If you have ever tried to work with a mortgage spreadsheet formula, then you probably understand the requirements of properly completing this type of a financial document. Mortgage spreadsheets are a very useful tool for many different types of investors and businesses.

However, there are a few things that investors and other businesses might overlook when using a mortgage spreadsheet formula. Some people may feel that their investment options are limited because they don’t realize that the mortgage business is not a one size fits all.

Maintaining Your Investment Strategy Using Mortgage Spreadsheet Formula

Here are some tips that you can use if you want to make sure that you fully utilize your mortgage spreadsheet formula. They are very important and will help you succeed when it comes to making sure that you make the most out of your mortgage spreadsheet formula.

Find the right table. In other words, find the right table that can make sense for your mortgage business. When you’re looking for a table, it’s important to understand that the product that you are about to invest in should be able to work for you.

You should also find a table that is easy to use and understand. There are times when certain table choices could require you to use certain formulas, which would need to be learned. However, with mortgage spreadsheet formula, you should always find tables that are easy to use.

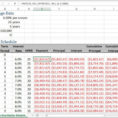

Look for companies that can offer you customization. Most spreadsheet companies will offer you standard tables that are pre-made and ready to go. They will also offer you customization on certain key elements of the spreadsheet. For example, some companies will offer a custom key for any company that you are working with.

While this is certainly something that you can add to your spreadsheet if you want to, there is a certain point that you should try to avoid and that is when you have to use these customization tables. It’s because the purpose of these tables is to provide you with additional key information, but it will usually mean that you are missing key pieces of information. You also don’t want to try to customize your spreadsheet to accommodate your business if you don’t really need to.

Make sure that you use the right key or formulas. It’s also a good idea to make sure that you get the right inputs for your mortgage business. It’s a great idea to make sure that you don’t use too many inputs, especially if the inputs that you have are not of good quality.

Make sure that you add one input to your spreadsheet for every company that you are dealing with. If you have 100 companies, it’s important to make sure that you have at least one input for each company. This is because some companies don’t have a big impact on your overall business, but there are some companies that you need to have input for.

You also need to make sure that you aren’t running multiple companies off of the same spreadsheet. This isn’t something that you want to do if you’re going to make sure that you have access to different inputs for different companies. You also want to make sure that you keep track of inputs for every business that you’re involved with so that you can work with different information for different companies.

Make sure that you analyze your mortgage spreadsheet formula and make sure that you know what you need. The key to getting the results that you want when it comes to using mortgage spreadsheet formula is by knowing what you need to keep in mind. If you don’t take the time to figure out what you need and where you need to add the inputs, then you’ll spend a lot of time trying to figure out how to set up the spreadsheet.

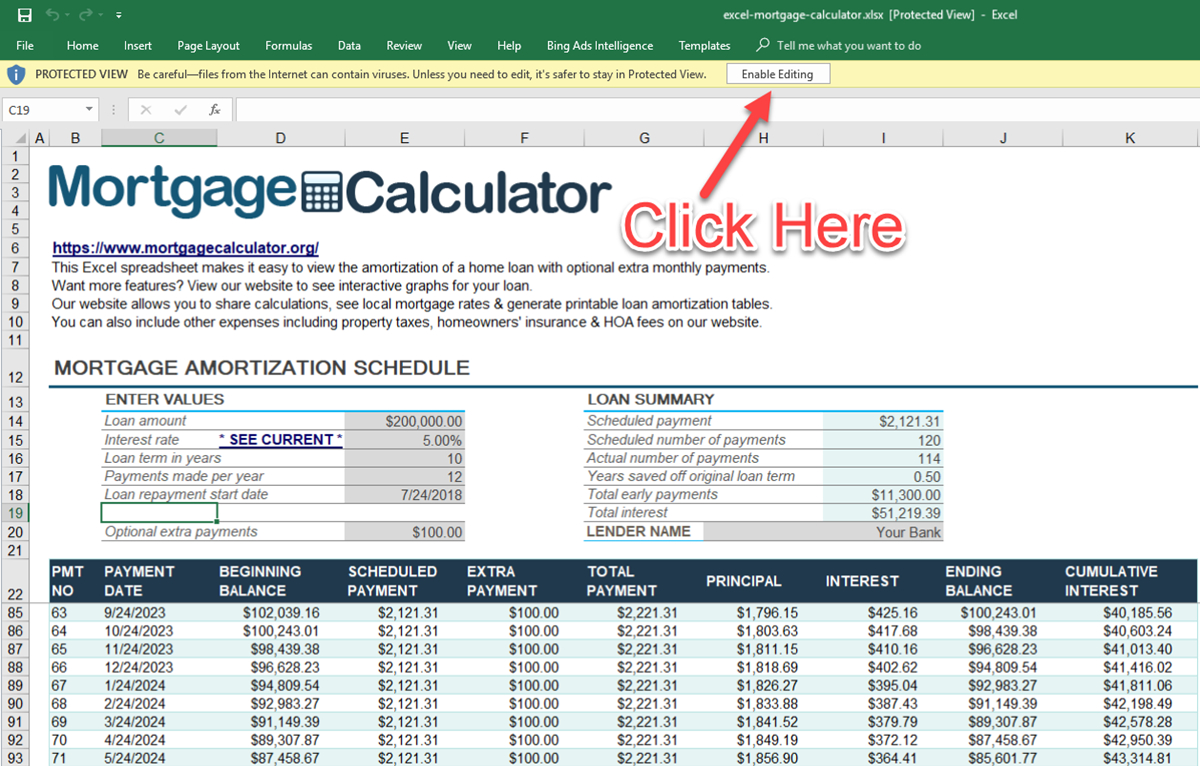

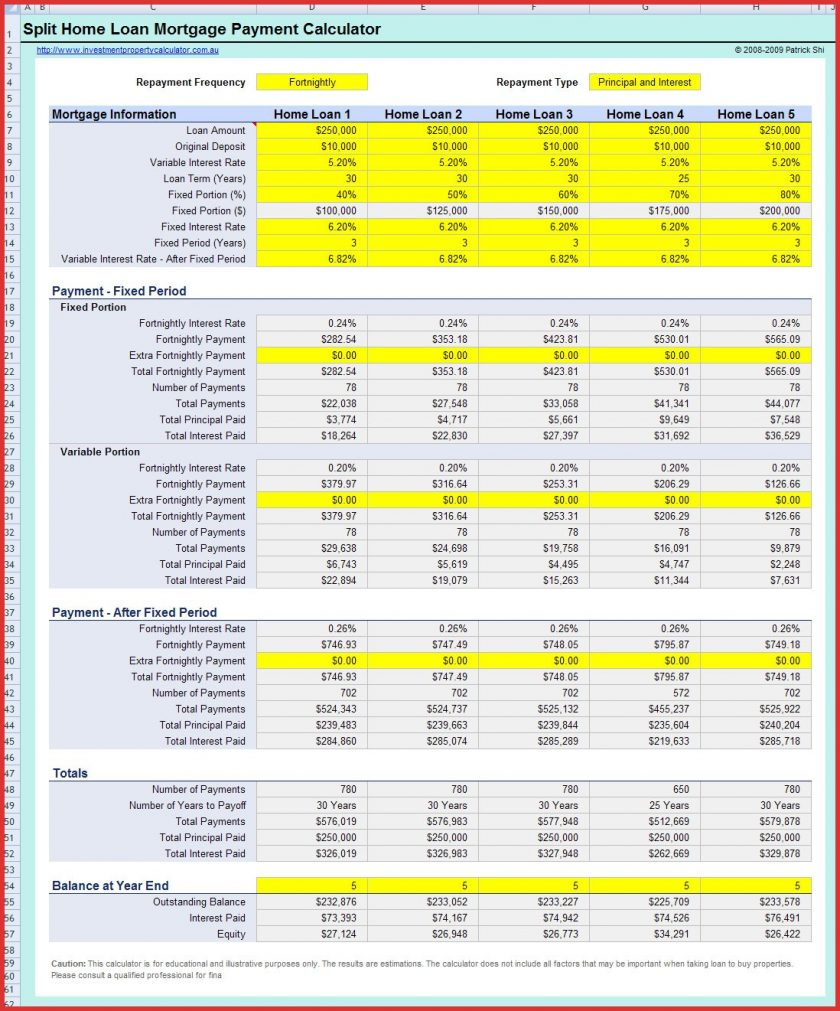

Take the time to understand your mortgage spreadsheet formula and make sure that you are getting the best results from the product that you’re using. This is something that should really make a difference when it comes to making sure that you’re investing your time and money in the right way. PLEASE SEE : mortgage spreadsheet

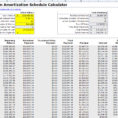

Sample for Mortgage Spreadsheet Formula