For those of you who own a home or for those of you who want to get into the mortgage business, it is important to know how to use a mortgage lender comparison spreadsheet. When you have your mortgage broker up front, you will see his advertisements about their low monthly payments and their great incentives to encourage new customers.

What you may not be aware of is that a mortgage lender might be offering a deal that they are not disclosing to you. The only way you can avoid signing on the dotted line is to compare all the offers that are on the table. A mortgage lender comparison spreadsheet will help you accomplish this goal.

Mortgage Lender Comparison Sheets – Find a Low Interest Loan Without Paying High Credit Card Bills

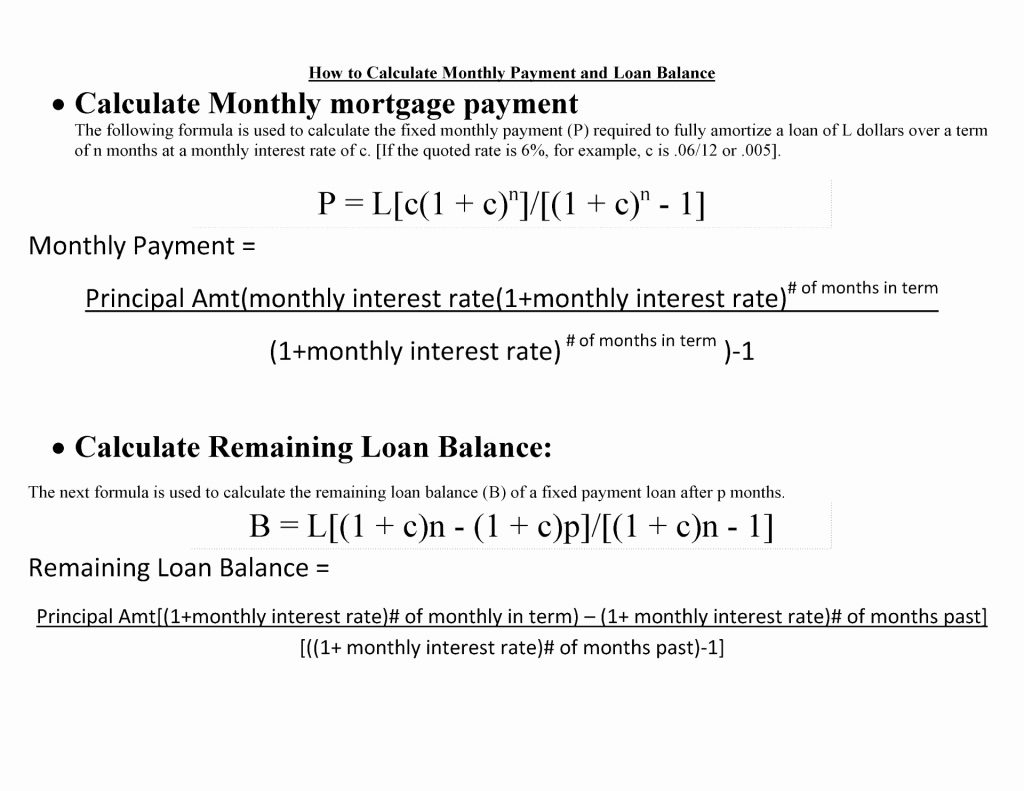

The best part about using a mortgage lender comparison spreadsheet is that it can give you a clear picture of how much money you should be paying every month on your mortgage. Most of us are at a loss when it comes to figuring out what our monthly payment amount should be.

It can be very overwhelming to pay off our own house, having a family, managing our household, etc. Imagine the financial stress if we had to pay back every mortgage that we had with the same company for years on end.

Make a list of the amount that you are paying each month for each loan. Try to include your interest, taxes, and insurance in your list. Once you have a list of all the money that you are paying on your loans, you will know where you stand financially.

It is important to realize that you do not need to make a decision until you make sure that you have gotten several quotes from multiple lenders. In fact, it is best to have an open line of communication with each lender.

Take the time to write down each company that you contact when you are doing your mortgage lender comparison spreadsheet. Make a note of what you were told and any bonus perks. Be sure to ask each one if they will be matching the savings that you will be making by using them instead of another lender.

It is important to be honest with yourself about what you are trying to accomplish when you are comparing different mortgages. Some people like to show their financial hardship in order to get a loan.

You should avoid this, since it will only make you feel sorry for yourself. If you really want to lower your monthly payments and save some money, then find a mortgage lender that will offer you a high interest rate mortgage with a competitive interest rate.

Once you have a list of the different rates and your overall financial situation, it is time to make a list of your priorities and the things that you would like to get. You should be looking for a mortgage that has a lower rate, but one that offers you added features that you want.

If you do not qualify for a mortgage that is listed with a lower rate, you may want to try the high interest rate with the low monthly payments. Then you will have the added benefit of saving money on the interest rate.

A mortgage lender comparison spreadsheet can help you avoid closing the deal with the first mortgage lender that you are interested in. It is a good idea to compare the products, services, and interest rates of several mortgage lenders before you sign on the dotted line. PLEASE READ : mortgage expenses spreadsheet

Sample for Mortgage Lender Comparison Spreadsheet