If you need to create a spreadsheet to handle your business accounts, a UK accounting spreadsheet template is essential. Here’s how you can get started with it.

Accounting is a very important component of running a business. But, unlike many other types of businesses, it can be complex and many people face difficulties in handling its accounting requirements. A spreadsheet can help you make accounting decisions faster and ensure that you’re always paying attention to the big picture.

As an important component of any accounting, you need to keep accurate records. You also need to take into account many other factors. Most companies use the balance sheet to calculate profit and loss. They also use it to record the assets and liabilities on their balance sheet.

An Important Accounting Template For Your Business

A company may not report a profit for a month, but it has to be accounted for in its balance sheet. It’s important that you know your company’s financial performance on a regular basis.

On the balance sheet, you will see a column called Profit or Loss. This is the figure that is calculated from all your company’s transactions. In addition to this, you will also see a column called Income or Expenses. This is what is reported to you by the company on a monthly basis.

If you want to calculate the normal profit of a company, you can use the profit statement. Then you have to add this to the current assets and liabilities, as well as interest expense and taxes. Make sure you put in the correct income figures.

The most important detail to remember is the depreciation. The more expensive something is, the more valuable it is to the company. Ona balance sheet, you need to calculate this amount.

You need to add your company’s asset value to your current assets and liabilities. This way, you will have a better idea of the current assets and liabilities of your company. Just remember that you can’t include only fixed assets, such as computers and furniture, because you don’t know what they are worth in the future.

Next, you have to take into account your return on equity. Every year, the company reports their return on equity. As a whole, it represents the company’s earnings over the last year.

Finally, take the value of your company’s current assets. This is what you are left with after everything else is added up.

It’s important to note that there are many types of accounting to consider when calculating your balance sheet. Make sure you know your company’s accounting and you’ll know how to create a good accounting spreadsheet. LOOK ALSO : accounting spreadsheet examples

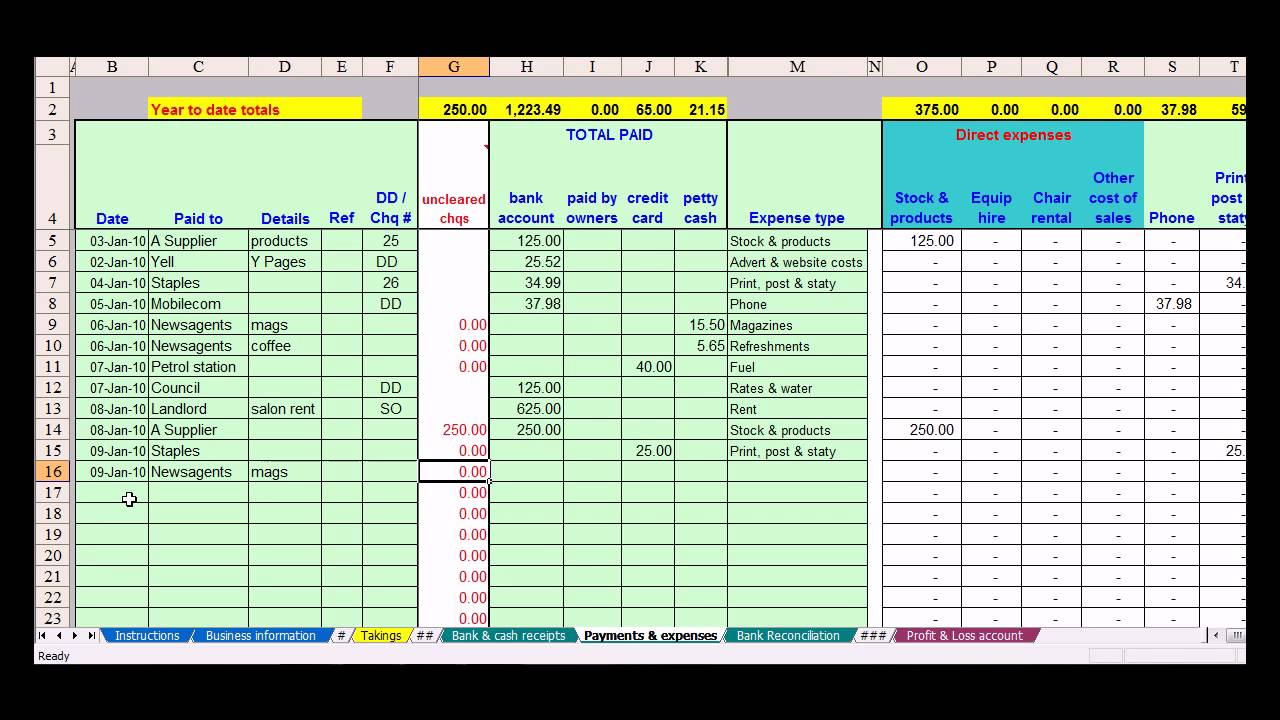

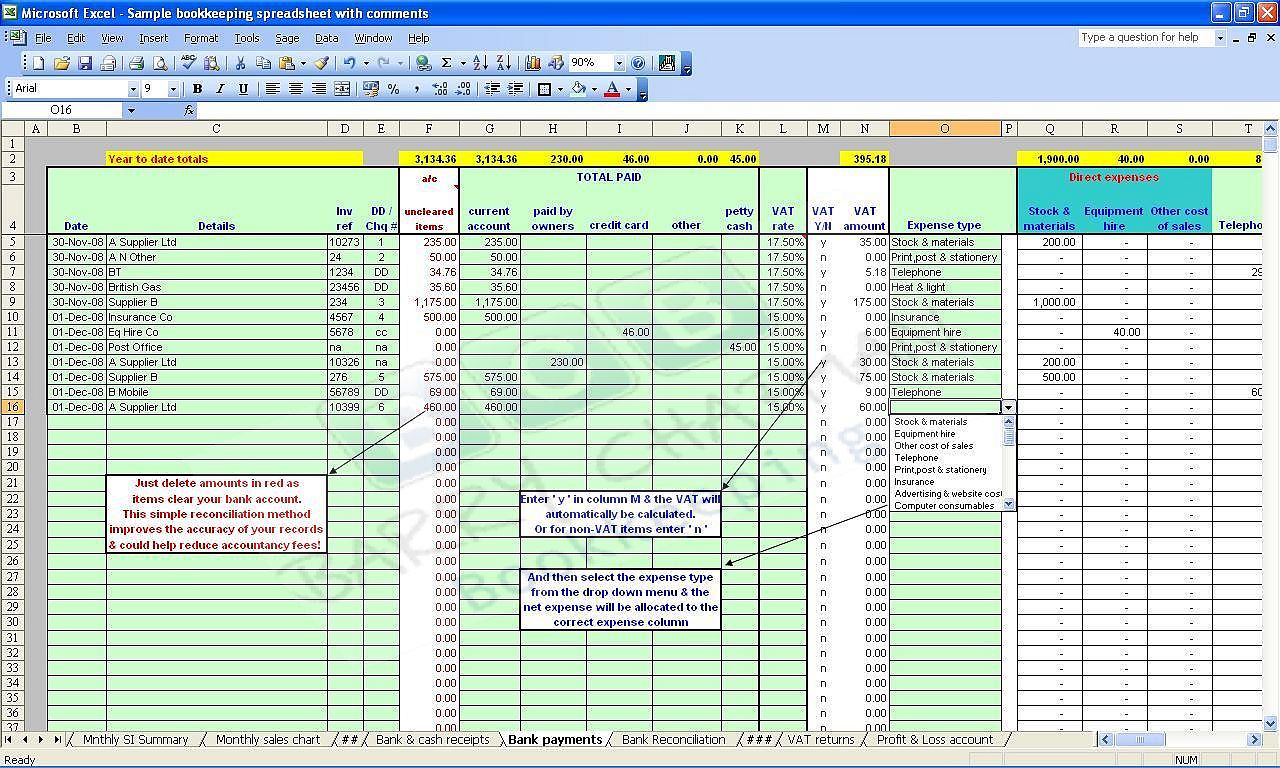

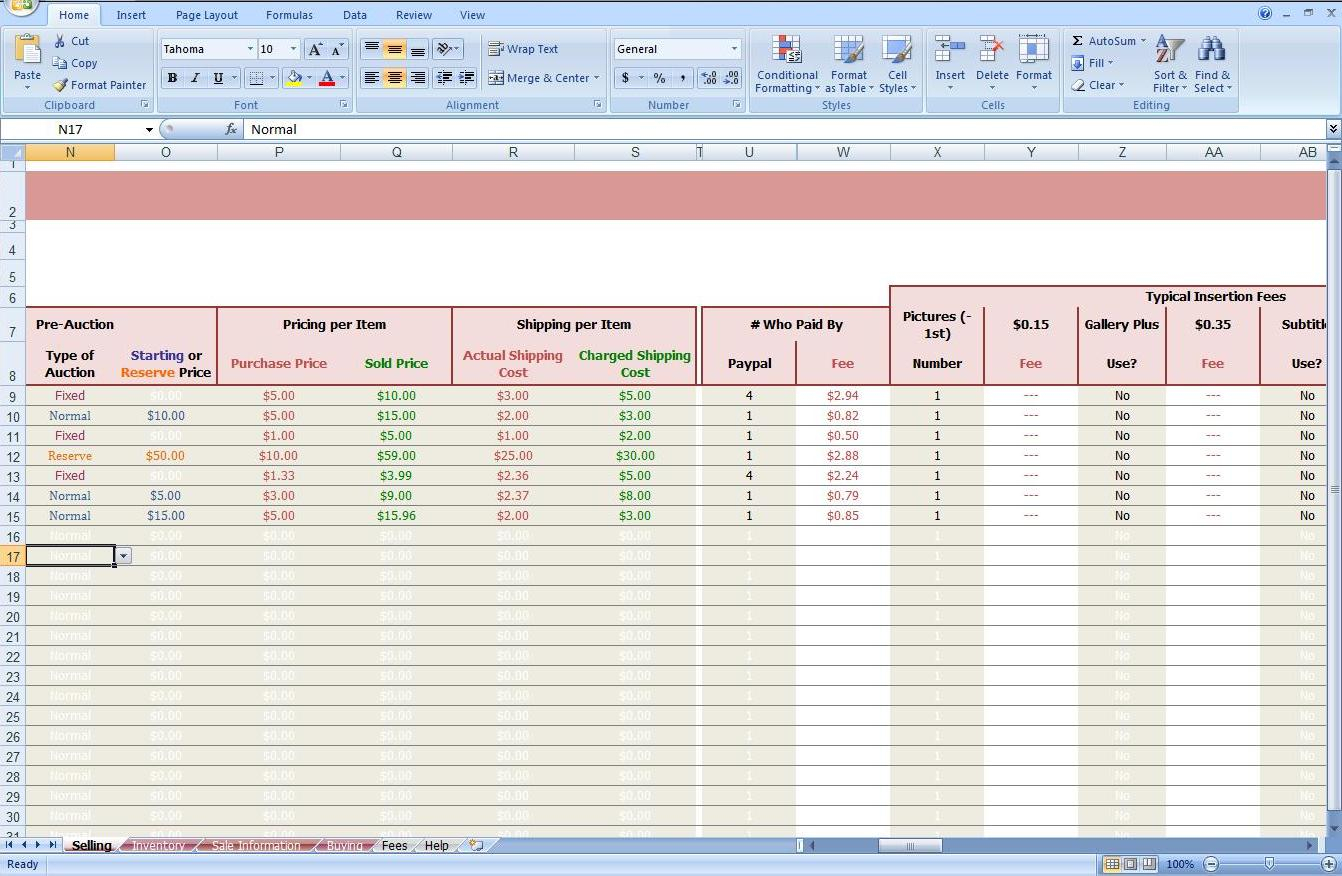

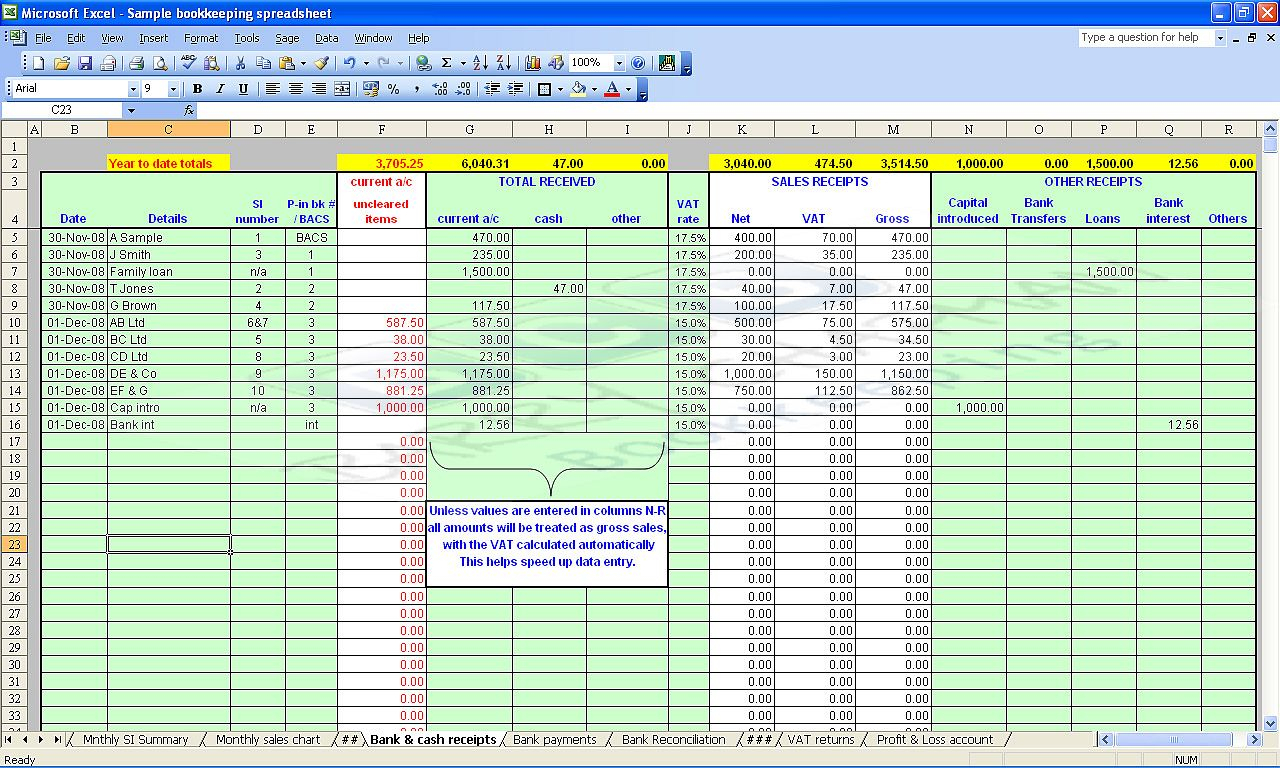

Sample for Accounting Spreadsheet Template Uk