Using a mortgage rate comparison spreadsheet will help you see what rate you can expect your loan to be for your new home. The first step is to make sure that you are able to do this, and then to find the spreadsheet that will suit you best. Once you…

Category: 16

Lay Accumulator Spreadsheet

The templates developed to utilize for saving calculations fluctuates dependent on the saving calculations made depending on the kinds of calculations to be created. They can be used for making CV, resume in order to apply for jobs. An extremely simple budget template can save a great deal of time….

Retirement Income Calculator Spreadsheet

A retirement income calculator spreadsheet can be a really useful tool in the planning of your future. These calculators will help you determine how much money you will need to live comfortably in retirement and also the rate of return that is required to keep your nest egg growing. A…

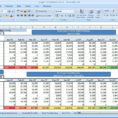

Mortgage Loan Spreadsheet

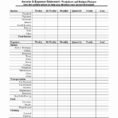

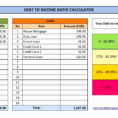

A mortgage loan spreadsheet is a spreadsheet that helps you manage your mortgage loan as well as all the other related mortgage loans and personal debt. You may be tempted to invest in software programs that can help you with your mortgage. However, as we are already aware, mortgage software…

Rent Collection Spreadsheet Template

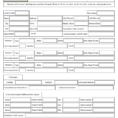

You may have heard of a rent collection spreadsheet template. But do you know what it is and how to use it? In order to successfully collect your rent, you need to know how to use a rent collection spreadsheet. When you are trying to collect a large sum of…

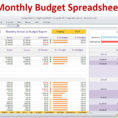

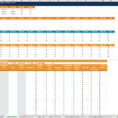

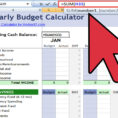

Monthly Budget Excel Spreadsheet Template

Creating a monthly budget using an Excel spreadsheet is a great way to organize your finances. It is helpful because it helps you stick to your budget, and this will help you stay on track. This is especially important for those that are trying to budget for their first time….

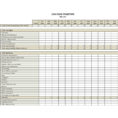

Payroll Forecasting Spreadsheet

Payroll forecasting is a process that involves using a payroll forecasting spreadsheet to forecast paydays for certain employees. You can also use this type of software to generate an estimate of the number of hours that will be worked on your project. Payroll forecasting has become more common and you…

![Retirement Income Calculator Spreadsheet Regarding Retirement Preparation Checklist [Free Pdf] With Calculator Retirement Income Calculator Spreadsheet Regarding Retirement Preparation Checklist [Free Pdf] With Calculator]( https://db-excel.com/wp-content/uploads/2019/01/retirement-income-calculator-spreadsheet-regarding-retirement-preparation-checklist-free-pdf-with-calculator-118x118.png)