The Advantages of 401k Spreadsheet

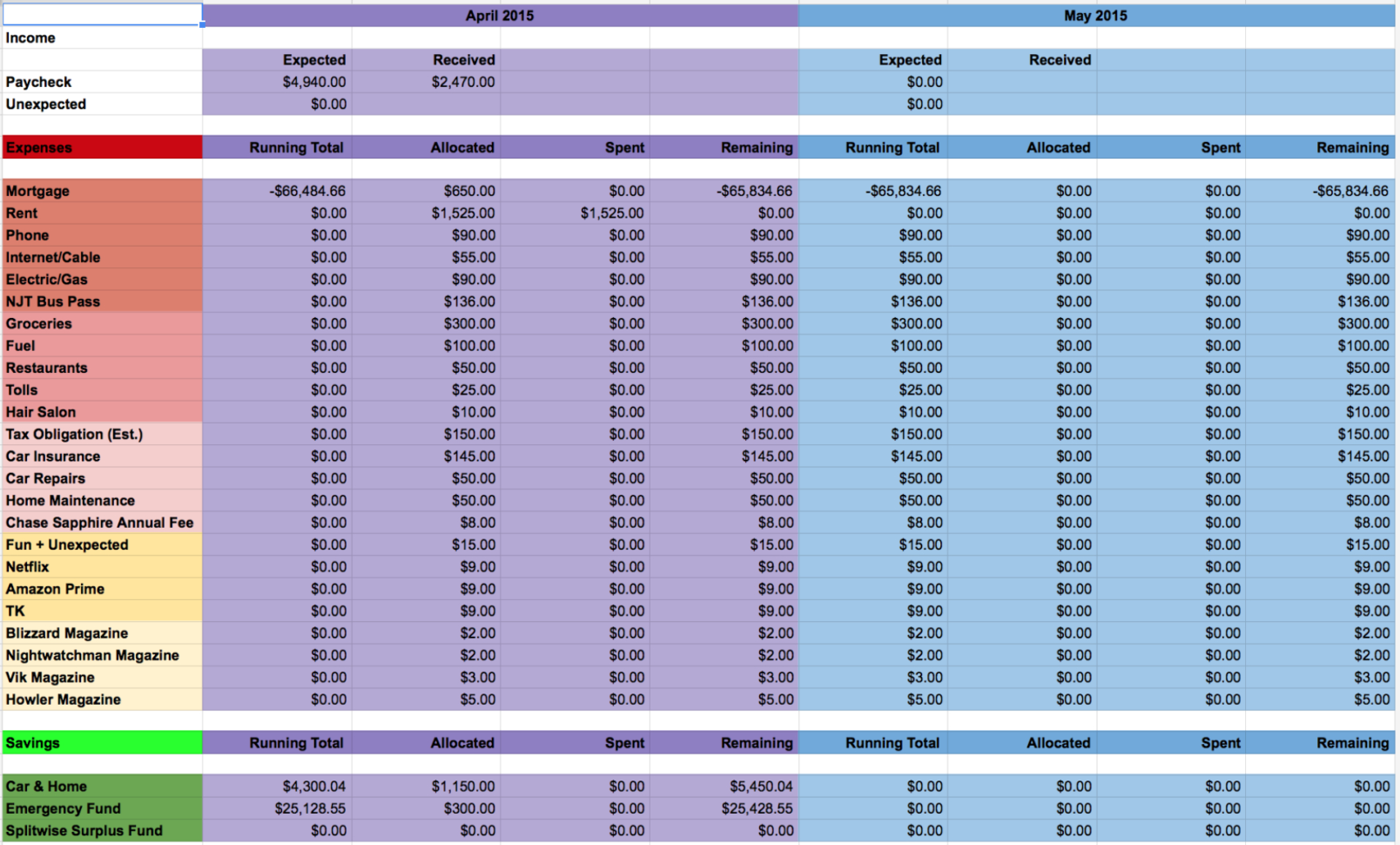

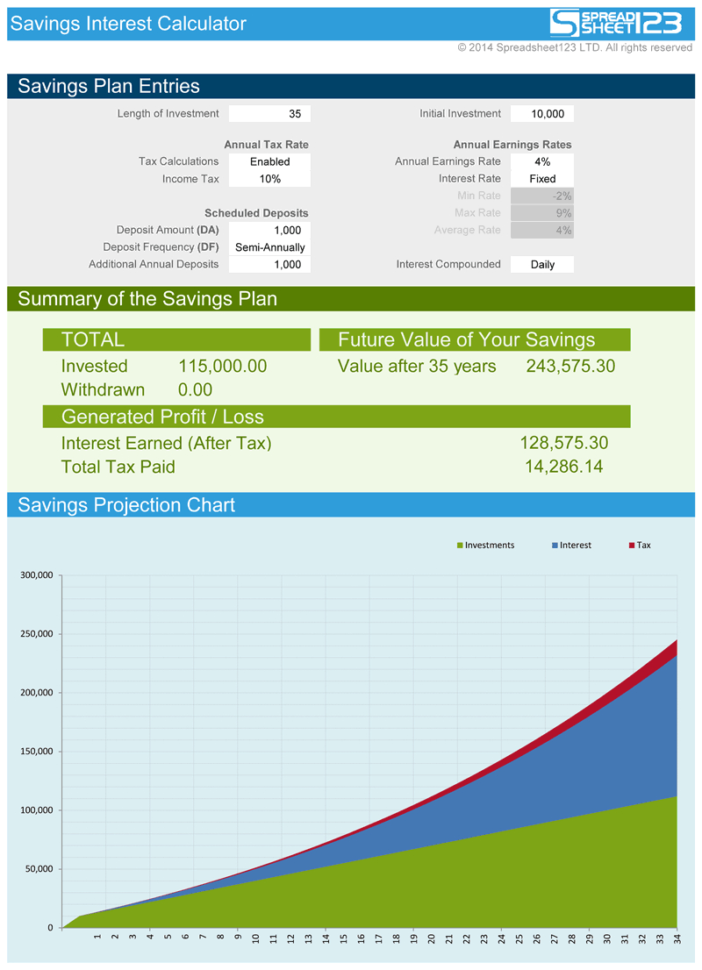

Just when you’re creating the spreadsheet, you must look closely at the many details which you must account for. No more sprinting from throughout the trading floor so that it is possible to grab your 401k spreadsheet prior to your buddy scoops it up. Also, bear in mind your spreadsheet needs to be extremely practical. Employing a spreadsheet enables you to look at the same document to acquire a general picture of the well-being of your whole investment portfolio. Given the widespread use of computers and easy solutions readily available online, it’s now feasible to easily download retirement planning spreadsheet from the web and tweak it in accordance with your expenses to acquire the most suitable quantity that you must save up. Therefore, an effective retirement planning spreadsheet is one which can deal with all your requirements and generate options which are most appropriate for you.

A Startling Fact about 401k Spreadsheet Uncovered

Click on Download to select the template you must use. If you cannot find the template that you require, you can choose the Template Gallery add-on. Double-click the template you’d love to download. Creating a contract template is a real time-saver when it’s to do with creating new contracts for many clients that all use the same clauses. The template is simply a beginning point. Nowadays you own a template, both filled and blank, it is likely to provide you with a notion regarding how you have the ability to go about making your own. If you want to create one in your, then here is a blank family tree template that you can download.

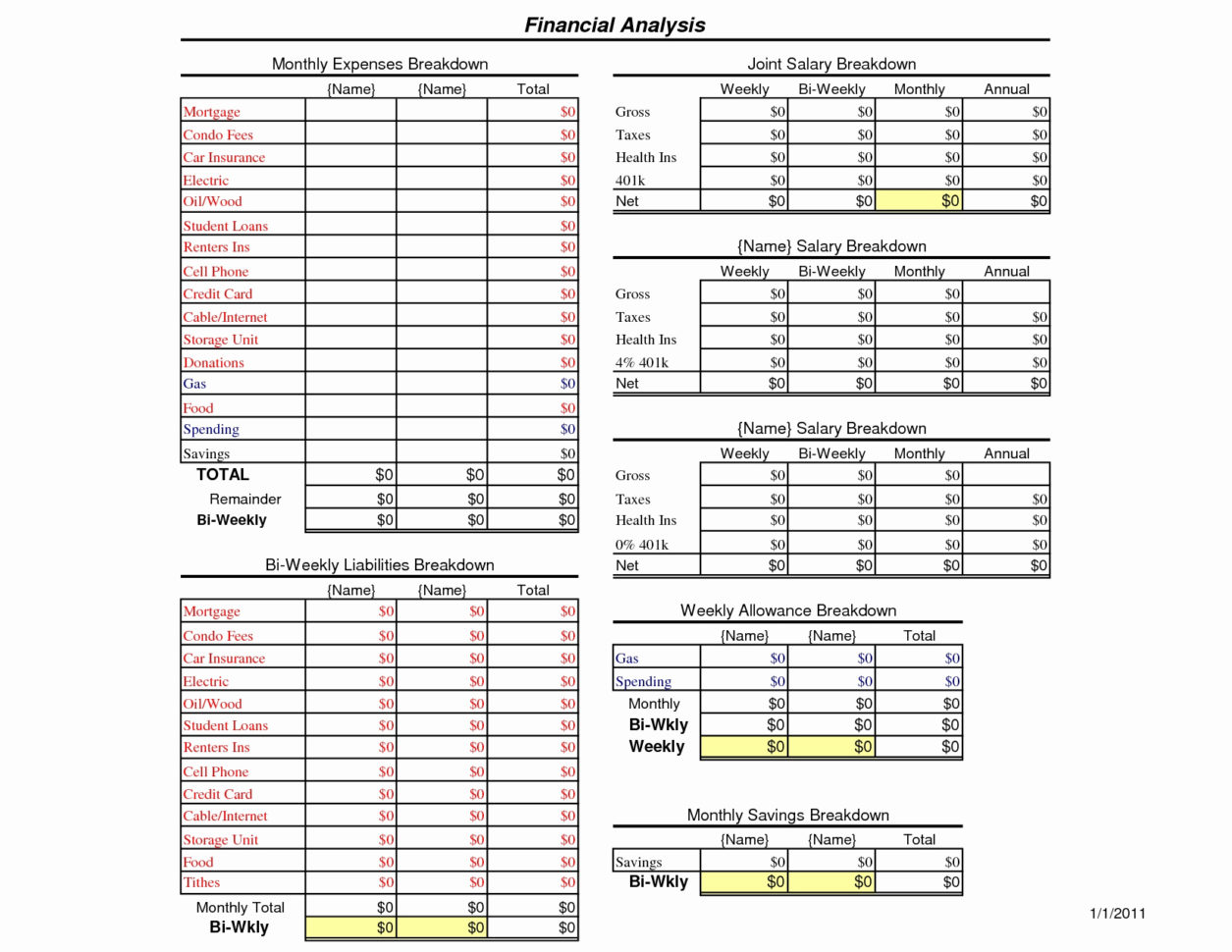

Retirement planning whenever you are a married couple or all kinds of couple in a committed relationship is doubly complicated. If you’ve got an employer plan we ask you to supply the normal expense proportion of the investments and the plan management expense. Sometimes you could be investing in a conventional 401k retirement program but perhaps given the type of job profile that you own a SEP plan may help you garner improved returns.

As you approach retirement, keep an eye on your expenses so that you are aware of how much income you’ll want to maintain your present standard of living. There is a dependable remedy to planning for retirement. Arranging a retirement is much more important than any bother event. A deferred retirement usually means that you aren’t fully qualified for a retirement annuity, but you can make an application for the deferred retirement when you could be eligible, including when you reach the MRA.

Hearsay, Deception and 401k Spreadsheet

You should get in touch with your tax or legal advisor concerning your specific circumstance. Some states tax Social Security benefits as a piece of income, while some don’t, or only tax some of your benefits. Taxes make everything a little fuzzy, obviously. For instance, if you foresee your earnings and earnings climbing later on, either due to job promotions, higher income as a consequence of an advanced level, or a more financially rewarding career ahead, you might fall into a greater tax bracket later. Utilize my spreadsheet to figure how much it is possible to contribute from your self-employment income annually. Nor does this need to create a huge income. A great place to begin to find out how long your retirement income will last.

The Downside Risk of 401k Spreadsheet

You may choose to get started SAVING more now to grow the assets later. If this is the case, you may want to put money into a more liquid asset, like a CD or a savings account. All investments carry a level of risk, and past performance isn’t a guarantee of future outcomes. The dollar amount of investments within each account produces a difference in the potency of the strategy. Put simply, how much can your actual investments drift from your intended allocation before you want to rebalance. You have to be in a position to access your money when you want this, either in the shape of paying debts, making charges, or withdrawing cash directly from your account. You must conserve a great deal more money for retirement the more you intend to spend.

Top Choices of 401k Spreadsheet

If your true allocation differs from your intended allocation, you might choose to sell off a few of your assets to put money into a different investment category, or you could choose to invest as-of-yet uninvested assets to adjust your allocation. The asset allocation you decide on depends largely on the point of your investing. When you know your intended asset allocation, you can employ your investment spreadsheet to compare your real allocation against your preferred allocation to make more informed investing decisions.