In simple terms, a basic accounting spreadsheet is a piece of computer software used to create financial records. Its origins date back to the mid-1970s, when financial managers started to use one to record their operations and the resulting increase in profits. It soon became standard practice for companies to use this type of software.

To get the most out of the functions offered by basic accounting, it is important to become familiar with the basics and let the software do the rest. Here are some examples of what a basic accounting spreadsheet can do:

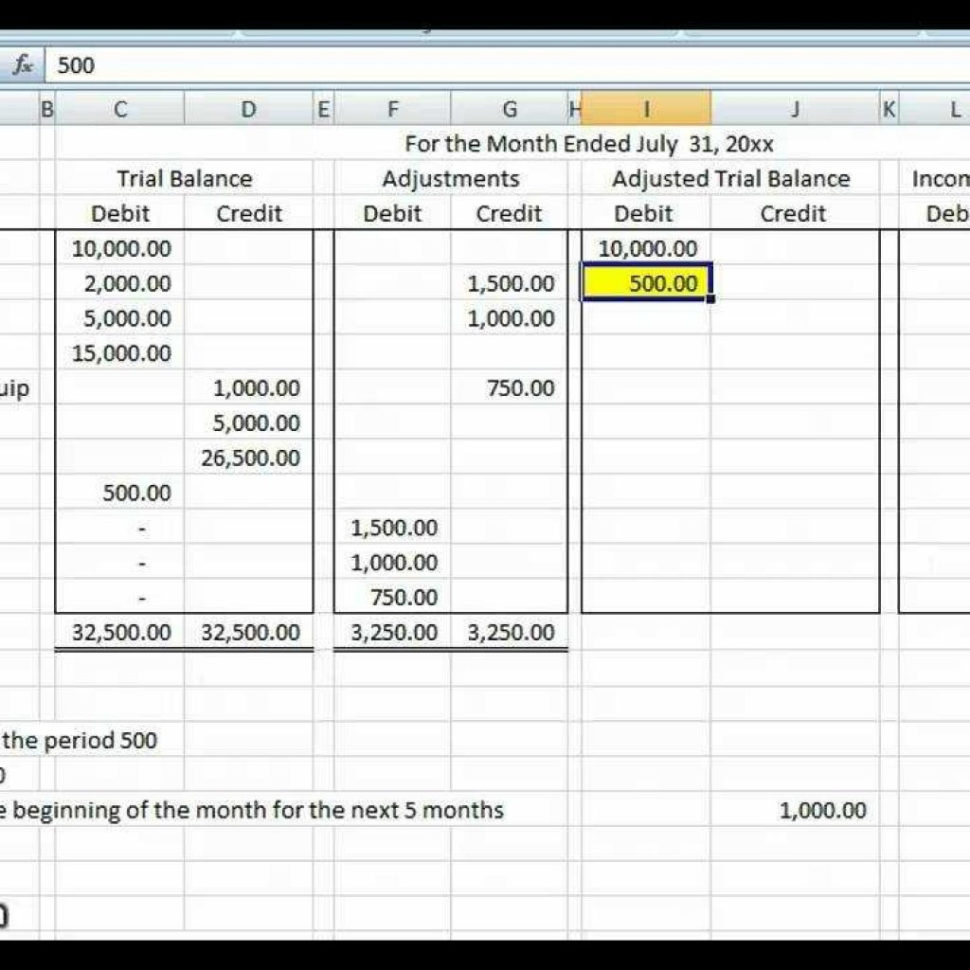

Get the main facts right – This will help you get your income statement and balance sheet in the correct order. It is also used to create income and expense accounts. This helps organize expenses, credits and deductions so that they come under one category. So, if an expense is paid and the company decides to write off the same as a loss, it will be easier to figure out the deductions on the income statement.

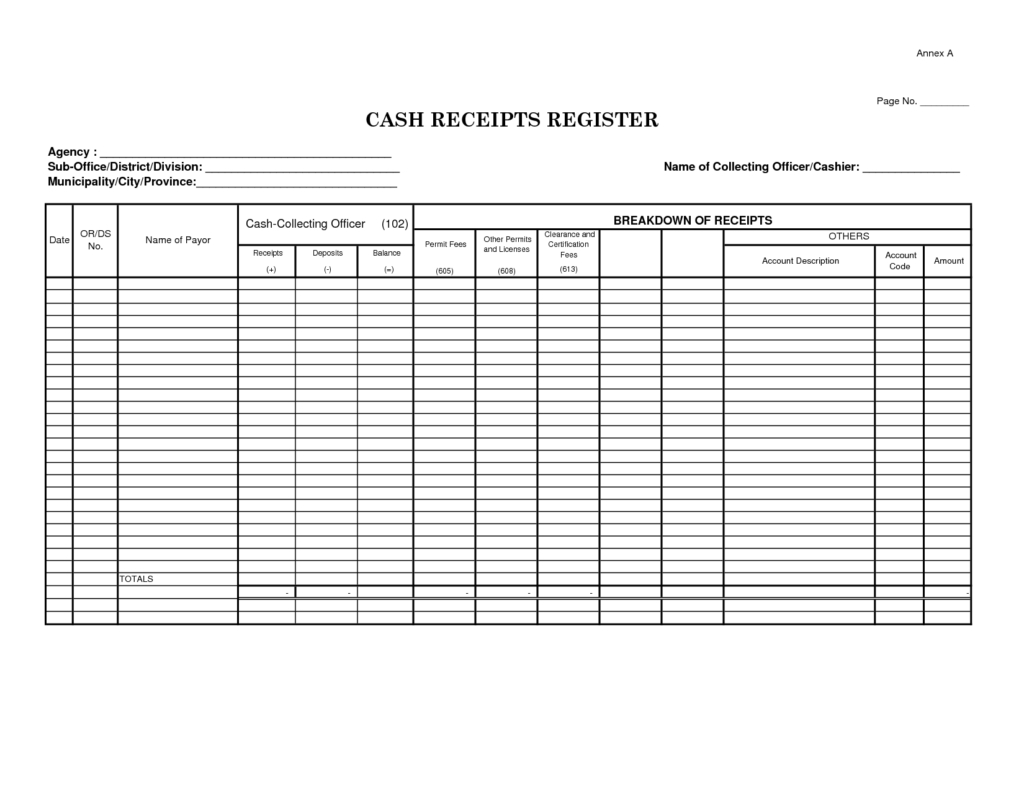

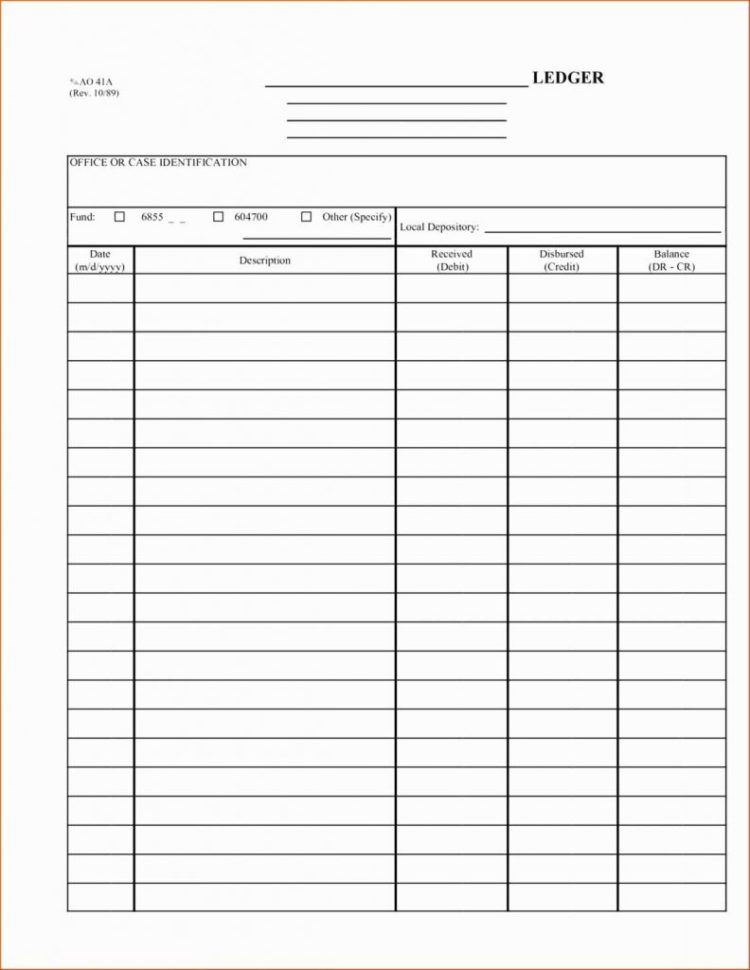

What Are the Basic Accounting Spreadsheets?

Track stock – This can help the company stay on top of the stock market, especially in the case of initial public offerings. It is where shares or stocks are bought and sold. This also helps measure the company’s profits and losses by putting stocks in specific categories, such as stocks owned by individual investors, large companies and corporations.

Keep track of sales tax – As you continue to grow and change, the company will have to come up with an annual business report. This is where it will file its returns and send them to the IRS for their review.

Track job descriptions – One of the first documents that a company sends to the IRS is the tax return form. This can include any type of job description, from the most minor entry to the highest level. In this report, all jobs will be recorded and categorized according to their level of pay. Track total income – This can include many different types of reports. It can include income from a particular region or area. A company may want to know where their cash is coming from, and how much it is actually coming from.

Get information on a company’s assets – To get a better idea of the business’s health, the owner may need to look at its assets. They can include tangible things like land, buildings, inventory, tools and machinery.

Get detailed information about payroll – While the IRS isn’t very interested in the details of a person’s income, the owners are. They need to know how much money is coming in and coming out. They can also check to see how many people work for the company, whether they are full-time employees or contractors.

Know how many people receive income statements – The IRS will only publish a company’s income statements and balance sheet if it has at least ten employees. This is why accounting software is required to tell the amount of money coming in and going out.

Basic accounting software is essential tools for any business. For more information on these vital tools, visit The Pro Accounting Software blog. READ ALSO : basement estimate spreadsheet

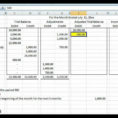

Sample for Basic Accounting Spreadsheet