An Impartial View of Pcp Car Finance Calculator Spreadsheet

You lease the vehicle for an agreed time period by making fixed monthly payments. Best of all you don’t need to choose whether to get the auto or not until the contract comes to an end giving you lots of time to work out whether you need to keep the auto or get something different. Therefore, if you’re hard on your vehicle, leasing might not be appropriate for you. If you fret about your vehicle’s resale value, leasing can give some security. You won’t have the car till you have made all your repayments. You ought to be focusing on how much it costs to have your vehicle during that time frame, not your complete equity. If you buy a used car from a car dealer, the worth of the automobile will immediately drop in value the instant you drive the vehicle off the lot.

Ruthless Pcp Car Finance Calculator Spreadsheet Strategies Exploited

If you purchase a car outright, you’re accountable for all of the bills. Ironically, you also need to look at buying if you maintain your car in immaculate condition. Or, in the event the vehicle is worth more than the MGFV (which is normally the case), you may use the difference between the last payment and its true market value for a deposit for one more new vehicle. You will be able to drive away a car you may not have managed to buy outright. After paying a comparatively low deposit, you hire your vehicle with the option to get it by the close of the contract. If you select a brand-new vehicle, it should remain within the company’s three-year warranty for most or all the loan period.

Remember though in the event that you intend to hand the vehicle back that if you’ve exceeded the agreed mileage limit, the finance company may chase you for excess mileage charges. You opt for the vehicle, apply for the finance, and after that confirm your purchase, and await delivery. If you would like to purchase the car outright, however, you can just make the optional final payment and after that it’s yours. If you opt not to purchase the vehicle, you can just walk away once you’ve made all the payments. You will have to keep the vehicle properly insured, maintained and in your possession until the complete value is paid back. If you foresee owning the exact same car for seven decades or more, you will save yourself money by buying. Based on what avenue you opt to go down when it comes to picking your new car, Hitachi Personal Finance can provide help.

Pcp Car Finance Calculator Spreadsheet Options

Check the precise amounts with the lender when you choose a financial loan. Alternately, if you’re seeking to acquire a loan to fund your next car, learn how much you are able to afford to borrow with our finance tool. Now you should understand how much you’ll need to borrow so as to pay off your very first balloon loan.

You would like to know what your monthly payment is going to be for the initial 3 decades and how much you’ll still owe. Your monthly payments may appear low but in regards to the conclusion of your lease, be ready for the last payment if you’re wanting to obtain the vehicle. Your monthly payments on the auto will be a lot lower than if you were buying it You are going to have access to new cars you will not have been in a position to afford to purchase.

Introducing Pcp Car Finance Calculator Spreadsheet

It’s possible to produce the payment be whatever you want, provided that it’s at least your essential payment. Monthly payments might be higher than another finance choices, such as PCP, as you’re paying off the complete value of the vehicle. Then there’s the big 11,340 last payment if you wish to have the vehicle. As soon as you’ve made your final monthly payment, for example, choice to obtain fee, you will have full ownership of the automobile.

Hire purchase is a means to finance purchasing a new or used vehicle. A purchase enables you to either purchase a new car impulsively when you’ve got a cash windfall or maybe to forestall a buy, nursing your previous car along, if your income drops. Another style of financing your vehicle purchase is via a personal loan.

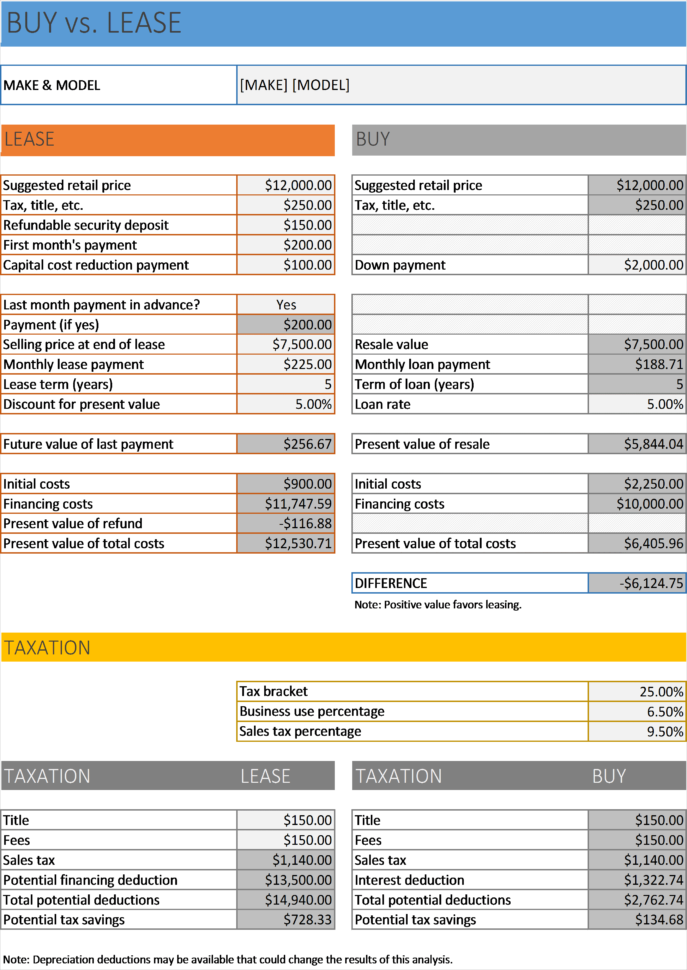

As soon as you know the money value, the very first thing to keep in mind is that the money is going to be added to your yearly salary, so will be subject to your rate of private income tax. At the close of the term you can either pay the last value (GMFV) and own the vehicle, or trade the vehicle in and use any equity towards the expense of the next motor vehicle. You’re able to play around with distinct values for the rate of interest, loan amount, and term to acquire various results.

Calculators are ideal for obtaining a quick answer. Our financial calculators offer flexibility and dependability, which will be able to help you in creating and achieving your financial goals together with help in your financial planning. With that, let’s use the rest of the balance calculator to compute the payoff amount of a current loan.

Sample for Pcp Car Finance Calculator Spreadsheet