The best way to start your spreadsheet for retirement planning is to have it organized. Not all of your information needs to be in the first column or the first row, which can get overwhelming quickly. Instead, choose the columns that will serve you the most in the most effective way.

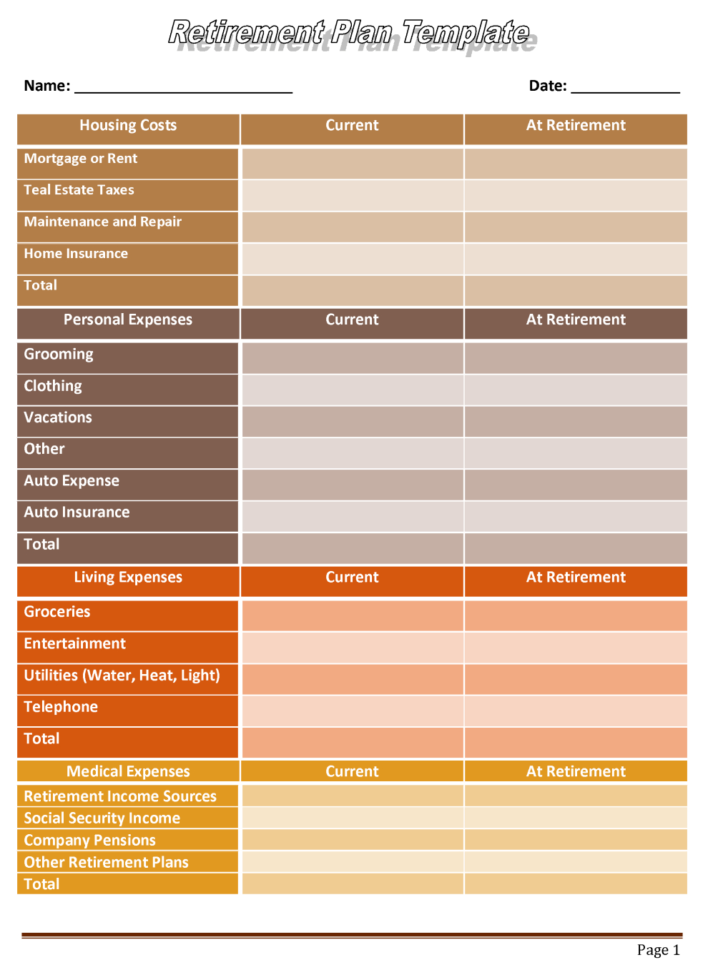

Columns are just words, and they don’t always say much. There are some words that are essential, such as “planning,” “income,” and “expenses.” Others are more obvious, like “living expenses”property taxes.”

The terms “income”mortgage payments” may mean something different to you than they do to me. To keep things simple, choose just one income column and a single mortgage payment column. Then just list your monthly expenses in columns on the left.

How to Use a Spreadsheet For Retirement Planning

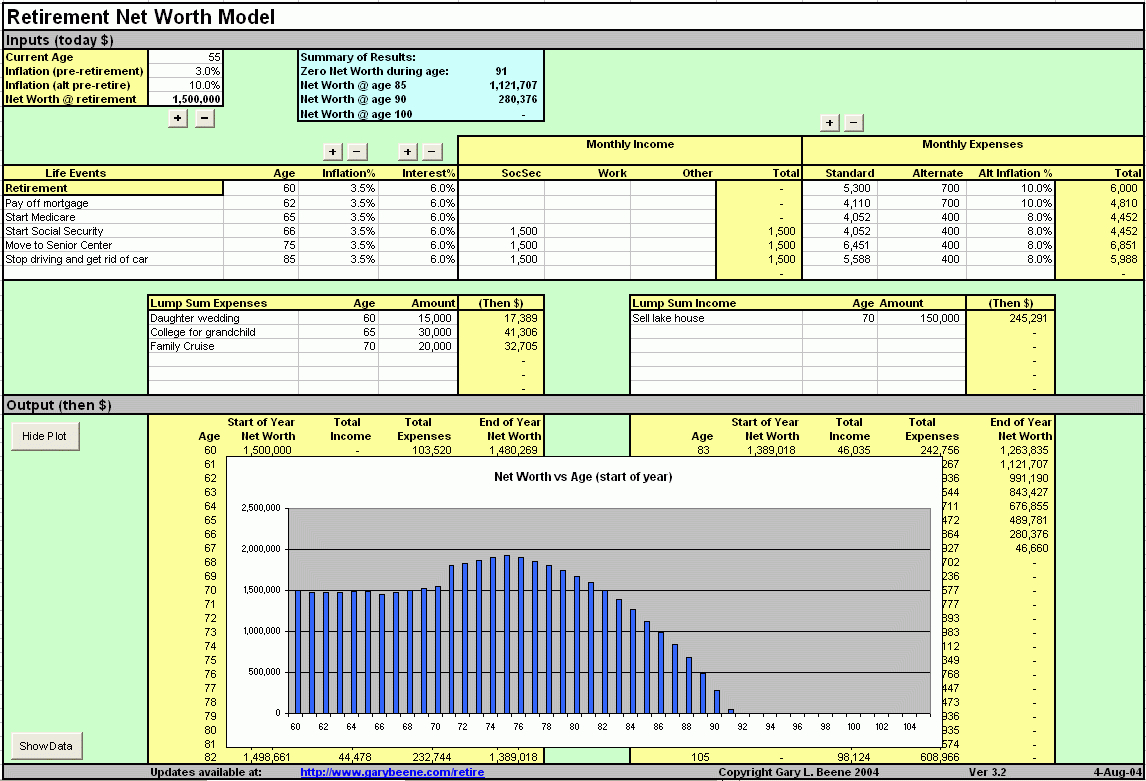

Don’t worry about doing too much analysis in columns labeled “financial statements”report.” You probably already know what those words mean. If you’re really into it, you can develop formulas that will help you work through your retirement plan from this point. At the end of the day, however, it’s just going to save you time and trouble.

The best kind of spreadsheet for retirement planning is the one that makes all of your numbers easy to read. When the numbers aren’t listed clearly, they have no meaning. However, this can make it harder to work with them later on. If you start off doing them by hand, you’ll avoid a lot of problems. When you get to the end of the spreadsheet, everything should still be in order, and the math should be well-structured.

Keep in mind that you might need to copy and paste different sheets into your spreadsheet in order to adjust something, or add more items to it. This is especially true if your spreadsheet is going to include more than one row. You should have a “copy to excel” feature that makes this easy. You could also make your calculations in a text file and copy and paste them in. Of course, that’s up to you.

One of the best things about a spreadsheet for retirement planning is that it is constantly being updated. You won’t get bored by seeing the same information over again. Rather, you’ll get inspired by the fresh data you see as you go through the different columns.

It’s a good idea to use a spreadsheet for retirement planning that you already know. I like to keep my own spreadsheet, and I tend to make updates all the time to it. Not only does it save you time and energy by making all the changes for you, but it’s also a great way to learn something new.

As you go through your spreadsheet for retirement planning, you might have more questions than answers. Fortunately, there are plenty of resources online. Try a few out first, and then talk to someone else who knows how to use a spreadsheet for retirement planning for guidance.

Make sure you don’t like all the formatting, and don’t mind looking at it all the time. That is a big part of the spreadsheet for retirement planning.

The best way to use a spreadsheet for retirement planning is to be flexible. You will probably find yourself changing your mind about certain items in the future, so you might want to set up reminders for those now. SEE ALSO : spreadsheet for project management

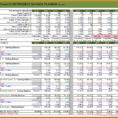

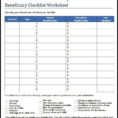

Sample for Spreadsheet For Retirement Planning