Today, with more consumers are enjoying financial freedom, investing is a popular method of investment. Using an annuity calculator, there are multiple different ways to approach this venture. Here are several good reasons why they are so important.

You need to make smart decisions. When you invest, you are taking a chance that you will not make any money. By using an annuity calculator, you can choose how you want to invest.

Most annuity calculators can be customized to your specific needs. For example, some offer just a few different investment options for you to choose from. Other calculators offer a complete portfolio analysis, as well as different types of investments.

Annuity Calculator – An Amazing Tool to Invest

Regardless of your investment needs, you will have several investment options available to you. There is a huge variety of annuities. Depending on your investment needs, you can invest in some, all, or none of them.

To get the most out of your annuity calculator, you need to know what you are investing in. For example, if you are investing in bonds, you may only need to select the appropriate plan, as opposed to investing in all the various bonds. Additionally, depending on your needs, you may even want to pick out one specific plan for specific needs.

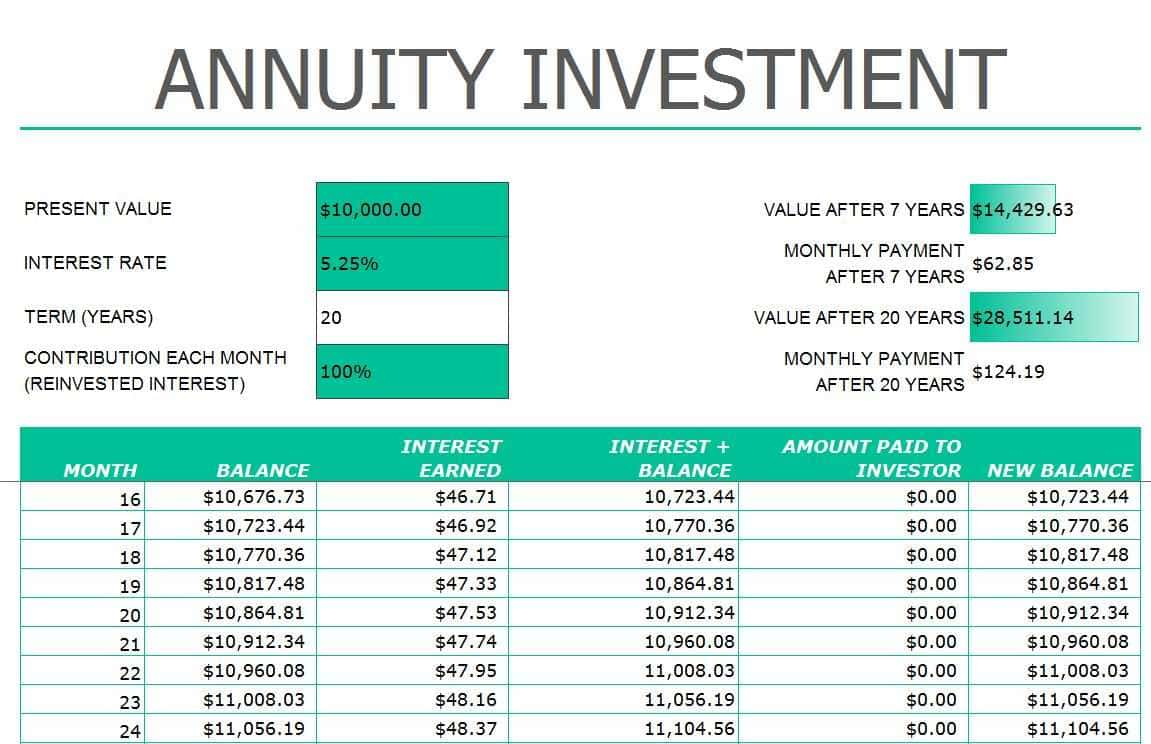

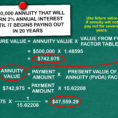

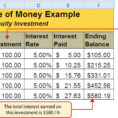

When you look at annuity calculators, you will find that there are several different types. One example is fixed annuities. Fixed annuities can last from twenty-five years to a hundred years.

Fixed annuities are the most common type of annuity, but there are many other retirement investment plans available to consumers. One of the largest, and most important features that people look for when choosing an annuity, is whether the plan provides a guaranteed rate of return, or is subject to risk.

Risk is one of the reasons why people do not want to take out a guaranteed return plan. If you invest in guaranteed returns, you cannot change your investment without risking the entire investment.

On the other hand, an investment that is subject to risk allows you to change the amount that you invest, but at the same time, you can ensure that you will not lose the entire investment. The lower the risk, the lower the payout, but there are fewer potential gains.

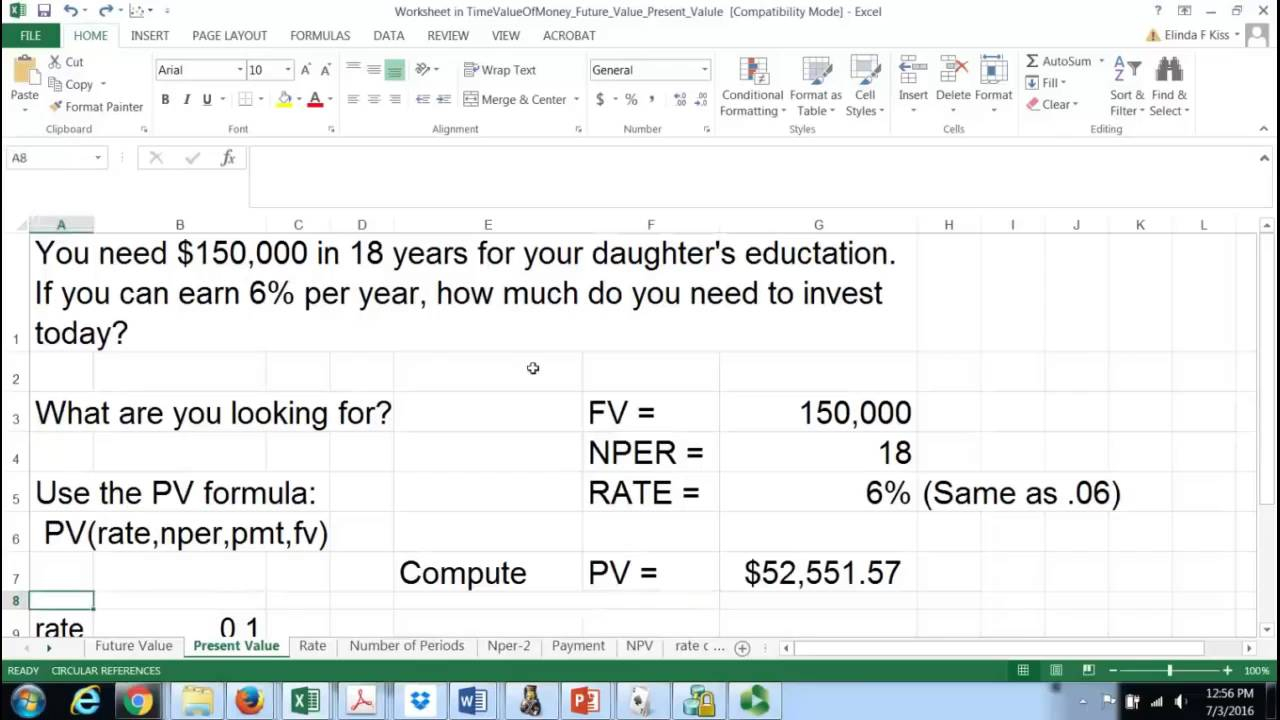

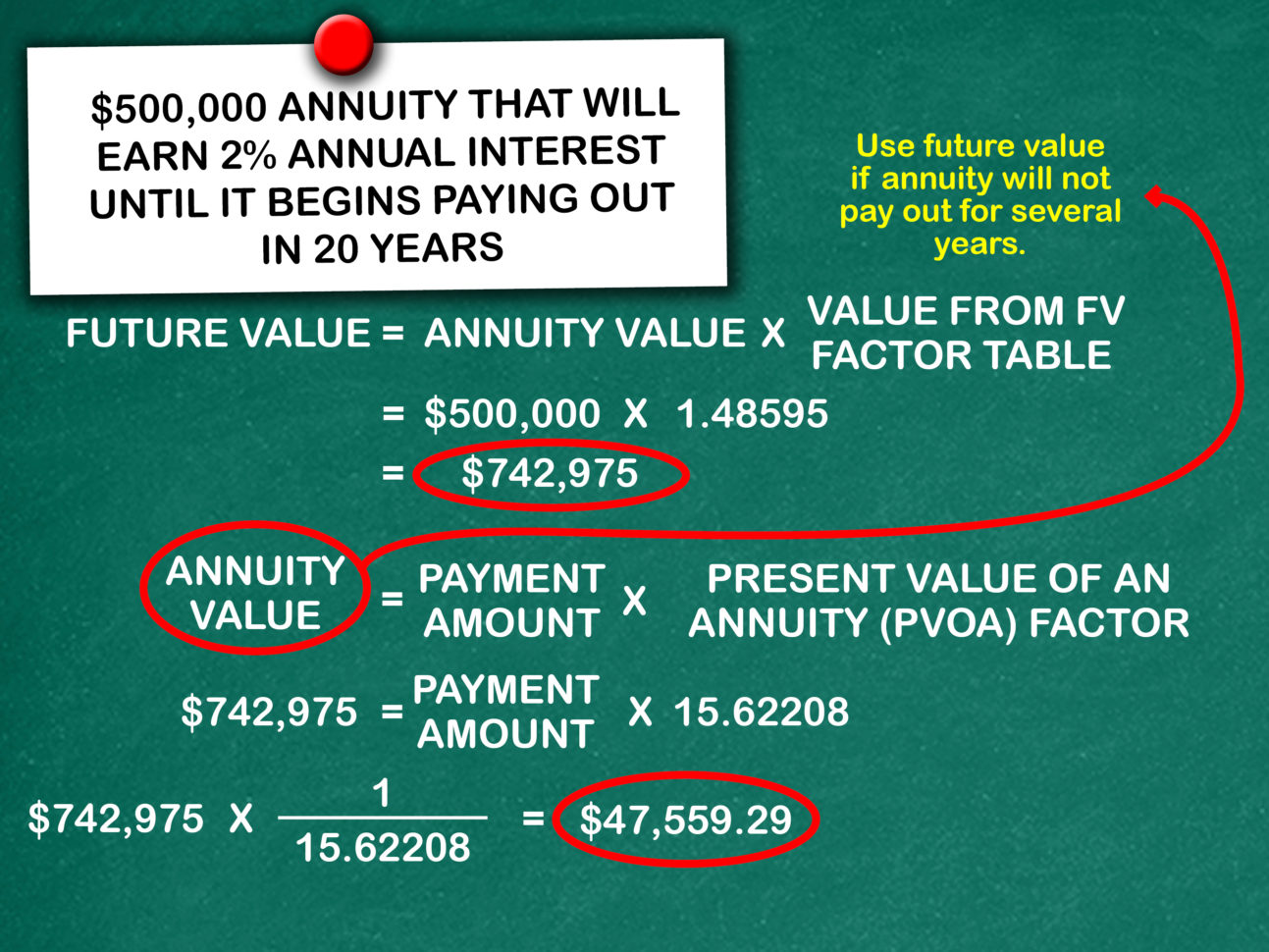

So, when you are looking at an annuity calculator, you are taking advantage of the opportunity to customize it to your own needs. By doing so, you will be able to accurately identify which annuity investment suits your individual needs, and offer you the best results.

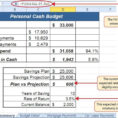

This can be helpful when determining the best investment option for you based on your own personal circumstances. By knowing what you are investing in, you can make informed choices that are easy to understand. YOU MUST LOOK : annual family budget spreadsheet

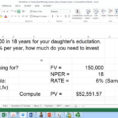

Sample for Annuity Calculator Excel Spreadsheet