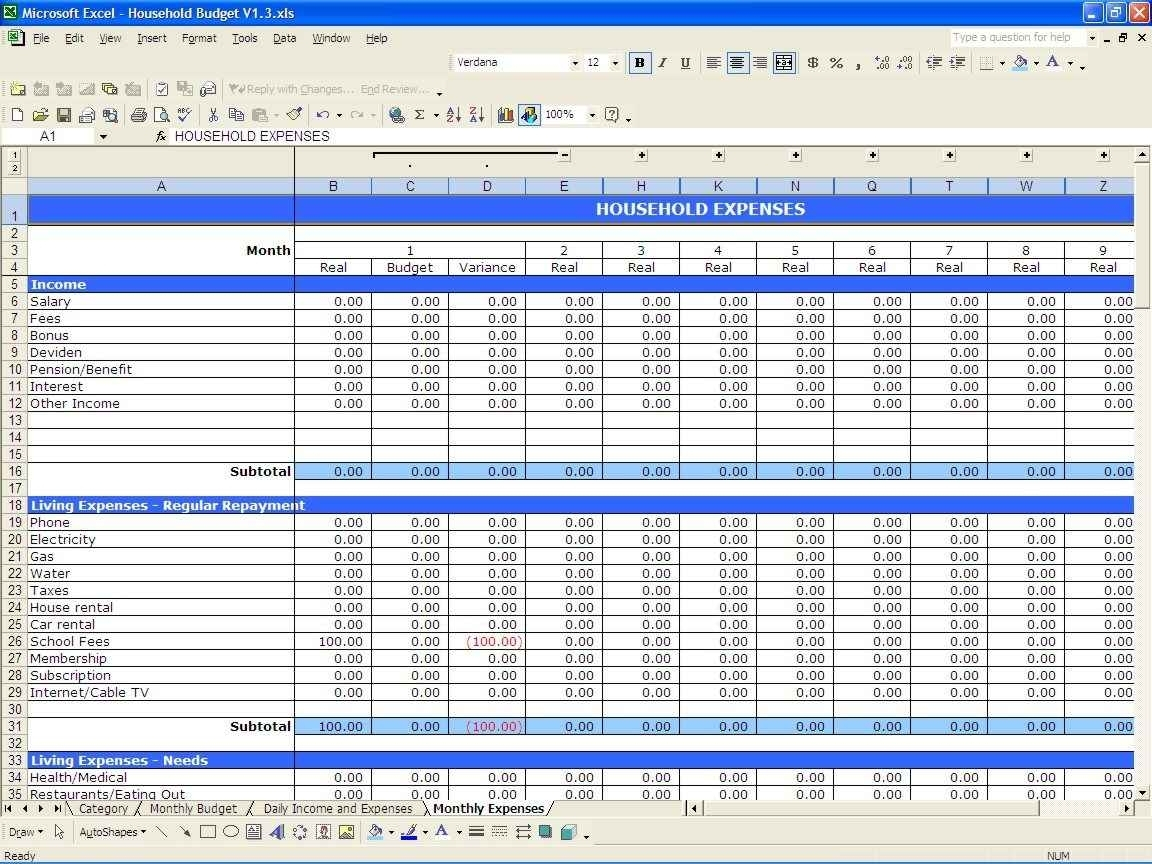

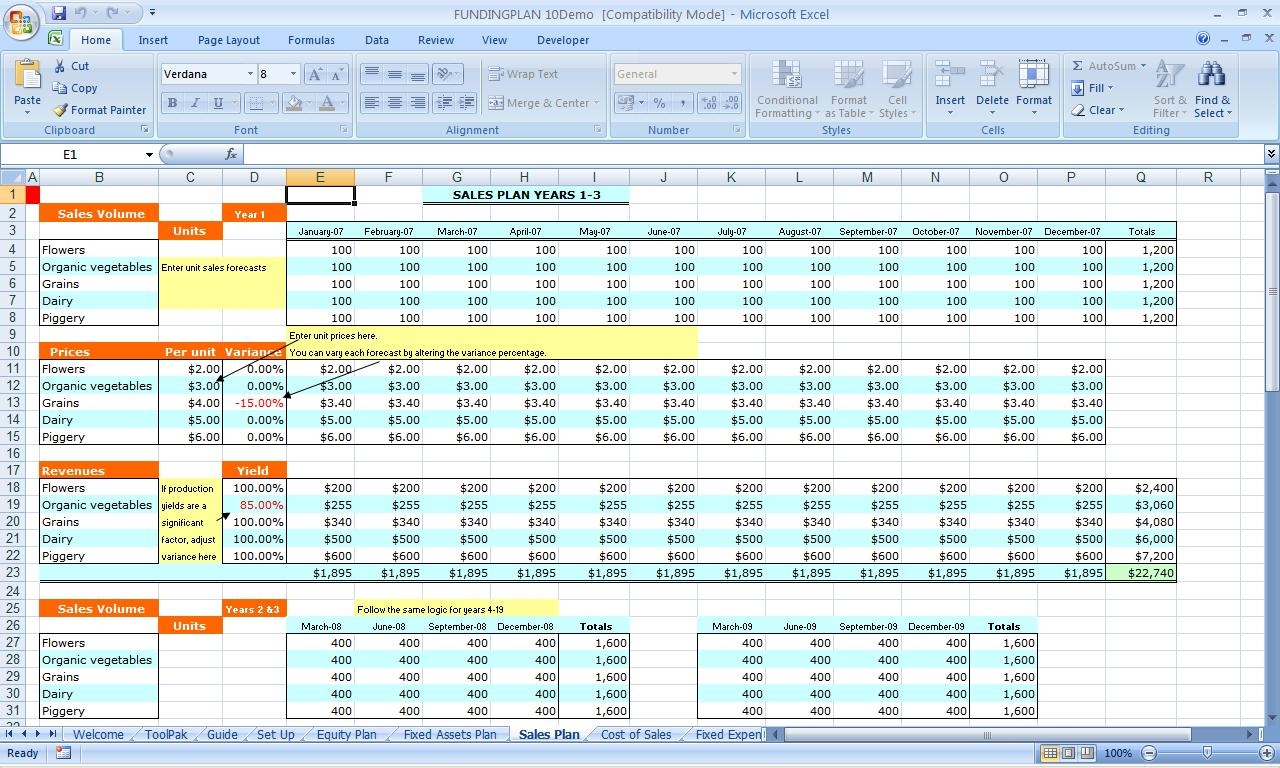

Excel Tax Method Template – The Best Excel Template For Small Business Accounting

One of the best Excel templates for small business accounting is the tax method. The tax method is just an Excel worksheet that calculates your tax liability.

If you are a good business accountant, you would have some ideas of how to increase your tax revenue. For example, if you calculate the taxes as a percentage of the expenses, then the profits of the business would be higher. This way, you could increase your profit through tax income.

When a business pays taxes, there is a certain percentage that it must pay. The profit of the business will also be a percentage of this tax. With this, you can calculate what kind of taxes are owed to the government. These taxes can be paid as personal taxes or capital gains taxes.

If you are not aware of the best tax calculator, then you could at least use the spreadsheet function. There are several websites online that can help you calculate the tax payments based on the industry of the business. When you are trying to figure out which tax strategy should be used, you need to know which tax strategy will generate more money for the business.

When it comes to tax management, the IRS has been trying to simplify things. They have many programs, which you can download.

For this reason, the IRS offers a tax calculator. There are different tax calculators available online. These are a great tool to see if you would like to use the tax deduction strategies that you have thought of. You can select the tax return type that would fit your business’ unique needs.

If you have any questions, then a small business accountant could help you solve these problems. A professional would definitely make more money from you by using their skills.

As an example, if you are planning to buy a house, you could choose a personal tax calculator to get the final quote from several dealerships. This way, you could find a suitable house for you. If you are not sure, then a business accountant could help you out.

In addition, a personal tax calculator will allow you to find the depreciation in the process. This will help you determine which real estate tax code will be helpful for your business.

As an example, if you decide to deduct the taxes, then you might want to deduct the housing taxes as well. The best way to avoid conflicts is to hire a professional who would work with you to figure out the best way to reduce your taxes.

These programs are not always easy to understand, but hiring a business accountant will certainly make your life easier. As an accountant, you will be able to find your way through the complicated IRS tax code and come up with a perfect solution for you. PLEASE SEE : basic accounting template for small business

Sample for Best Excel Template For Small Business Accounting