With the increase in income tax rate being imposed on US citizens in the US, it is only normal that tax preparation has also increased. However, for those who are planning to file for individual tax returns and want to prepare one’s own tax return, it is important to remember that you need to have a comprehensive and up-to-date tax planning spreadsheet.

It is difficult to find an accountant or a professional who would not suggest individuals who are planning on preparing their own taxes to use a tax-preparation system to prepare their taxes. However, it would be prudent to note that before you go out and purchase one of these systems, it is important to do a little research.

The first step to take would be to examine various versions of tax preparation software. This could involve going online to see what programs and forms are available for download, as well as search online to compare the benefits of each program. It would be preferable to try out a few to see which program works best for you.

Tax Preparation Software – Planning For 2020

After you have found the right system to suit your needs, it would be a good idea to do a little research into how these programs work. Some of these systems have their own wizards, while others allow you to drag and drop the form you want to use, or let you enter the information manually. It is important to see if you can manipulate the form as a wizard to make it more effective.

There are also some tax preparation software programs that let you enter the information automatically, but the important thing is to figure out what type of setup works best for you. This could be made even easier by setting up some priorities when you are using the program.

One of the most important aspects is to make sure that the software you have chosen will allow you to upload your paper work in order to be able to see what your tax return looks like. Most tax software systems now allow this, but there are a few out there that don’t. This may be an issue for some people, but should also be a deciding factor when you are looking at tax preparation software for your use.

It may be tempting to simply stick with your current tax preparation software, but there are some aspects that should be considered. Most people who are more interested in the larger picture tend to turn to a multi-function tax software that has many different functions and data fields. This will help to provide a level of convenience in the process of preparing one’s own taxes, as well as making it easy to navigate all of the data.

This can be done by switching to the option to view multiple files when you are using the current system. If you are already using the current system, then using the option should be fairly simple.

If you decide to use a system that uses a wizard, it is important to consider a few things before making your final decision. While the wizard may be easy to use, there are a few people who find it difficult to navigate through the maze of forms and so forth. You will want to consider the complexity of the forms that you are dealing with, as well as the amount of information that the forms contain.

While most are easy to read, there are still some that are easier to understand than others. If you are trying to navigate the charts and graphs in a system, then you will want to make sure that you are comfortable with the Wizard.

These four factors should be taken into consideration when looking at tax planning software for your tax preparation needs. Before you use a specific program, it would be a good idea to take a look at these factors, as well as other advantages and disadvantages, and determine if it is a good choice for you. PLEASE LOOK : 20 critical security controls spreadsheet

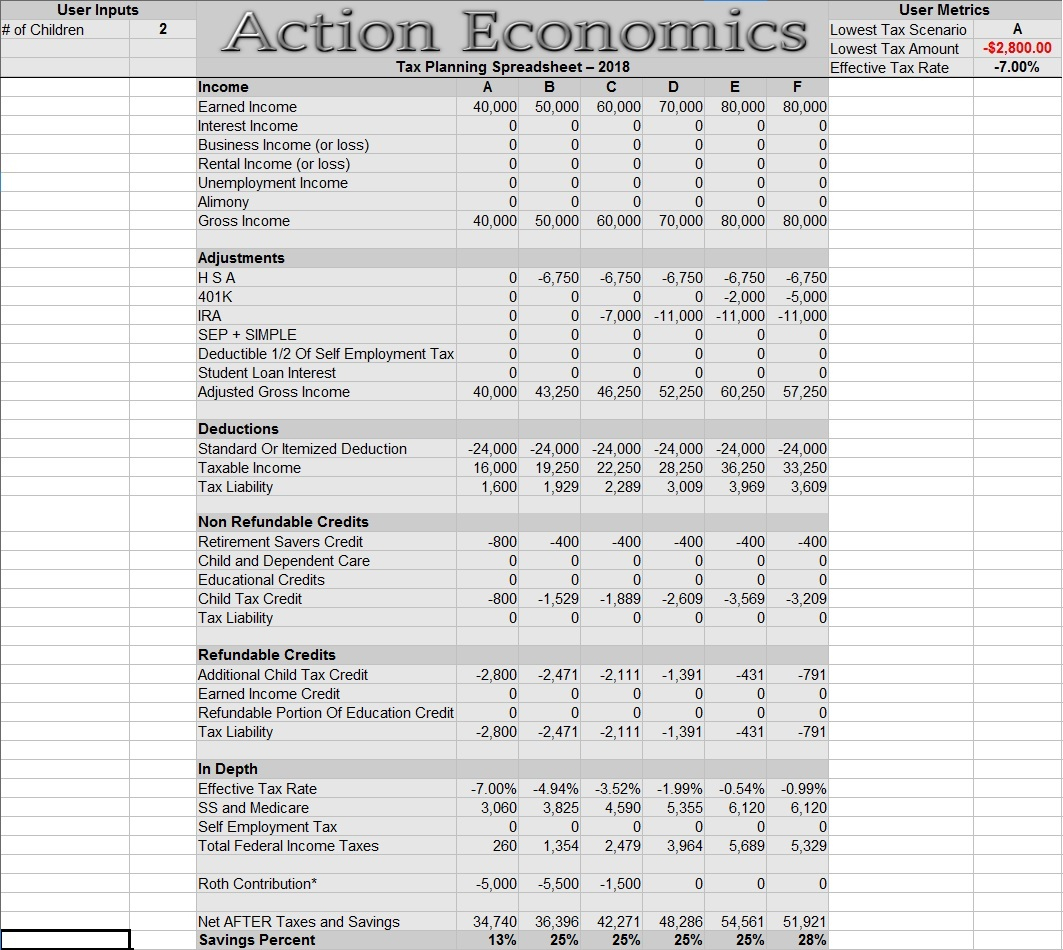

Sample for 2017 Tax Planning Spreadsheet