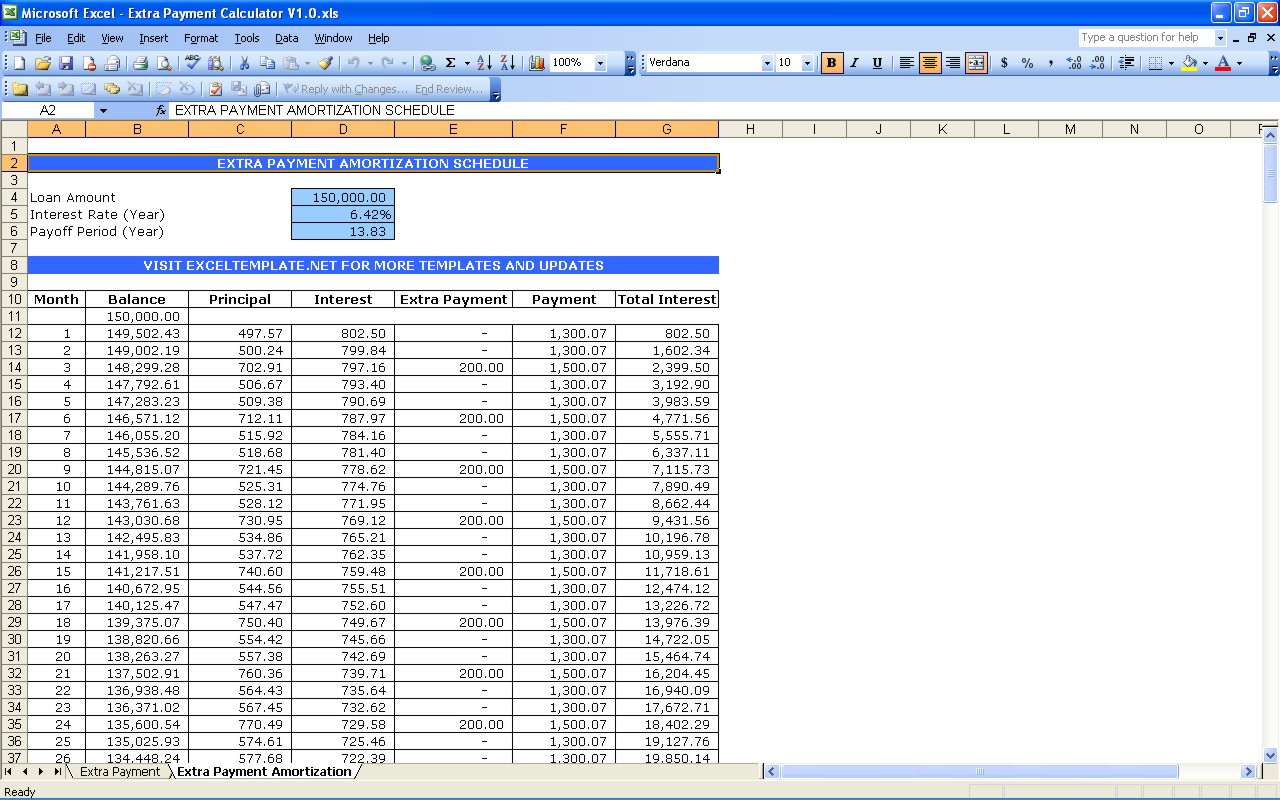

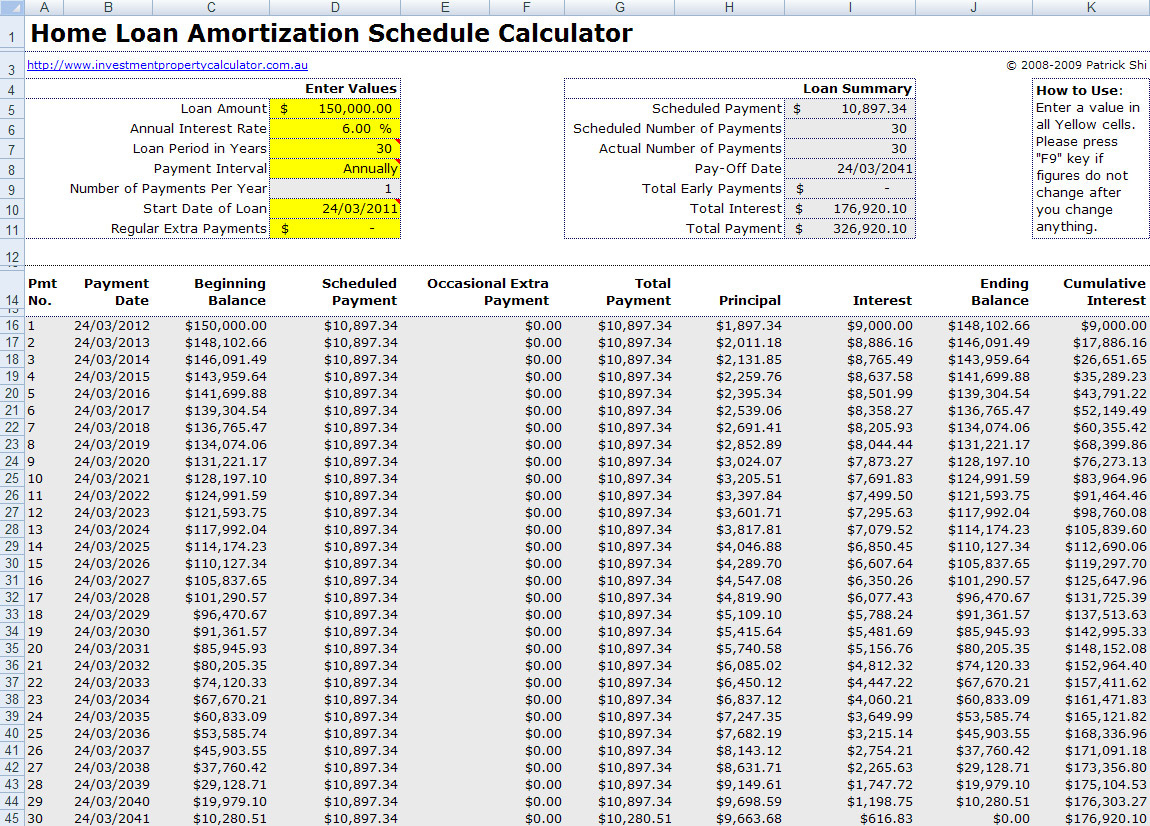

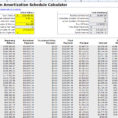

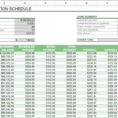

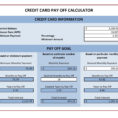

A mortgage payoff sheet is a payment schedule that tracks all of the monthly mortgage payments. It also tracks the interest rate and the amount of principal due, including the mortgage insurance premiums. The payoff sheet works by assigning a “cost” for each payment and computing it based on a payment period.

Each month the homeowner’s income will determine how much money is paid out, and how much is received in the form of interest. When the principal balance is zero (in other words, the mortgage has been paid in full), the homeowner will receive an amount of interest called the “settlement” rate. This figure will be used by the lender to compute the cost of the loan.

The Purpose of a Mortgage Payoff Sheet

The intent of this is to assure that if the borrower defaults on the loan, the full faith and credit of the mortgage lender will not be affected. If the loan is paid off before the maturity date, then the lender retains the entire principal amount as part of the borrower’s debt.

Most borrowers will decide to use a mortgage payoff sheet when they have more than one loan to deal with. They will use it to help them budget and make a budget.

The mortgage payoff sheet is simple to make, and can be used to track a monthly income. The homeowner simply enters in his or her current income and expenses (federal taxes, social security, state taxes, mortgage payments, etc). The next step is to make a list of all of the mortgage payments and the amount due for each.

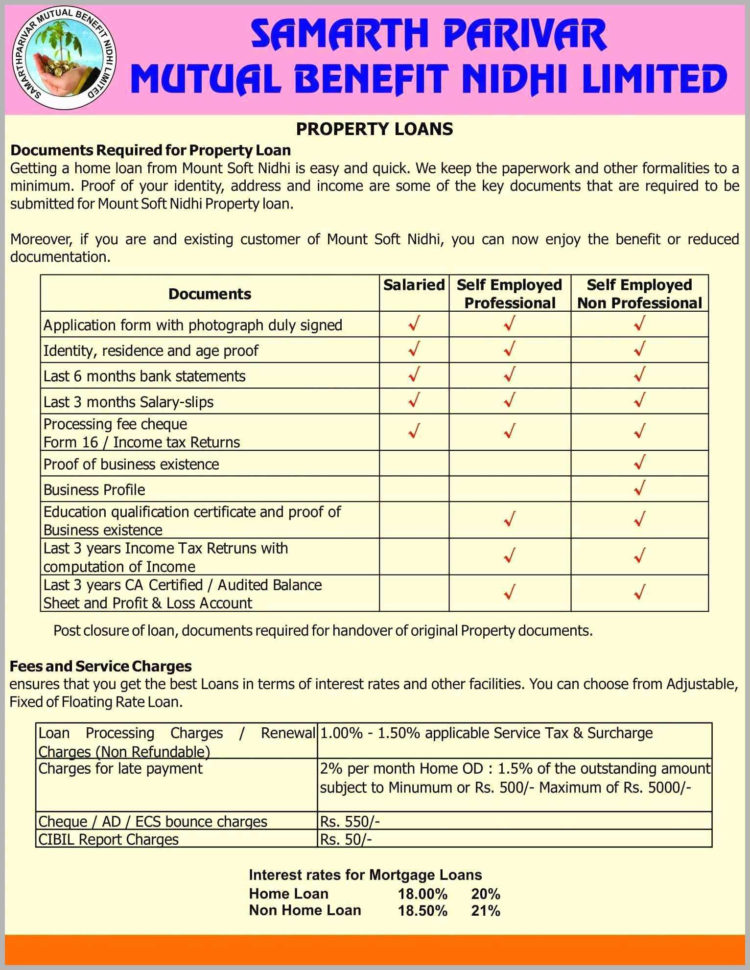

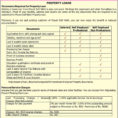

A mortgage payoff sheet may also include a statement of fact. The statement of fact includes the total principal, and the annual percentage rate (APR). The borrower can enter in a number of factors to be included in the statement of fact such as down payment amounts, estimated taxes, homeowner’s insurance premiums, and any other fees the homeowner may owe.

The annual percentage rate will be computed based on the principle balance of the loan and the statement of fact. The APR will be entered in the spreadsheet and should be entered in accordance with the information in the statement of fact.

The purpose of the mortgage payoff sheet is to track payments, interest, fees, and the principle balance. Once the data has been entered into the spreadsheet, the paper will be ready to be filled out and mailed to the lending institution.

A mortgage payoff sheet is not a formal document. It does not have the force of law. It does not constitute the borrower’s contract with the lender, and does not constitute any legal obligation on the part of the lender.

Many documents and formal documents contain the terms of the agreement written in a formal format. A formal document is something that could be cited in court, and as such, must be accurate and in compliance with the law.

Mortgage paperwork may be written in an informal format, without proper formalities. This does not prevent the document from being of importance, because many legal documents are written in this way. If the homeowner is being sued for his or her actions, the mortgage payoff sheet is something that can be used to back up the claim that the homeowner made against the lending institution.

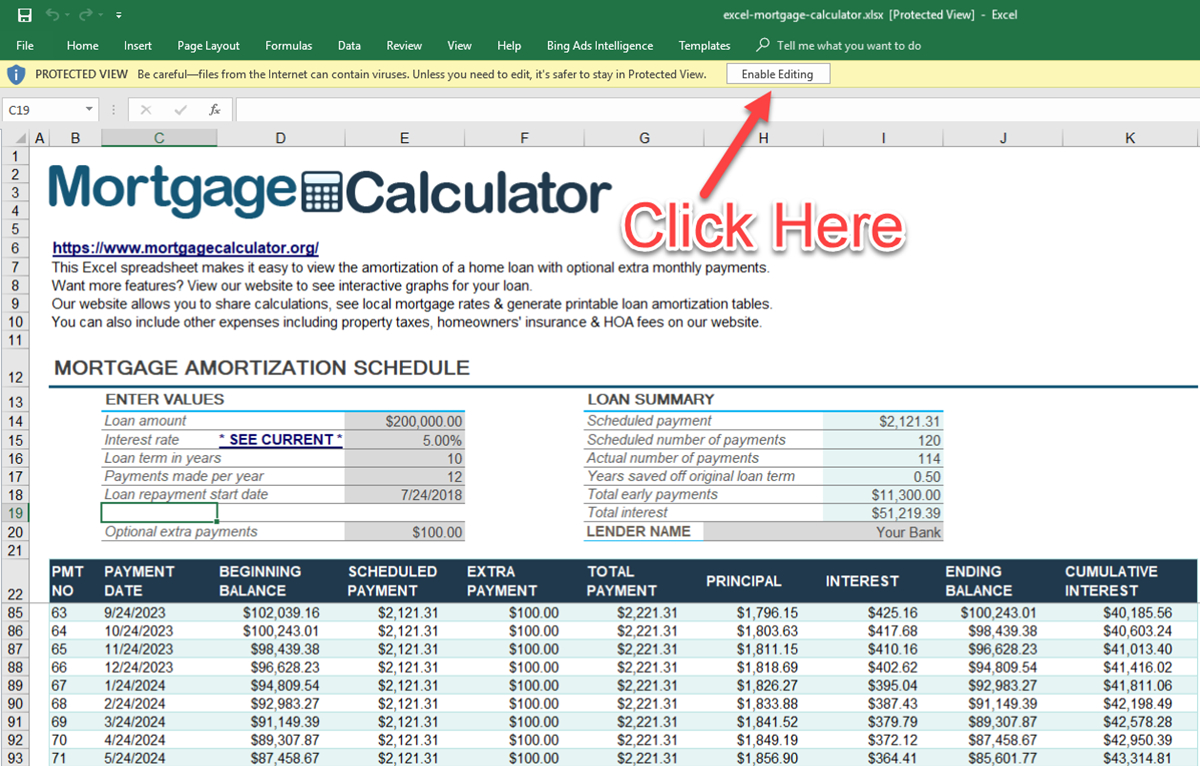

The mortgage payoff spreadsheet should be used only as a guide and not as a rigid legal framework. It is a guideline, and not a rule. It is important that the homeowner reads and understands it and will discuss the document with the lending institution as needed. READ ALSO : mortgage payment spreadsheet excel

Sample for Mortgage Payoff Spreadsheet