Bookkeeping Questionnaire Template Bookkeeping questionnaire templates can be a very useful tool for your business, especially if you have to conduct a lot of it. Just think, how much time can you save in trying to prepare a bookkeeping questionnaire? You need to give the list of employees in your…

Category: Bookkeeping

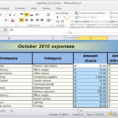

Bookkeeping Expenses Spreadsheet

How to Use a Bookkeeping Expenses Spreadsheet If you have a business or are thinking about starting one, you need to be aware of what bookkeeping expenses you can easily calculate on your own and what your personal bookkeeping expenses may be. Too many entrepreneurs forget this. That is why…

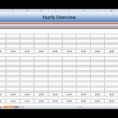

Double Entry Bookkeeping Template Spreadsheet

Using a Double Entry Bookkeeping Template – Tips A double entry bookkeeping template spreadsheet allows you to keep all your income and expenses all in one place. It is a spreadsheet that is split into three sections: accounts, transactions, and workbooks. By using this template, you can keep all your…

Bookkeeping Checklist Template

Bookkeeping Checklist Template – What Are the Pros and Cons? You may have had a lot of questions regarding bookkeeping checklist templates, and whether they are good or bad. There are some pros and cons to the checklist, but do not let these be the deciding factor in your decision….

Free Bookkeeping Templates For Small Business

Benefits of Using Free Bookkeeping Templates For Small Business Free bookkeeping templates for small business are the latest trend in the industry. Because of the many advantages that it offers, it has become a preferred method by many new and existing businesses. The first advantage is that it can cut…

Bookkeeping Website Templates

Bookkeeping Website Templates – Learn How to Create Effective Bookkeeping Website Templates For Professional Services With the number of people becoming more interested in creating a personal or business, their information online is becoming an important component of their way of living. But creating such website will require careful planning…

Bookkeeping Engagement Letter Example

Bookkeeping Engagement Letter Example – Let Your Personal Experience Help You Write a Bookkeeping Engagement Letter Writing a bookkeeping engagement letter is one of the easiest things to do in business, and one of the most difficult things to do in business. The first question that comes to mind when…