If you are familiar with accounting software and have your own business accounts, then using accounting spreadsheet examples is a must. It will help you develop basic accounting templates which you can easily integrate with your business’s accounting records. You will also learn the benefits of such basic management tools which make use of data to organize finances, increase efficiency and decrease mistakes.

To begin with, let us try to understand the basic concept of this tool. The spreadsheet programs have become very popular among small-scale business owners and entrepreneurs alike. The purpose of using this tool is to simplify your accounting reports and store your important information for easy access later. By this, you will be able to keep track of all your financial activities and analyze them at a glance.

These are simple tools, but they are highly useful if you want to successfully manage your business. There are a number of accounting spreadsheet examples which can help you integrate and customize your business finance software with ease.

Make a Better Accounting Statement

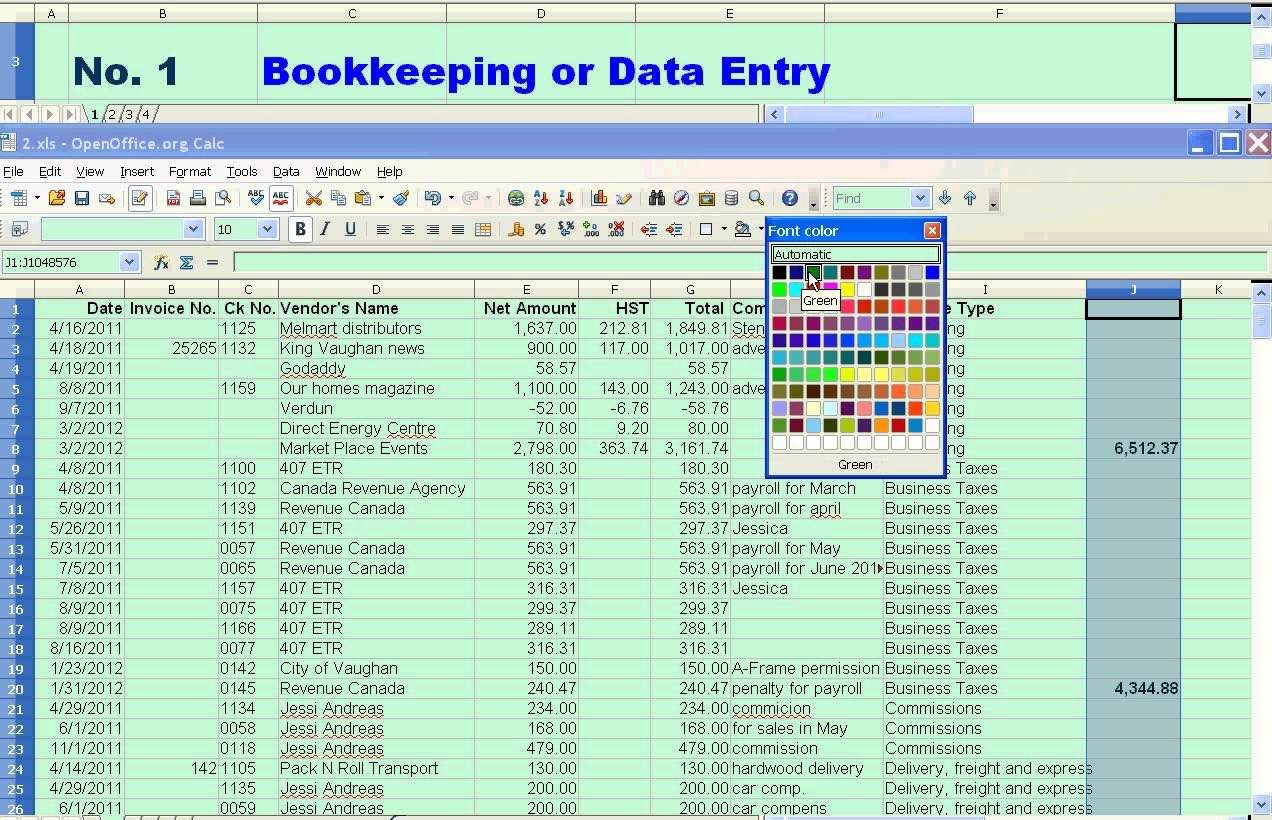

You can use this tool to create different versions for each business account. For example, you can select the service mode for your restaurant’s restaurant operation or marketing mode for your home based business. It is also important to make your software for a particular function user friendly. You need to choose the color for each page, the font type and size, and so on.

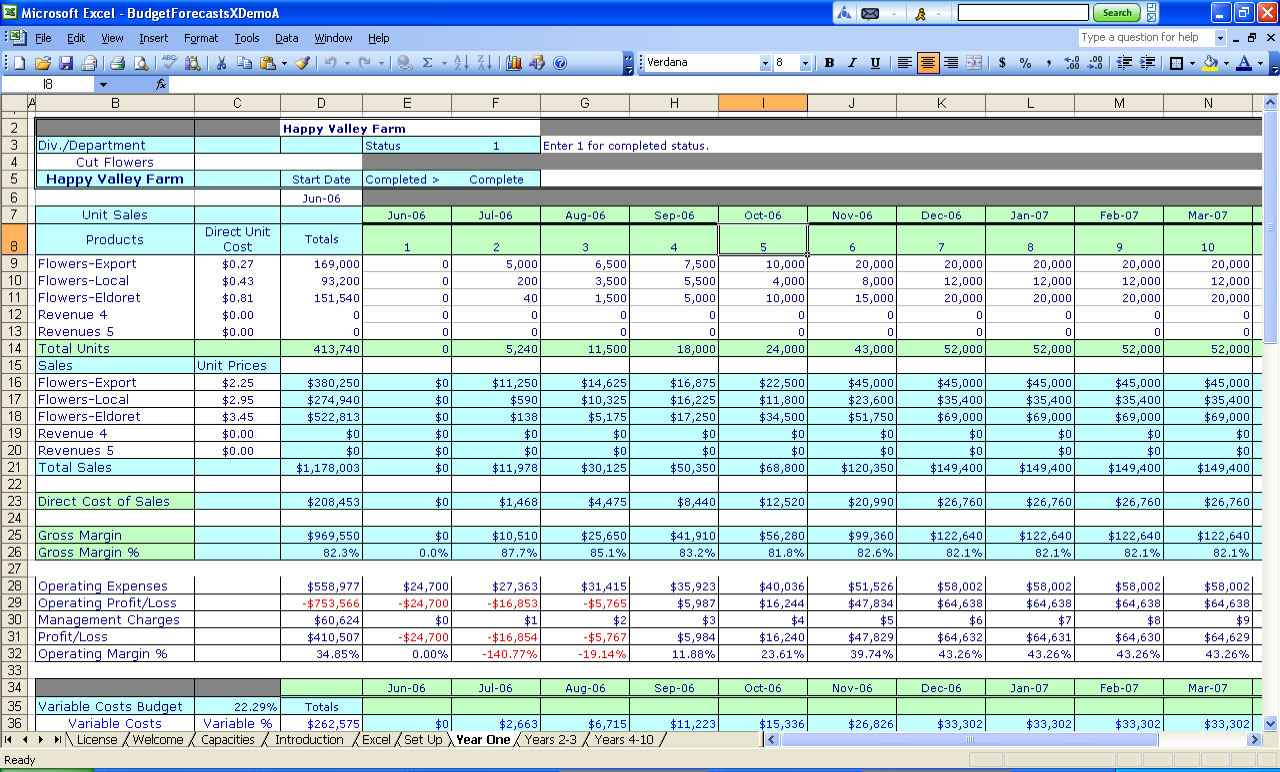

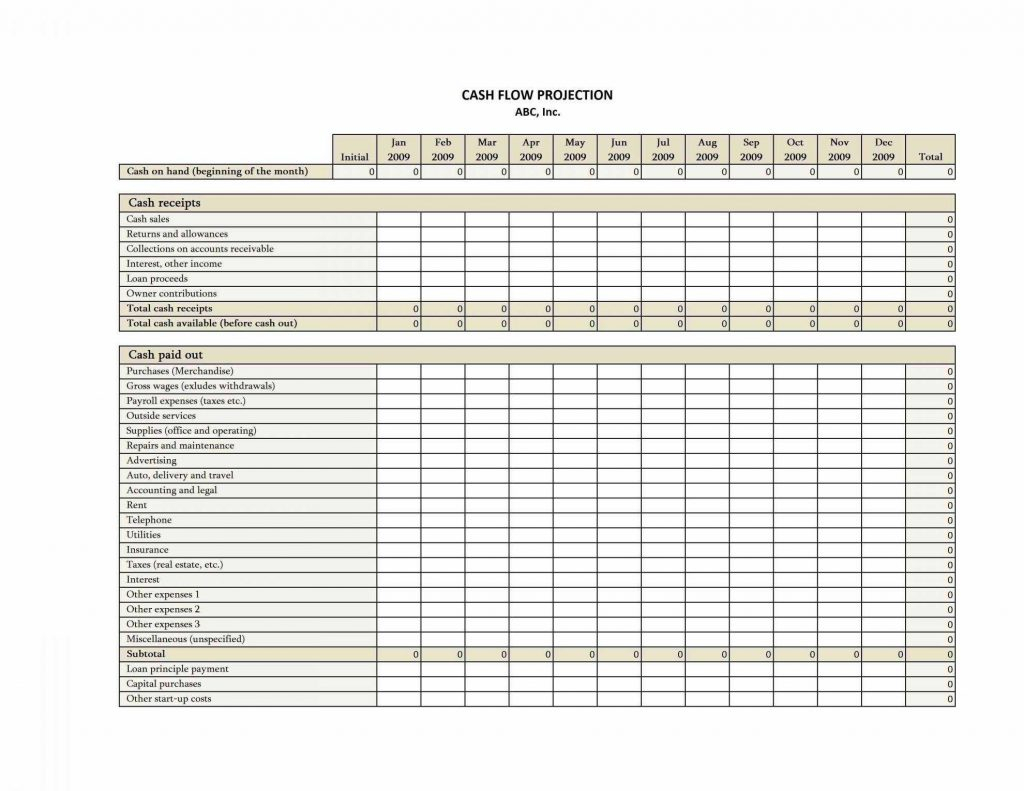

When you start working with accounting spreadsheet examples, you need to create a single file that will keep track of the daily activity of your company’s audit trail. It will be a common place for you to record your monthly statement for the previous year.

This is an effective way to capture any type of financial transactions. The more data you record the easier it will be to identify any discrepancies in the records. On the other hand, the accountant will need a very simple system to analyze the records once the transactions are properly organized and recorded.

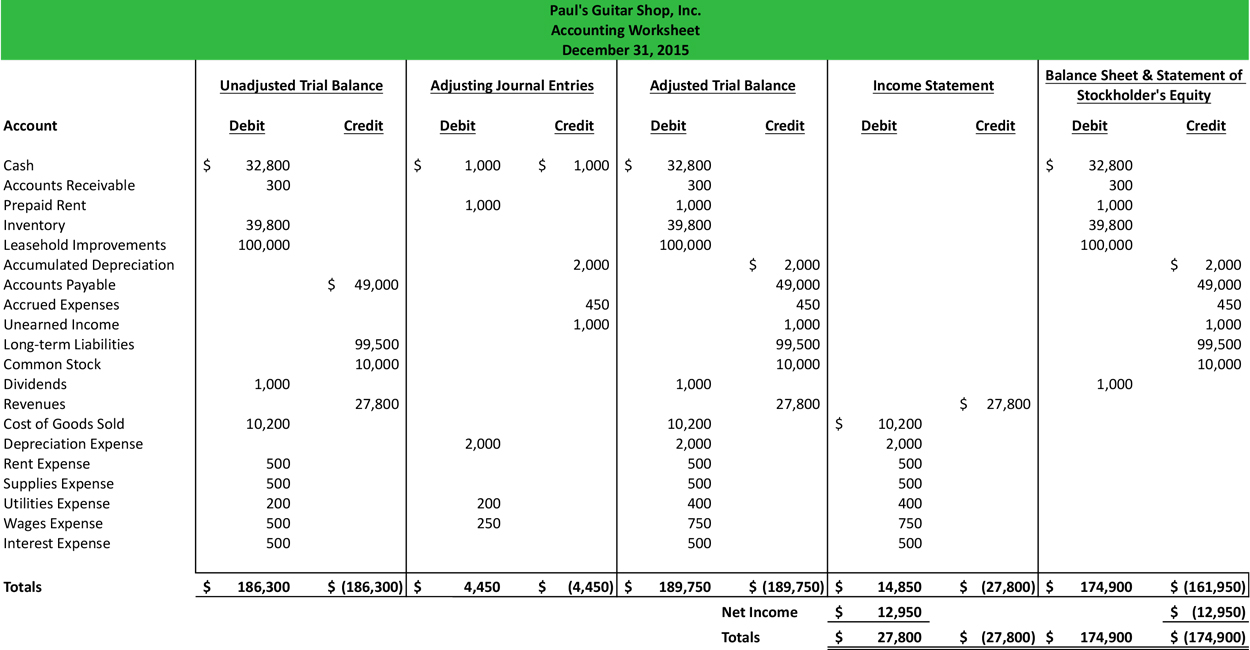

Your accounting spreadsheet should include every transaction and financial statement you make. In order to maintain the appropriate balance sheet, you need to prepare all financial statement for the past 12 months and list all transactions in the given line item. If you do not include all of the records in your accounting ledger, your accountant may not be able to clearly identify what exactly happened during the past year.

In addition, your accountant would have no way to compare the finance for your business against the forecasts it has been made for the same period. Using this accounting tool, you can make sure that your financial statements match the predictions of your accounting experts. This makes your accountant’s job simpler and you can concentrate on keeping your business running as planned.

The most important financial statement is the balance sheet. When you make your business’s financial statements, you need to make sure that they accurately reflect the current balance of your company.

It is critical to know if the financial statements have the same distribution as the tax result. The more records you have, the easier it will be to keep track of all accounting operations.

Since every company has a company’s balance sheet, you can use it to manage your accounting expenses. You can also add the expenses to the statement when they occur so that you will be able to monitor and manage your business’s financial life. With this, you will be able to come up with the perfect financial statement for your company. READ ALSO : accounting excel spreadsheet sample

Sample for Accounting Spreadsheet Examples