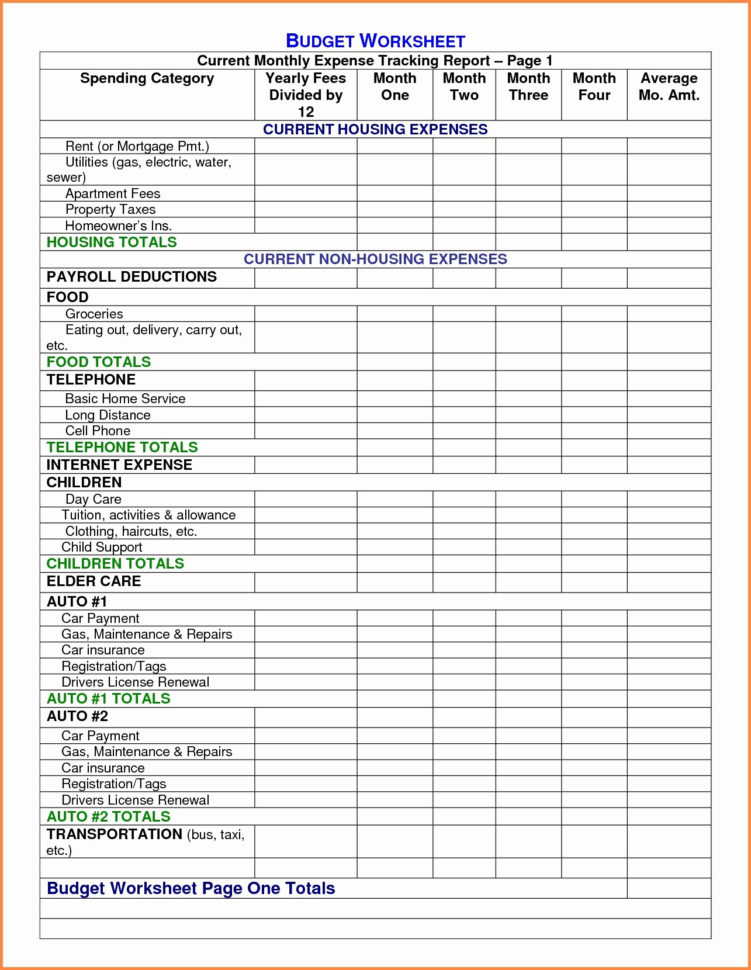

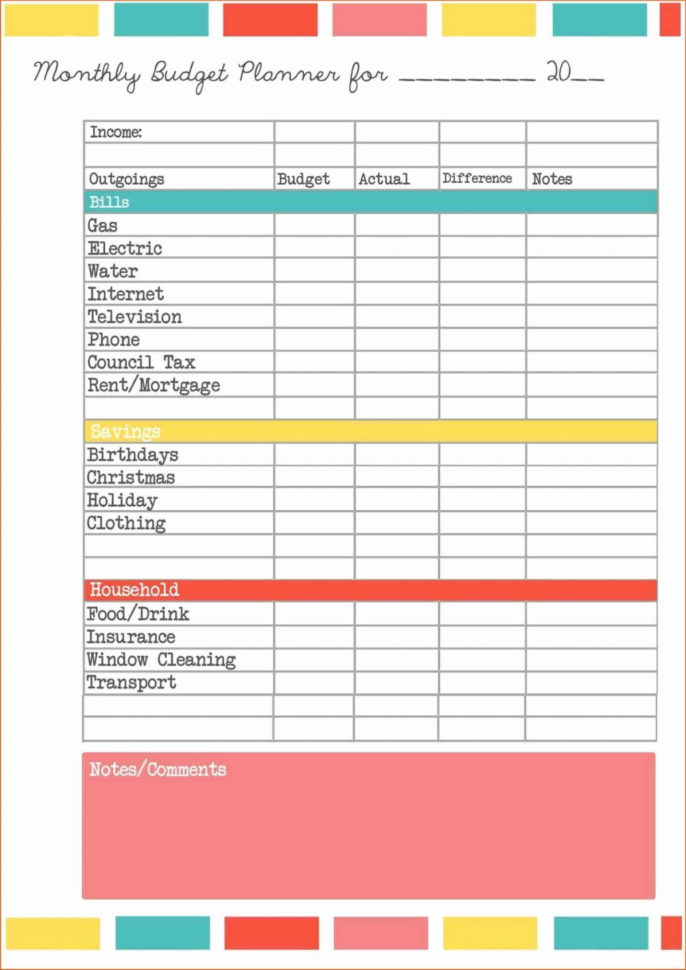

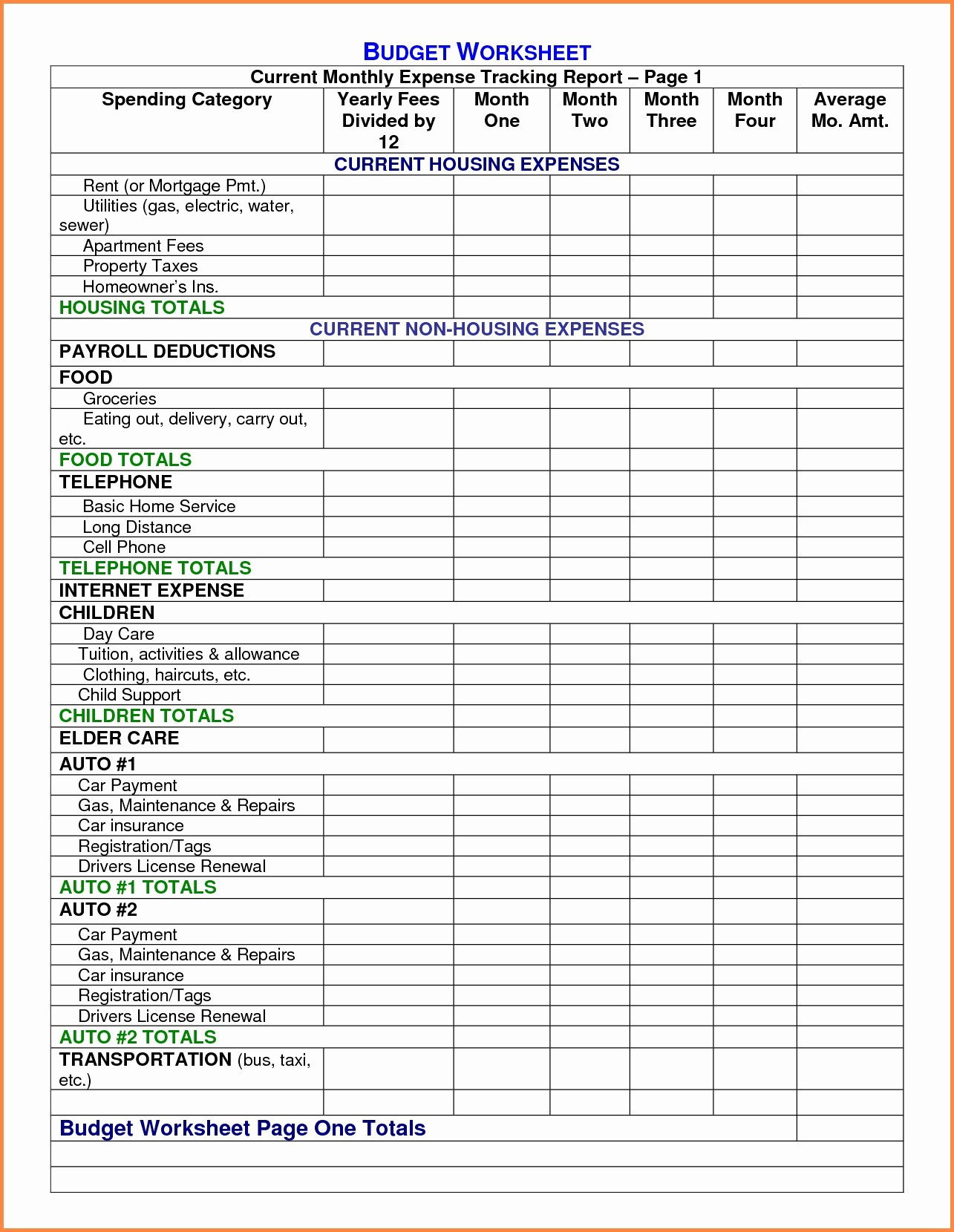

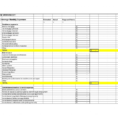

Your monthly budget should contain all the essential details, as well as details that are specific to your business. This spreadsheet will allow you to take control of your finances and track all your financial activities to ensure that you are paying your bills on time and that you are not spending more than you can afford.

So what should be included in your monthly budget? Below is a listing of several items that should be included in your expenses report.

Monthly Budget Expenses – How to Properly Track Your Financial Statements

Tax Information. In order to properly manage your income and expenses, you need to know how much income you are bringing in and how much you are spending. Make sure that this income is reported correctly. There are many sources for these reports but you should be able to gather the information yourself or purchase one from your local government offices.

Employee Benefit Package. A payroll service can provide you with all the paperwork that you need to accurately calculate the cost of the employee benefit package you offer your employees. There are many ways to calculate the amount of the employee benefit package and you should research each method that you can find before you decide which one to use.

Tax Deductions. You should also track your deductions so that you can determine which ones are legitimate and which ones should be disregarded. You should be able to determine whether or not you have itemized deductions so that you can be prepared for any unexpected tax related expenses that come up. Keep all receipts for items that should be itemized.

Emergency Savings Account. Most people understand that when they have an emergency, money comes into their savings account. Having an emergency savings account allows you to be prepared when there is an emergency and you are not able to take care of it on your own.

Additional Income. As your business grows, you should be able to add additional income to your business for profit purposes such as creating inventory, purchasing equipment, or even promoting your business.

Tax Liability. Calculate the amount of tax liability that you are paying so that you can make sure that you are on the right side of the law.

Billing Invoices. When customers call you and request a quote, you need to be able to determine the total amount due and have the ability to pay it immediately without having to wait on a payment.

Opening a New Account. By setting up a new account, you will be able to take advantage of all the promotional offers that you could receive but you will also be able to reduce your overhead costs.

Cash Flow. All of your transactions should be recorded so that you can be sure that your cash flow is correct and that there are no surprises as to where your money is going.

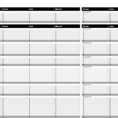

In addition to having all of these items in your monthly budget, you should also be able to budget out all of your expenses. Making sure that your expenses are calculated properly will allow you to be prepared for any unexpected expenses. SEE ALSO : monthly budget excel spreadsheet template

Sample for Monthly Budget Expenses Spreadsheet