Accounts payable reconciliation is the responsibility of both a taxpayer and a bank. It involves the ability to view financial records in order to check if any transactions have been made incorrectly or whether they are being correctly recorded. In case a money transaction is not correctly recorded, it is referred to as an “excessive amount” and the bank or creditor will look for a way to recover their money, which is usually paid out to them.

Recalculations need to be done regularly, just like monthly reports or tax declarations. This is so that any errors can be corrected and that no need for any punitive actions be taken. It will also help in determining whether the taxpayer has enough funds to pay his or her debts and if there is any likelihood of any deductions to be claimed.

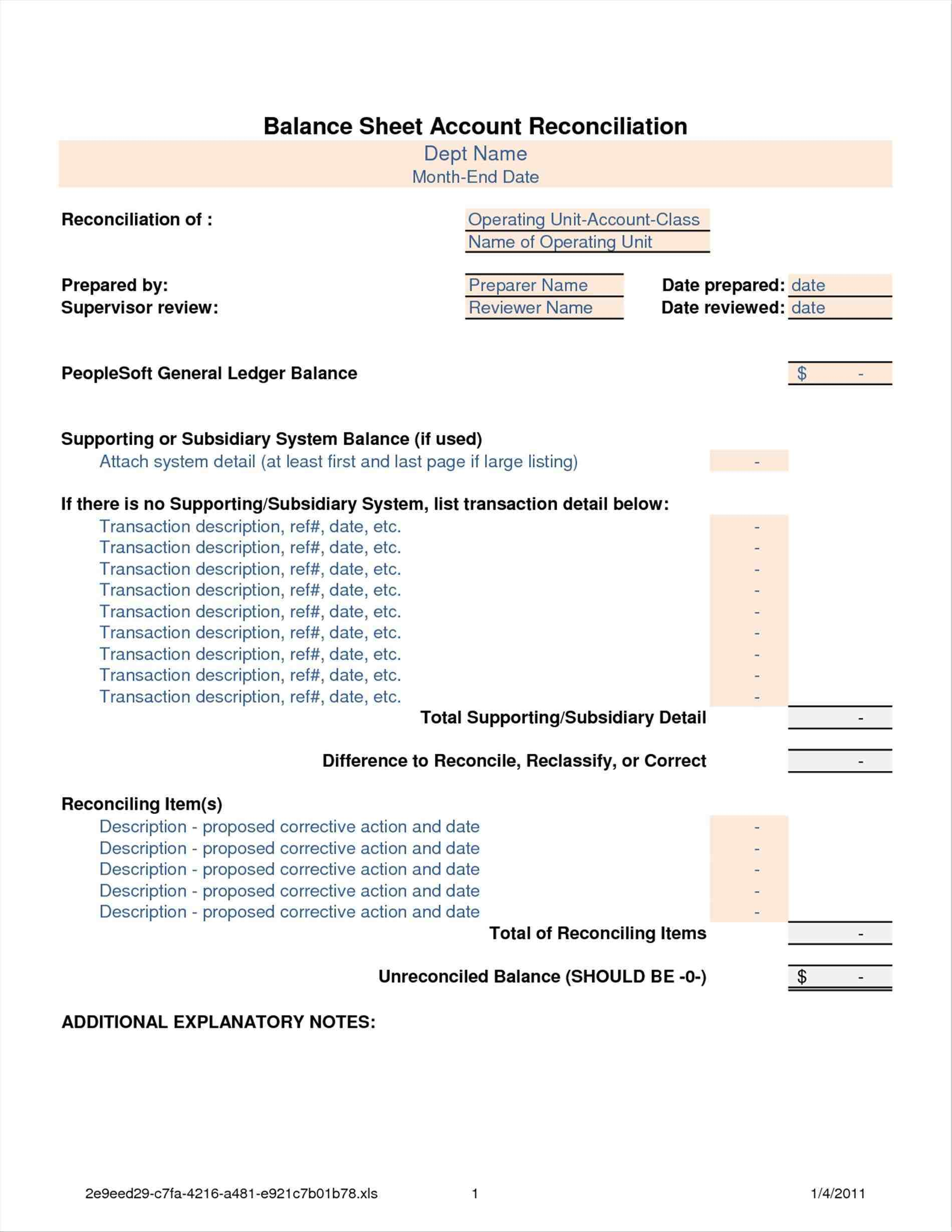

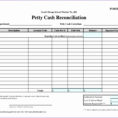

The process of reconciling accounts payable reconciliation is quite easy and all you need to do is to take the accounts payable, the due date and the minimum payment, your income details and the amount of taxes you have declared. This will form the basis of the calculations.

Accounts Payable Reconciliation – A Simple Way to Monitor Your Accounts

If you are making payments to multiple agencies, it is best that you take the dates and the amounts from the list, as this will make it easier for you to determine the amounts. You can include that your payments have been made on time or if you had no income at all, the most you can lose will be the amount of your money deposited in your bank.

If you are able to receive payments from multiple agencies, which is common during the course of the year, you may choose to calculate this separately. This is because it will ensure that the calculation is accurate, although it will take more time and will only be accurate in the case of up to six payments per agency.

In order to calculate the Accounts payable, you can take the information on the report form given to you. It will tell you how much you owe, the exact number of months of payment left and the balances. Some of the calculations also include the interest rate, payable periods and the maximum account payable.

The report also tells you how many months will have to accumulate before the amount you owe will go up to the next level. If you want to know the exact amount, you can easily access the calculation online.

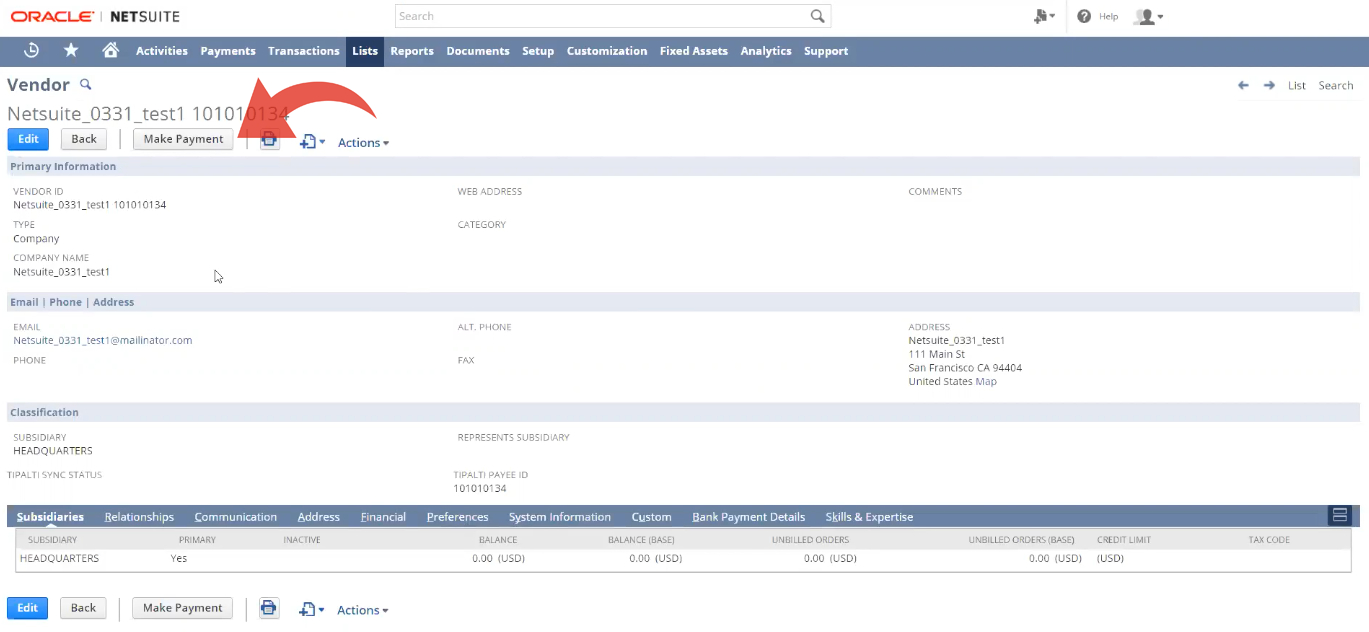

When you reconcile, it is important that you know what to do before you start. The first thing you need to do is to enter all the required details, which will ensure that the calculations are accurate.

The next step is to do this by checking all the new records and all the other data, like those that have been changed. Then you have to enter the amounts you have changed and the numbers for interest rates, maximums and other terms. These will be the ones used to calculate the amount to be paid to your account.

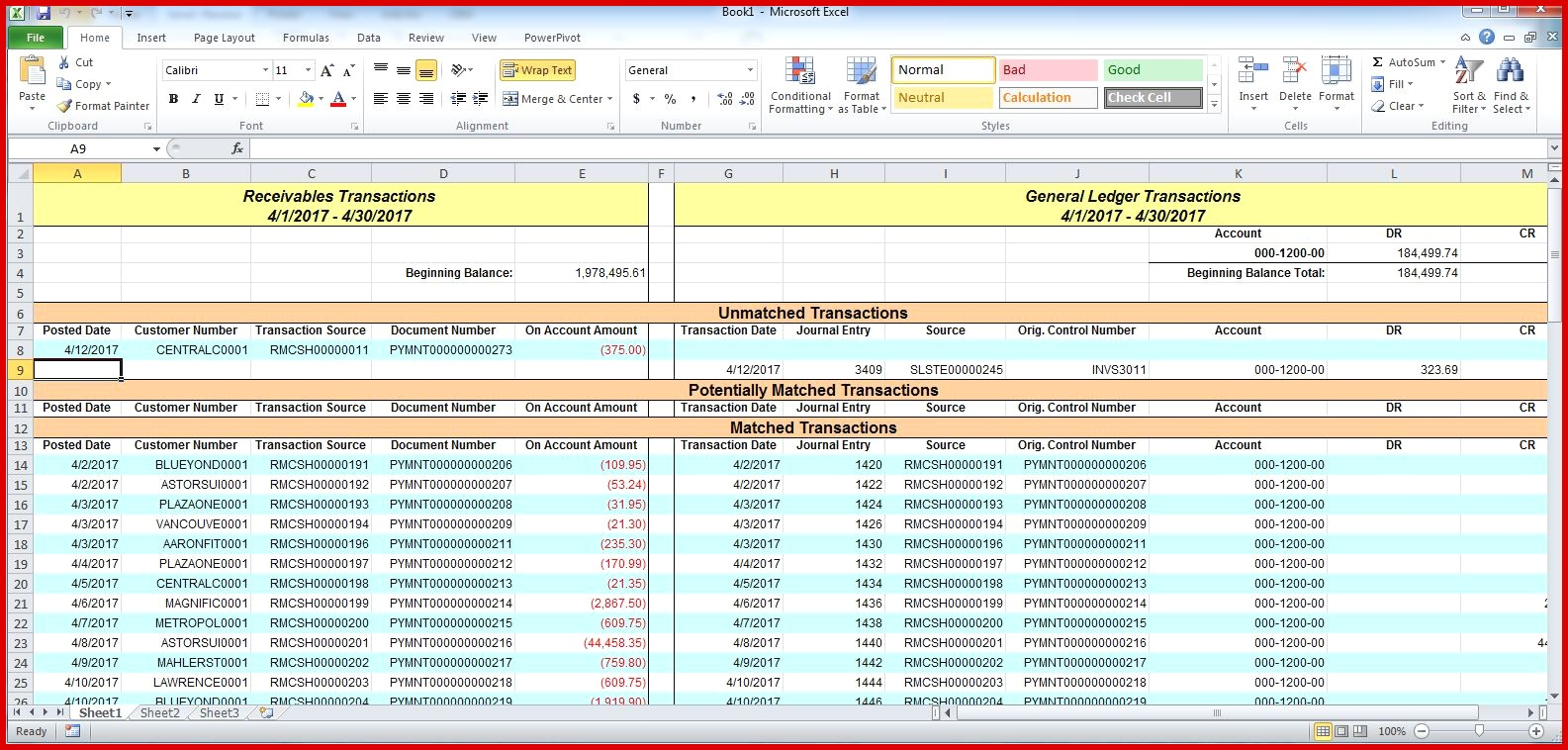

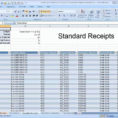

Once the amount is calculated, it will show up as a spreadsheet. This spreadsheet will help you in making necessary corrections and provide you with the time for you to go through the calculation, in order to be sure that the sums are correct.

In case you cannot reconcile your accounts, it is possible that a committee will come to your aid and you will need to reimburse them for the amount that you owe them. This will not only benefit the debtor but also the creditor who will not need to use that money to recover any of their money. YOU MUST READ : accounting spreadsheets for small business free

Sample for Accounts Payable Reconciliation Spreadsheet