Rumored Buzz on Loan Amortization Spreadsheet Discovered

By the close of the month, you will observe your loan was reduced and you’ve saved your money. The loan has to be fully repaid by the conclusion of the expression. Personal loans can be useful in a lot of scenarios. Amortized loans are made to completely pay back the loan balance over a particular period of time. It is common for those who have overspent to take out loans to consolidate charge card debt sitting at higher rates of interest. You’ll also enter when you wish to pay off your loan. If you prefer to do a mortgage, our Payment Calculator Mortgage Samples will be an extremely helpful tool.

Loan Amortization Spreadsheet Fundamentals Explained

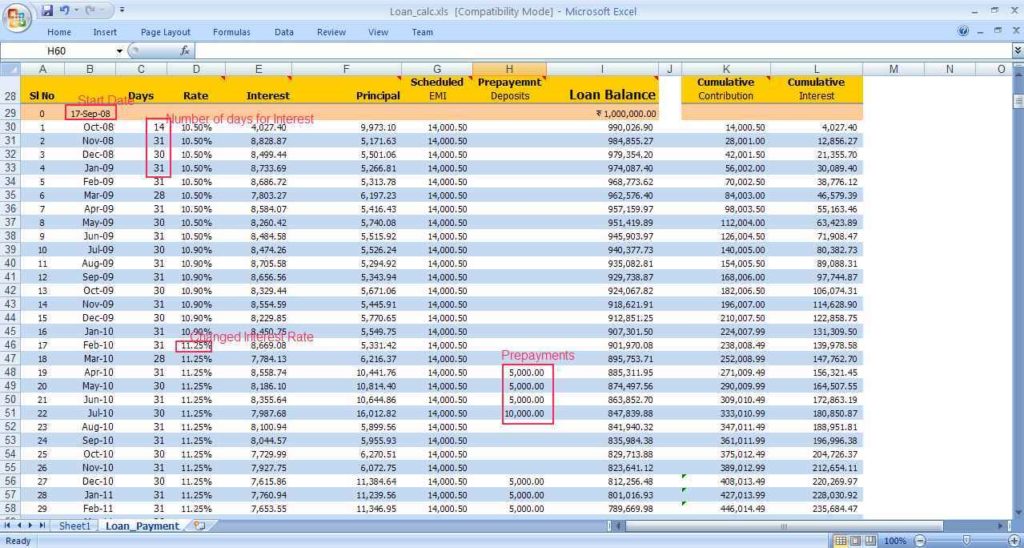

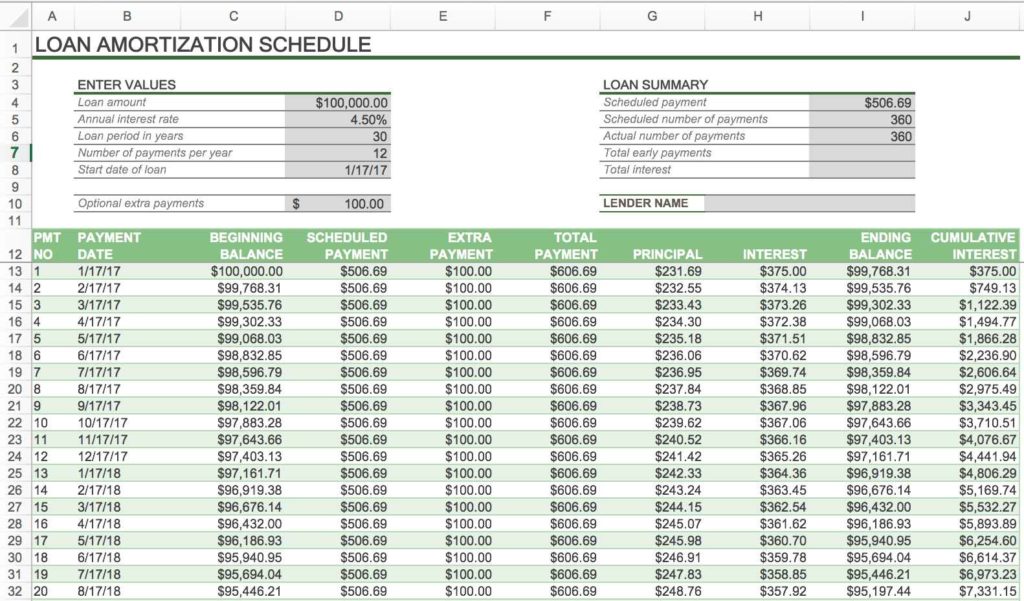

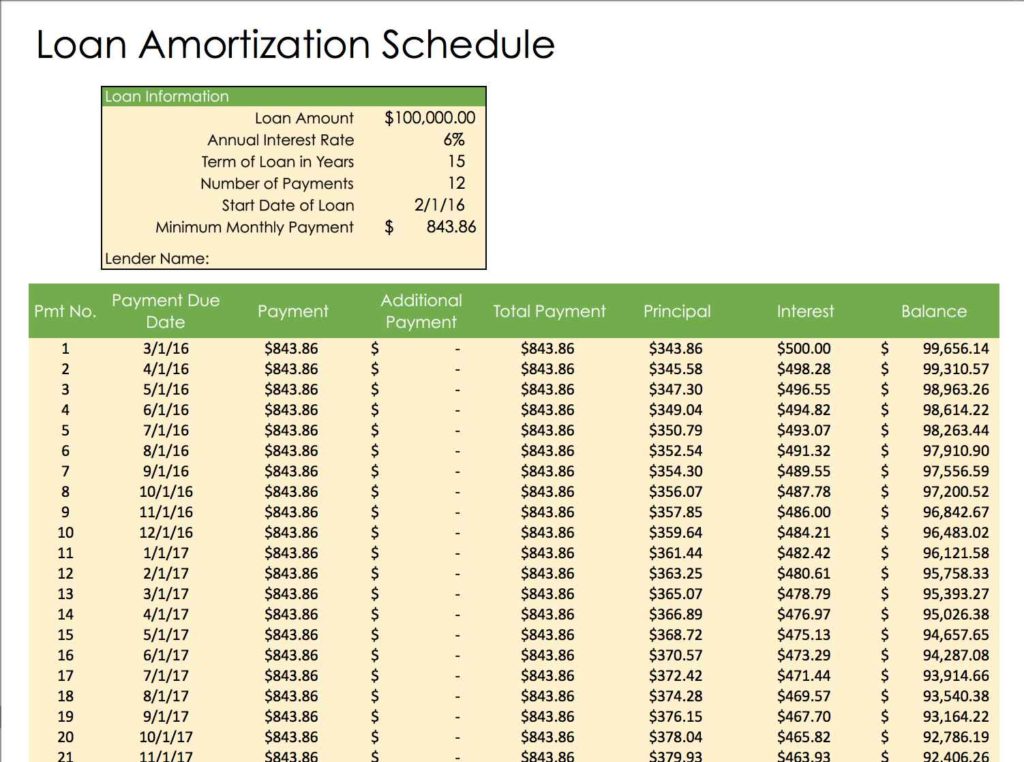

The schedule indicates the remaining balance still owed after every payment is made, which means you understand how much you have left to pay. Once an amortization schedule includes rounding, the previous payment usually must be changed to constitute the difference and bring the balance to zero. If you also need to create an amortization schedule of any sort, you may download totally free amortization schedules from our site. An amortization schedule is a helpful tool when you choose a financial loan. An auto loan amortization schedule enables you to carry out the essential math to derive an approximate monthly payment, provided that you can input all the necessary information. After figuring the monthly payment using the amortization formula, it is fairly easy to derive. Knowing the auto loan amortization formula can help you earn a much better free amortization schedule using 365 360 to use decision about your auto loan and the kind of loan you wish to take out.

As you see, the calculator can be employed to compute a lot of different things. The calculator is pretty simple at this time, and it would want to get a great deal more intelligence to manage dates properly. Mortgage calculators are a great way for you to receive an overall idea about what you want. The calculator will return the amount that have to pay monthly to achieve that. It uses figures such as the monthly interest rate and the total number of payments in the loan term to add interest to principal for the final figure. What to enter into an amortization calculator Most amortization spreadsheets are easy to construct whenever you are utilizing a superb on-line amortization calculator site. To make an amortization schedule using Excel, you may use our completely free amortization calculator that’s in a position to take care of the form of rounding required of an official payment schedule.

The repayment sum is fixed so that you won’t be shocked by how much you must pay over a time period. A loan repayment period can go on for many years where it will become tedious to keep account of all of the installments and their individual payment time. See the way your loan becomes paid off as time passes, or how much you’ll owe on your loan at any certain date later on.

Rumors, Lies and Loan Amortization Spreadsheet

Begin by going into the entire loan sum, the yearly rate of interest, the range of years necessary to settle the loan, and how frequently the payments have to be made. You merely add the excess payment to the total amount of principal that’s paid that period. Utilize our Refinance Calculator to analyze your possible mortgage refinance and our Extra Payments Calculator to figure out the effect of creating extra payments on your present loan. Let’s explore the 3 distinct methods by which you can make additional payments.

Whether you make payments at the start or the close of the month creates a difference, as an example. A region of the payment covers the interest due on the loan, and the rest of the payment goes to lessen the principal amount owed. Your payment stays the exact same, but you will pay less and not as much interest with each monthly payment. For instance, you’ll want to compute the monthly payment. Looking at the auto loan amortization chart, you will have the ability to figure out how many payments you should make ahead in order to pay less interest on the loan. In the start, you’re going to be making large interest payments and tiny payments to the principal.

Whatever They Told You About Loan Amortization Spreadsheet Is Dead Wrong…And Here’s Why

The advantage of creating extra payments can assist you in saving money in compounding interest and decrease the duration of your loan too. The fantastic benefit of amortization is that you understand how much you need to pay every month, under a fixed rate of interest, to finish paying off the loan at a certain moment. After borrowing money, a lot of people don’t understand how much they’re really borrowed. Just like with a mortgage, as more money is covered by the consumer to the charge card company, the principals of charge card amortization show that there is going to be less interest owed on each individual payment in the event the card isn’t being used. PLEASE SEE : Inventory Spreadsheet Template Excel