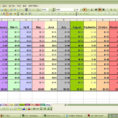

In this article, I’ll show you how to use an open to buy spreadsheet to make money. This works as a cash flow spreadsheet that shows you what you could sell your house for, if you ever wanted to. Here’s how it works:

Open spreadsheet that shows what could be your home. In here, you would be able to enter the amount of money you need to purchase a house. It will show you what it would cost you to buy the house you’re looking at. You can even add up the numbers to see what you could be spending.

Open to Buy Sheets Excel Tips

In here, you can see the different types of houses you could purchase. The spreadsheet will show you all the different houses available. So you can decide what kind of house you want to buy.

There are many different features in this open spreadsheet. You can see every detail of the house you are looking at. If you find a house that you like, you can quickly check out how much it costs to own that house.

You will also need to input the amount of money you’re willing to spend on buying a house. This is how the calculator works. It will calculate what you could sell the house for in terms of cash. You can easily enter the amount of money you need to buy the house.

This spreadsheet is user friendly. You just have to input some information and you get the result. And it is accurate. It has been used by many real estate agents, so you know it is one of the best.

Use open to buy spreadsheet for free! You can download one online for free. It is perfectly legitimate.

Use free online sites to find a real estate agent who specializes in selling houses at the best price. That’s what the price you should be paying will be determined by the agent. He or she knows the secret tricks that enable them to get you the best deal.

It’s easy to use and free. You don’t have to pay any money to use the site. And you don’t have to enter any information at all.

Use open to buy spreadsheet to save time. You don’t have to run from pillar to post trying to find a good agent.

Get a free quote online and then use the calculator to find out what price you could afford to pay. You can get a quote from multiple agents online and then compare it to see which one will give you the best deal.

If you’re not comfortable buying a house, you don’t have to pay anything. It is completely free. That is one of the reasons why this open to buy spreadsheet is so popular. PLEASE LOOK : open spreadsheet online