Bookkeeping For eBay Business

Starting up a business does not come without having to do the business like bookkeeping for eBay. This is especially true for people who want to start their own eBay business and are well aware of the numerous regulations that need to be followed to ensure the compliance of the federal law in the market.

It is very easy to start a business on eBay, but the regulations and laws must be followed so that the business runs as smoothly as possible. The operating model of an eBay business is different from that of a regular store and it calls for good bookkeeping to take care of all things related to the sale of products. To protect the interests of the business, proper bookkeeping is essential.

A qualified bookkeeper can really boost the eBay business and make it more profitable. Here are a few pointers that you can follow to make your bookkeeping for eBay business more profitable.

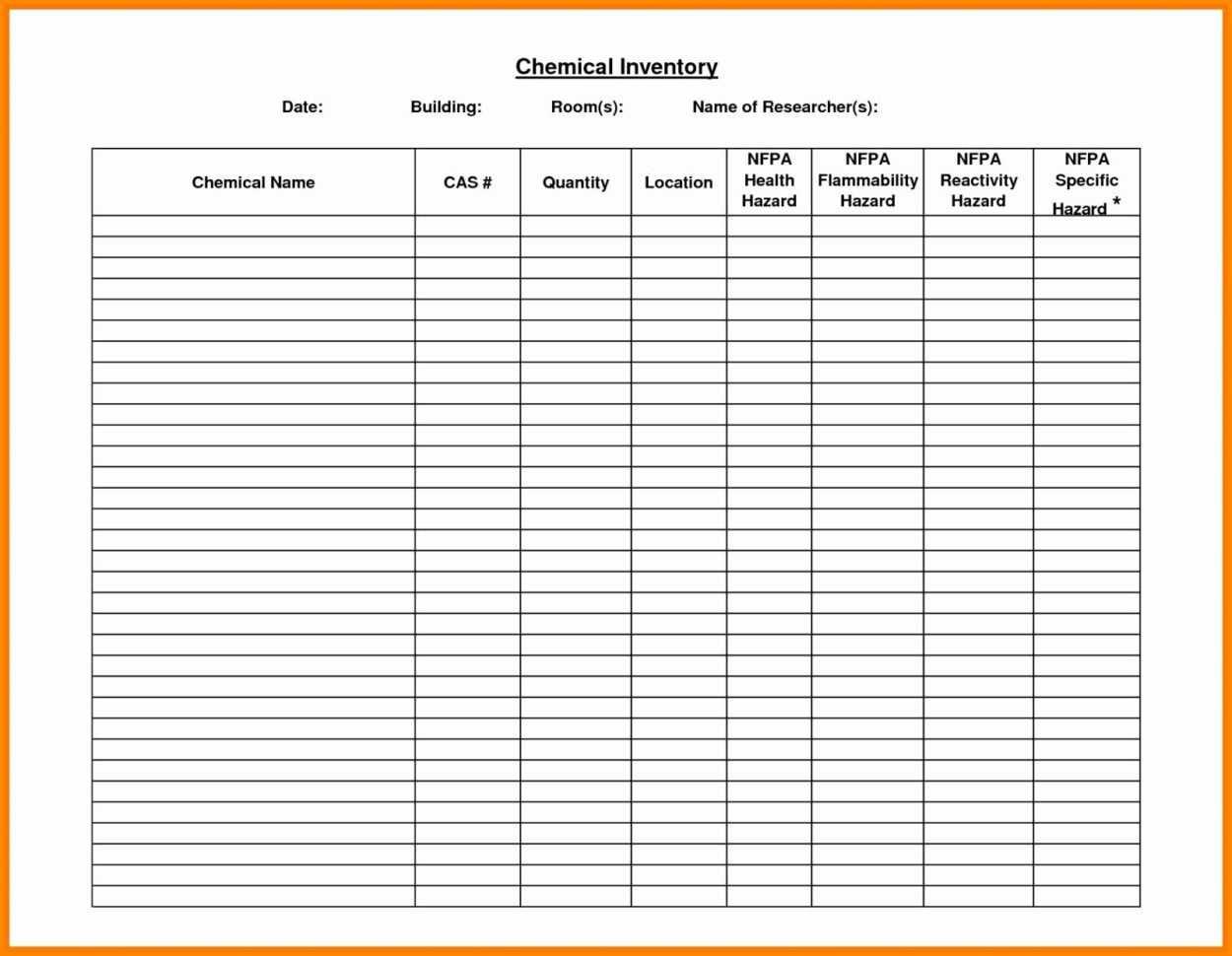

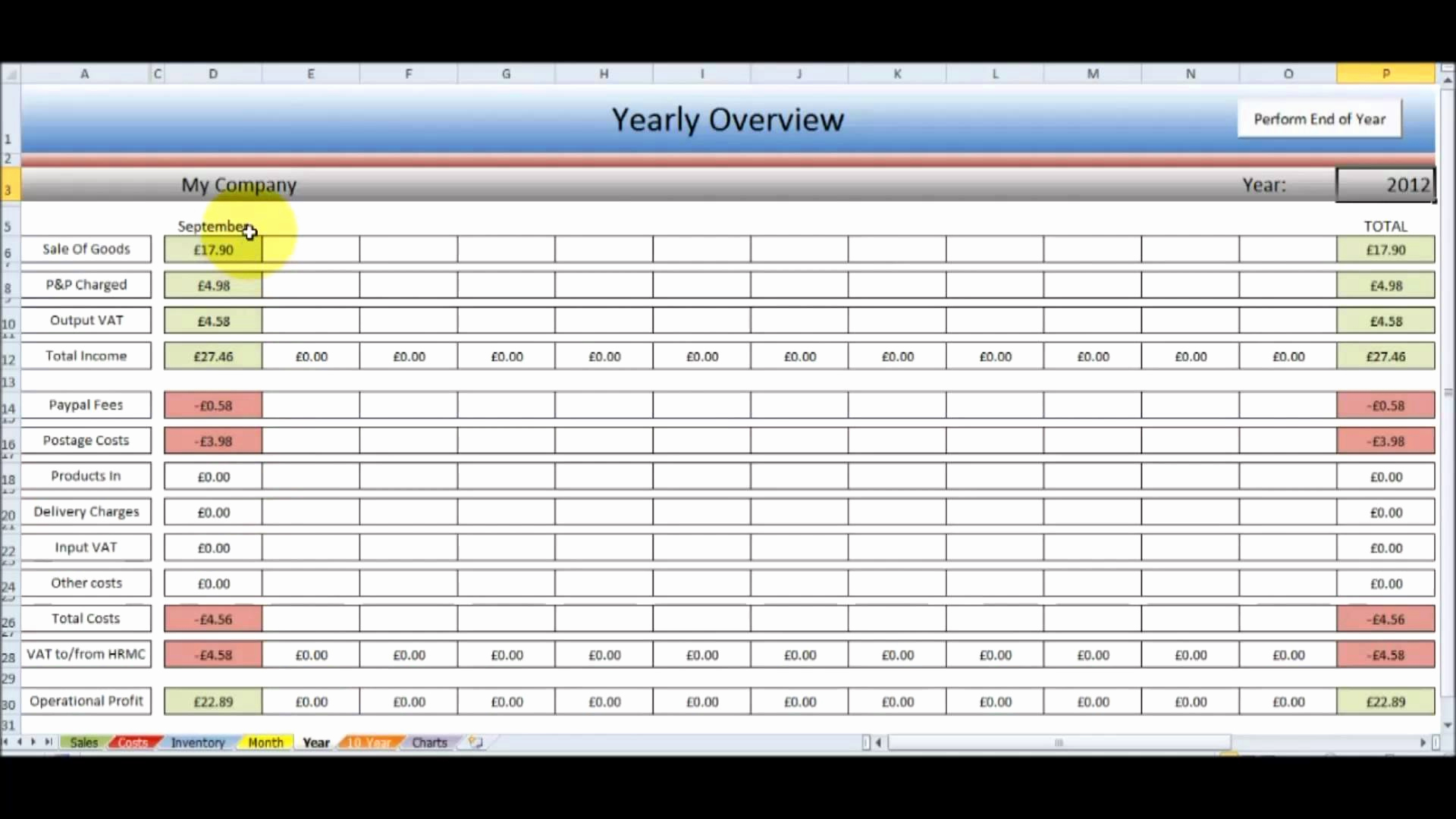

First of all, do not underestimate the importance of inventory. Inventory is the lifeblood of any store. Inventory includes the merchandise purchased by buyers in the store and the stocks that are kept for future sales. Every seller should keep track of every sale made and the corresponding expenses incurred to get the product delivered and its cost of stock.

Every bookkeeper should also know the local taxes. There are different types of local taxes that are applicable in each state. These taxes may be high or low depending on the income level of the seller.

These taxes are usually levied according to how much revenue the business receives in a year. To avoid paying too much taxes, it is important to pay taxes on time. This is even more important for businesses that make their profit in the form of a commission on each sale.

If your business depends on commission, it is very important to submit all required taxes to the tax authorities to avoid the latter putting your company under the tax scrutiny. After all, if the company fails to meet the taxes, they can impose heavy penalties. It is important to pay taxes promptly or else, the penalties will be very heavy.

Do not try to avoid paying taxes to the tax authorities. Yes, the IRS has enough resources at its disposal to collect the taxes from the seller. But with time, the IRS will grow lazy and will not continue to chase them with stiff taxes.

Remember that not all taxes imposed by the IRS are incurred by the seller directly. Other third parties may be affected by the tax levy such as property tax, sales tax, and other state and local taxes. Knowing about the sources of these taxes will ensure you to avoid being tagged with unnecessary and excessive taxes.

Another important thing that you should consider is to avoid any transactions which the tax enforcement agencies may deem as illegal or tax evasion. Every business must follow all applicable laws to avoid having their business targeted by these enforcement agencies.

Once your business starts earning you will find that making your own ‘books’ to collect taxes becomes less of a hassle. You will be able to concentrate on what you do best-selling more of your products. PLEASE LOOK : Bookkeeping Flyer Template

Sample for Bookkeeping For Ebay Business

![100 [ Jewelry Inventory Spreadsheet ] | Supplies Inventory With Within Bookkeeping For Ebay Business 100 [ Jewelry Inventory Spreadsheet ] | Supplies Inventory With Within Bookkeeping For Ebay Business]( https://db-excel.com/wp-content/uploads/2018/10/100-jewelry-inventory-spreadsheet-supplies-inventory-with-within-bookkeeping-for-ebay-business-118x118.jpg)