How to Use a Bookkeeping Expenses Spreadsheet

If you have a business or are thinking about starting one, you need to be aware of what bookkeeping expenses you can easily calculate on your own and what your personal bookkeeping expenses may be. Too many entrepreneurs forget this. That is why it is important that you begin by making use of a bookkeeping expenses spreadsheet.

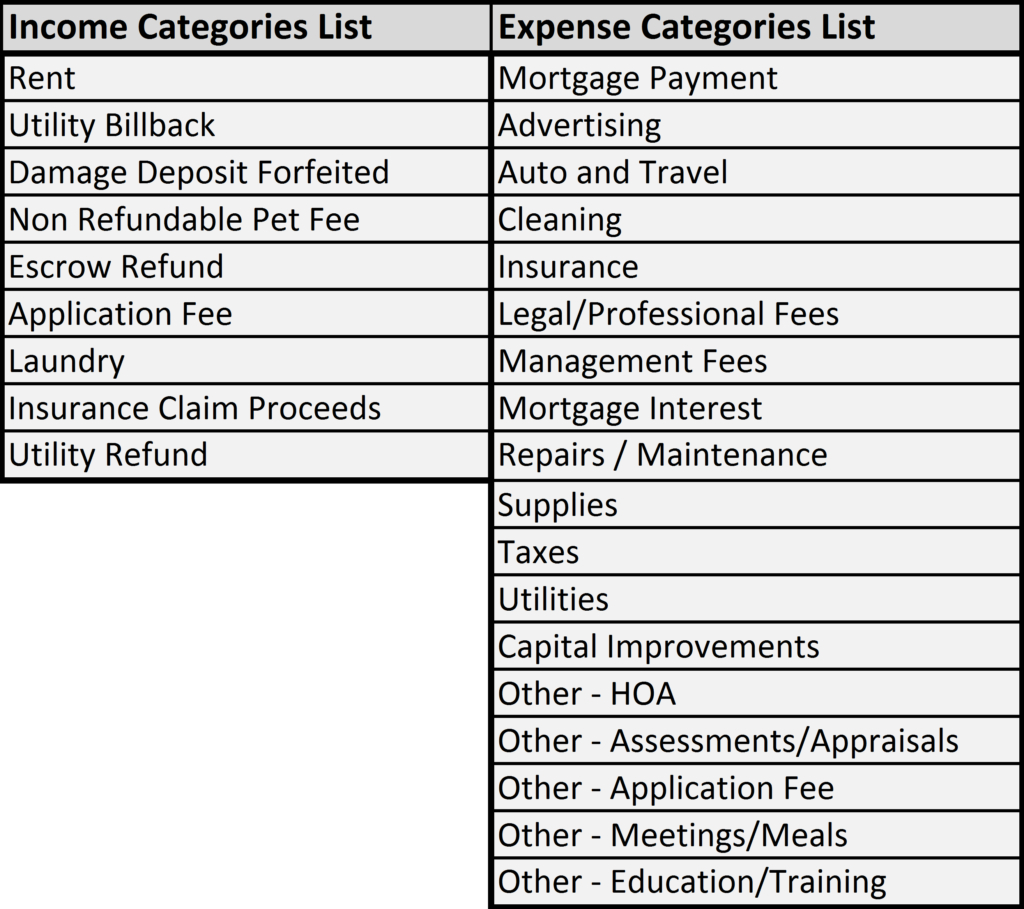

You have to make a separate record for each of your employee benefits. For example, if you are offering health insurance, do you offer an individual deductible or family? Do you need to pay taxes on the premium or the actual cost of the insurance? Does the deductible you offer still apply if you choose to get a high-deductible plan?

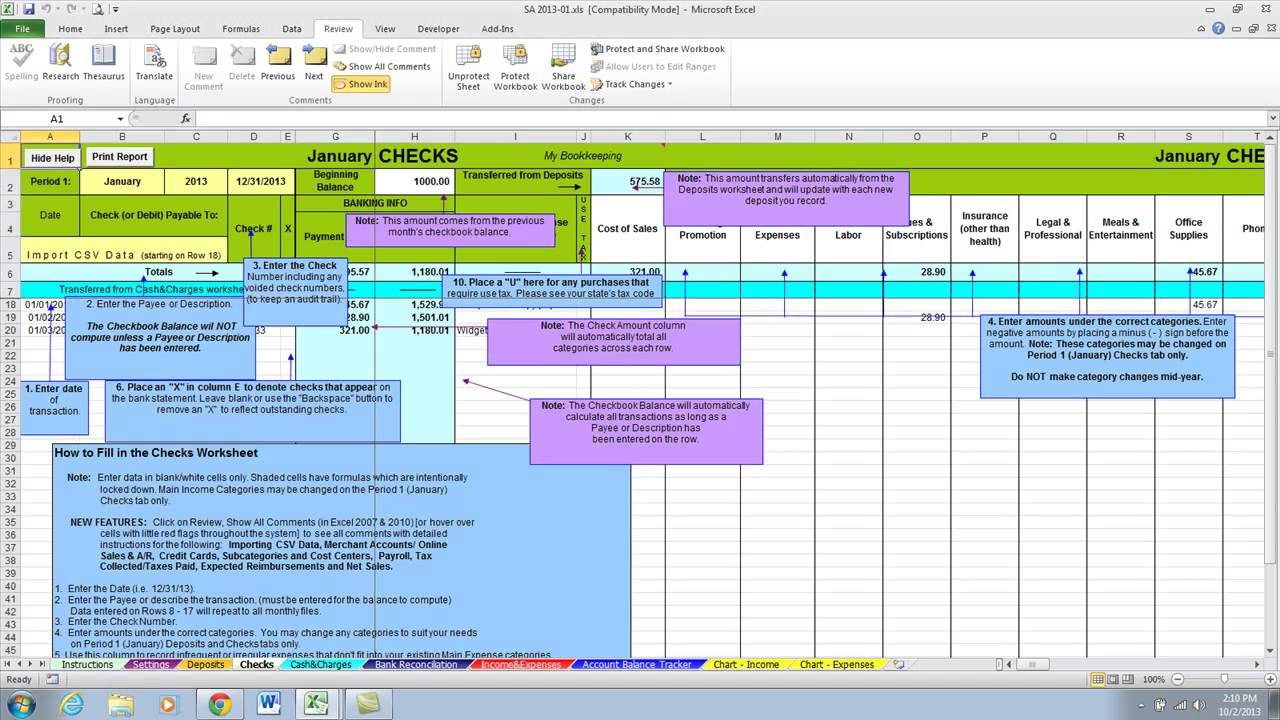

There are a variety of bookkeeping expenses that could help you prepare for this kind of information. Most people simply look at the paycheck to determine how much they should deduct from their paychecks. But that only considers how much they will spend, not what they will save. It is obvious that the more you save, the more you will be able to save, but that only goes so far.

Most of us spend a big expense in car repairs when we need to go somewhere and have to stop at the gas station. That can add up, and there is no real way to quantify that. How about you set up a different spreadsheet for your car costs and make sure you do not waste money on gas.

Some of your biggest expenses may be needed later. Maybe you will get a mortgage, and it is quite possible that you will need the money in the future. It is possible that you can even get a second mortgage from the mortgage company.

If you have taken out a home equity loan, then you have made some money from interest, but now you are carrying that with you and then in due time you will have to pay the tax liability. How about setting up a separate expense for this? You can do this for all of the loans you take out, including car loans.

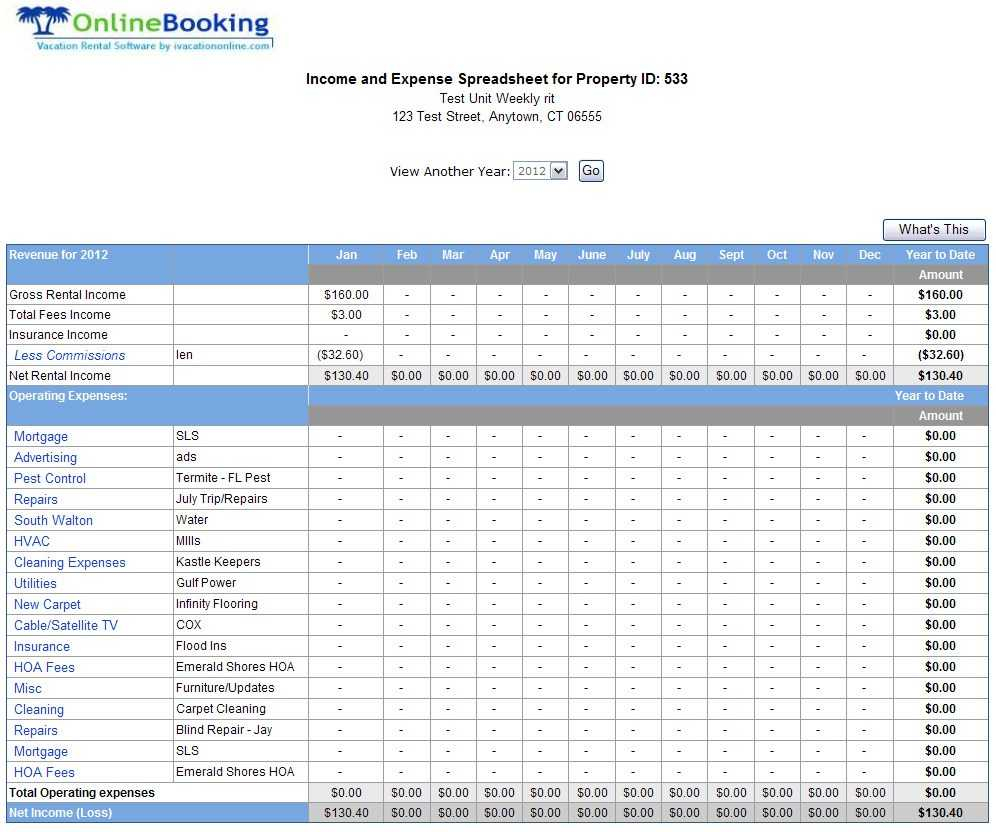

A bookkeeping expenses spreadsheet can also help you figure out your percentage of the sales that come from outside sources. Many people do not realize that they may be receiving commission payments from suppliers who may have just placed an order for products to be delivered. A bookkeeping expenses spreadsheet can help you figure out how much of the sales that have been coming from outside sources are actually coming from your own staff.

Also you may have to keep track of sales and orders for goods that are not sold at your store, but come into your store every day or every other day. The easiest way to do this is to have each customer deposit cash, and you can keep track of how much cash they pay in. If you don’t keep a record of this information, you could wind up paying back more than you should, which will reduce your profits.

Supplies are also another area where you will need to keep track of. If you have a store you will probably be selling paper clips, but what about snacks or a bag of potato chips? This will help you track how much money you are spending on supplies in advance.

Another factor that can affect your financial statement is your gross profit. What this means is that you will want to make sure that all of your profit figures include all the money you have spent on the supply cost of the items sold. If you do not have a separate column for this, you will wind up having to write a lot of numbers and adding more work to your budgeting task.

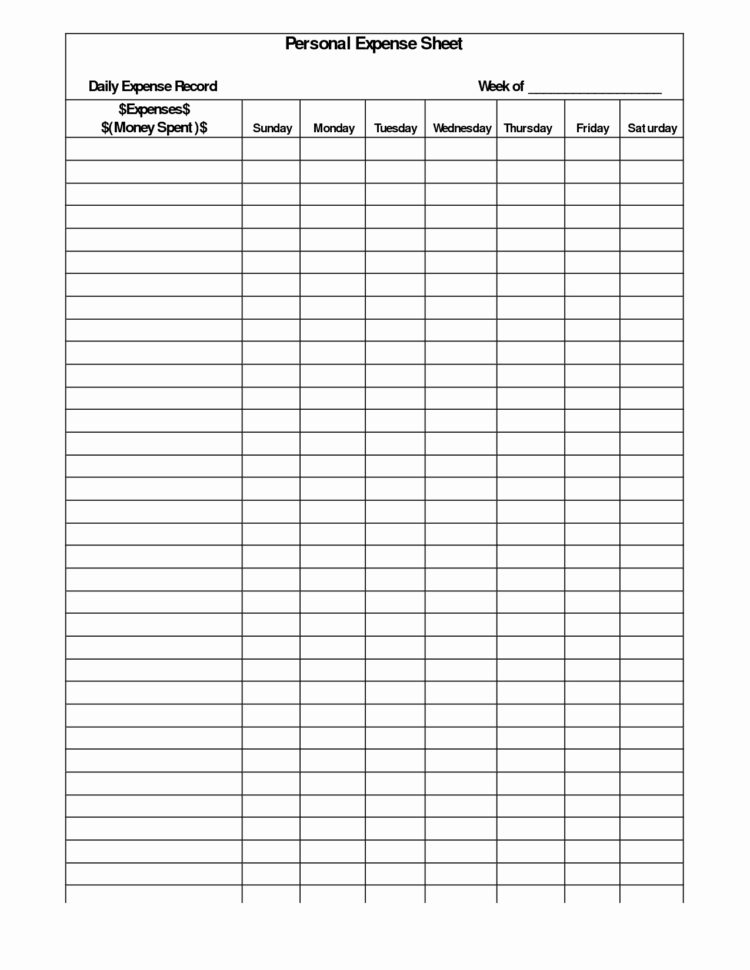

Keeping a bookkeeping expenses spreadsheet is a great way to ensure that you can track what you spend money on. If you do not use one, you could wind up spending more on your budget than you would like to. YOU MUST LOOK : Bookkeeping Excel Template Uk

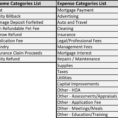

Sample for Bookkeeping Expenses Spreadsheet