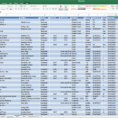

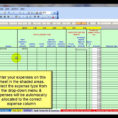

Excel spreadsheet is the new and improved way to keep track of all your accounts receivable. Many small businesses find themselves suddenly faced with a very large amount of money on hand that they need to access in order to handle current operations. It would be wise to research what options are available to you in order to make your accounts receivable payable as soon as possible. Below are some advantages to using an Excel spreadsheet to keep track of your receivables.

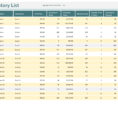

It’s simple and effective: You can enter the information that you need in the Basic spreadsheet functions such as adding, subtracting, multiplying, dividing, and product pricing, and convert the data into currency in order to convert the payment into US dollars. You can also see how much is owed in an easy to read table format and then convert it into another format such as either percent dollar amounts, or total amount. You can use the program anywhere, anytime and generate your report in minutes.

The reports are always up-to-date: It’s important to keep track of your receivables and where they are due so that you are always aware of the situation. If you have an Excel spreadsheet you can generate reports at any time for updates. This will provide you with a great deal of information so that you can determine your next step.

Personal Accounting With Excel Spreadsheet

It’s convenient: Many people who own Excel workbooks found that they use them even if they don’t have a computer at home. If you want to get the most from your business, you can save time and have the ability to check your receivables on the go.

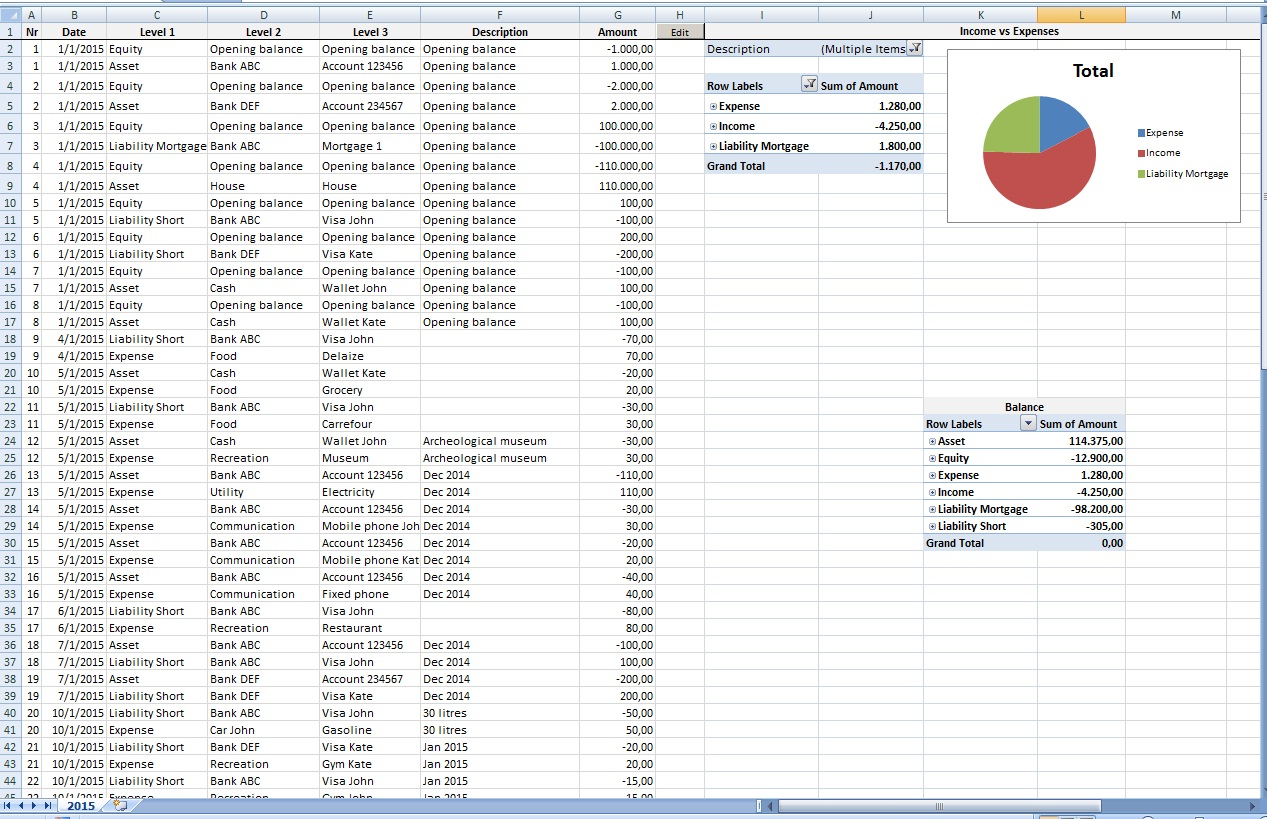

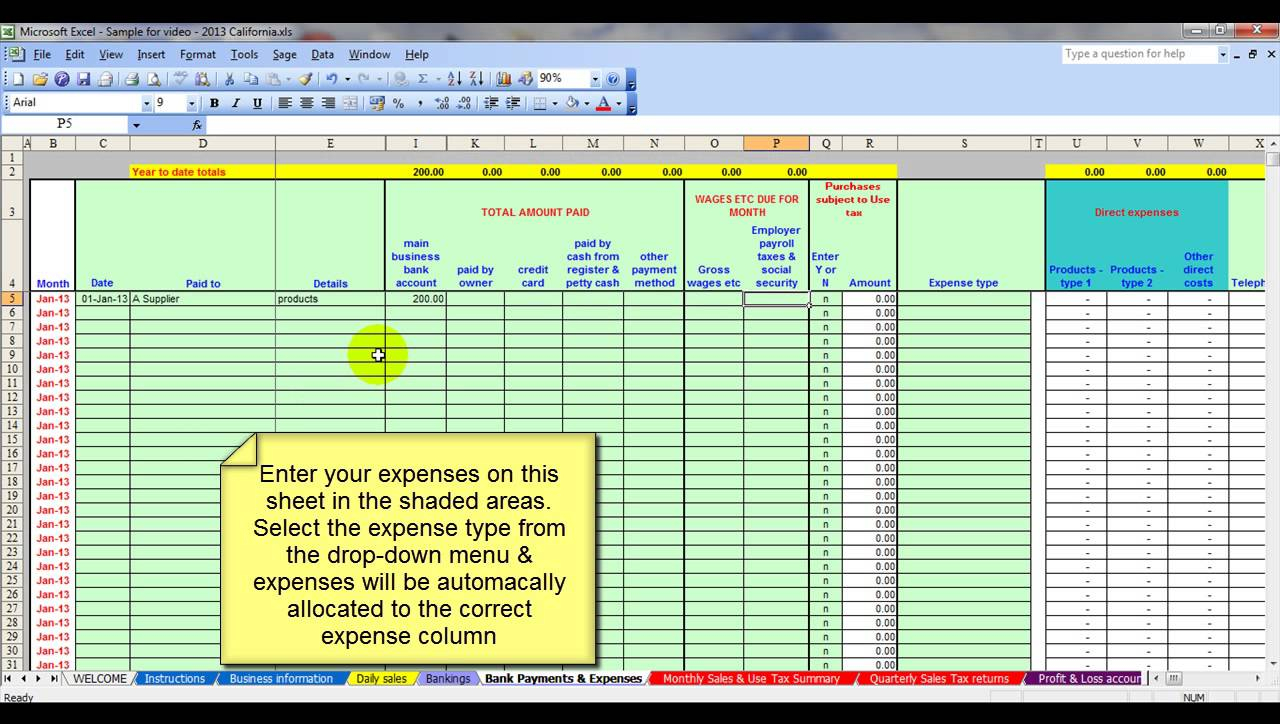

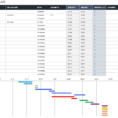

There are many different forms of reports: Some reports are built with just one type of data while others allow you to customize the output of the report based on the type of information that you have entered. In addition, you can change the format of the report in order to match your business. For example, ifyou only have sales in dollars you can set the report to be in dollars with all figures in a table format or in a graph.

Create easy-to-read reports: Whether you are looking at invoice details or you have several payments to make, the details of each invoice will be listed in a clear and easy to read format. The most recent, larger transaction will be highlighted and will be part of the report.

Your financial statements will show all figures in an easy to read format: If you have to look at your financial statement each month to see if there are errors or discrepancies in your report, you can’t remember if you have paid for something or not. You can choose from many different reporting formats and types, and take advantage of the powerful tool that the Excel spreadsheet has to make the task much easier. This is a very useful tool for anyone that needs to make sure that their monthly financials are accurate.

It’s easy to write: Not only is the excel spreadsheet easy to use, but it’s also very user friendly. You can put the sheet to the side, as well as print it for easy reference. You can make it look like a presentation using Microsoft Word.

You can choose which reports you need to access: There are many different reports that you can create, including the results of a sales order, reporting an invoice balance, cash out reporting, or a line item reporting. Each report is easily set up to show the amounts owing, amount due, and total balance of the account. You can set up reports to automatically update when new invoices arrive so that you can easily see the report without having to open the program to see the data.

You can also export the reports and email them out to other people that are involved in your organization. You can include more detailed fields if you need to. The report can include current and historical information, as well as reports in a wide variety of formats.

So, now that you have an idea of what an excel spreadsheet can do for you, go ahead and start filling one out. and see what your business can do to meet your accounting needs. PLEASE LOOK : access spreadsheet