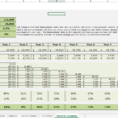

If you have some home-office work that you need to prepare, a good idea is to create an income expense spreadsheet. The best idea is to keep one spreadsheet for everything that you need to calculate.

If you are not a spreadsheet person, you can make the same work in your cell records as you would with a spreadsheet. You just get all the information for your total expenses and get some labels and input the data into the cell. The most important thing to keep in mind is that you have to make sure that the spreadsheet has real time data in order to be useful.

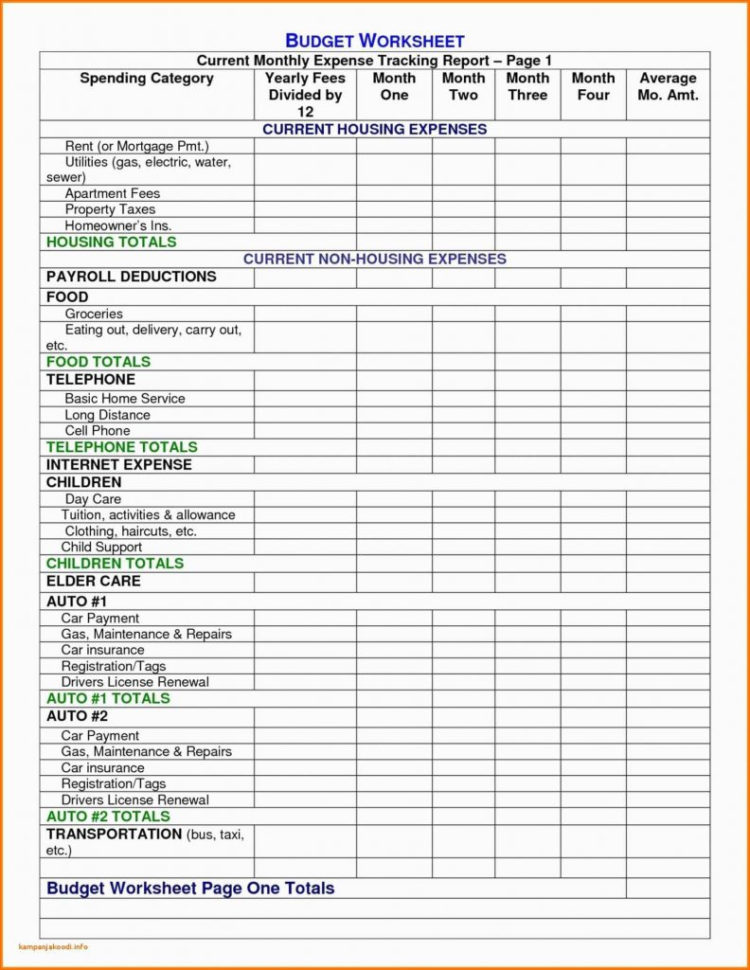

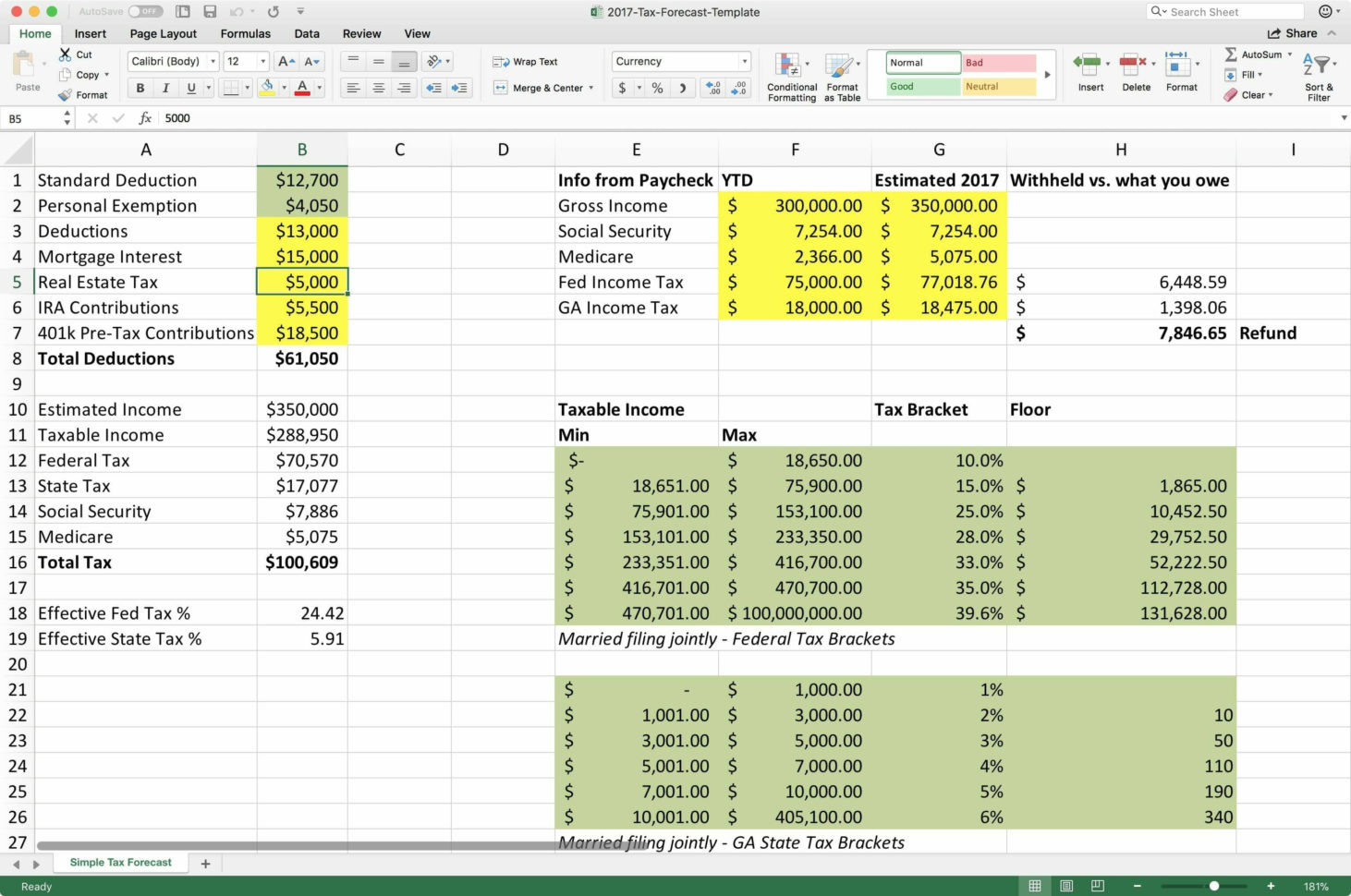

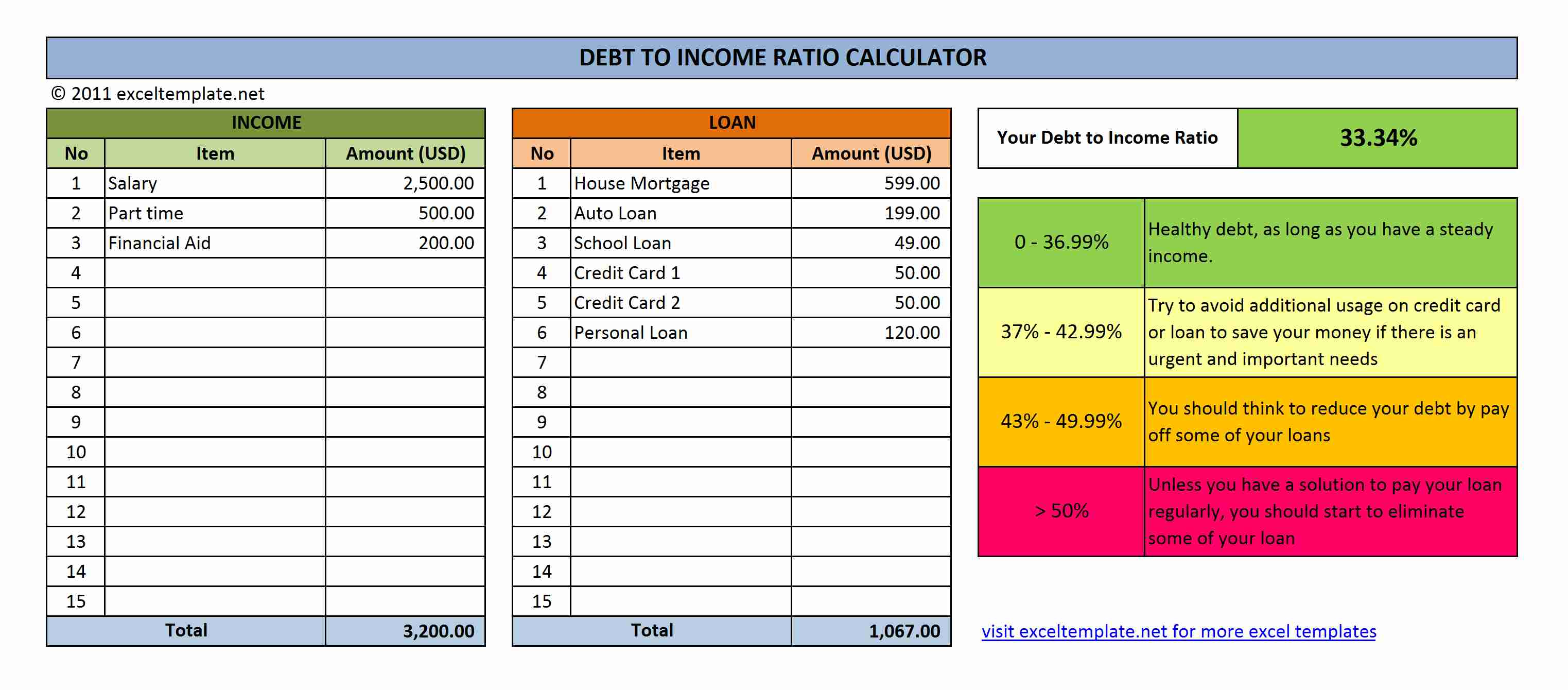

If you have a lot of financial statements and need to keep track of them, or you need to understand your budget better, an expense sheet is essential. By creating an expense spreadsheet, you can easily calculate your taxes and other expenses.

How to Create an Income Expense Spreadsheet

I know of a friend who loves her accountant. She has several spreadsheets that she creates for herself, and she also has separate sheets for tax deductions and other expenses.

One of the most important sections in her spreadsheets is the section where she lists her necessary expenses. The necessary expenses should include things like the computer for her business, furniture for her home office, and books for her personal library. Each month she writes down the necessary expenses for herself, and you can see which section needs attention.

For each of the items that she lists as her necessary expenses, you will need to get a pen and paper so that you can record the date and amount of the expense. Then you should write the name of the individual or company that paid for the item and its current dollar value.

If the expenses are paid for by an individual, there is no need to include the details of the payment in the income expense spreadsheet. Just include the details in the appropriate column. If the expenses are paid for by a company, you will need to include the name of the company and the employee.

In your income expense spreadsheet, you should also get a column for expense deductions. The column should include the dollar amount that was deducted by the individual or company.

Next, you need to create an income expense spreadsheet by grouping the deductions that have similar types of expenses. If the expense was for mortgage payments and food for two children, you could group these two expenses together.

I also find it helpful to group similar types of expenses together in the column that has the column labeled “Other.” When you group similar types of expenses together, you are making it easier to find the expense deduction later.

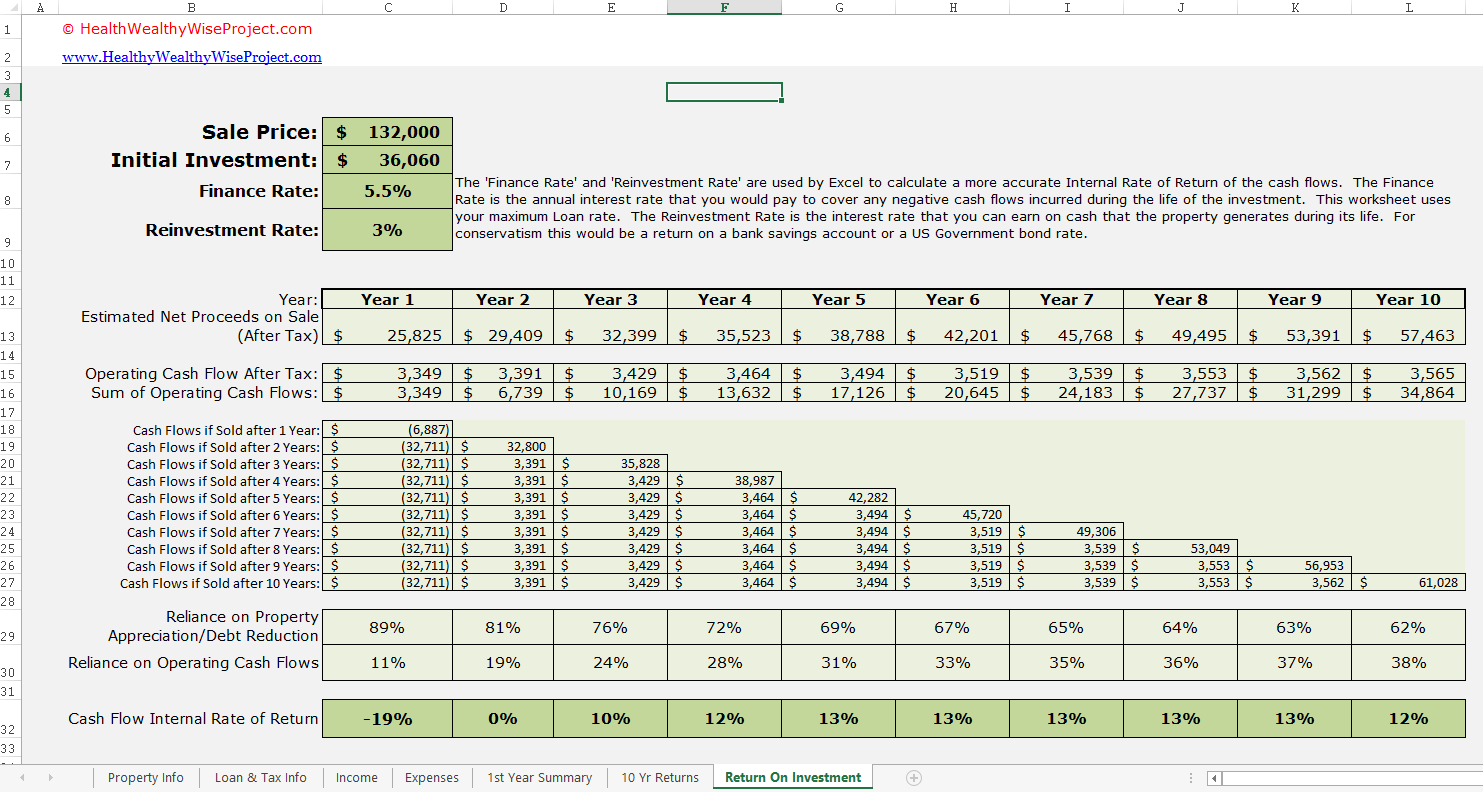

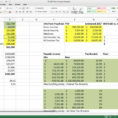

Finally, the income expense spreadsheet is very important because it allows you to organize and tabulate all of your finances. You can use the expense sheet to run a comparison of your financial situation and decide whether you are earning enough money.

Remember, if you are a stay at home mom, the expense sheet is your key to keeping track of your finances. I hope you have found this article useful. PLEASE SEE : income spreadsheet

Sample for Income Spreadsheet Excel