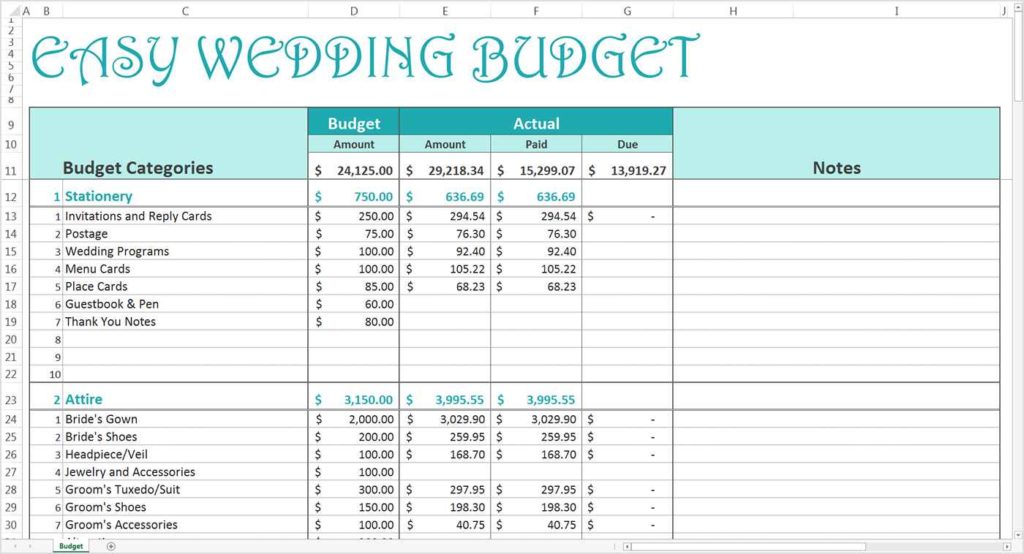

Make it happen and finish the budget. When you are making a household budget it’s important to have a different category for each expense in your budget to be certain you are going to have an accurate budgeting worksheet. Putting a budget together needs a resource that assists you to organize your finances. Maybe you’re interested in developing a budget for monthly small business expenses or company projects. Your very first budget should truly be simple to manage and keep up with to assist you in getting a handle on your finances. A new budget has to be completed for each and every month and therefore don’t become lazy and assume that each and every month is going to be the exact same. Possessing a working budget in place will allow you to identify precisely where you stand with your finances.

Budgeting doesn’t need to be an arduous undertaking, however, due to the power of budget spreadsheets. Monthly budgeting is a typical challenge. Heck envelope budgeting was a lifestyle in their opinion.

To get back on the right track, your finances must lead the way you live, not vice-versa. If it comes to managing your finances, obtaining a good budget in place is critical. Perhaps it’s similar in regards to personal finances. It is vital to categorize your individual finances as it can help to streamline your cash flow.

The Ideal Strategy to Budgeting Spreadsheet Template

Now you are aware of how much money you need to spend on various items, the objective is to make it as easy as possible to understand how much cash you’ve got available. Obviously, there are lots of various ways you’re able to budget money, based on your income supply, family size, and the degree of visibility you want into your finances. Make certain it’s available even in case you’ve only 1 in it, and check how frequently you can withdraw your cash. Expenses come up and if they do, you wish to be certain you have more than enough money to support yourself. Controlling small expenses will permit you to devote your money rationally, setting your goals will let you save, and a systematic approach can help you to figure out where your hard-earned money goes. Non-monthly expenses are expenses which don’t happen each month, yet are expenses you know will eventually happen. The aspects which people wish to separate like the price of the labor, the price of the material which is going to be use in the undertaking, the price of new appliances that individuals wish to grow their home and so forth. LOOK ALSO : Budget Spreadsheet Template Mac