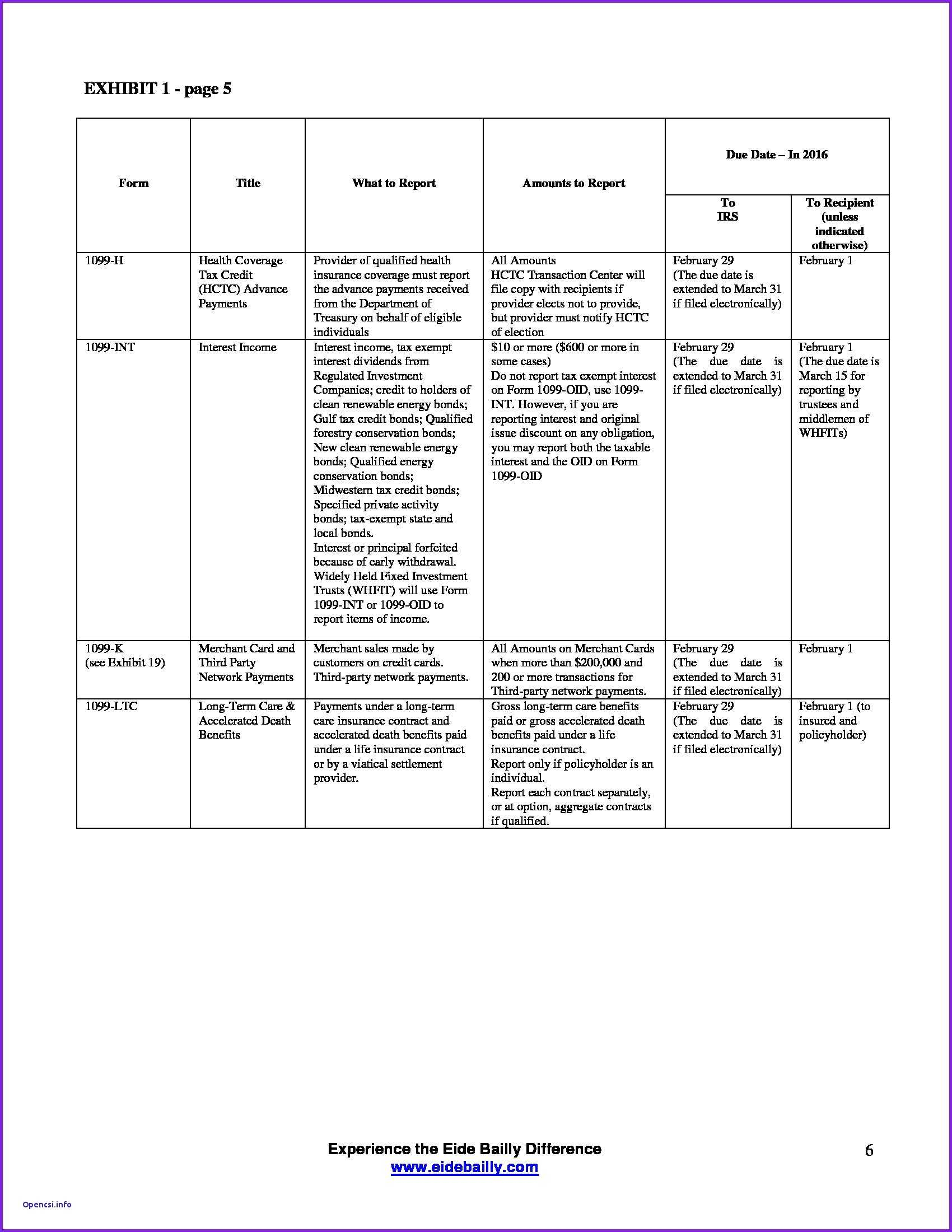

An important feature of a new self-employed business is the 1099 expense spreadsheet. It is your primary way to keep track of your income and expenses. You may have to manage a home office business with this document.

I may not have been doing this when I started. But this is a tool that I use all the time. And for me, the most difficult part of managing the business is keeping track of everything.

Before you get started, you will need a copy of this spreadsheet. I can’t stress this enough. Getting a copy of this spreadsheet for the first time is very important.

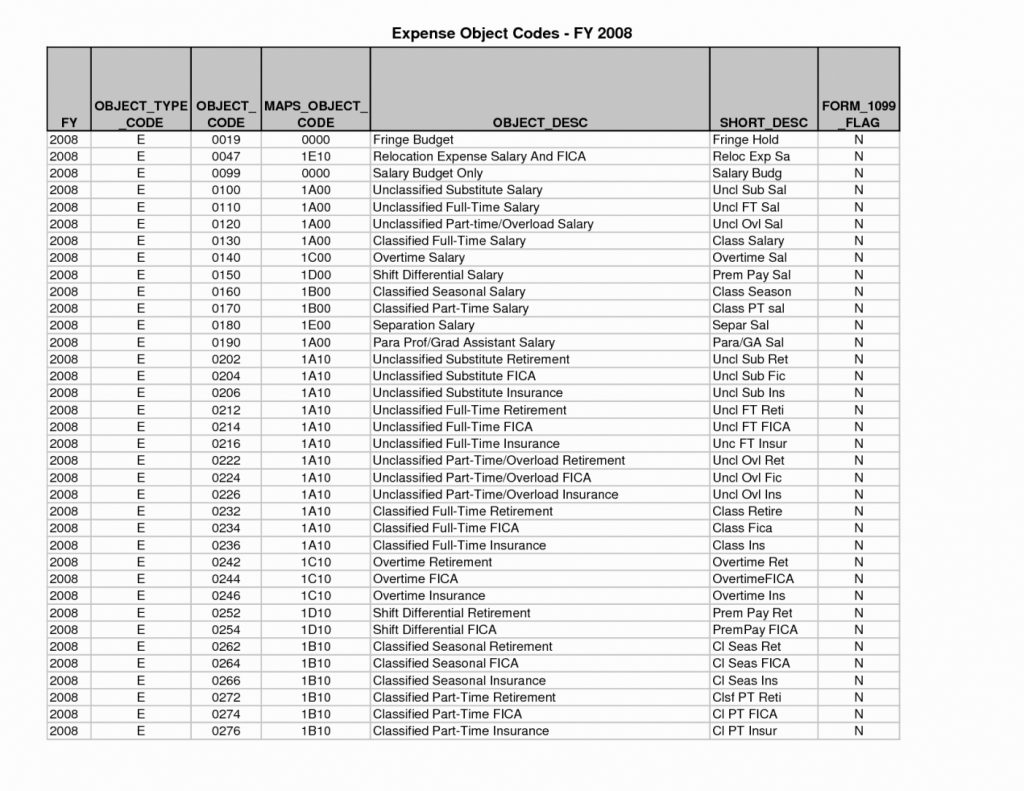

How to Maintain Your 1099 Expense Expense Sheets

If you are not familiar with this type of spreadsheet, it is a computer file that you enter your expense information into and you are done. You then print out the spreadsheet and make sure that you print in the format that it expects. After printing, you can save the document to disk, and if you want, you can even email it to yourself or to someone else that you have hired to help you manage your business.

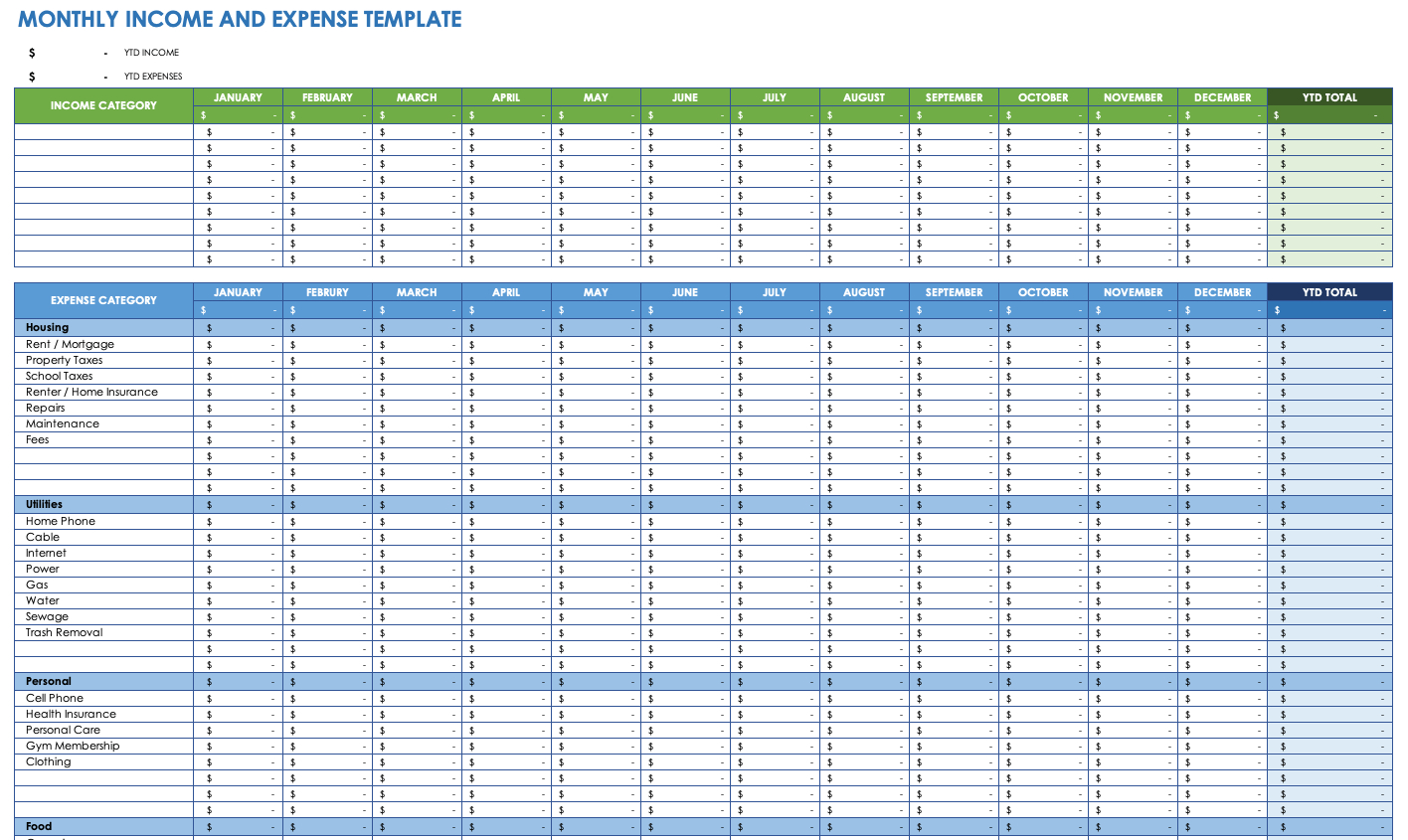

In the future, you may want to add some items to the expense record. For example, I have recently added some service charges to my cost basis. This makes sense because most of my service charges are phone calls.

You can do this on the expense summary sheet. Enter the information. After printing, you just attach it to an email or print it out. You can also do this at any time.

In addition to the service charge, I now have an itemized expense for each service that I perform. The service charge is at the bottom of the total. The service charge and the total price are shown as an itemized column. It shows the amount of money spent for the service, the period over which the service was provided, and the cost of providing the service.

So you can see that I now have an itemized service charge, and I get billed for the same service using a certain date and a specific product. I can see exactly what was spent for the service and the amount of money that were provided to me by the product.

To make this a little more useful, let’s say that I do the same service in a different situation, but I provide the same product to the customer. In this example, I would enter the information differently. I would enter the information for a different service, with a different product.

But because I am provided with two different services, I can include the service charge for both services in the cost basis and in the total. This makes my business look better and easier to understand. It gives me a better picture of what I am doing and where I am spending my time.

Having a cost basis spreadsheet is one of the most valuable tools you will ever own. It allows you to more easily keep track of your expenses and financial activity. And, if you’re new to the business, or you simply don’t have time to keep track of it, it allows you to cut back on the amount of time that you spend managing the business. PLEASE SEE : yearly expense report template