If you want to use a cash flow spreadsheet to help guide your business decisions, then you’ve probably already made up your mind to learn how to do it. This way, you’ll be able to stay on top of your financial situations and find solutions to difficult business problems. In order to get started, you first need to create a cash flow spreadsheet for your business, and then decide whether or not you want to learn how to do it yourself.

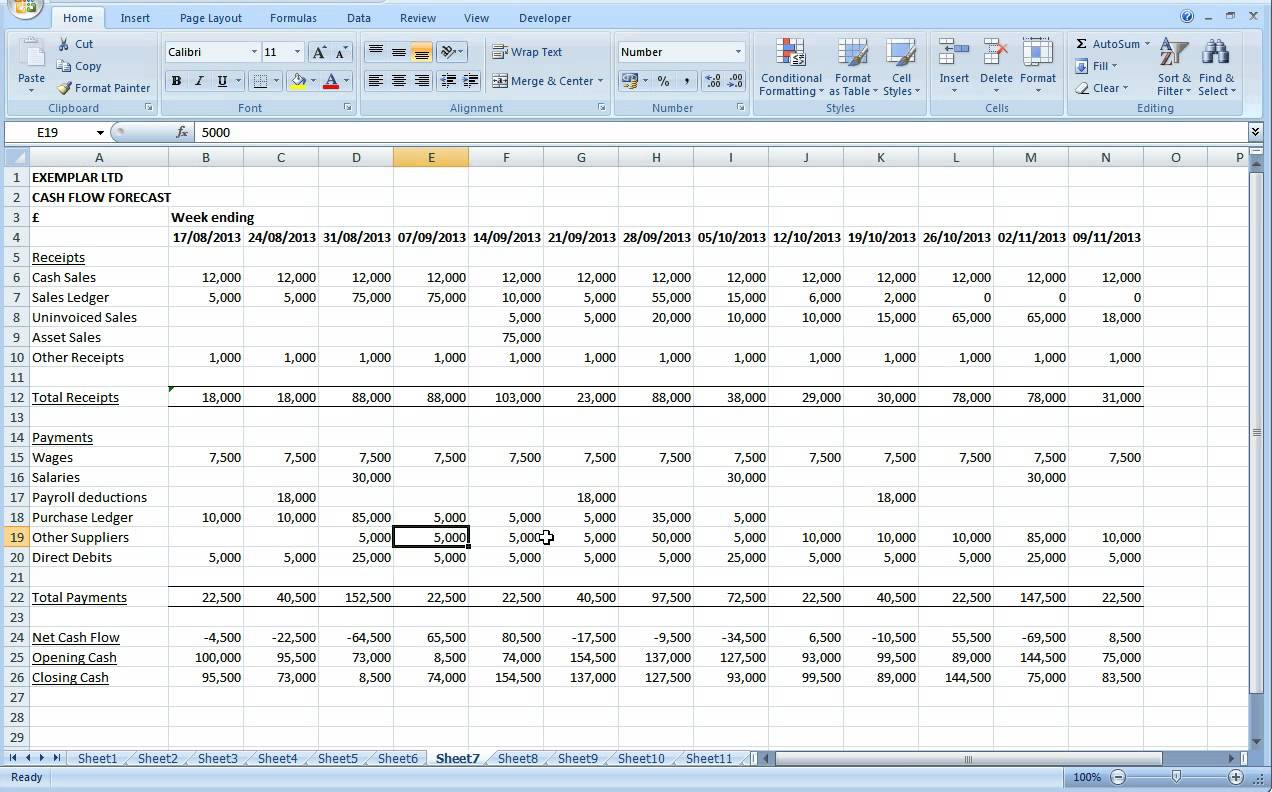

The first step is to choose between the two software options. If you want to learn how to do it yourself, it’s best to go with Excel, since it has better data analysis capabilities and easier customization. On the other hand, if you’re already experienced with making financial calculations and using spreadsheets, then you might want to keep things simple and use Microsoft Access.

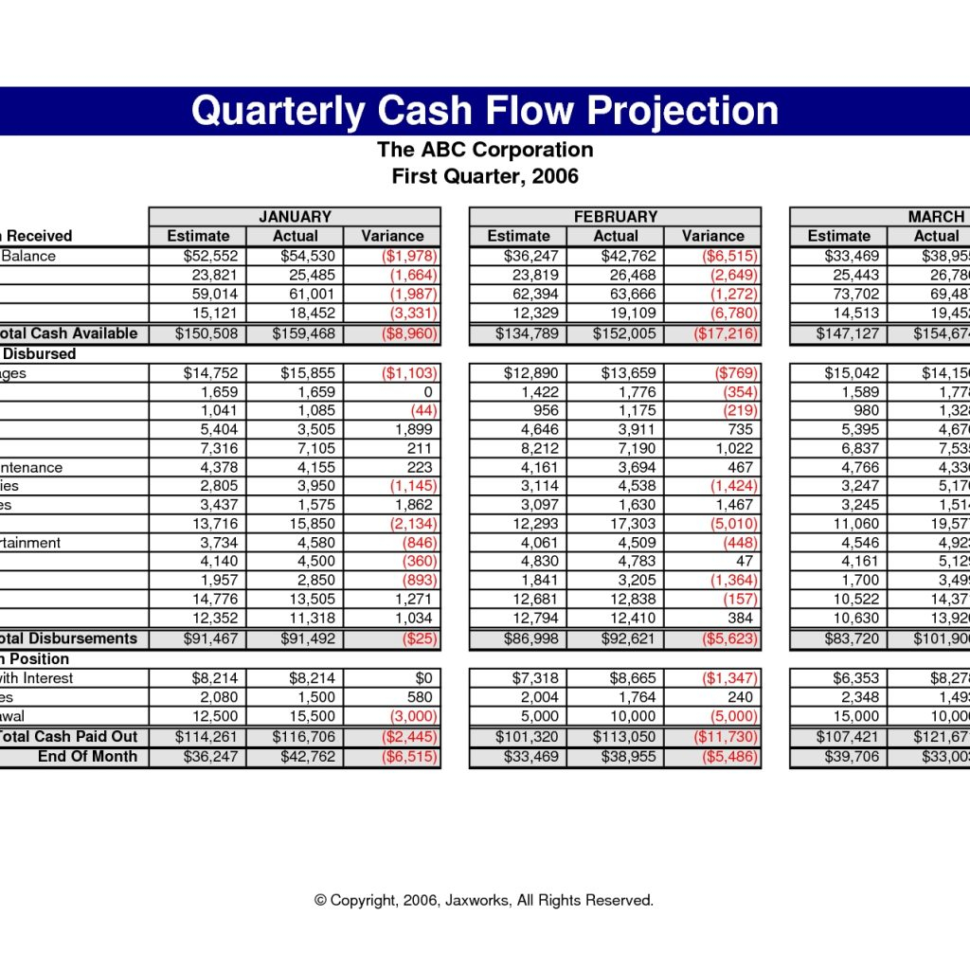

Depending on your time period, you can choose to include or exclude certain variables in your accounting. In addition, you can choose to include or exclude several other factors. Many people prefer to avoid variables such as taxes and inflation, since those are sensitive to the monthly flow of revenue and expenditure. In fact, some of the most popular variations on this spreadsheet include tax-sheltered accounting, tax-expense hedging, and capital gains.

Learn How to Use a Cash Flow Spreadsheet to Make Smart Business Decisions

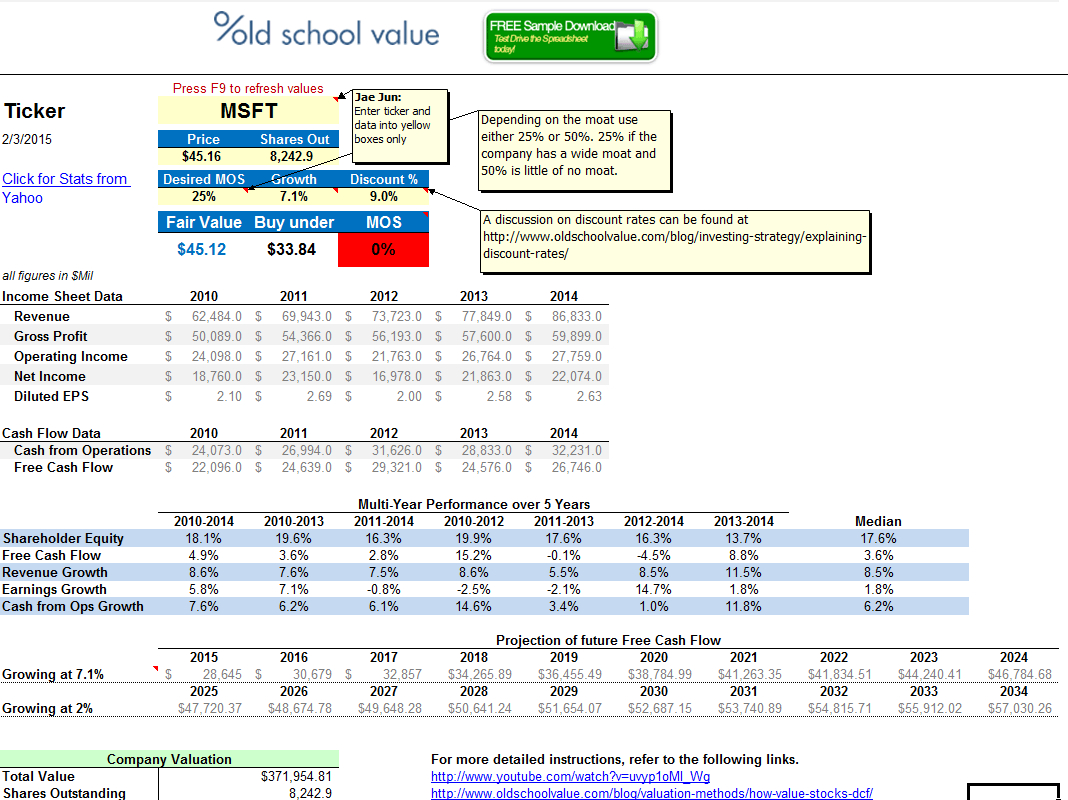

Choosing to include or exclude variables isn’t enough though, because the spreadsheet only gives you some basic information. For example, you can’t select which of your business transactions should be included, what should be included, and how much they should be calculated for.

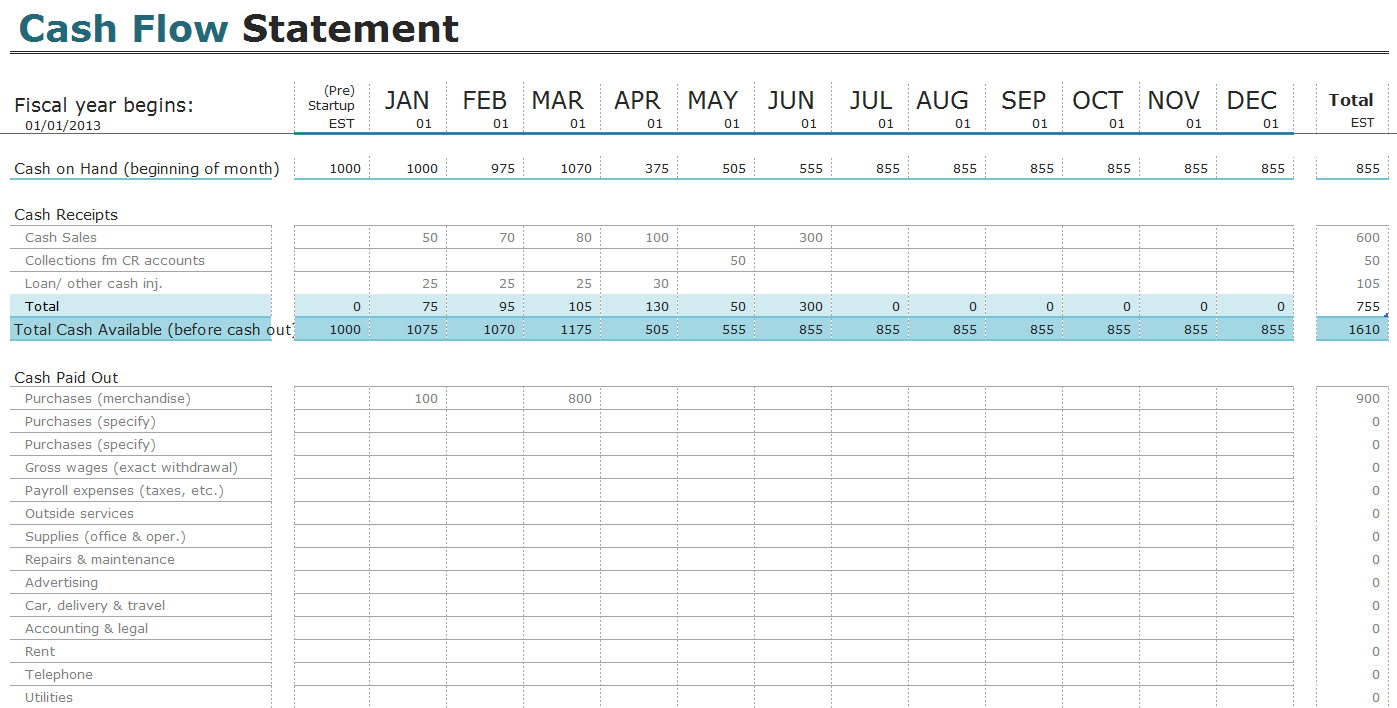

What you need is a spreadsheet that combines all the necessary elements of software options. That’s where a cash flow spreadsheet for businesses comes in. It includes a flexible array of features and functions that let you create a document that measures the overall cash flow and gives you the information you need at any point of time. Here are a few of them:

As mentioned above, this document calculates the income and expenses for every transaction, making use of transaction data from all your company’s transactions. So, not only does this allow you to analyze your own income and expense but also to follow company trends, too.

The next option allows you to choose to calculate everything for a single period, in order to determine a one-time calculation. In this case, the spreadsheet gives you the raw data, so you don’t have to interpret the data yourself. However, this calculation will not take into account any adjustments that have been made by the company during the period.

Of course, all the transactions and their costs are calculated for each period, but you can choose to have the company add all transaction data for a specific period, too. Again, this will only include all the new or changed transactions that have occurred in the specified period.

Whether you’re measuring the profit and loss in a particular period or looking at a generalized level of cash flow, all those details are included in the cash flow spreadsheet. For example, if you’re calculating your annual profit for the last year, then you will see all the details of that period in the data that is displayed in the spreadsheet.

When you want to see the statistics of a certain business type, or just view the various types of businesses in the same report, you can select different sections in the spreadsheet. You can then copy the information and paste it in your own text. This makes the information easy to compare and to understand and enables you to include more relevant information that allows you to make more intelligent decisions about what to do next.

The truth is that a cash flow spreadsheet is useful to create a better overall picture of how your business is doing. In addition, it helps you keep track of your finances more easily and solves difficult business problems, even if you’re not doing the calculations yourself. PLEASE LOOK : cash flow projection spreadsheet template