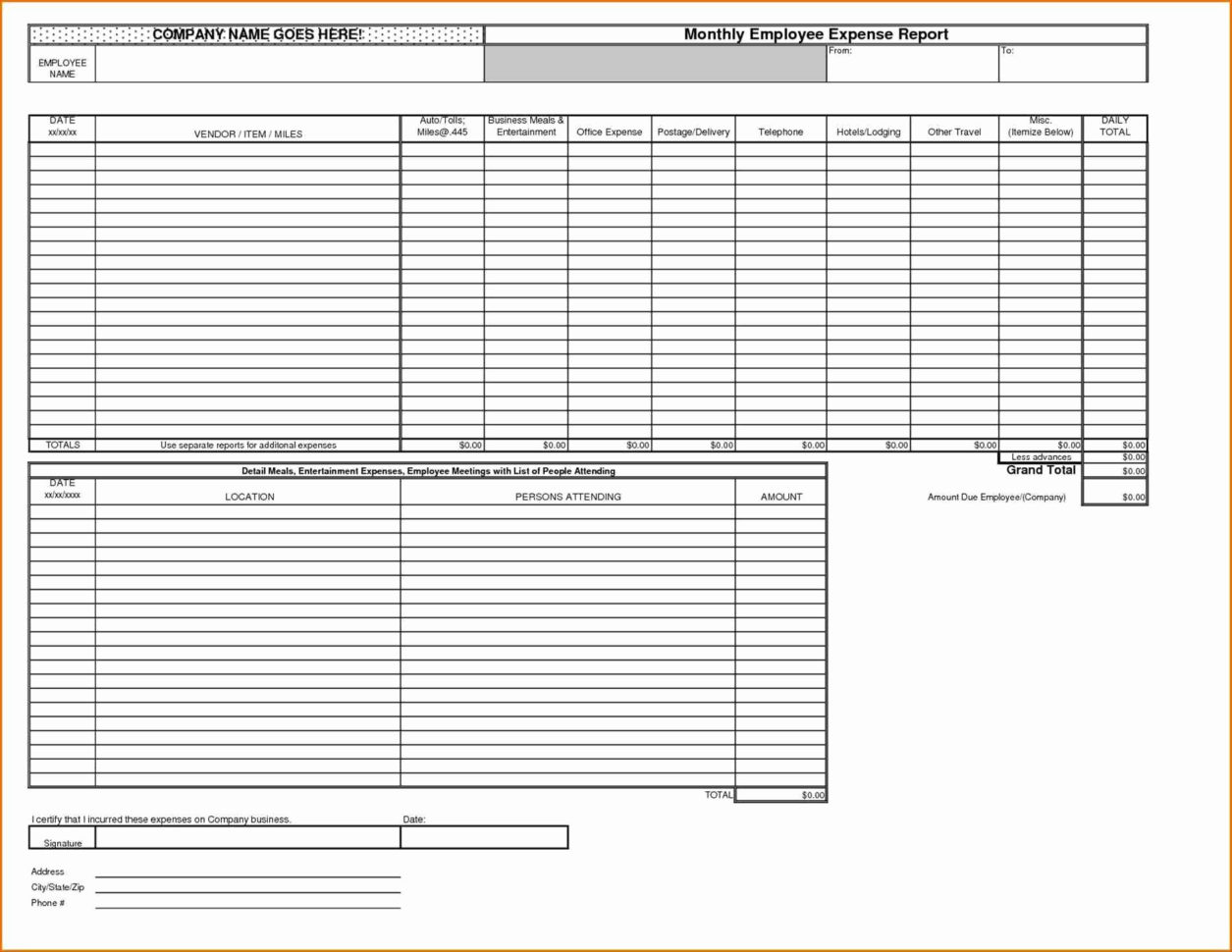

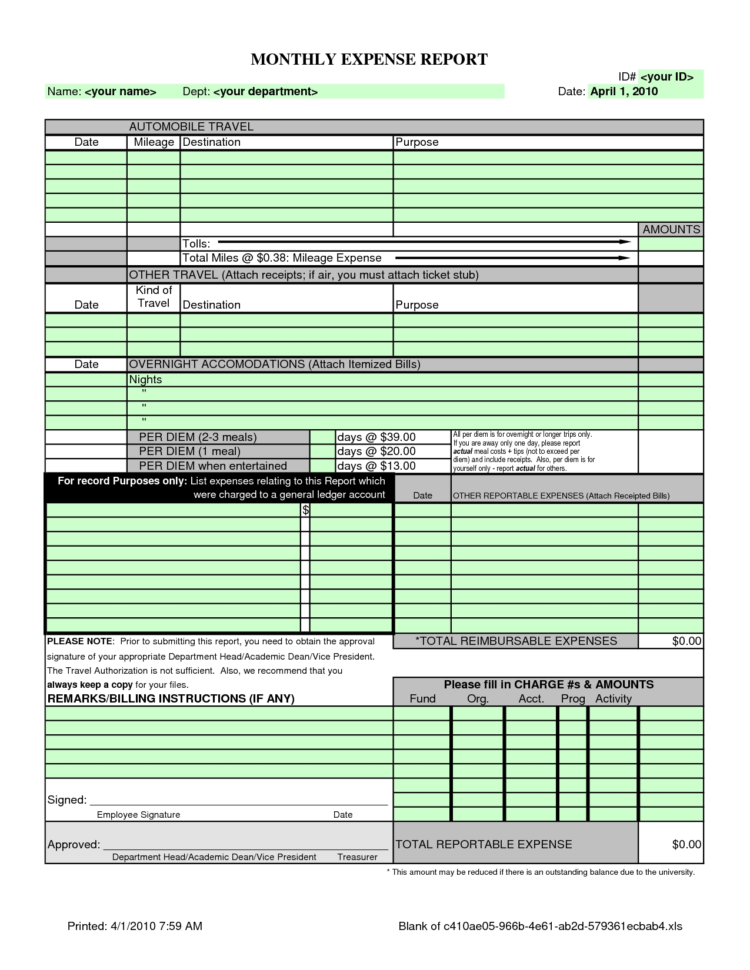

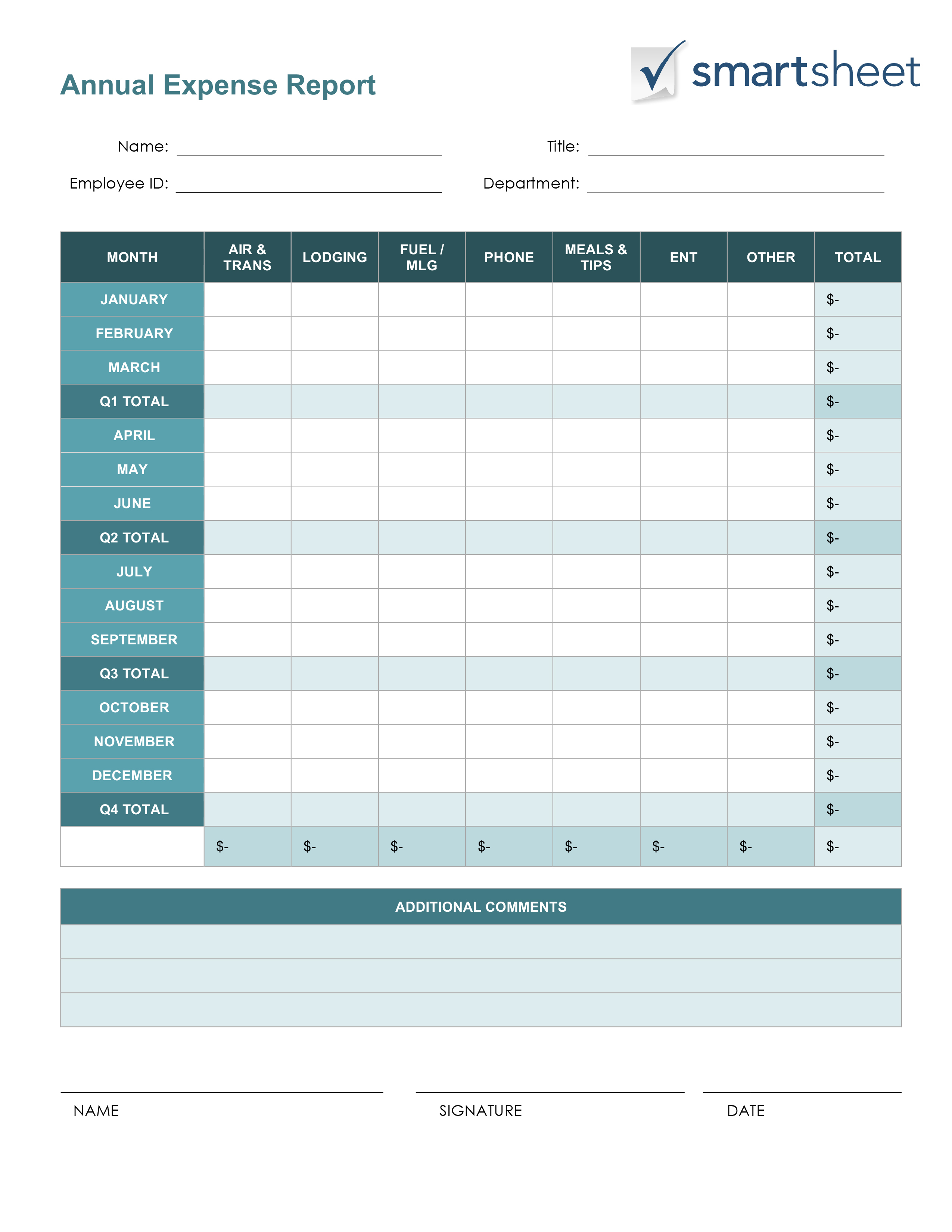

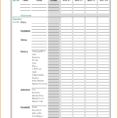

What is a Monthly Business Expense Report Template?

Whether you are a mom, dad, or both, it is important to get a monthly business expense report. Any reputable business reporting firm will give you that document for free to use as a template for your next one. These are easy to use, and you can customize them with your personal information and home information.

It takes just a few minutes to gather the information and submit it to the company for processing and tracking. The best thing about this form is that you can get a free report every month.

You do not have to print the document for the receipt sheets. You can submit these electronically or if you prefer you can have printed receipts at the local grocery store.

As an example, you can add little things to the expense report to make it more personal. You can list your family’s medical history on any particular page, or you can choose to list your full names on the home page. You can choose to list only the income or the deduction, so you can find out what is going into your pocket each month.

You can also add a separate page for any other deductions or information, such as state and local income tax information. In addition, you can include child support payments, veterans’ benefit payments, and any other information that are recorded with the Internal Revenue Service.

Do not forget to deduct all your medical expenses from your insurance. By choosing to write a check for the actual cost of the services instead of writing the deductible, you will actually save yourself money each month.

At the end of the form, there should be a summary page that gives an overview of the information you entered on the form. Make sure you add all the information to the Summary Page. If you leave any blank lines, you will not be able to submit the form or to the recipient’s address for payment.

Next, you will need to fill in the Budget Page. It is important to budget for all of your monthly expenses. It is very important to keep the bills paid as often as possible.

Do not forget to send any tax season forms, such as W-2s, to the appropriate department in time for filing. This is very important, because the more time you save in filing the forms, the more money you save.

Having a small business expense report is important to be able to analyze your business expenses. With that information, you can determine if there are certain areas of your business that you could use to cut costs.

To begin with, if you do not have a report, consider getting one. They are a valuable asset to any small business owner. YOU MUST SEE : monthly business budget template excel

Sample for Monthly Business Expense Report Template