Free Debt Reduction Spreadsheet

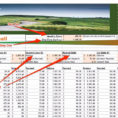

When most people think of a debt reduction spreadsheet, they think of a spreadsheet designed to help a consumer identify his unsecured debt. The reality is that the information contained in these types of programs can provide a user with additional ways to pay off his debt. In this article we are going to discuss a few of the more important methods that you can use.

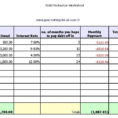

One method you can use is to put down all of your bills and then calculate what amount you need to have in each account every month to pay them off. There are many different kinds of bills. Most people tend to leave off some of their credit card bills, and this can be a mistake.

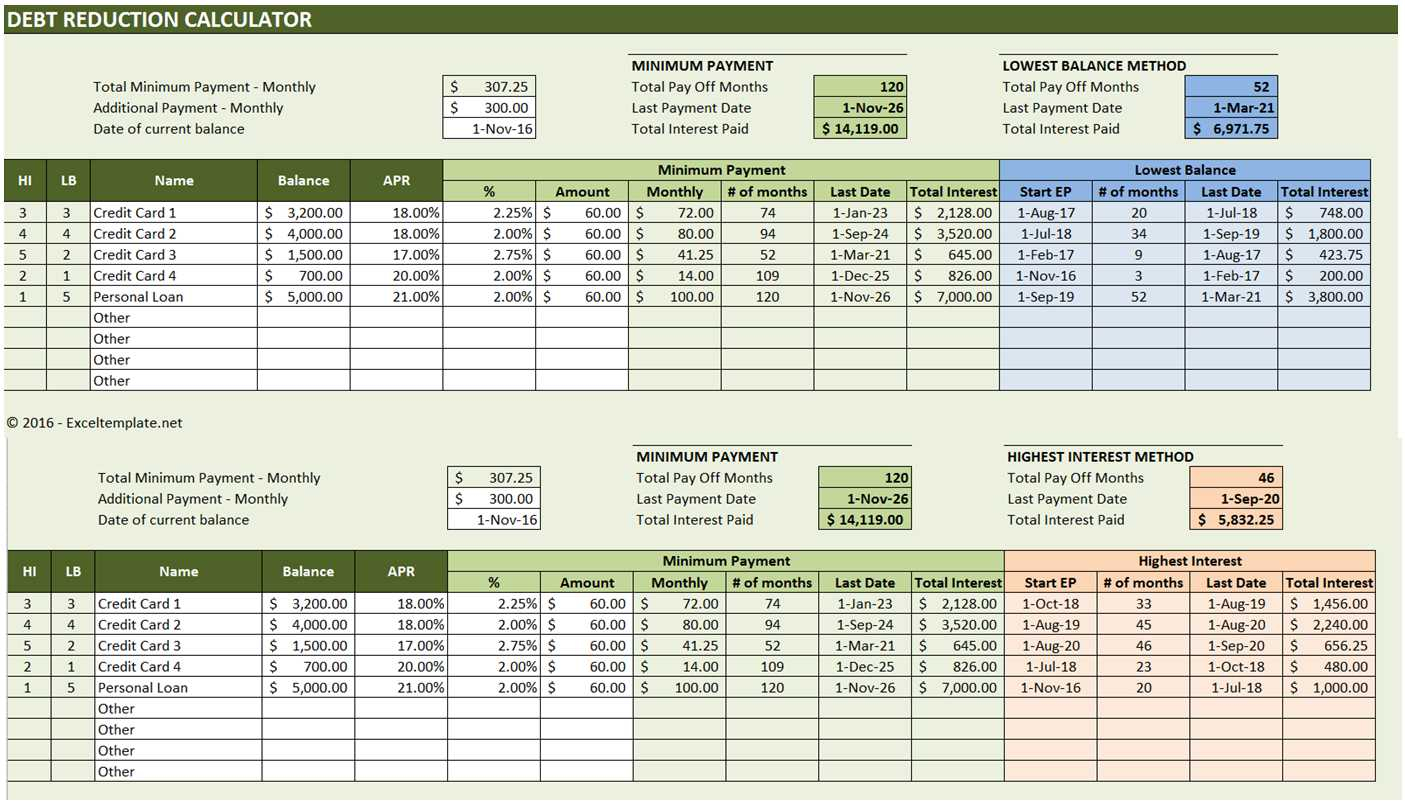

Next, you will need to put down the minimum payment you will have to make on each credit card bill. You want to make sure that it is sufficient to cover the balance in each account. Once you have a list of all of your accounts and the minimum payment required each month, you should be able to identify the unsecured debt you will need to consolidate.

There are many other sources of money you can use to pay off your monthly bills. If you are lucky enough to work at home, this can be one of the most effective ways to reduce your debt. In many cases the payments can be automated and paid by your employer so that you do not have to think about it.

Some employers offer a program called electronic fund transfers. This allows you to put the money in your account without ever leaving your office.

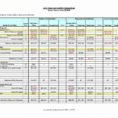

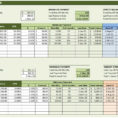

Finally, you will want to compile a debt elimination spreadsheet that takes all of your bills into consideration. It is possible to compile one in just a matter of minutes. This will allow you to quickly find the right consolidation program for you.

The easiest way to research and compare debt consolidation programs is to use a spreadsheet. Once you have your list of bills, you will be able to quickly enter all of the interest rates, the minimum payment, and the total due.

By combining all of your bills into one, you will be able to see what the best consolidation program is for you. When you compare all of the programs available, you will be able to narrow down your choices and then find the right consolidation program for you.

It is important to use a debt consolidation programs that will take into consideration the type of accounts you have. If you only have one credit card, the minimum payment that you have to make can be too low.

Sometimes, if you have a small income limit, you can only be approved for one debt consolidation program. If you find that you can qualify for two or more programs, then you should consider consolidation.

With the right information, you can develop a plan that will help you consolidate your debt and get you on the road to financial freedom. Do not make the mistake of choosing a program because you see a poster that says it is “the best.” YOU MUST READ : free church tithe and offering spreadsheet

Sample for Free Debt Reduction Spreadsheet