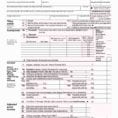

Kids, Work and Qualified Dividends and Capital Gains Worksheet 2018 The matter of how to tax unearned income is really political. Therefore, if you feel having issues with your private writing, all of our design templates highlighted along the content offers you some hints together with techniques about providing far…

Category: 1 Update

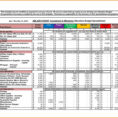

How To Create A Business Expense Spreadsheet

Most home based business owners do not have to worry about how to create a business expense spreadsheet. After all, most of the expenses are for company business costs and not personal expenses. However, there are some expenses that belong in the personal category and should be reported on a…

Treasurer's Report Excel Spreadsheet

Facts, Fiction and Treasurers Report Excel Spreadsheet To open the file, simply click the report you wish to look at. With Power BI, you can make a stunning report in no moment. Besides the character and size of the company, financial report is a crucial document for the reason that…

Excel Spreadsheet Template For Employee Schedule

An Excel spreadsheet template for employee schedule is a good way to start out your own business. This type of program is simple and has plenty of features, and it saves you from the complicated tasks that you have to do to make your program work properly. A workable and…

Social Security Calculator Spreadsheet

What You Don’t Know About Social Security Calculator Spreadsheet Could Be Costing to More Than You Think Spreadsheets can automate the procedure for you and make it possible for you to earn quick adjustments to your inputs. Put simply, it’s a spreadsheet that can help you to make the decisions…

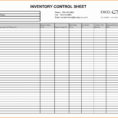

Pantry Inventory Spreadsheet

The Key to Successful Pantry Inventory Spreadsheet Automatic reminders when inventory items are going to come to an end or expire. Decide how frequently you wish to take inventory. There are food inventory forms that it is possible to use for such a goal. Pantry Inventory Spreadsheet – the Conspiracy…

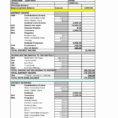

Expenditure Spreadsheet

Expense spreadsheet is a chart used to record the expenditure on business and also to examine the cash flow. It helps in effective accounting. It is designed to show the income and expenditure of any business. Expensing is the method where an item is written off after its sale. This…