Who is Discussing Free Simple Bookkeeping Spreadsheet and Why You Should Be Concerned From our example, you can add a few things you might need to finish your spreadsheet. Sample bookkeeping spreadsheet If you’ve obtained such abilities, make certain that you record them at the resume and you’ll certainly stick…

Category: Bookkeeping

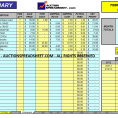

Simple Bookkeeping Spreadsheet Excel

Why You Should Consider Using an Excel Bookkeeping Spreadsheet Excel is an excellent business software program and has an extensive feature set that you can use to keep track of your finances. However, if you want to take advantage of the numerous options it offers in your budgeting toolkit, you…

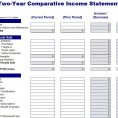

Free Bookkeeping Templates

Bookkeeping Spreadsheet For Small Business

Bookkeeping Spreadsheet For Small Business – Bookkeeping Checklist If you are looking for a bookkeeping spreadsheet for small business, you should consider these guidelines. The three most important elements of any good bookkeeping sheet are the accurate records of your cash flow, the schedule of transactions and the effective management…

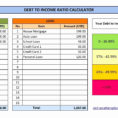

Household Bookkeeping Template

How to Use the Best Household Bookkeeping Template To ensure that you are using the best possible financial management systems, the best household bookkeeping template is one of the most crucial things you can use. For example, if you are struggling to make ends meet and have decided to file…

Free Bookkeeping Template

Fraud, Deceptions, and Downright Lies About Free Bookkeeping Template Exposed You may use our templates above. Actually you’re welcome to use all the bookkeeping templates you find here in any manner which suits your requirements. When you download templates you are able to set the parameters so the software does…

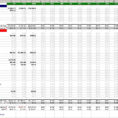

Monthly Bookkeeping Template

Life After Monthly Bookkeeping Template Top Monthly Bookkeeping Template Secrets Well… because it is a ton simpler to start off with templates. Actually you’re welcome to use all the bookkeeping templates you find here in any manner which suits your requirements. Templates also permit you to include miscellaneous details about…