There are two main types of taxes: income taxes and sales taxes. Although most people tend to use the term sales tax to describe the concept of a personal income tax, there is another type of tax that is entirely separate from these two and is referred to as the sales tax. This type of tax includes most sales taxes in the United States, including gas, lodging, and food.

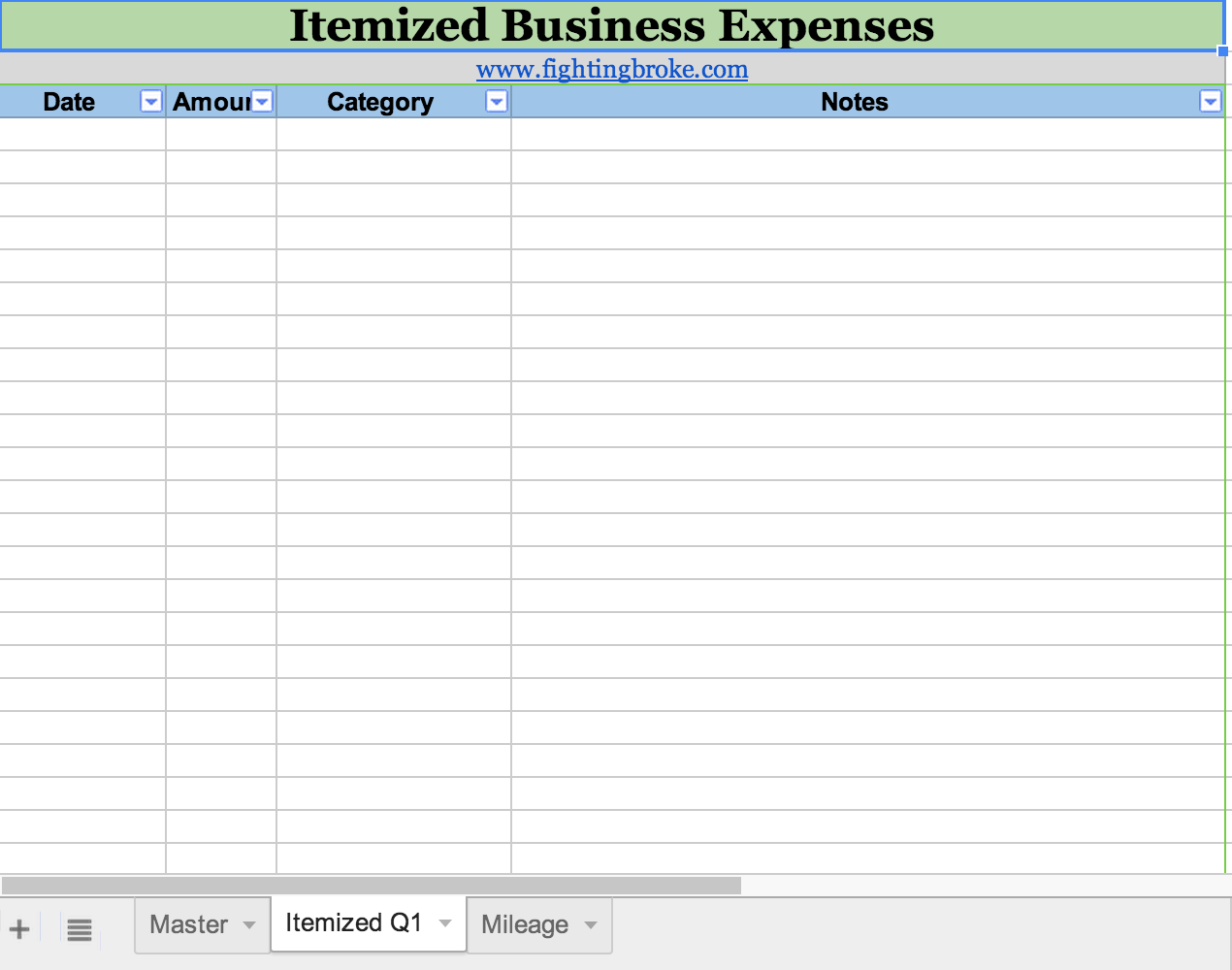

The idea behind a spreadsheet for tax expenses is to keep track of all of your money – both the money you are paying each month, and all of the money you are spending. It can be helpful for business owners, although they may not realize it until they look at their monthly income statement. There are many tools that you can use to help you keep track of all of the money you are spending.

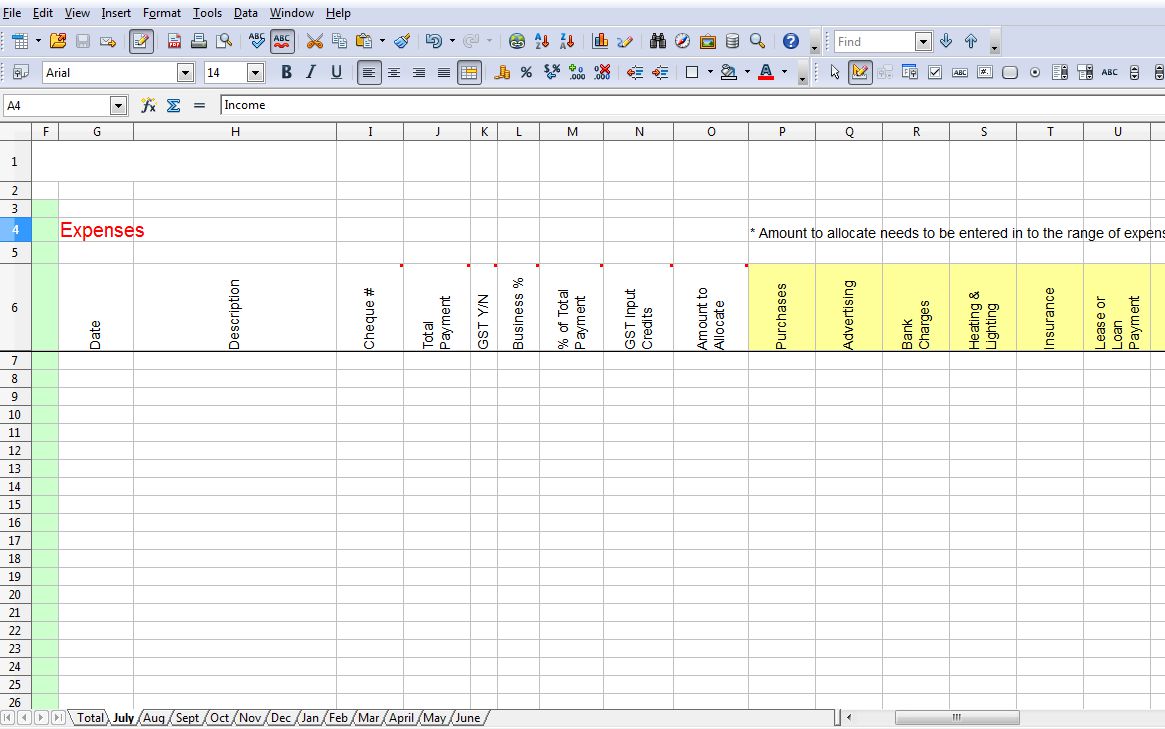

Expenses will come in many forms, so a spreadsheet for tax expenses may need to be designed for all of the different types of expenses that are involved with running a business. These expenses may include business inventory and other equipment and supplies, and any new or used products that you are selling.

Using a Spreadsheet For Tax Expenses Will Help You Keep Track of Your Money

If you have been in business for quite some time, you should know that business tax rates change every year. It is important to keep yourself up to date on your taxes because this information can help you and your business stay compliant with the law.

With the changes that occur every year, it is important that you are keeping an eye on your business taxes. If you are tracking your taxes, you can set aside some days to track your income and expenses. You can also take a copy of your bank statements and prepare them according to the instructions that come with your accountant.

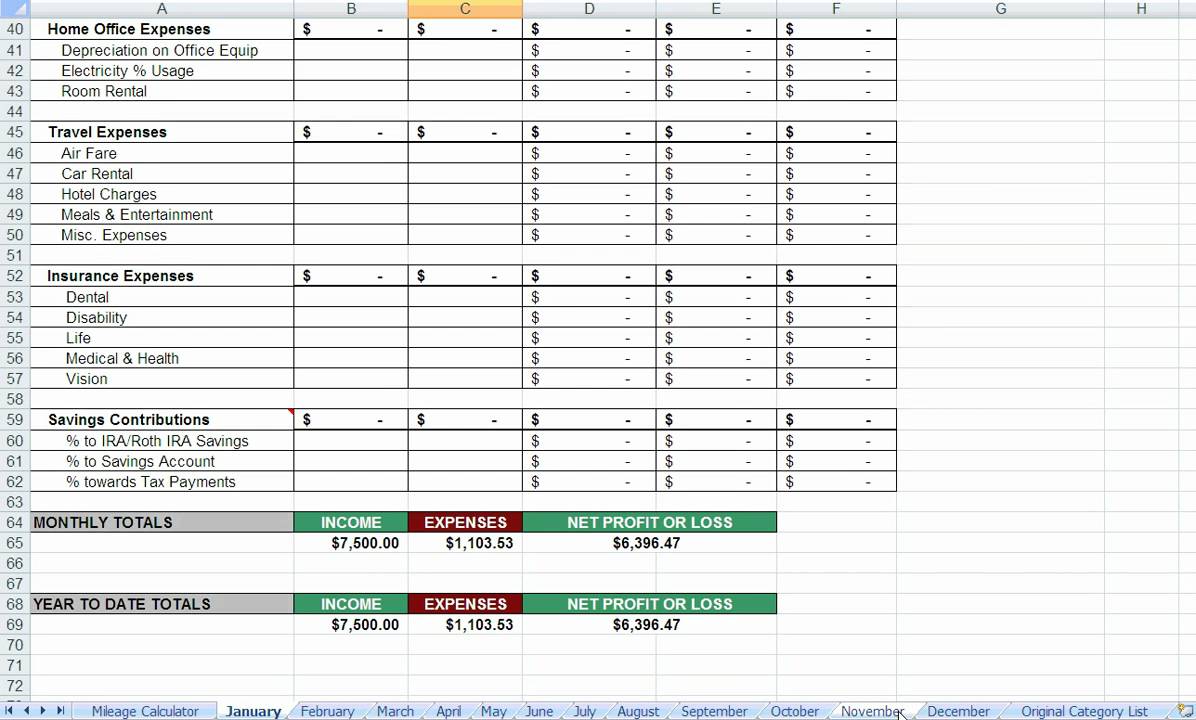

Many of us have forgotten how to properly calculate our income and expenses. By using a spreadsheet for tax expenses, you can find out what you have owed the IRSand track your finances. You will also be able to find out if you are paying too much or too little for tax deductions.

With the changes that occur every year, it is important that you are keeping yourself up to date on your taxes. You can find out what your taxes are, if you have earned any deductions, and what you owe in taxes. With these documents, you can ensure that you are following the rules that govern your income taxes.

Keeping accurate records of income and expenses is very important, because if you don’t, you may have to pay a lot more taxes. Without good records, you may not be aware of certain deductions that are being made. Being aware of what you owe in taxes can help you pay less and save you a lot of money in the long run.

The loss from profit-loss can sometimes be something that is not considered by the IRS, so you may not know if you are losing money with your business. You can use a spreadsheet for tax expenses to determine whether you are making money or losing money in your business.

In addition to being able to keep track of your expenses, it is also an essential part of your accounting system. Having an effective business tax system is very important, especially if you want to keep your business in good standing with the IRS.

A good spreadsheet for tax expenses will help you keep track of all of your expenses and what they include. These types of accounting systems are very useful, and they can help you figure out whether or not you are making money or losing money in your business. YOU MUST SEE : simple expense form