Quickly Learn How to Use an Accounting Spreadsheet

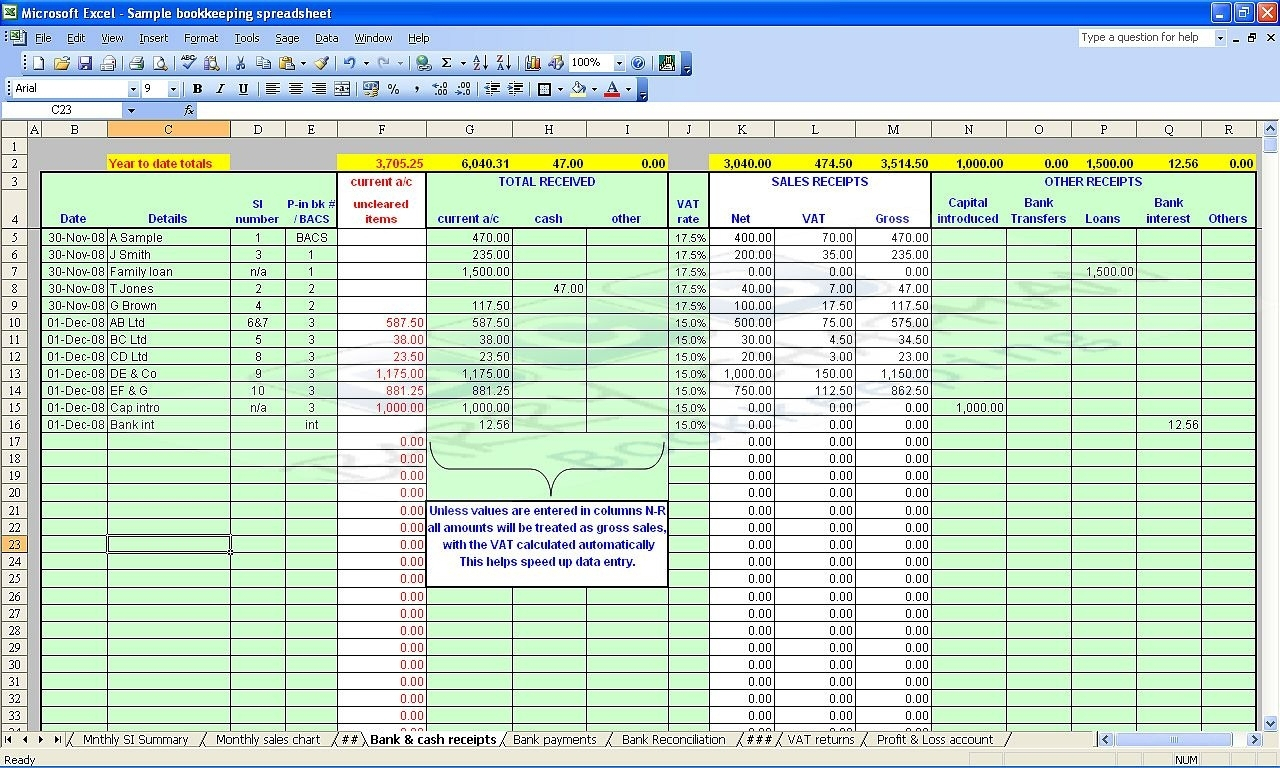

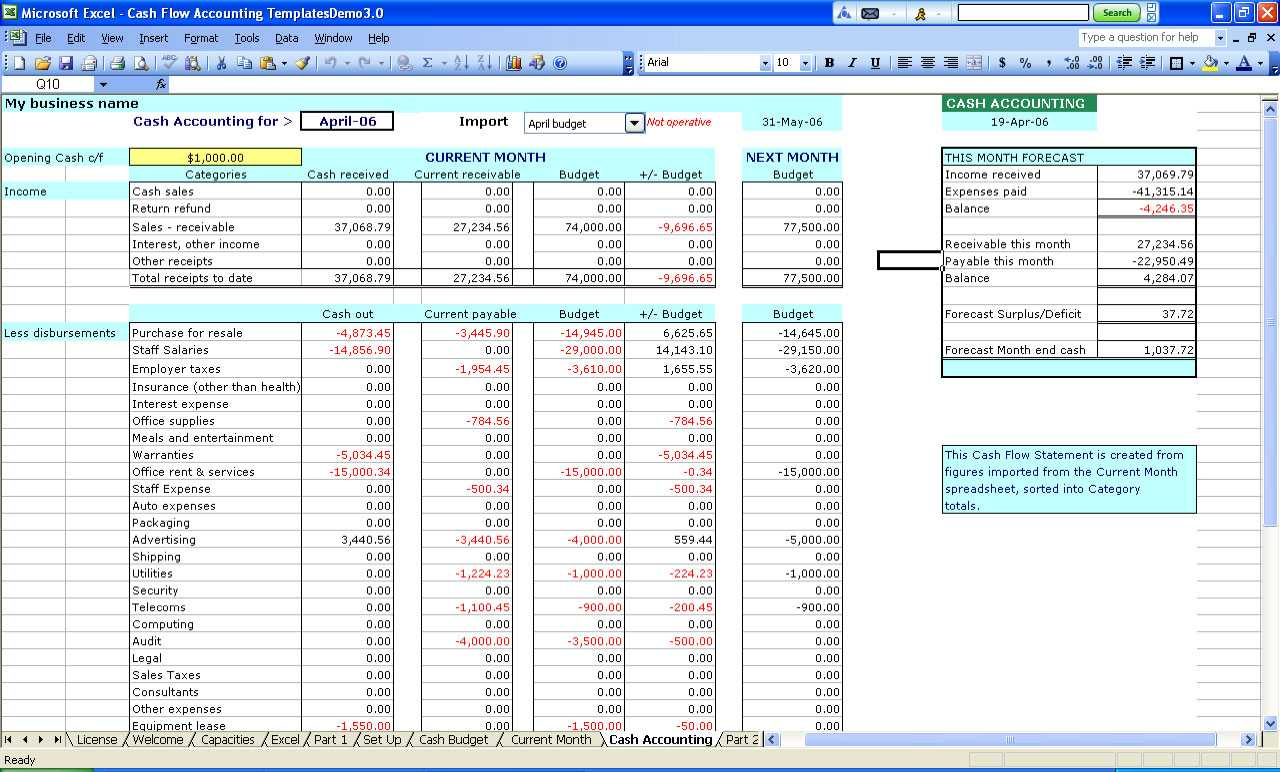

The best way to learn how to use an accounting spreadsheet is by using an accounting spreadsheet template. These free templates are designed to quickly show you the methods of all your tasks and to demonstrate in a visual format everything that you need to learn. These templates have all the formulas for each column of the sheet, so that it is easier to understand and you can put your knowledge into practice right away.

It can be easy to get confused if you do not know the basic procedures of the business. Some procedures may require several calculations in your head, which makes it hard to know how to go about doing it. This is why it is better to do a whole lot of practice or take help from someone who knows the basics of the profession.

Using an accounting spreadsheet template will let you review the data that you have gathered and convert it into simple charts. You will know what is included in the data so that you can easily put it into the appropriate columns to make the computations. Even if you are not the financial manager, you can do some of the calculations yourself in order to make sure that your computations will be accurate.

A good accounting spreadsheet template should include all the calculations you can think of. You should be able to add up different transactions, subtract income, produce and estimate the balance sheet. This way, you will be able to verify if your calculations are correct and that they are showing all the data properly.

To do this, you should know the basic procedure in making a balanced sheet. Calculate the income for the month. Divide the sum of the income for the month by the number of months. That will give you the net income for the month.

Add the past profit to that figure to determine the net profit. That will give you the total income for the month. Your revenue will be the sum of the income for the month minus the expenses.

The expenses will be the income minus the expenses and you will have to put all the expenses in a separate column. As the expenses are decreasing, you will see more money coming out of your pocket.

Now divide the sum of the net income for the month by the number of months to get the monthly income. That will give you the monthly net income.

Now you will put your income in a separate column. Divide the net income you have for the month by the number of months to get the per-month income. This will give you the monthly profit.

Another procedure will be to calculate the credit statement. Divide the credit line by the number of months.

If you have some experience in the accounting profession, you should know how to do these calculations and how to do it well. It will only take a few minutes to learn, which is very helpful if you are just starting out in the profession. PLEASE LOOK : accounting spreadsheet template for small business

Sample for Accounting Spreadsheet Template Free

![Spread Sheet Templates ] | Excel Spreadsheet Templates Doliquid Inside Accounting Spreadsheet Template Free Spread Sheet Templates ] | Excel Spreadsheet Templates Doliquid Inside Accounting Spreadsheet Template Free](https://db-excel.com/wp-content/uploads/2018/11/spread-sheet-templates-excel-spreadsheet-templates-doliquid-inside-accounting-spreadsheet-template-free.jpg)

![Spread Sheet Templates ] | Excel Spreadsheet Templates Doliquid Inside Accounting Spreadsheet Template Free Spread Sheet Templates ] | Excel Spreadsheet Templates Doliquid Inside Accounting Spreadsheet Template Free]( https://db-excel.com/wp-content/uploads/2018/11/spread-sheet-templates-excel-spreadsheet-templates-doliquid-inside-accounting-spreadsheet-template-free-118x118.jpg)