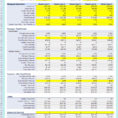

Businesses are using a job cost analysis spreadsheet to determine how many employees are costing their company in salaries and benefits. But what exactly is a job cost analysis spreadsheet? A spreadsheet contains information that can be used to create or adjust an income statement, balance sheet, cash flow statement,…

Category: 16

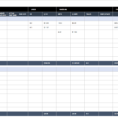

Rental Tracking Excel Spreadsheet

If you are looking for a rental management system with the help of a rental tracking excel spreadsheet, then this article was written to provide you with some helpful information. Rental tracking excel spreadsheet allows a rental management company to keep track of their rental properties and the outstanding loans…

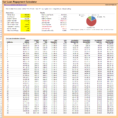

Money Spreadsheet Template

A money spreadsheet template can make the difference between making some money online or failing. You can use a spreadsheet to organize and simplify your business, giving you the tools you need to stay on top of your business. Using a money spreadsheet template allows you to easily create a…

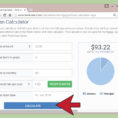

Online Loan Repayment Calculator Spreadsheet

There are many free online loan repayment calculators available today. These calculators, however, are just that: they’re a tool for calculating how much money you’ll be paying back on your loans. One of the best free online loan repayment calculator is the Simplify Your Loan calculator. It uses the World…

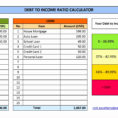

Mortgage Payment Spreadsheet Excel

A mortgage payment spreadsheet is a tool that is useful for homeowners and home owners to keep track of their mortgage payments. It allows you to have a visual reminder of the amount of money you owe, with all of your monthly installments broken down and displayed in a neat…

Savings Goal Spreadsheet

If you have a Savings Goal spreadsheet, you’ll find a whole lot of useful information. All businesses need to have a plan for saving money and managing the accounts to pay bills and keep things running smoothly. However, you will find that with a Savings Goal spreadsheet, you will find…

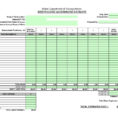

Sample Construction Estimate Spreadsheet

There are many uses for a sample construction estimate spreadsheet. Many contractors use this as a way to see how the estimate would be prior to starting the project. They also use it as a way to see if the estimate is too high or too low and see if…