Bookkeeping For eBay Business Starting up a business does not come without having to do the business like bookkeeping for eBay. This is especially true for people who want to start their own eBay business and are well aware of the numerous regulations that need to be followed to ensure…

Category: Bookkeeping

Monthly Bookkeeping Spreadsheet

Monthly Bookkeeping Spreadsheet – What Is It and How Can It Help Me? One of the advantages to using a monthly bookkeeping spreadsheet is that it allows you to track time and also make sure that you are doing everything that you can to reduce the stress associated with cash…

Landlord Bookkeeping Spreadsheet

The Debate Over Landlord Bookkeeping Spreadsheet Details of Landlord Bookkeeping Spreadsheet Business proprietors frequently have to juggle a great deal of hats. It’s dangerous, for small business proprietors to assume they won’t need regular advice from an experienced accountant or tax advisor. A landlord is allowed to claim a level…

Small Business Bookkeeping Spreadsheet

Using a Small Business Bookkeeping Spreadsheet Software Small business bookkeeping can be difficult. This is why, in these difficult economic times, so many businesses are starting to use small business bookkeeping spreadsheet software. If you’re not yet familiar with the methods of making good financial decisions for your business, this…

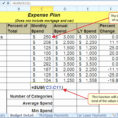

Bookkeeping Excel Spreadsheet Template Free

Bookkeeping Excel Spreadsheet Template Free – How to Choose a Good One There are lots of spreadsheet templates for free downloads, but the fact remains that there are actually quite a few to choose from. When making a decision, a person should be aware of these basic things to look…

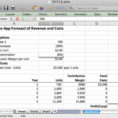

Small Business Bookkeeping Spreadsheet Template

How To Save Time And Money With A Small Business Bookkeeping Spreadsheet Template A small business bookkeeping spreadsheet template can save you time and money in completing your bookkeeping task. It is important to have a proper bookkeeping software system in place because you don’t want to get into a…

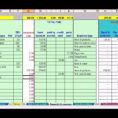

Bookkeeping In Excel

Bookkeeping in Excel Bookkeeping in Excel is a very popular and easy-to-use application for companies to manage their books. Most large companies don’t bother with accounting software at all and continue to rely on this little program for accounting purposes. However, accounting software can be a very complex and laborious…