Although there are many different online payment programs that claim to help you receive your bills on time, it is best to not get involved with any program that asks for your credit card information or personal data. This could include the likes of a payment spreadsheet that will issue…

Category: 16

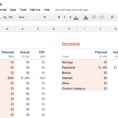

Rental House Expenses Spreadsheet

One great way to keep track of your rental house expenses is a rental house expense spreadsheet. It is a free program that comes with your accounting software. The cost of your rent plus other expenses will be available and easy to see. As stated before, this program is free….

Rmf Controls Spreadsheet

As your doctor gives you an MRI, you’re going to have to make a decision about whether or not to get an MRI Machine with Mobile MRI Controls. The main reason you might need these is because your doctor has you on a radiation dose monitor. Radiation doses from the…

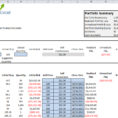

Mortgage Spreadsheet With Extra Payments

The purpose of the mortgage spreadsheet with extra payments is to quickly and easily manage your mortgage payments. As the name suggests, it has extra payments added to it for ease of payment. This allows you to be able to make quick decisions when paying off your mortgage quicker. The…

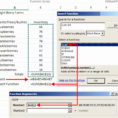

Options Spreadsheet

An option spreadsheet is a list of contracts, that you have with a number of different financial institutions. These are used to determine the value of an underlying asset. This is usually a contract between you and a financial institution, that the value of an asset will be determined in…

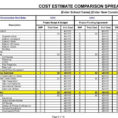

Plumbing Estimating Excel Spreadsheet

If you’re running a plumbing estimator business, you’ll find the plumbing estimating excel spreadsheet a valuable tool. This handy little program is often used by plumbers to determine what parts are needed and how much they will cost. You can get all of this data in just one easy-to-use file….

Mac Spreadsheet Application

Apple has recently released Mac spreadsheet application. Most of the times, this application is referred to as MS Excel. However, there are some cases when the application is referred to as Mac Excel. Although there are some cases where MS Excel is used for Microsoft Excel, the compatibility of Mac…