The Accounting Spreadsheet: How An Accounting Spreadsheet Works

Accounting spreadsheets are a powerful tool in the financial world. They allow you to keep a record of how you have been spending money, but they do not specify how you will pay for those items and that is where a computer program comes in. In today’s economy with tight budgets, an accounting spreadsheet can help you do a great deal.

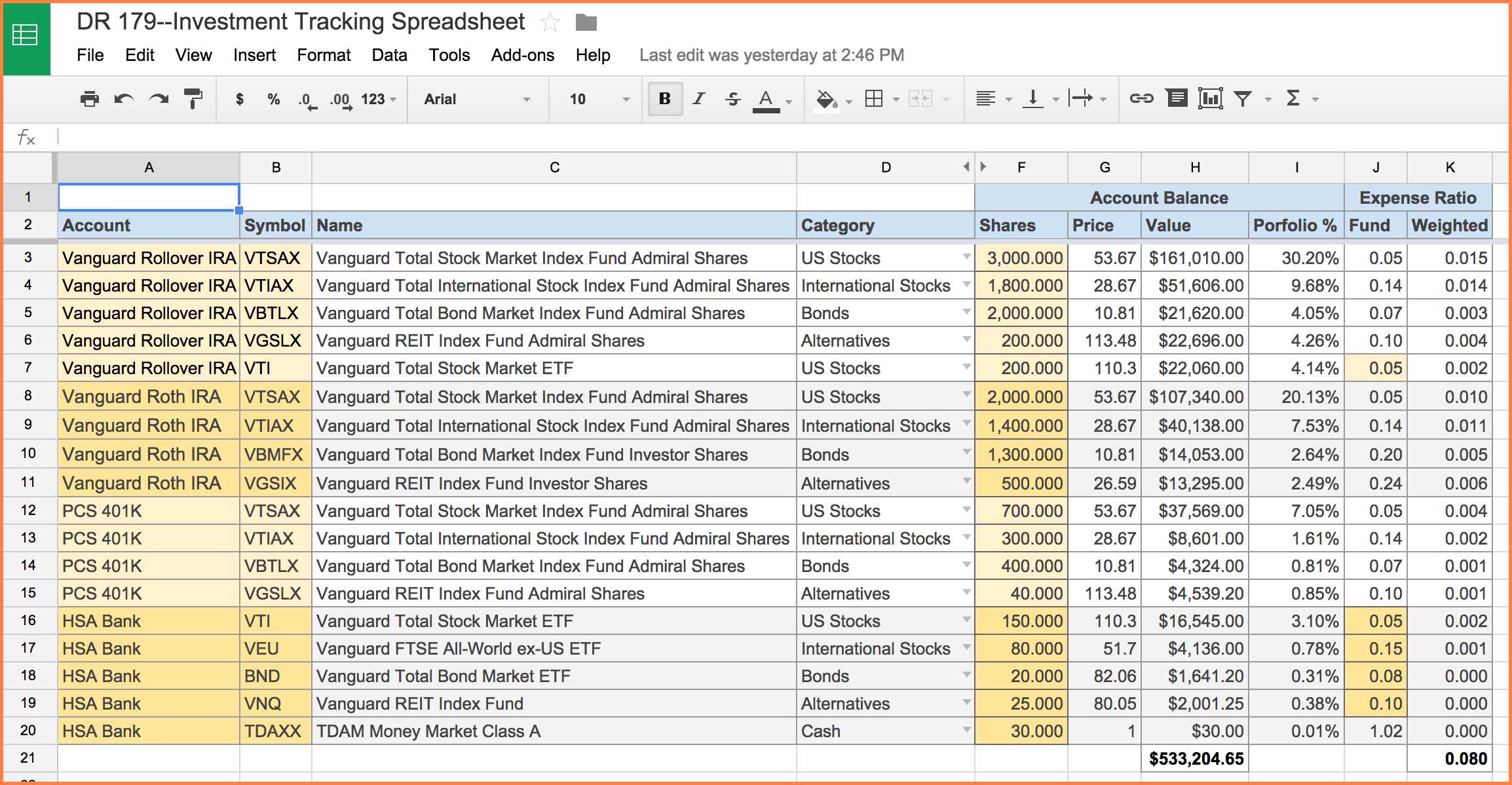

A spreadsheet is a standard financial tool in the financial world and is able to show you what it costs to run your business. This is usually referred to as the operating cost.

This shows you the present values of money, while showing you how much money you would need to bring in each month. Accounting spreadsheets let you see all of this in one place, so it is important to understand the way they work.

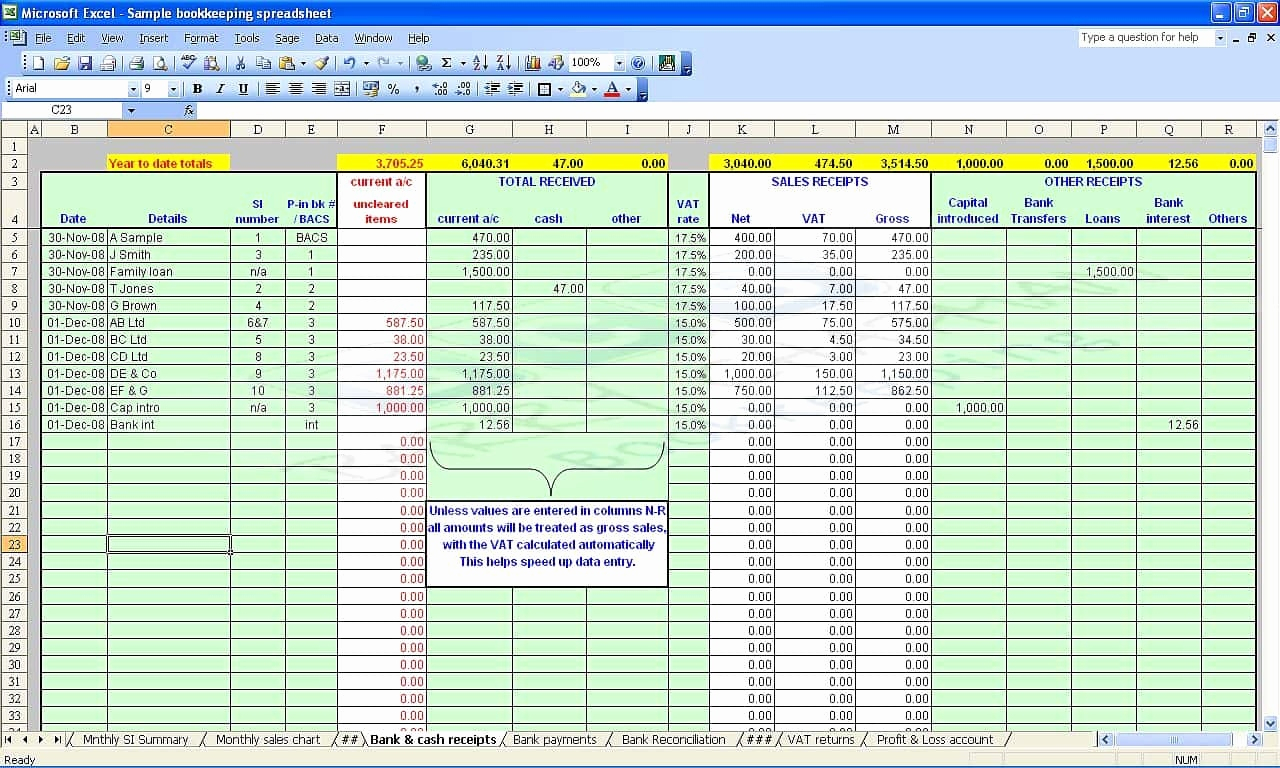

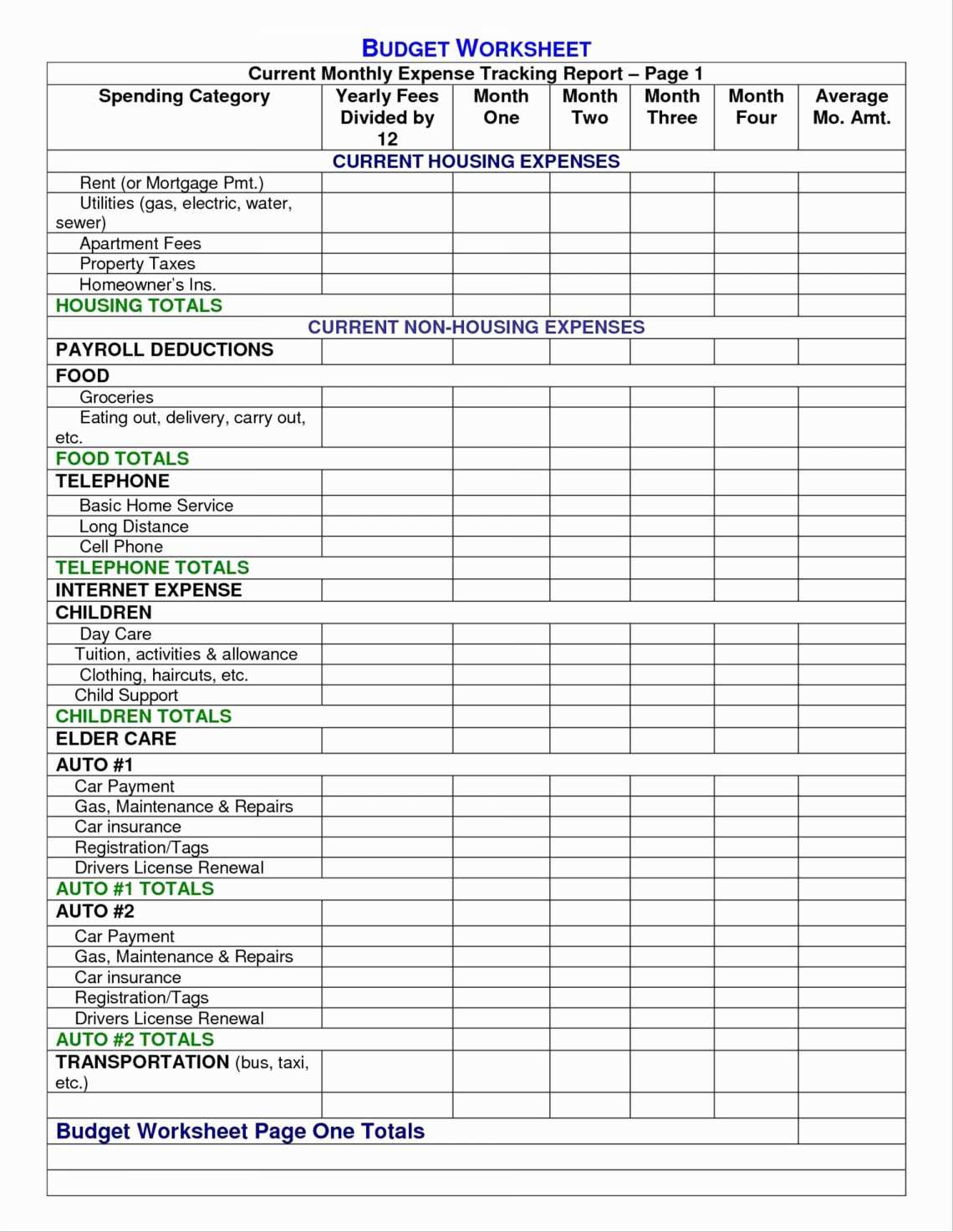

The first part of the sheet is the “summary” section, which reports the current period, usually the last six months. The next two sections are the current month, the next few months and the past year, and then the list of items.

For the summary line, the period ends at the end of the first line. This is followed by the “costs”, the amount of money you have spent, followed by the list of items. The current month, then next few months and finally the past year are then reported.

In the list of items, all costs are included, however this will not always be the case. As each item is purchased, the cost will be reported at the end of the period. This is the only section that is included for the current month.

A later line in the sheet, called the current period, begins with the current month. From there, the remaining details of the year are listed, this is the same way as the previous section.

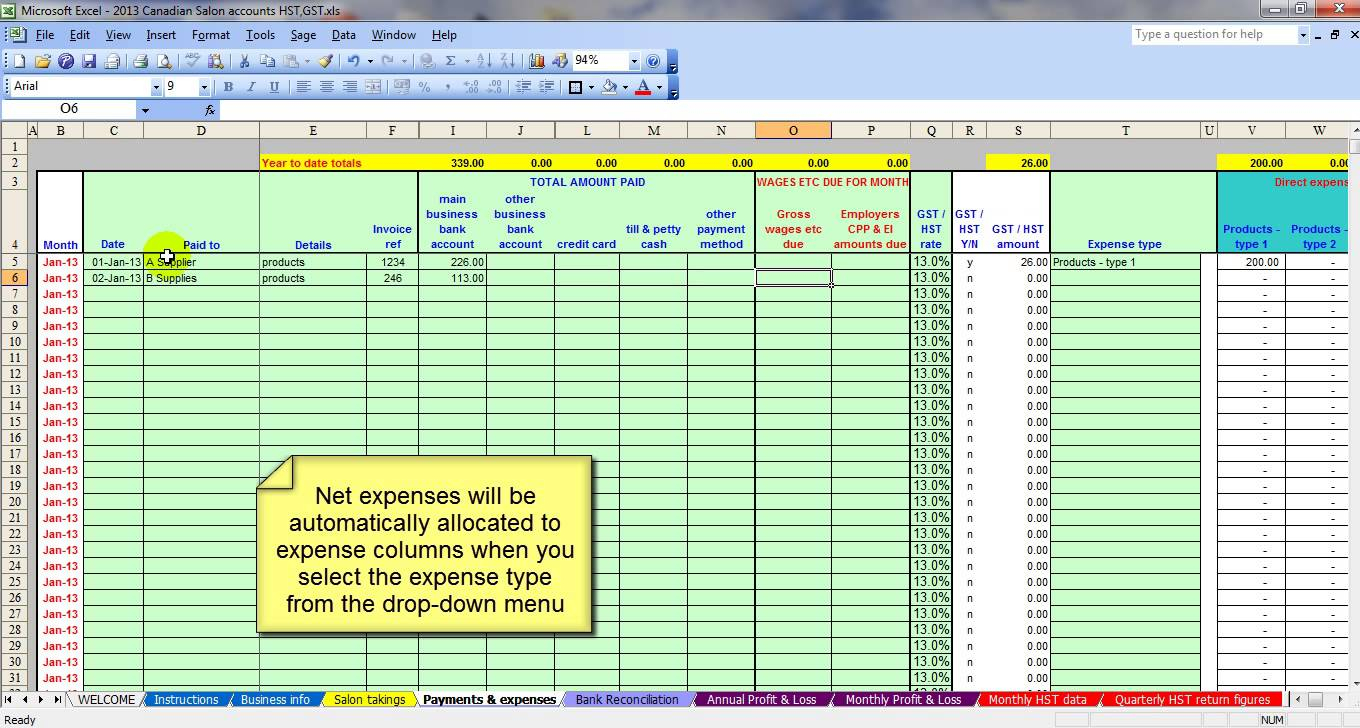

The following line is called the sales tax forms, and it includes the amount paid in taxes. This is only shown for the month and year if that is available. Otherwise, it is reported on the sales tax forms section of the sheet.

There are tabs at the bottom of the sheet, these will be referred to later. These tabs let you split the sheet into various areas and can be used to separate different categories of expense.

The tab that look like a line, but is for expenses, will include income taxes, sales taxes, interest and rent, in that order. On the other tab is the operating expense, which is the cost of running your business. In this section, you can split it into small, medium and large businesses.

Then there is the expense category, which is in three sections. The first section is an expense for each individual employee, the second is an expense for the company as a whole, and the third is the expense for the firm. LOOK ALSO : accounting spreadsheet templates for small business