Home Loan Sheets – Are They Necessary?

Home loan paperwork is something that is very much important. Whether you are applying for a conventional mortgage or an unsecured home loan, the information on the mortgage application and the information you will provide when you make a loan application must be accurate. It also helps to have a thorough understanding of what it is that the loan officer is looking for and how he or she will know that it is being submitted accurately.

One of the first things you must do when you get a home loan sheet is to get a look at the types of document that will be included in the loan. This will help you understand whether you need to include all of the documents that are required. If you do not know all of the requirements then simply ask the loan officer about it.

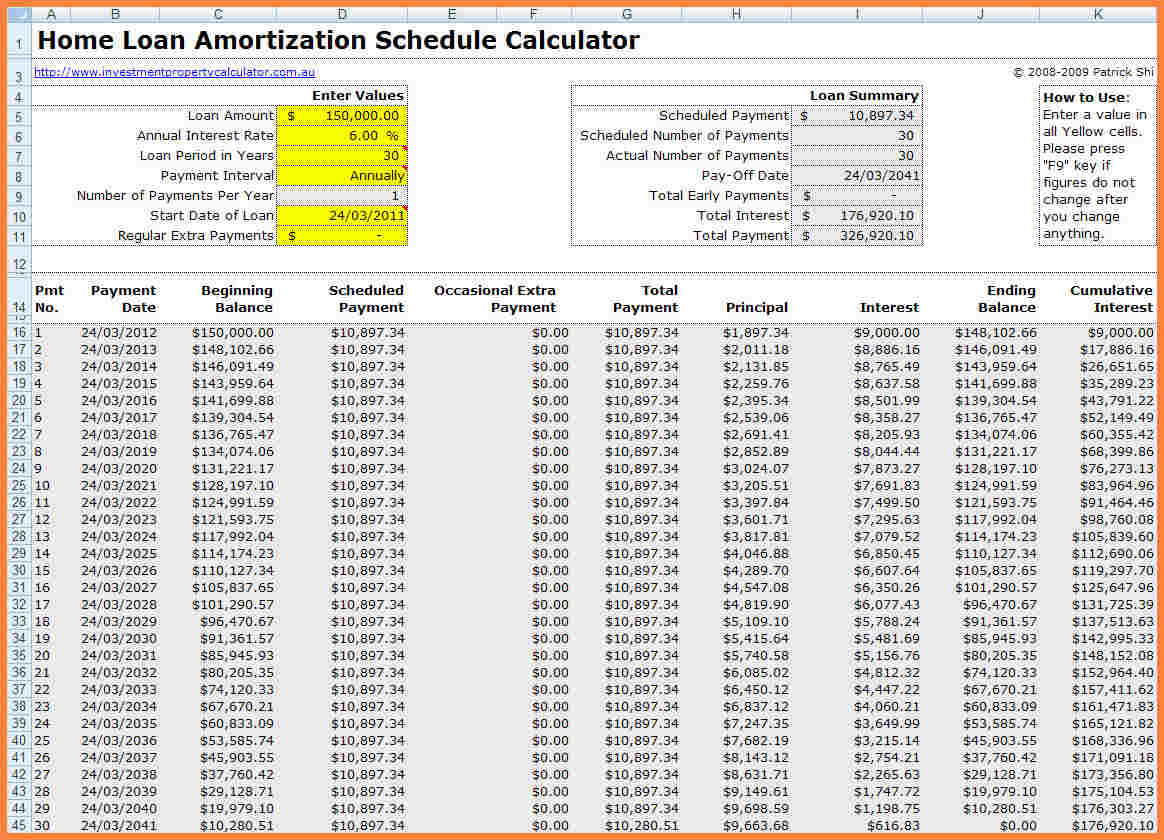

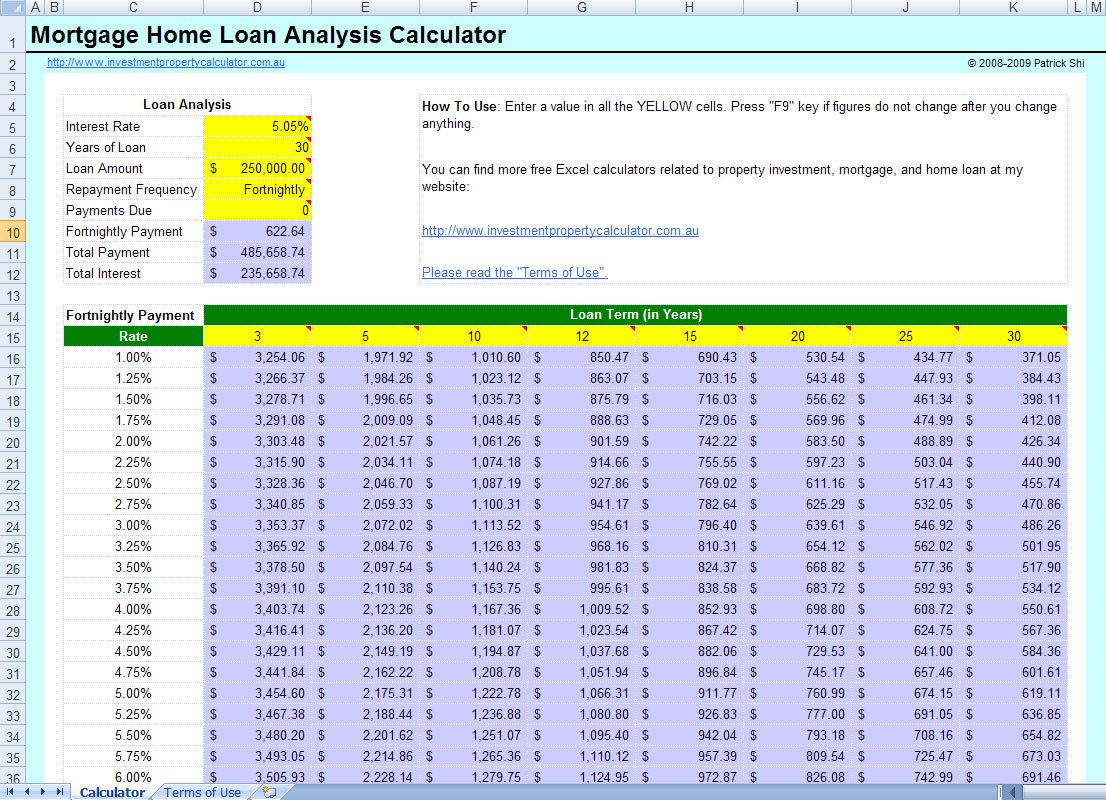

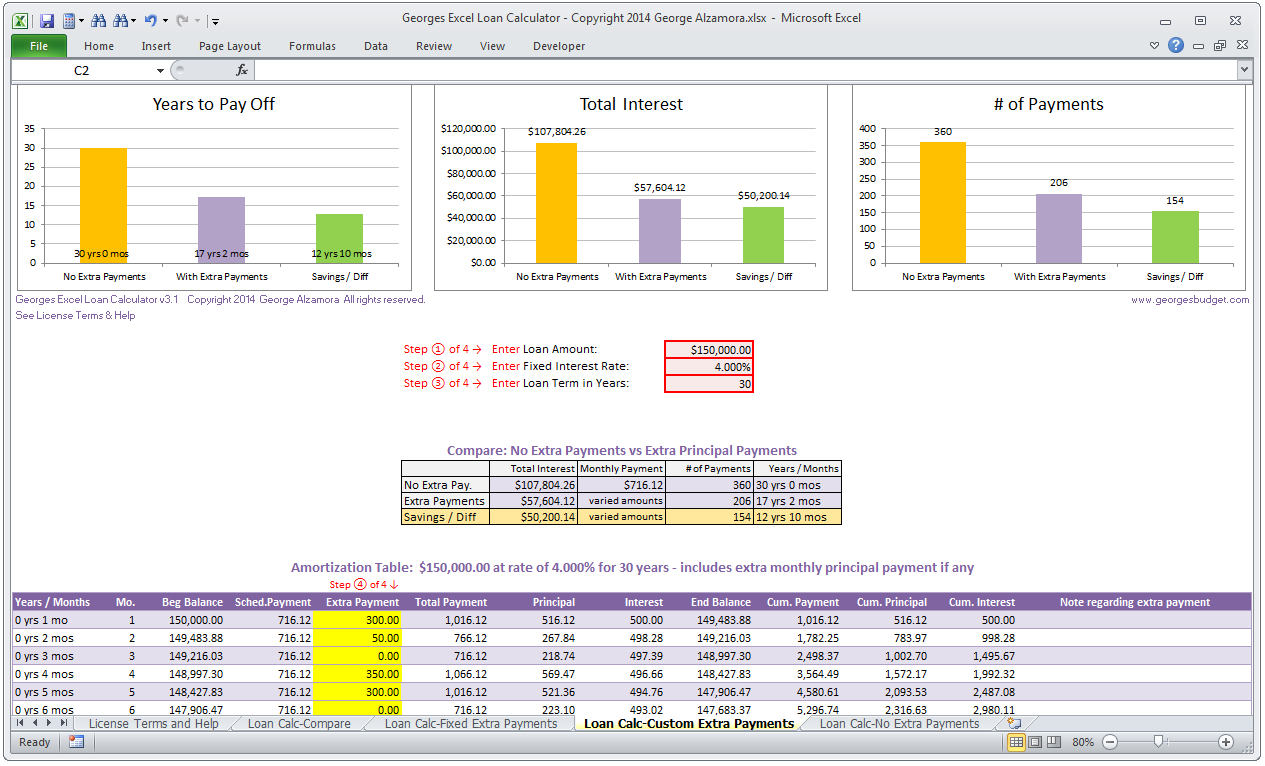

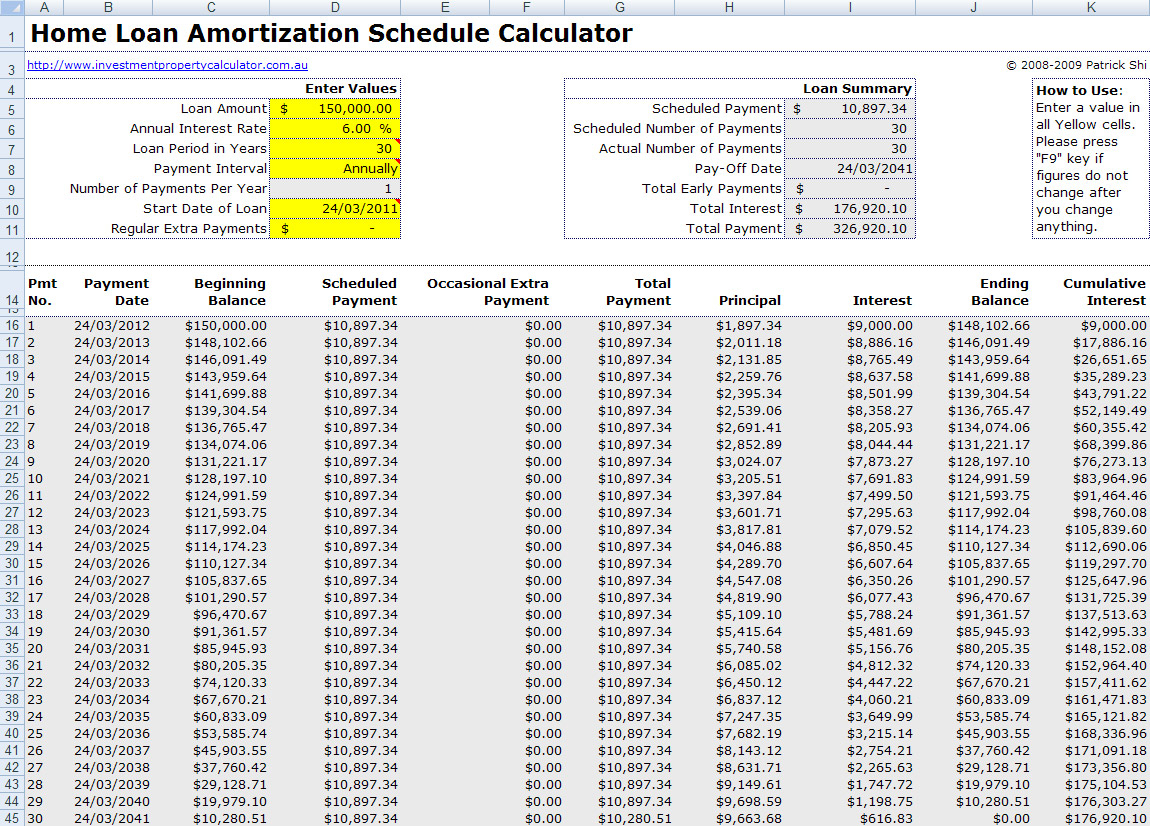

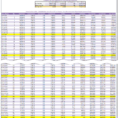

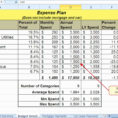

When you compare the documents you will probably find that there is more than one document that you will need to write down. The documents will include information such as the amount of the loan, the rate you will pay for the loan, the value of your property and the due date of the loan. You may also see the date on which the transaction will be recorded into the record book.

In many cases, you can find that a loan sheet has a file or folder where you can store the documents that are needed. This folder or file will include a directory of the different items that will be written down. Each page will also contain the names of the document authors, the date of the document and the names of the companies that have entered the contract to offer the loan.

With so many loan documents, some people like to write them down one at a time so that they do not have to write out a document that may not even apply to the loan. This is because most documents are only listed one time. In this case, the best option is to simply write down the important parts.

Before you begin writing out all of the home loan documents, you must make sure that they are formatted properly. For example, when you look at the loan application, you should check that the heading of the loan form is in the proper format. It should include the required fields. If it does not have the proper format then you may want to go back and work on it.

Another mistake that many people make is putting all of the loan form in the same order. This usually happens when they have put down the terms of the loan and when they have used the computer to fill out the application. When you compare the loan documents with the requirements, you should find that the forms are organized in the order that they are mentioned. This should be done so that you do not mix up the documents.

Finally, there are different types of loan sheets that are used in different places. In many cases, the mortgage document may be found in the name of the borrower, the property owner or the lender. Therefore, it is important to check the format of the loan sheets that you are using.

Most loan sheets that are used by banks will have one column for the borrower, one column for the property owner and one column for the lender. Some lenders may choose to use two columns instead of one. To find out what format the lender uses, check the loan document or by contacting the bank.

When you compare the loan documents that you will use, you will find that they are not all the same. There may be special instructions that must be followed so that you do not find yourself in trouble. For example, if you are dealing with a secured loan, you will want to consider if you can go ahead and use the document that is required.

Even though this is only one option, it is worth checking with your lender to see if the loan is better suited for the security that it offers. One thing to remember is that you can get a very high interest rate on a secured loan but the risk is higher than if you are dealing with an unsecured loan. Of course, you could pay off the loan sooner if you found out that you do not need it. READ ALSO : home loan comparison spreadsheet

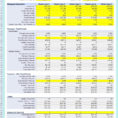

Sample for Home Loan Spreadsheet