So now that you know how to keep track of your own expenses, it’s time to look at the pros and cons of having a business expenditure spreadsheet. Just be sure to review it every week to see what you can save. By keeping a budget that allows you to save money on items that don’t impact your life, you will be able to enjoy what it is you have and enjoy life to the fullest.Business Expenditure Spreadsheet – How To Make Sure You Are Spending What Matters

A business expenditure spreadsheet can really help a business owner come up with the necessary data needed to control his budget. Most companies and individual know how expensive a single trip to the spa can be, but that one expensive trip could be the difference between success and failure.

In today’s society, information is king. With the advent of cell phones, email, and social networking sites, it seems people are becoming more connected to each other. As a result, our lifestyles are being dictated by how we communicate with each other.

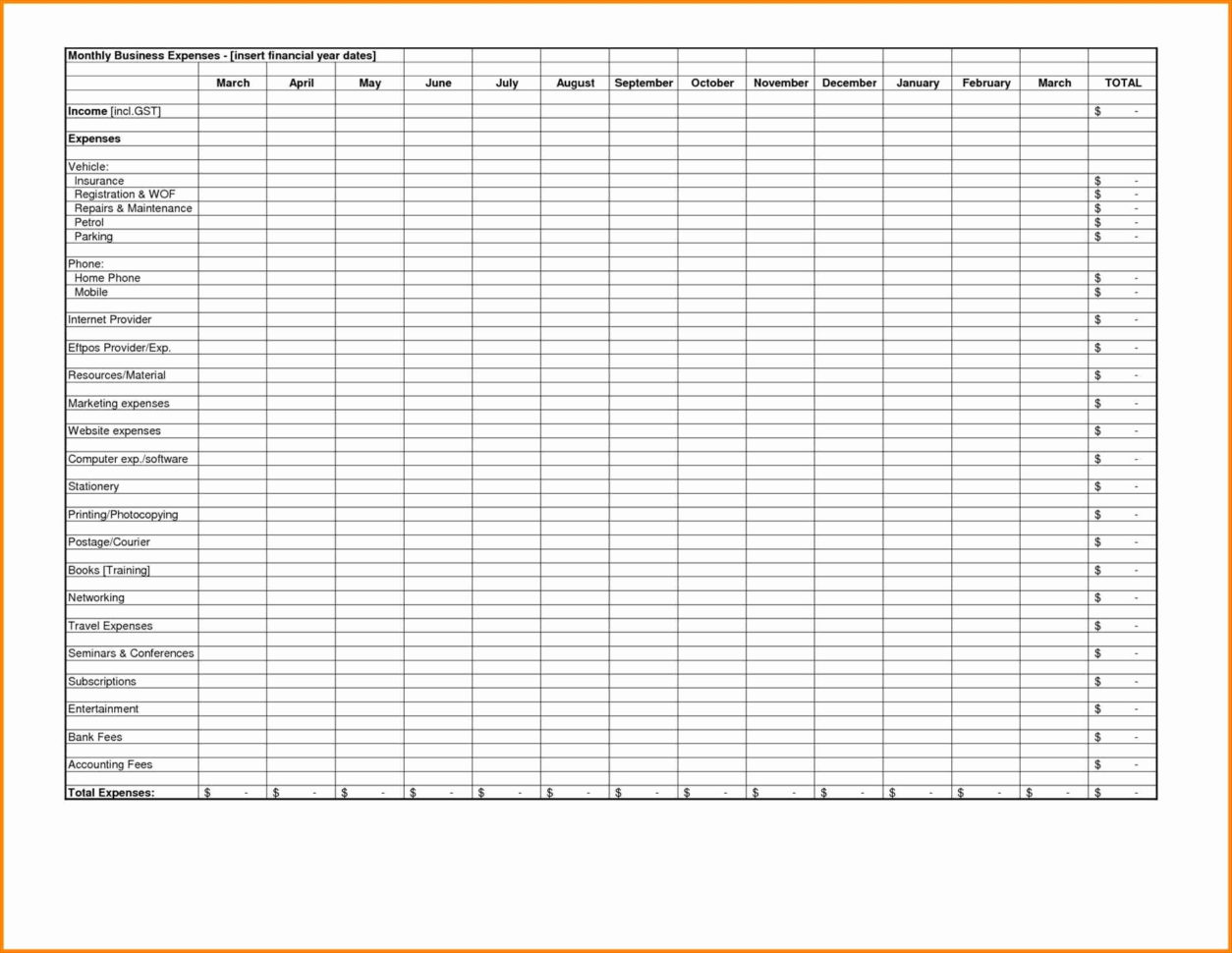

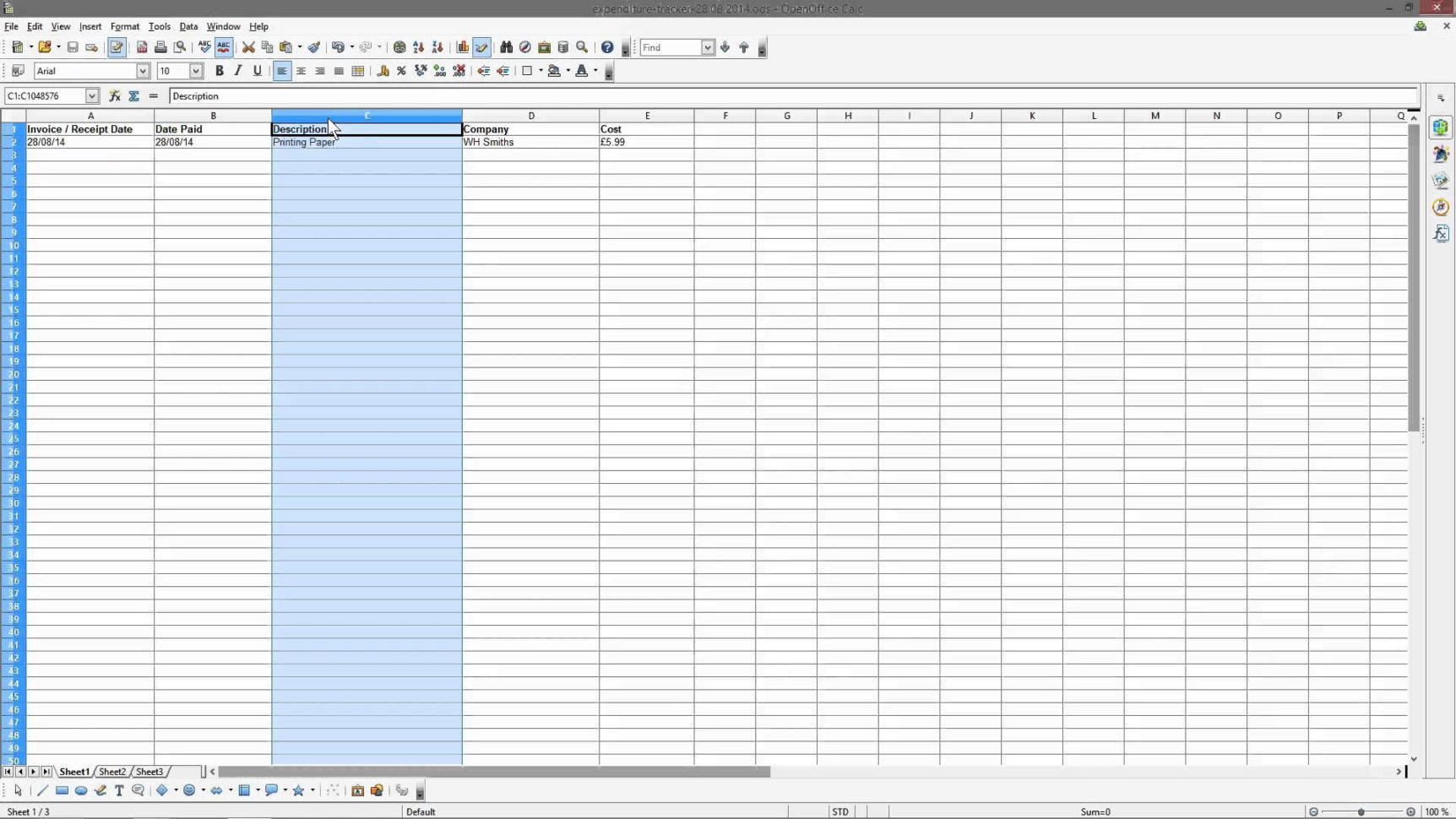

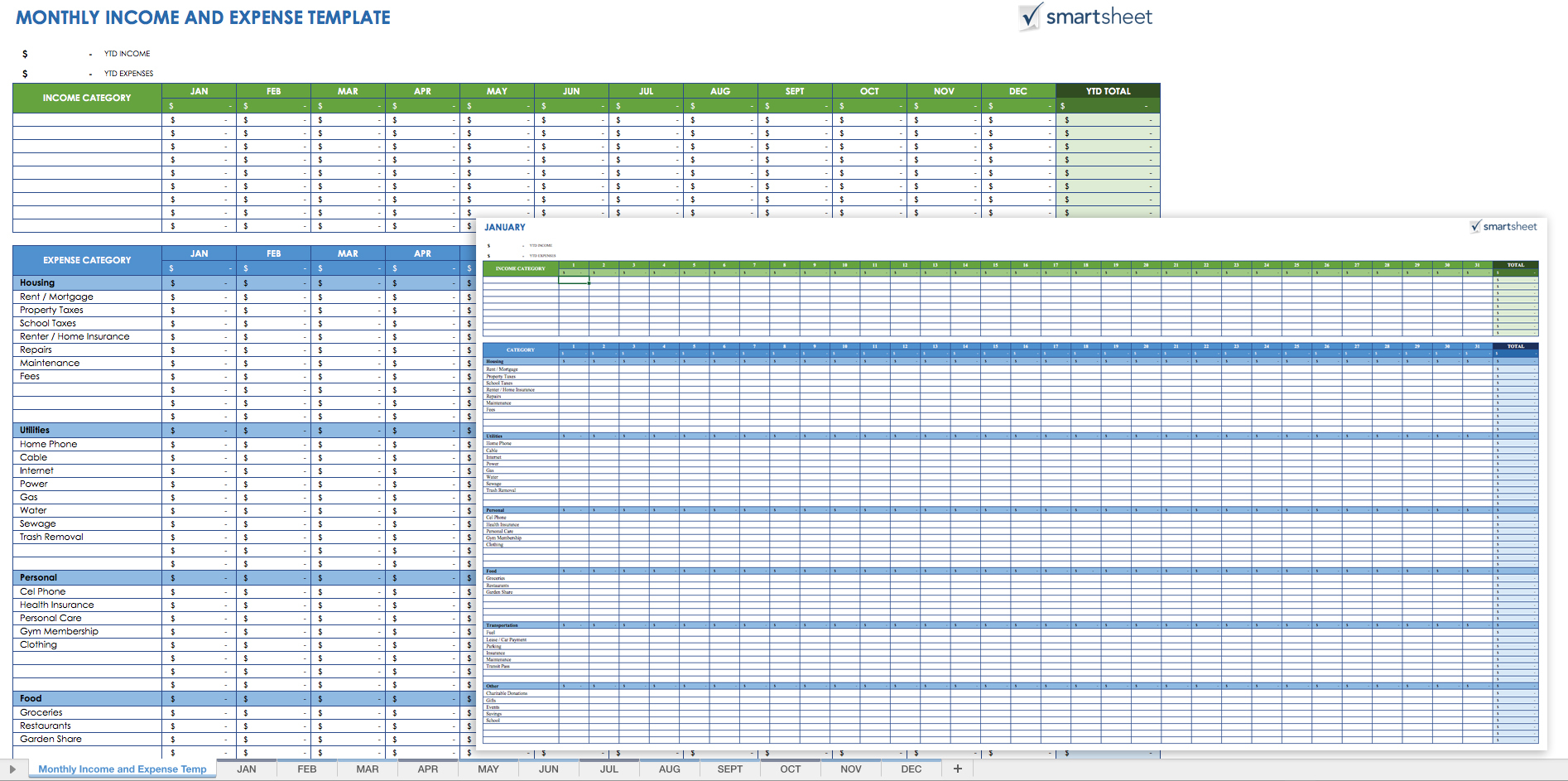

A business expenditure spreadsheet can keep track of all these changes. This type of notebook is basically used for keeping track of all the little things that affect your overall business and personal lives. By reviewing your expenses every week, you can keep an eye on what you’re spending, what you have, and where your money is going.

In addition to keeping track of your expenditures, a business expense spreadsheet can also help you plan out a budget that will work for you. Just think about it; if you were to go to the spa, you would end up paying twice the amount just because you chose to do it at a location that was outside of your budget.

Therefore, a business expenditure spreadsheet can provide you with the tools you need to maintain a budget that works for you. It’s one of the best ways to make sure you spend only what you can afford. Plus, if you want to make sure you are sticking to your financial goal, having a budget at hand is extremely helpful.

As we continue to learn more about the impact of inflation and recession on our economy, we are in danger of hitting another economic collapse, but at least the web is there to provide a tool that can give us a reality check. It is important to keep in mind, however, that financial indicators may change unexpectedly in ashort amount of time.

Regardless of whether you are trying to develop a business expenditure spreadsheet or keep track of what your budget is doing in the real world, your best bet is to keep a balance between both. Be sure to not overspend or underspend. Keeping a budget that you know is realistic and won’t give you a financial burden is the best way to ensure success for yourself, your family, and your business.

If you find that you are making too many unnecessary purchases, it may be time to upgrade your business expenditure spreadsheet to something better. There are some nice tools available online that can help you stay on top of your financial status. Just remember that your budget will help determine how much you can spend and how much you can save.

A good strategy is to have a budget that allows you to save money at the end of the month. Even if you have set aside just a certain amount for all of your expenses, have a separate budget for the mortgage, utilities, and taxes. You may save a lot of money by doing this, but just as importantly, saving money is essential to getting ahead in life.

While budgeting for your personal income is important, be sure to incorporate your business expenses into your budget. As you look at your monthly expenditure, be sure to include everything from groceries to a spa. Doing so can help you understand how much you spend on things that don’t matter as much as you think they do. YOU MUST READ : business cash flow spreadsheet

Sample for Business Expenditure Spreadsheet