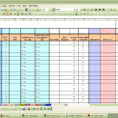

Excel Workbook Or Profit Loss Spreadsheet Template – The Difference Between Loss and Profit

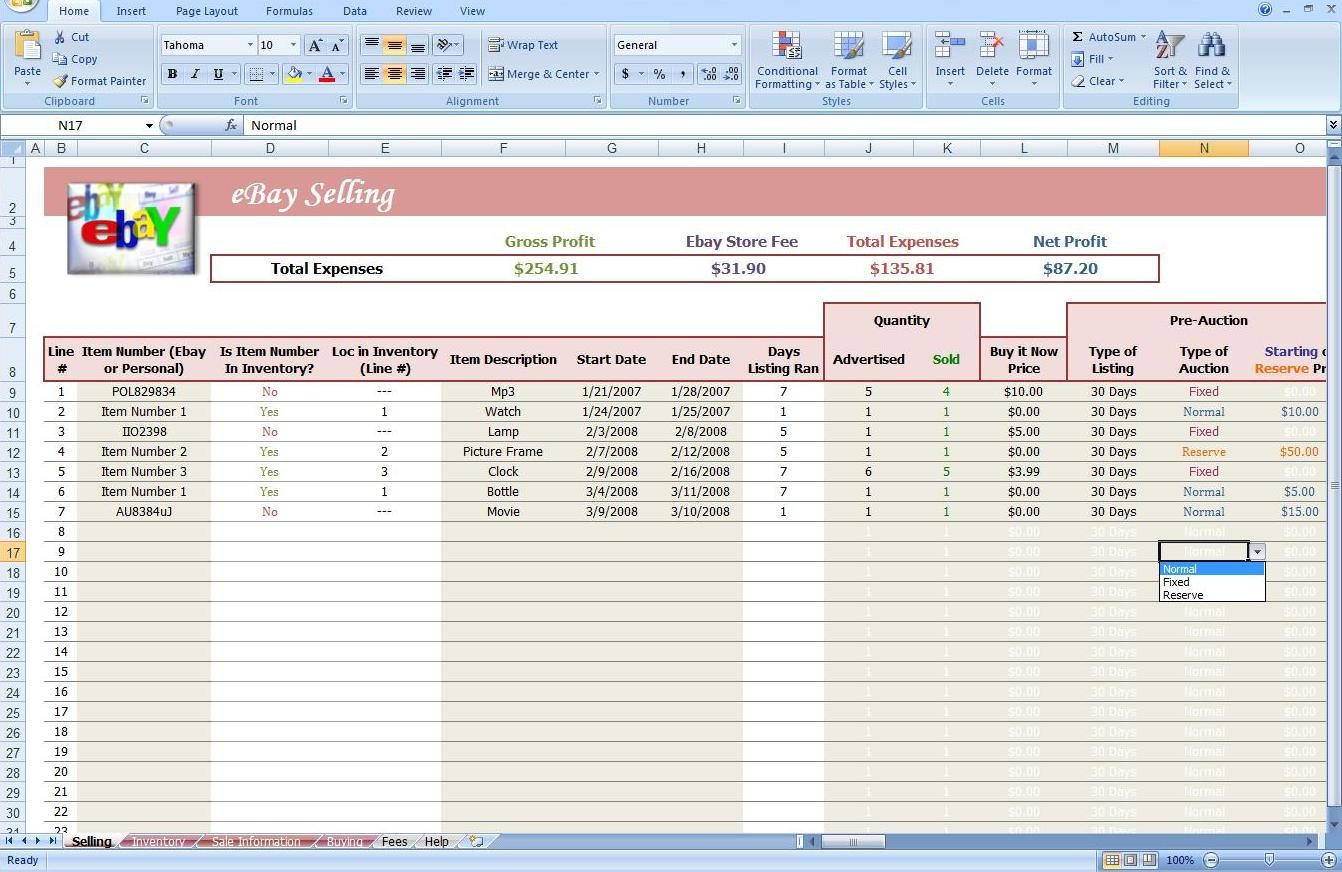

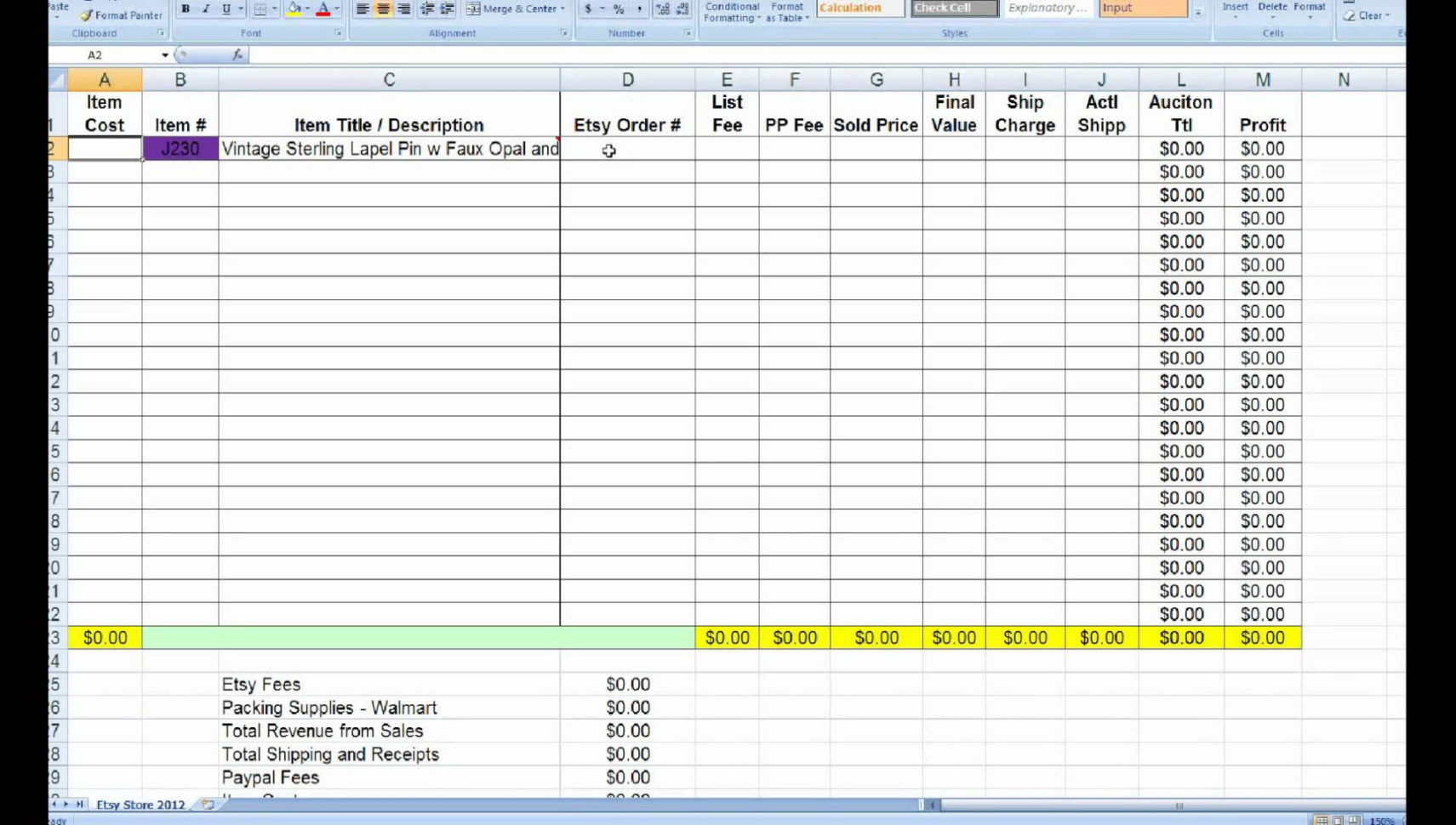

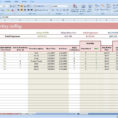

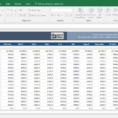

Excel workbook or profit loss spreadsheet template is basically a workbook to be used for making decisions regarding business transaction. Most people who use it as part of their business practices only see it as a list of financial data and make decisions in the form of payoffs.

On a regular basis, I’m asked about profit margins and what are profit losses and vice versa. The difference between the two is that profit losses are profitable while profits are losses. To determine if a business or product is profitable or not, there is a simple formula to calculate profit or loss.

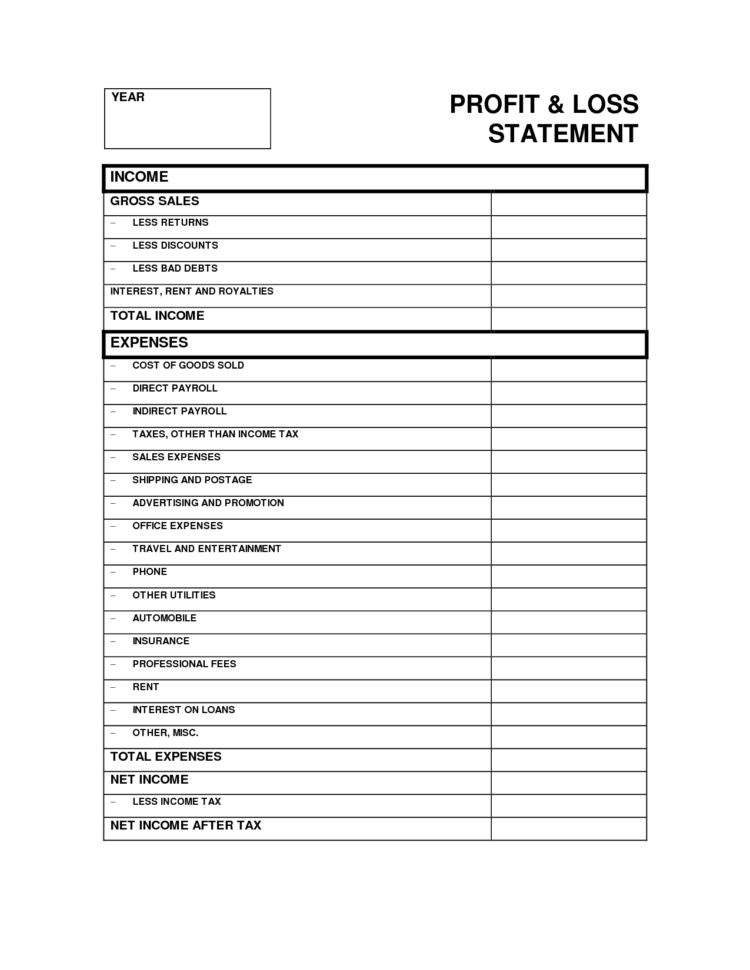

Profit is income that comes from a source. This source could be revenue, cost of goods sold, rental expense, interest, dividends and so on. Profit refers to the gross profit. The difference between gross profit and net profit is called the net profit.

Net profit is the profit minus cost of goods sold. Net profit can be calculated in several ways.

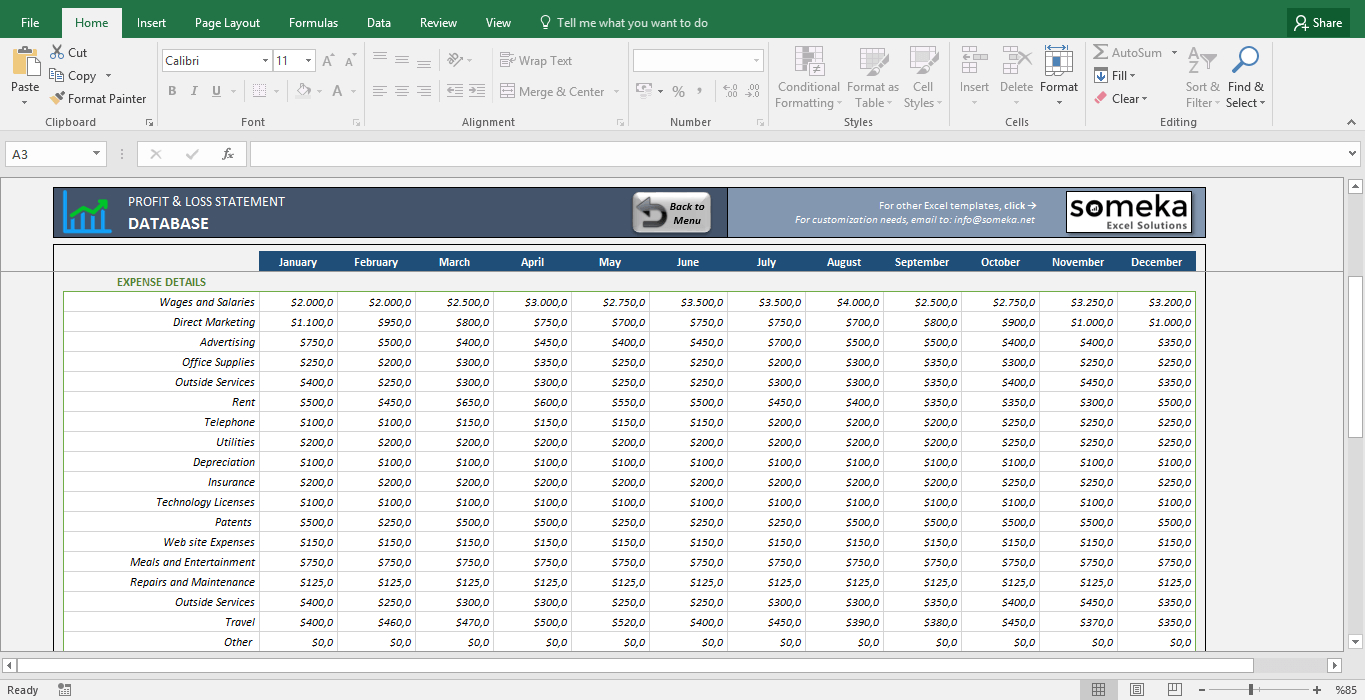

Cost of Goods Sold (COGS) is one of the key business metrics that gives information on the profitability of a business. It comprises expenses such as rent, utilities, and direct labor costs. Therefore, this measure is mostly considered a short-term reflection of the profitability of a business.

Operating Costs (OC) and Interest Expense (IE) can also be considered as key long-term measures to provide a short-term reflection of profitability. They are the same thing as the COGS plus the indirect expenses such as depreciation, labor and facility taxes.

Income Statement (I) is the financial statement of a business. It is a statement that summarizes the income from the sale of assets and the income generated byincome sources. The income statement includes the income statement and balance sheet.

Income Statement is a report that summarizes the revenue that flows from sources to the income statement. In this document, the source is defined as any of the different sources of income that generate income such as salary, salaries and commissions, dividend income, interest income, rent income, interest and return of capital.

Balance Sheet (B) is the most important part of the financial statement. It is a report that summarizes the assets and liabilities of a business. Balance Sheet includes the cash and accounts receivable.

Debt Payment Schedule (DPS) is another important part of the financial statement. This is a schedule that shows how much of the current debt is due at a given point in time. This report is useful in estimating the balance sheet by subtracting total current assets from total current liabilities.

You will find some of these reports used in many finance and accounting courses. You can download them from your favorite online site or search for a copy of these reports to ensure that you have the right ones. PLEASE READ : Profit And Loss Statement Template For Self Employed Excel

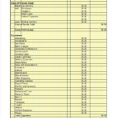

Sample for Profit Loss Spreadsheet Template Free