A quick search of the internet and you will find hundreds of websites that offer advice on how to apply for small business loans. It’s important to understand that there are many loans out there. All you need to do is make sure that you have applied for the right loan and have proof of employment. Otherwise, you are wasting your time and money.

A quick search for loans for small business will produce a myriad of results. Many of these websites are not affiliated with a bank or other financial institution. In fact, you can often find business owners who are not even American citizens.

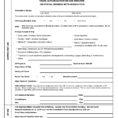

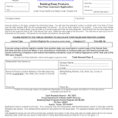

When using a financial institution to get a loan, it is imperative that you apply with the appropriate company. Most of the time you have to fill out an application to get approved for a credit card, a mortgage, or for your first car loan.

Apply For Small Business Loans – How To Get Approved

You must keep in mind that these are only two types of loans and you may be able to get a better rate if you get approved for the latter. When applying for a loan to start a business, the requirements may be a little different from applying for a credit card.

The only requirement for an individual to be able to apply for a small business loan is to have the ability to pay the monthly payment. Unfortunately, it is still a requirement that you meet credit standards.

Whether you are looking for credit cards, business loans, or a line of credit, it is always best to get approved before you start your business. Even if you know what type of business you want to have, it is still possible to get denied. Getting approved for a loan or line of credit before starting your business can help you save time and money.

Any individual who hasa good credit history or has had some form of credit in the past will probably be approved for loans. If you have been turned down for other loans, you should expect this same thing when you are trying to get a small business loan.

The most important thing is to ask for a loan so that you can get your business up and running. Loans are not required until you start making money.

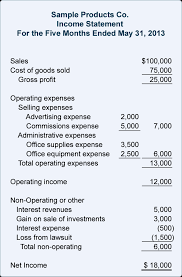

Before you can apply for a loan, it is important to go over your finances and determine what type of loan you are going to get. When you know what type of loan you are going to get, you will be able to see if you will qualify for a loan and get approval for the right type of loan.

All businesses must have a business plan before you can apply for a loan and without a plan, it is easy to get approved on a lower interest rate. When you have a plan, you can see what the future holds for your business.

There are thousands of loans out there for individuals and small businesses. Use your common sense and if you don’t qualify for a loan, you can learn the facts about loans and how to get approved before applying for a loan. PLEASE SEE : accounts receivable excel spreadsheetttemplate