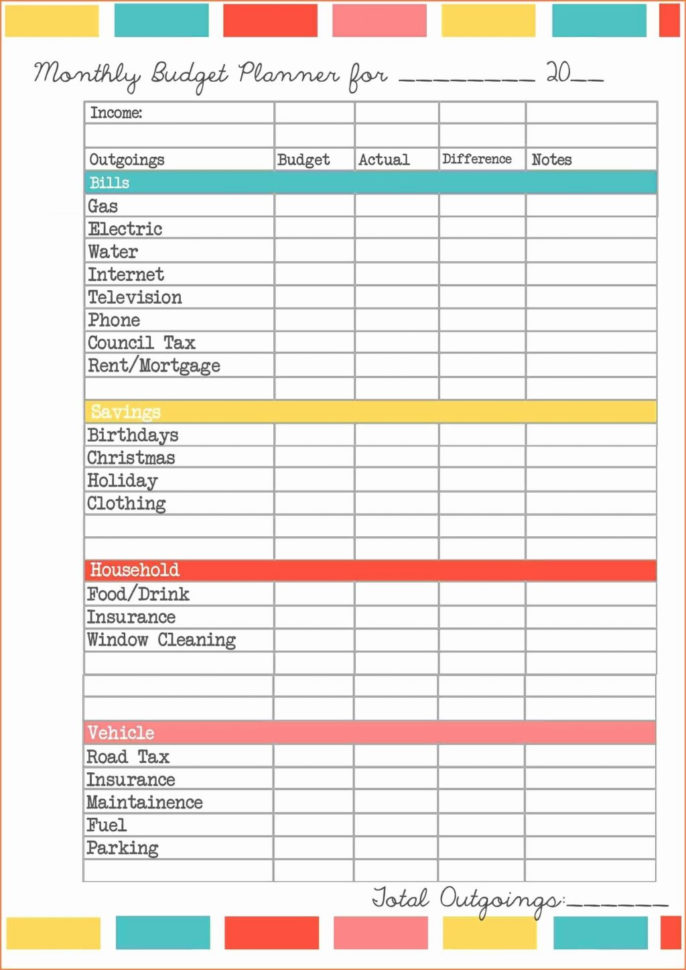

A mortgage expense spreadsheet can be the difference between making a great mortgage and a bad one. Calculating the mortgage expenses you pay each month is a must if you are thinking about buying a home.

It can be difficult to set up a proper budget, and most homeowners just don’t know how to go about it. For these homeowners a mortgage expense spreadsheet is a great tool. It can save them hundreds of dollars on their monthly mortgage expenses.

Mortgage Expense Sheets – Save Big on Your Home

Using a spreadsheet to keep track of your money is much easier than it may seem. There are many different online services that can help you with this task. Just visit any number of the most popular sites and you will find the one that will be right for you.

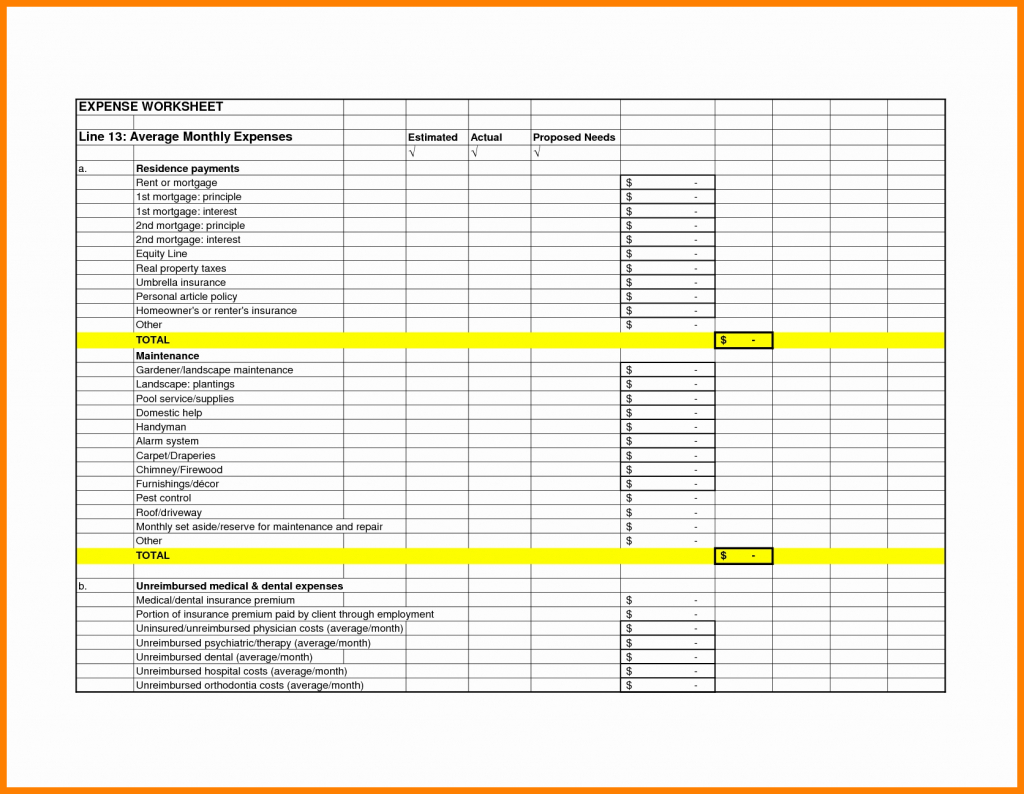

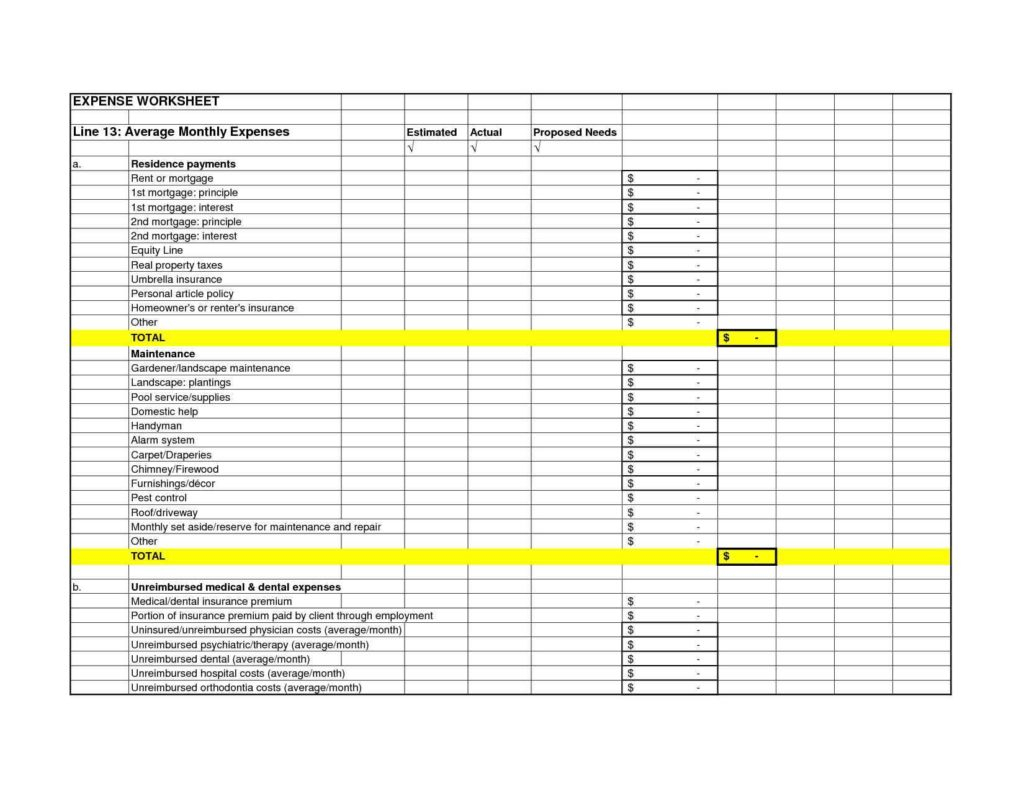

The biggest advantage of using a mortgage expenses spreadsheet is that it eliminates the guessing games involved in figuring out your own expenses. A mortgage expense spreadsheet can give you an accurate, up to date account of all your monthly spending. You can use this information to plan ahead for your mortgage.

Another main benefit of using this type of calculator is the simplicity of it. You can enter in your data without having to guess what the final results should be. This way you will be able to see exactly how much money you will have to pay each month toward your mortgage.

It is also possible to find a good software that will give you the option of entering in your own information. This can make the whole process easier and faster.

Before you begin entering in your monthly mortgage expense into the spreadsheet, you should prepare yourself first. When you have finished preparing, you can begin typing your information in as if you were inputting it by hand.

Keep in mind that you will have to enter all of your personal information, such as the name of your spouse, your net monthly income, etc. This is one of the major advantages of using a mortgage expense spreadsheet.

After you have entered in all of the basic information, the next step is to decide what type of mortgage you want. This may include things like: fixed rate, adjustable rate, or a combo of both.

To make sure that you do not get too far behind in your mortgage payments, you should set aside a contingency fund, so that you have some extra money in case of emergency. You can also consider working with a real estate agent to increase your chances of qualifying for a lower interest rate.

Your mortgage expenses spreadsheet can be very helpful when you are shopping for a home. Having all of your expenses available can help you get a better deal on the house you are looking at.

If you are considering using a mortgage expenses spreadsheet to keep track of your mortgage expenses, you should review the free trial offers offered by many of the best online providers. This is one of the easiest and most effective ways to save money on your mortgage. PLEASE SEE : mortgage excel spreadsheet

Sample for Mortgage Expenses Spreadsheet