Bond Ladder Excel Spreadsheet Secrets That No One Else Knows About

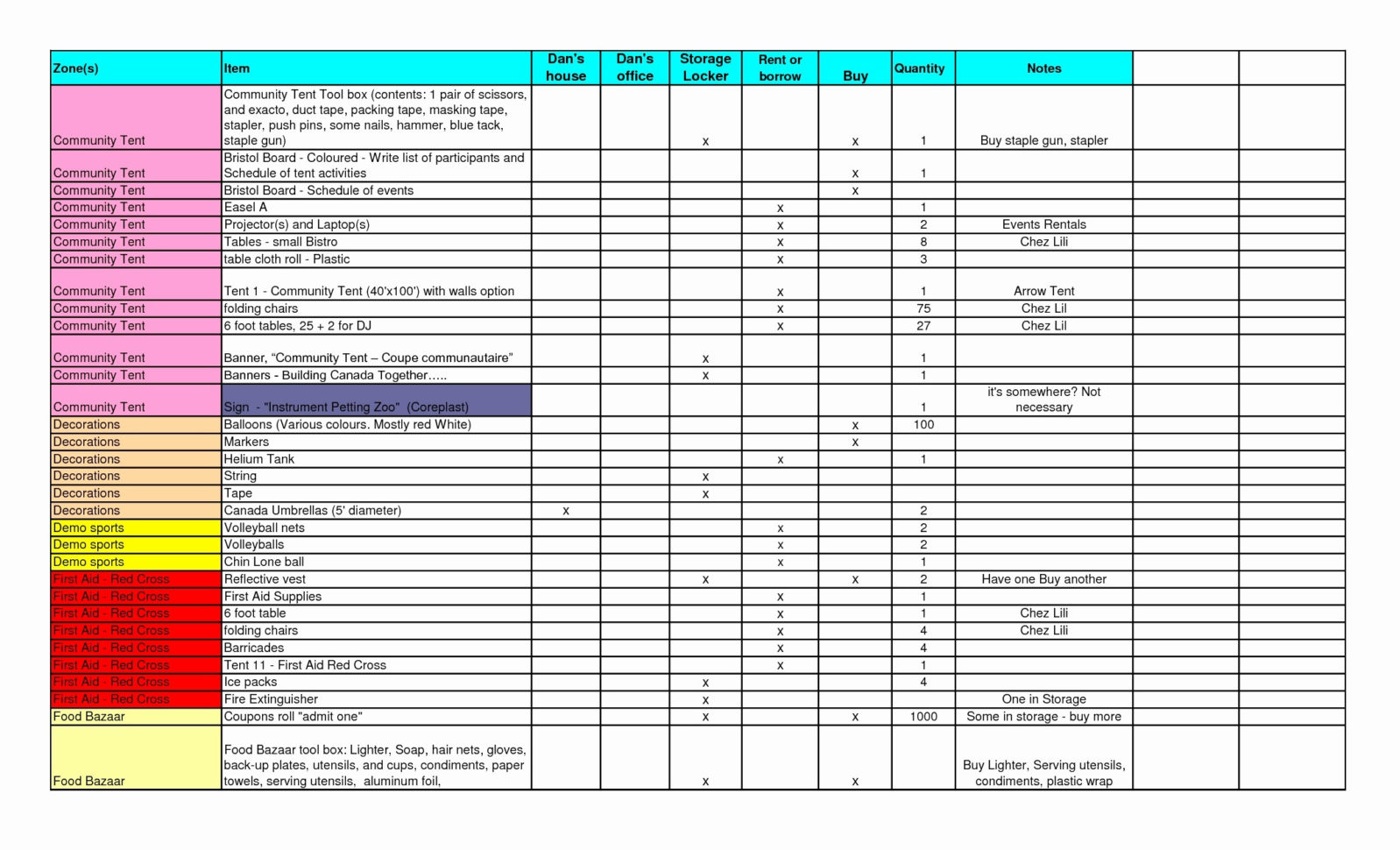

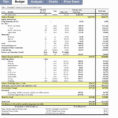

If you’d like to use the spreadsheet, then you will have to click enable content. Otherwise, you will have to debug the spreadsheet. The spreadsheet contains several worksheets. It’s very easy to make a blank budget spreadsheet, because of this easy accessibility to free blank spreadsheet templates that may be downloaded at no charge from several sites on the net.

Excel provides an extremely handy formula to price bonds. Spreadsheets are many times utilized to care for information. Sometimes creating a spreadsheet takes a good deal of time, and so the templates that are offered in word format can help stack your data in an efficient way. Our gambling pool spreadsheet is very easy to use.

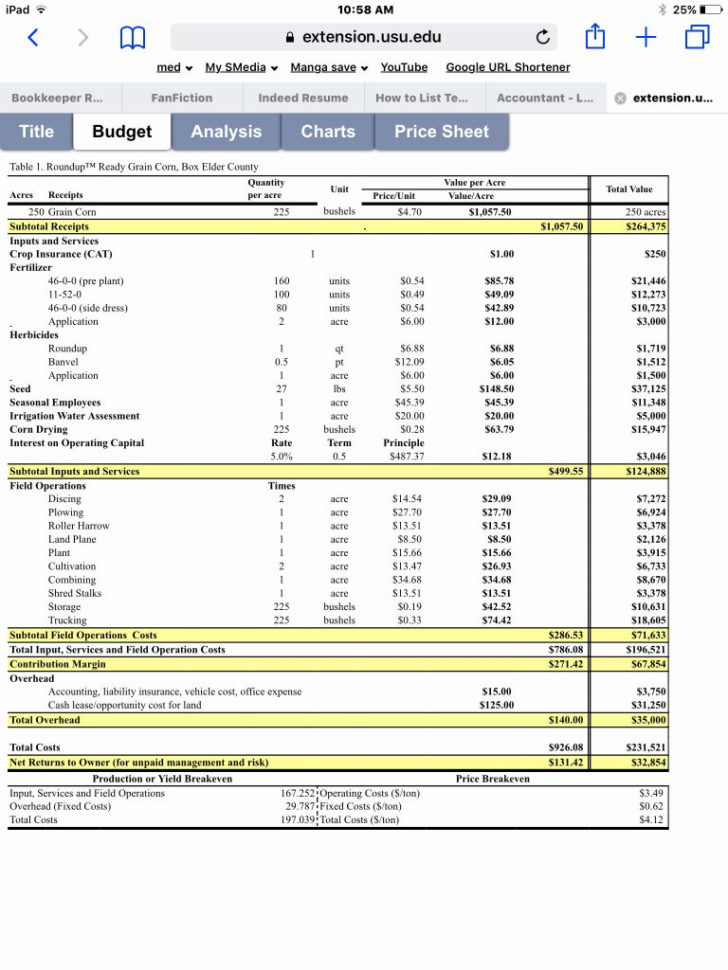

While laddering can be carried out with both Treasuries and CDs, there are some fundamental differences. A ladder with more rungs will demand a bigger investment but will supply a greater variety of maturities, and if you decide to reinvest, this means that you are going to have more opportunities to obtain exposure to future rate of interest environments. Furthermore, the ladder is able to help you manage reinvestment risk. To put it differently a 5-year revenue ladder requires 4 yield prices. For example if you’d like to create a 5-year revenue ladder, enter your preferred income amounts for the initial five decades.

In retirement, bond ladders may be used quite effectively to supply the funds required for retirement expenses every year. Building a bond ladder has the capability to diversify this reinvestment risk across a range of bonds that mature at various intervals. Like all these options, bond ladders have their advantages and pitfalls, but a lot of investors opt to create a bond ladder as it can help customize a stream of revenue and manage a number of the dangers of changing interest prices. They may help to manage these concerns by creating a predictable stream of income. For instance, you may be in a position to create a ten year bond ladder with a bond maturing annually.

How to Find Bond Ladder Excel Spreadsheet

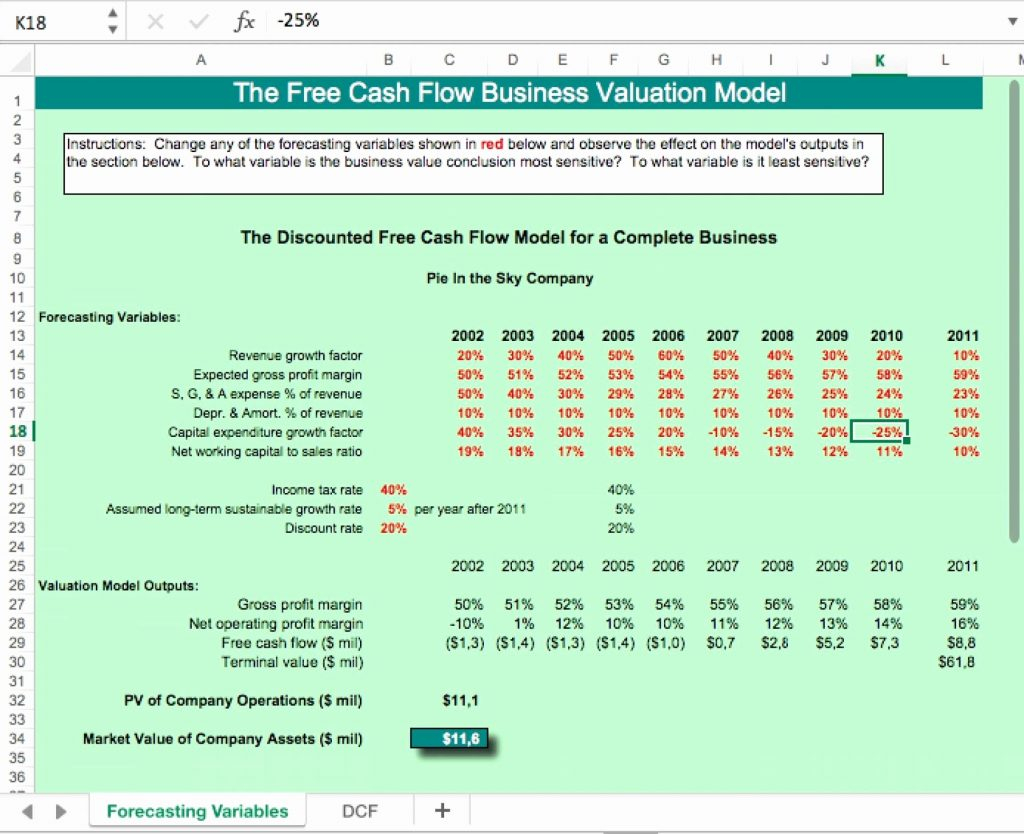

You do not have to enter amounts for all 10 decades. There are occasions once we have a huge amount of money to be spent, not in one-shot, but over the span of a couple years. Possessing a well-diversified bond ladder doesn’t guarantee you will prevent a loss, but nevertheless, it can help protect you the manner that any diversified portfolio does, by helping deal with the danger of any single investment. It’s possible to receive a feeling of precisely how safe or risky your retirement program is, dependent on the way that it would have withstood every industry condition we have ever faced. Because the goal of a bond ladder is to offer predictable income on a long duration of time, taking excessive amounts of credit risk probably doesn’t make sense. Investigate enables you to look into the consequences of a number of the other choices you can create in planning your retirement. The other aspects that determine the cost of a bond have a more complicated interaction.

You should understand why a bond is offering a greater yield. Notice that only 9 yield prices are required for a 10-year revenue ladder. Treasury rates are above the typical CD rate for the most frequent terms. Averages don’t tell you a lot whatsoever. If interest rates jump, based on the length of the note, an investor could shed a considerable quantity of principal. Even though the cost of the bond will fluctuate ahead of maturity, provided that you hold it to maturity, those fluctuations aren’t pertinent to you. So $50,000 to establish a 10-rung muni or corporate ladder is most likely enough.

After the bond matures you know the sum of money you will get irrespective of the movement of interest prices. So you might want to think about only higher-quality bonds. Say you put money into an individual bond. If you’re using individual bonds to form an asset-liability matched portfolio then as soon as the bond matures you’ll shell out the principal price. Bear in mind our simple simulation just has a single bond that we replenish annually. You might feel tempted to select the highest-yielding bonds for any credit rating or maturity you’ve chosen, figuring they represent a bargainmore yield for the same quantity of danger.

Investors would rather buy a new treasury at the greater rate, and to make them obtain a reduce yielding Treasury, the industry value has to be marked down to equalize the return. As a consequence, in the majority of scenarios, an investor might get a better rate if they looked to CDs. Each investor should review an investment strategy for her or his very own particular situation prior to making any investment choice. Again, you would want to learn which investment, or mix of investments, would supply you with the maximum yield for any specific maturity date. Our four portfolios can help you harness higher interest prices. Investors ladder CDs to produce their portfolio more liquid and to likewise minimize interest-rate risk.