Using a credit card spreadsheet to monitor your spending and balance is a great idea. There are so many benefits that come with using such a program. This article will show you the many benefits of using a credit card spreadsheet to track your spending and manage your money more effectively.

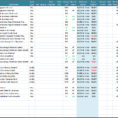

First, it will help you to have a better overall satisfaction and to keep track of all your purchases. You can use this as a tool to help you cut down on unnecessary expenses.

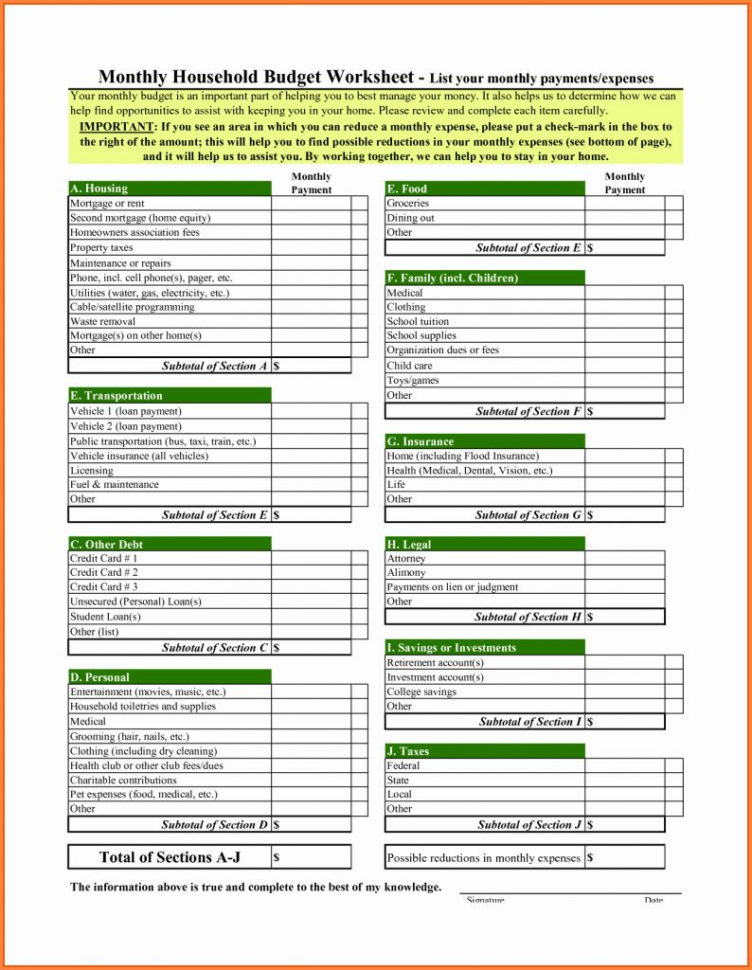

Second, you can use this spreadsheet as a tool to cut down on your cash flow. You can know exactly where your money is going every single day and how much you are spending every month, allowing you to set a budget for yourself.

Use a Credit Card Spreadsheet to Track Your Spending and Savings

Third, using a credit card spreadsheet can help you stay organized and put a stop to your worries. Not only will you know where your money is going but you will also know where you are spending your money, so you can decide if you really need that new pair of shoes or to buy groceries instead.

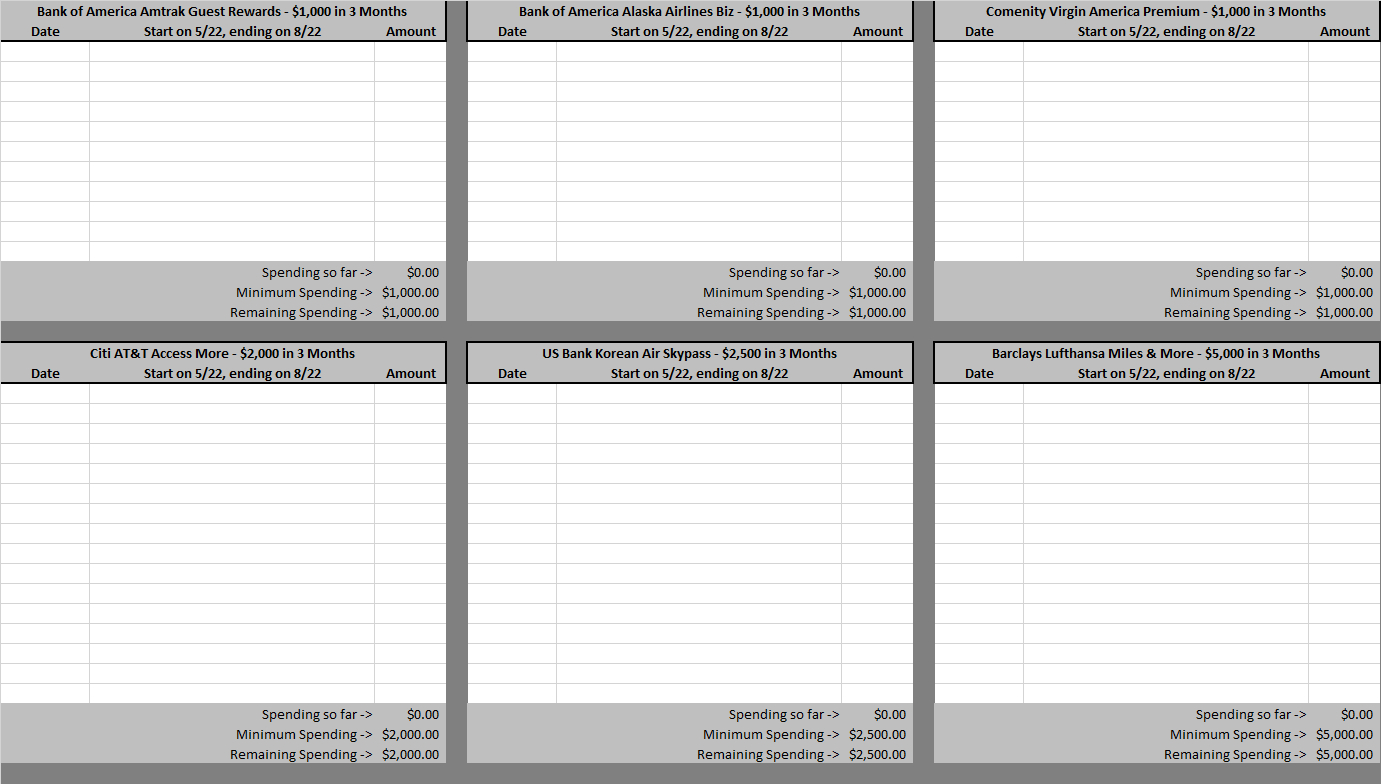

Fourth, this personal finance product is simple to use. You can write down the amount you spend every single day and with just a click of your mouse, you can have the total amount of your spend every month, as well as the amount of money that you have saved or earned.

Fifth, this personal finance product can help you save a lot of money. With a credit card spreadsheet, you can see at a glance how much you have saved and how much you have spent.

Sixth, debt management programs and other financial tools are used by millions of people every day to stay debt free. It is always good to know the easiest way to get out of debt and to stay debt free.

Seventh, using a credit card spreadsheet will help you plan your budget and manage your money efficiently. You can get a better sense of where your money is going so you can set a budget and stick to it, avoiding expensive impulse buys.

Seventh, you can track your finances more easily. By tracking your income and expenses, you can set a budget and manage your finances in a way that is comfortable for you.

Eighth, using a credit card spreadsheet can help you stay organized. You can set a budget that fits your lifestyle and you can create a savings account or transfer money from your credit card to a savings account.

Seventh, you can use it as a stress reliever. The spreadsheet helps you to reduce your stress levels and to stay motivated throughout the entire month.

Although, it is not a credit card spreadsheet, using it is a great personal finance product that can help you stay on top of your finances. Not only will you get a better understanding of where your money is going but you will also know where you are spending it so you can decide if you really need that new pair of shoes or to buy groceries instead. PLEASE LOOK : credit card rewards spreadsheet

Sample for Credit Card Spreadsheet