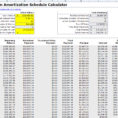

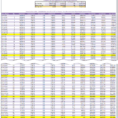

If you’re trying to calculate your mortgage amortization schedule, you need a Loan Amortization Schedule spreadsheet. A spreadsheet is just a nice graphical way to help you visualize your amortization. This will give you a way to create a timeline that helps you find out when you can expect your monthly payments to be low and then figure out when they are going to get high.

The math behind your amortization schedule will help you get your monthly payment back to normal. In order to make your payment normal, you’ll need to make sure that the interest rate on your mortgage is low enough to keep up with the payments.

In order to make sure that your amortization schedule is helpful to you, it’s important that you understand your mortgage. You’ll want to make sure that the amortization schedule for your home loan is an accurate one. This will allow you to find out how much money you have coming in and then calculate how much you can afford to pay each month.

How to Use a Loan Amortization Schedule Spreadsheet

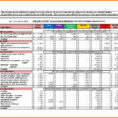

It’s important to know what the numbers mean because your financial statements are showing you the entire picture. Financial statements are only as good as the number that tells you what you’re paying. If you don’t know what that number is, you won’t be able to make the proper budget or make decisions.

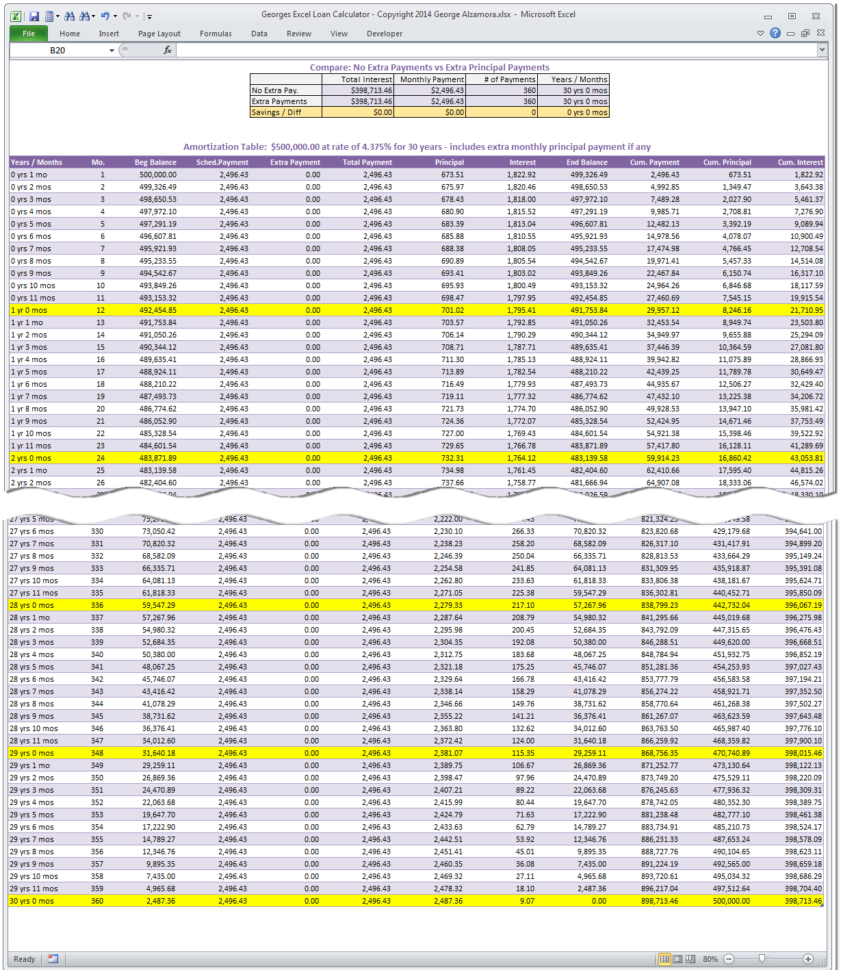

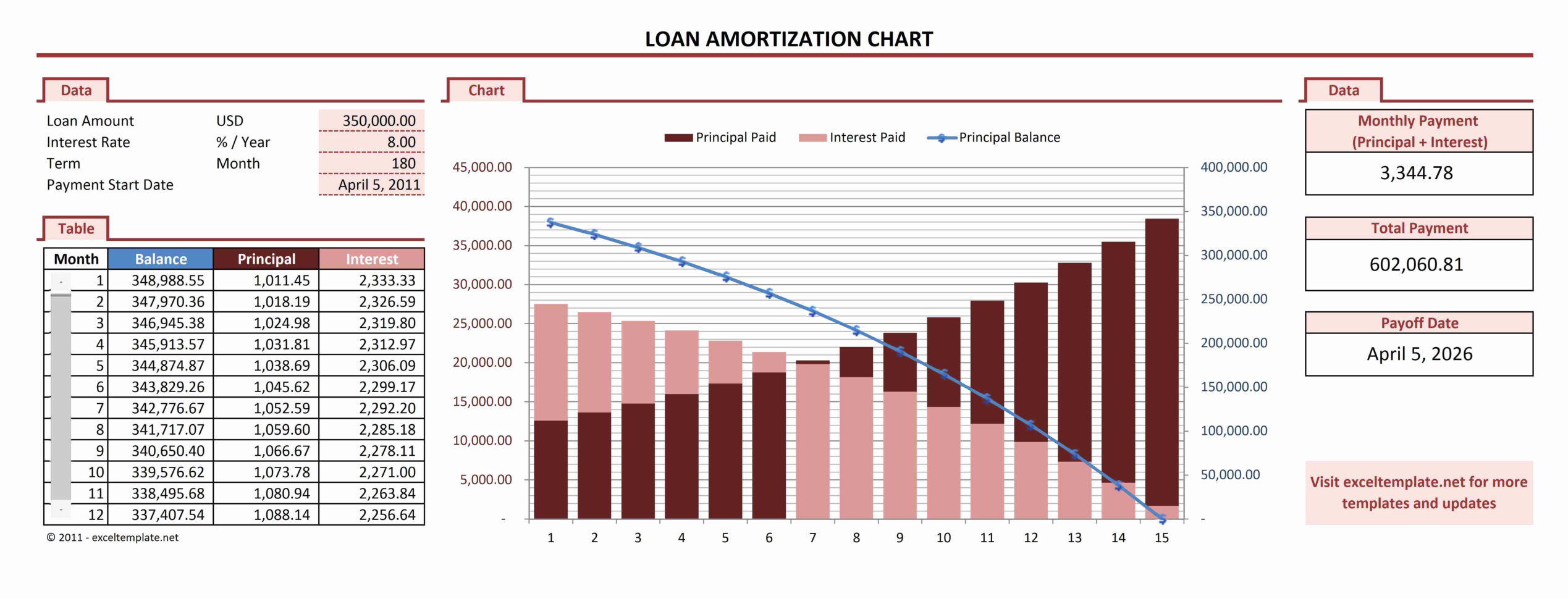

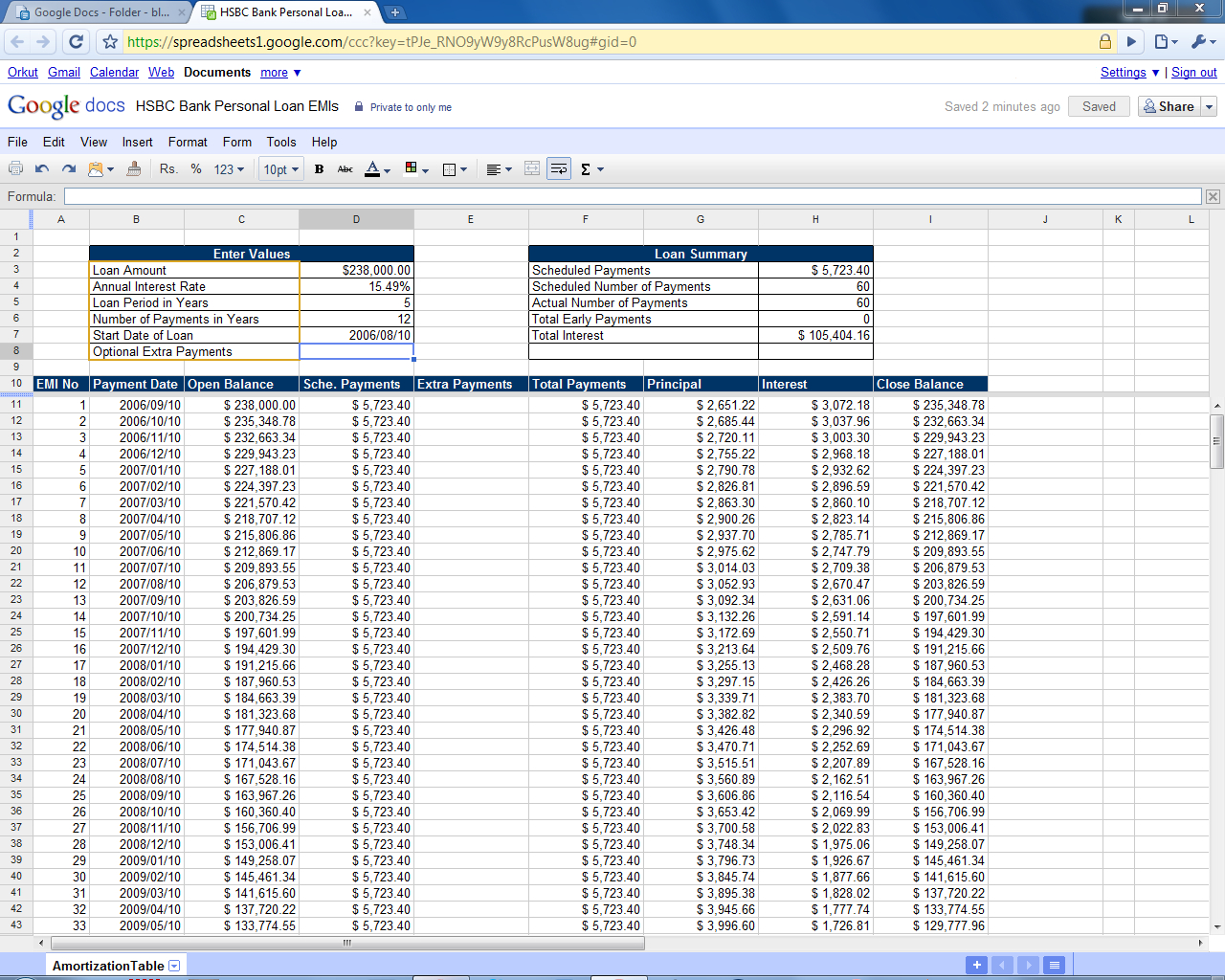

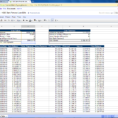

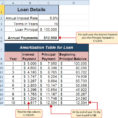

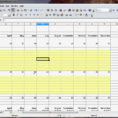

In order to use a spreadsheet that will help you calculate your amortization schedule, you’ll need to figure out the totals that show your mortgage loan as well as the total payments that you have to make each month. Make sure that you have this information in front of you before you begin creating your spreadsheet. You should also make sure that your mortgage lender gives you the figures that you need for this.

In order to make sure that you can use the loan amortization schedule to make sure that your financial statements are in line, it’s best to do your calculations yourself. You need to make sure that your mortgage statement is the same as what the amortization schedule shows. If the amortization schedule is too high, then your mortgage statement is too low.

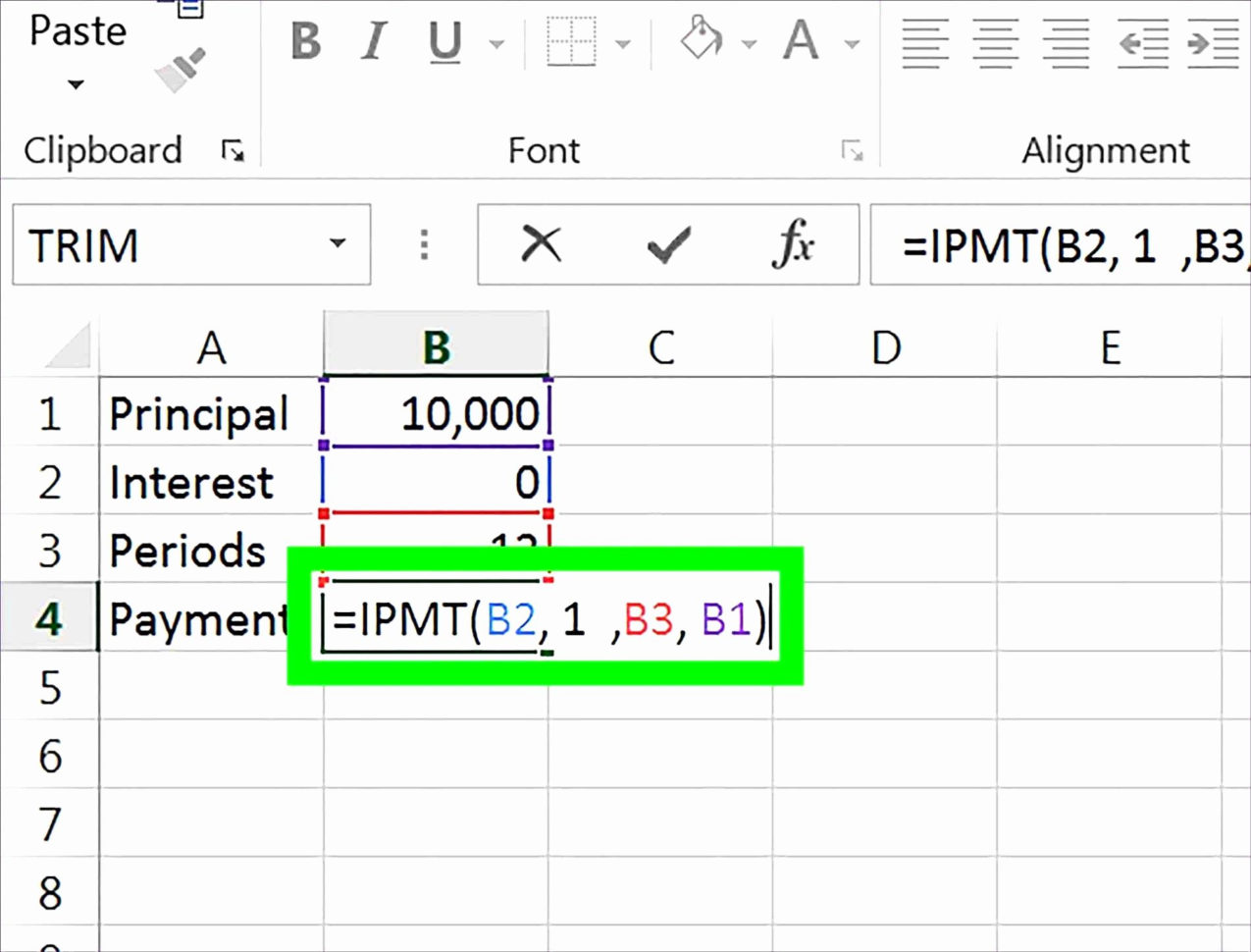

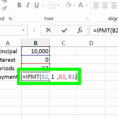

Don’t worry if you don’t know what all of the figures are. When you use a spreadsheet to calculate your amortization schedule, you’ll need to enter all of the numbers. You should always enter the total of the mortgage, and closing costs, and any improvements that are happening to your home. You also need to enter your annual interest rates for both the principal and the interest that you’ll be paying.

When you have all of the numbers entered for your loan amortization schedule, the spreadsheet will be ready to go. After you print the sheet, you can then use your calculator to figure out how much you have to pay each month and then decide how much you can afford to pay each month. This is an easy way to figure out your budget.

After you use a spreadsheet to calculate your loan amortization schedule, make sure that you put in a small amount of time each week to figure out your budget. If you neglect this, you’ll be missing out on ways to save money. Try to spend at least 30 minutes a week on your budget.

Once you know how much you have left for each expense and how much money you can afford to spend each month, you should make a note of it. Next, you should figure out how much you have left in your budget and how much money you should leave for expenses. Just keep in mind that you should budget for two things – one for how much you have and one for how much you’re going to spend each month. As you add more expenses to your budget, you’ll need to divide it up further. Divide it up until it’s manageable. Add it up for each expense. Then you’ll have to figure out how much you have left over and what you’re going to spend that money on.

Your budget is your own personal roadmap for spending money. It’s your budget that you’ve set up. so that you can budget your money without getting into debt. YOU MUST LOOK : llc accounting spreadsheet

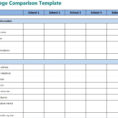

Sample for Loan Amortization Schedule Spreadsheet