Excel – Basic Accounting Formulas

Basic accounting excel formulas are used to perform a wide variety of accounting tasks. Excel is a Microsoft software that is used by accountants, financial planners and auditors to manage their finances.

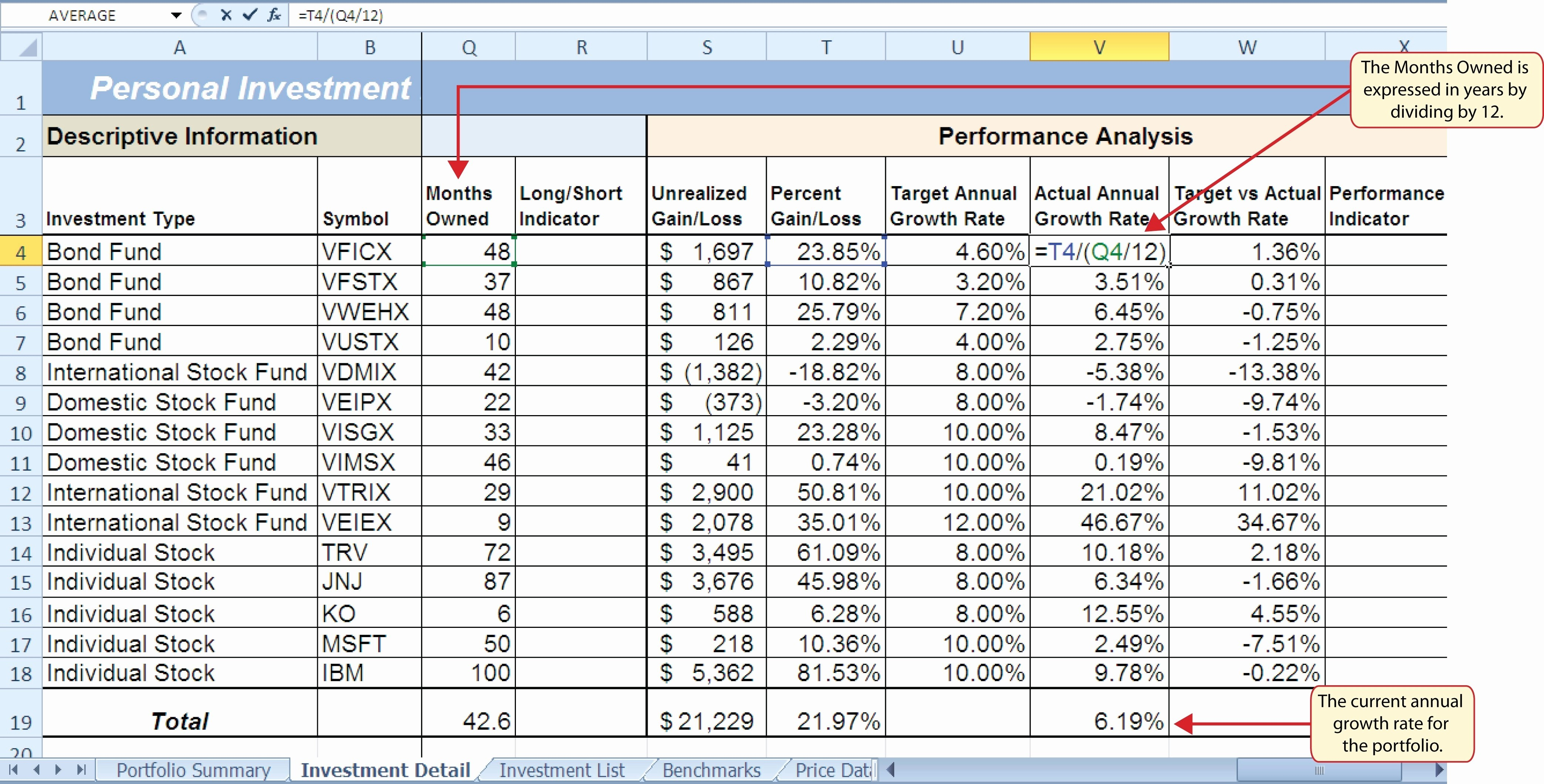

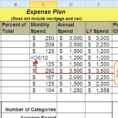

The most commonly used basic accounting formulas are the ones that take a particular number and divide it by other number in terms of the overall amount. These calculations can be made for any level of income. Using the same formula to calculate depreciation on cars will produce similar results to when calculating depreciation for houses.

The same basic accounting formulas are also used to calculate profit and loss accounts. A formula such as this one will show a profit from a particular activity when the expenses are zero and when the revenue is zero.

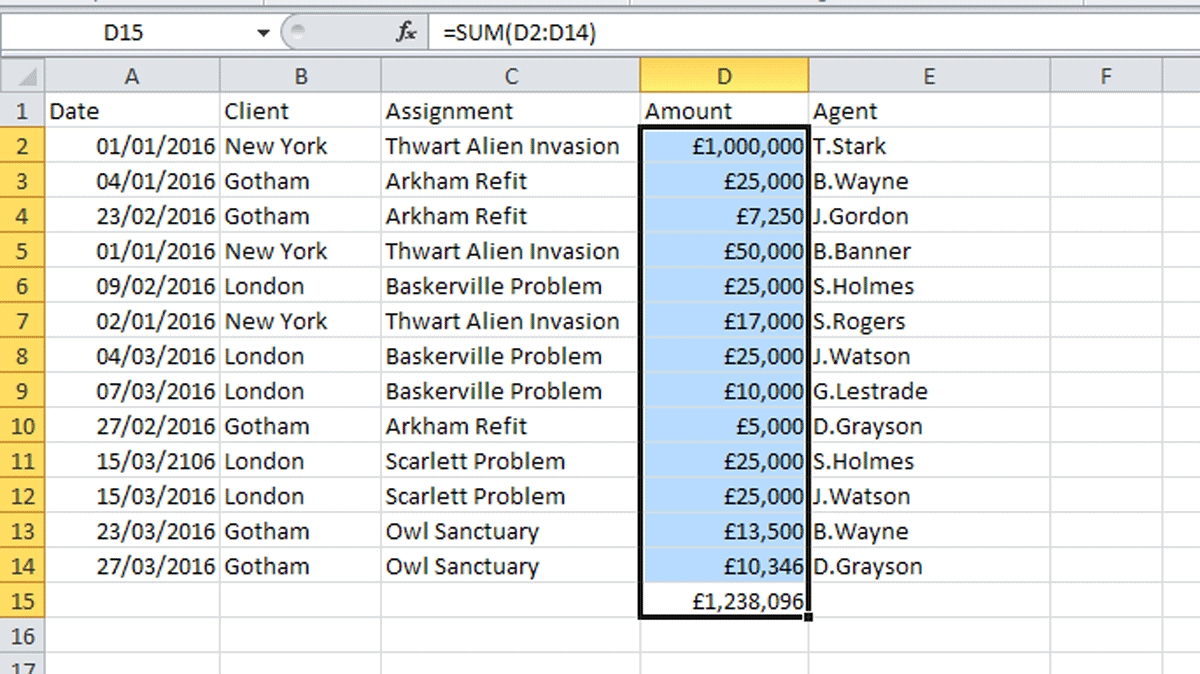

Other basic accounting formulas include income from selling shares, interests, royalties and dividends. Calculating percentages of sales, income from capital goods, property tax, office rental and office investment are also one of the common forms of calculation.

Corporate income taxes, including corporate social security, are also included in the list of basic accounting formulas. The types of profit sharing are usually presented as percentages, gross income and net income. The business income tax, corporation tax and personal income tax are also calculated with these basic accounting formulas.

The accounting profession is based on the use of basic accounting formulas. Every company or business should have an organized business structure and a system of records so that the proper accounting records can be maintained. Once the records are complete, the accounting department of the business should follow the procedures needed to make sure that all the necessary accounting records are correct.

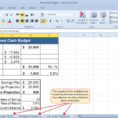

Basic accounting formulas can also be used to determine total revenue of a company, and can also be used to compute the net profit of a company. A common type of calculation is also used to compute the gross profit of a company.

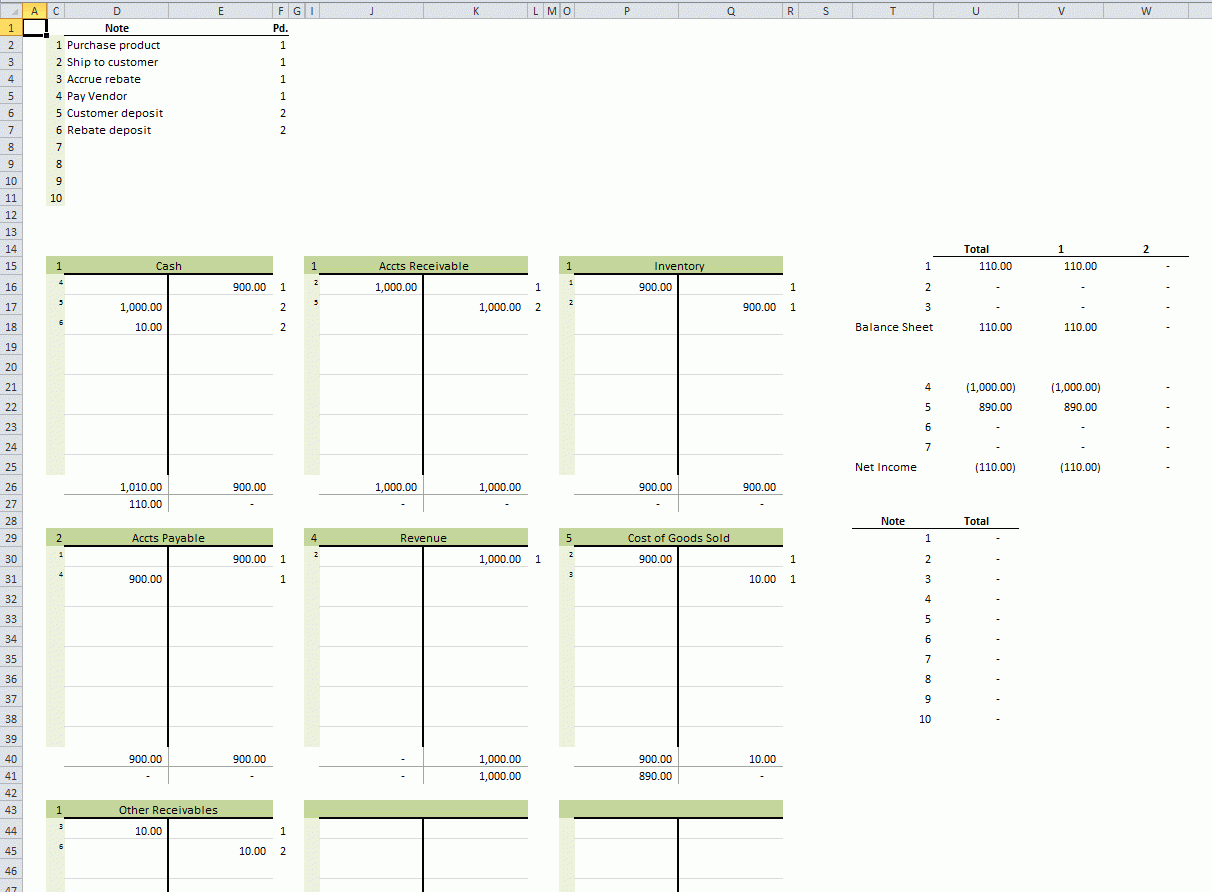

The basic accounting formulas can also be used to compute gross profits and net profits. A formula such as these can be used to compute the balance sheet of a company.

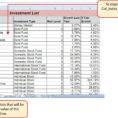

Some of the more useful basic accounting formulas include the financial statement, debt analysis, cash flow analysis, gross profit per share analysis. Other accounting forms include the ratio to book value, stock price, the ratio to the basis and the ratio to the current market price.

Basic accounting formulas are also used to calculate depreciation of assets, interest on loans, interest expenses, tax liabilities, tax rate, stock option expenses, tax expense, credit cost, tax rate of borrowing, and tax return. The formulas can also be used to determine the amount of lease financing.

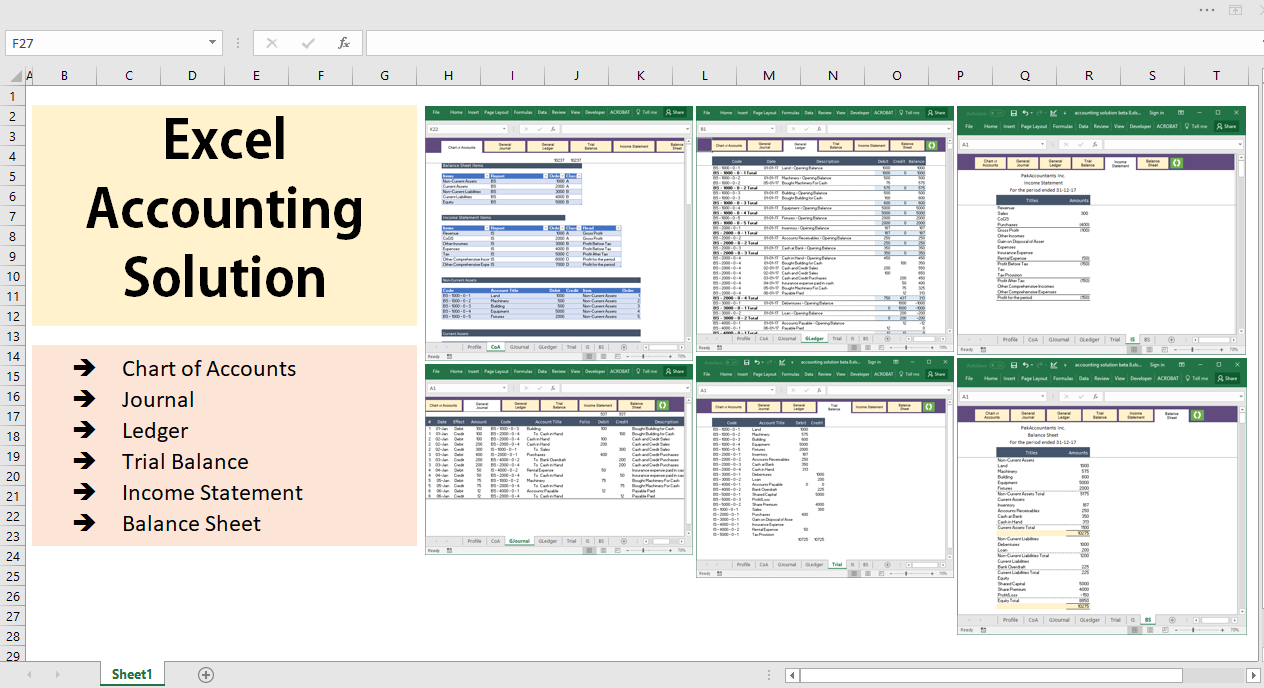

The process of creating basic accounting formulas can also be used to calculate management accounts. The formulas are also used to create the income statement, balance sheet, cash flow statements, and income statement per section. READ ALSO : accounts payable excel spreadsheet template

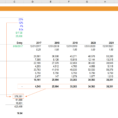

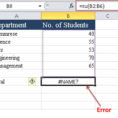

Sample for Basic Accounting Excel Formulas