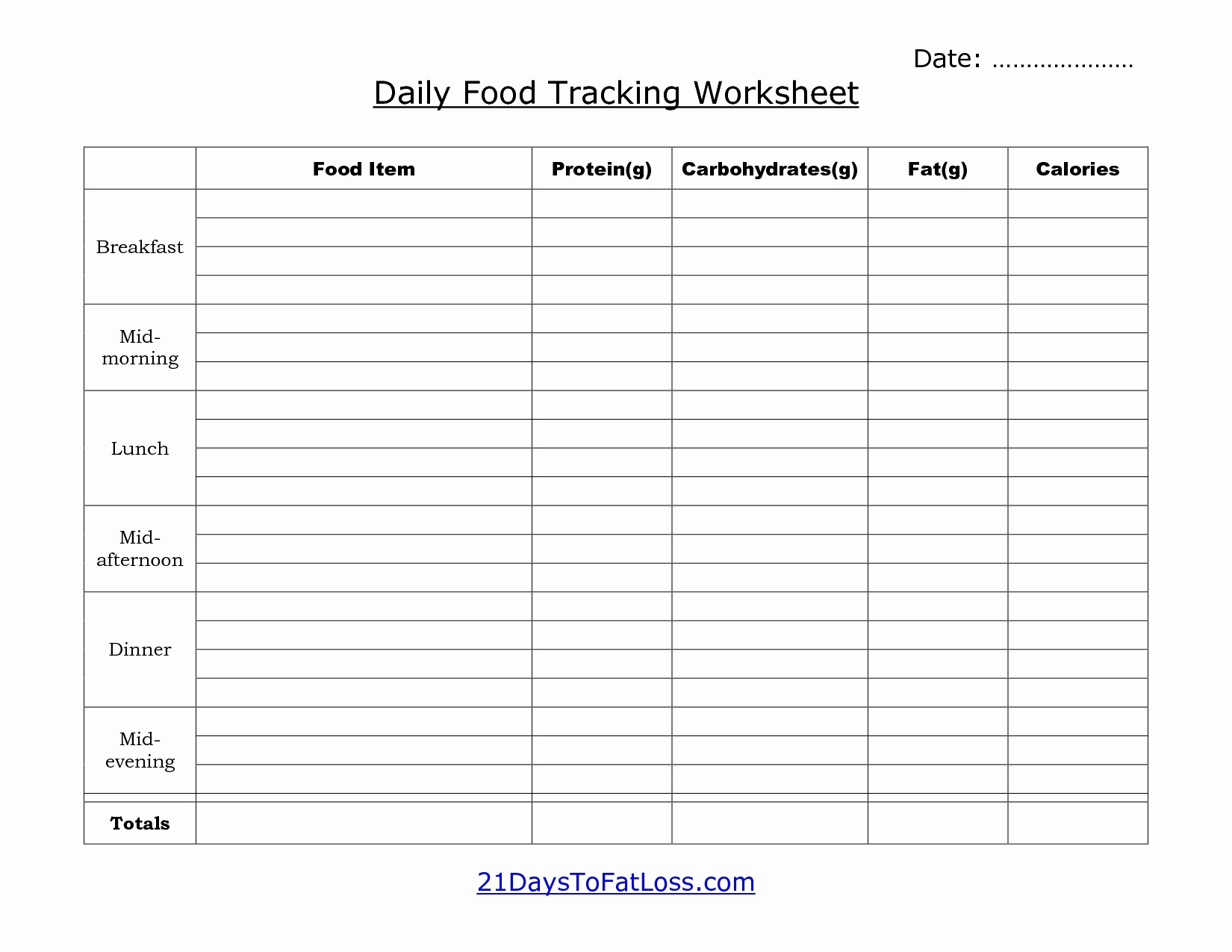

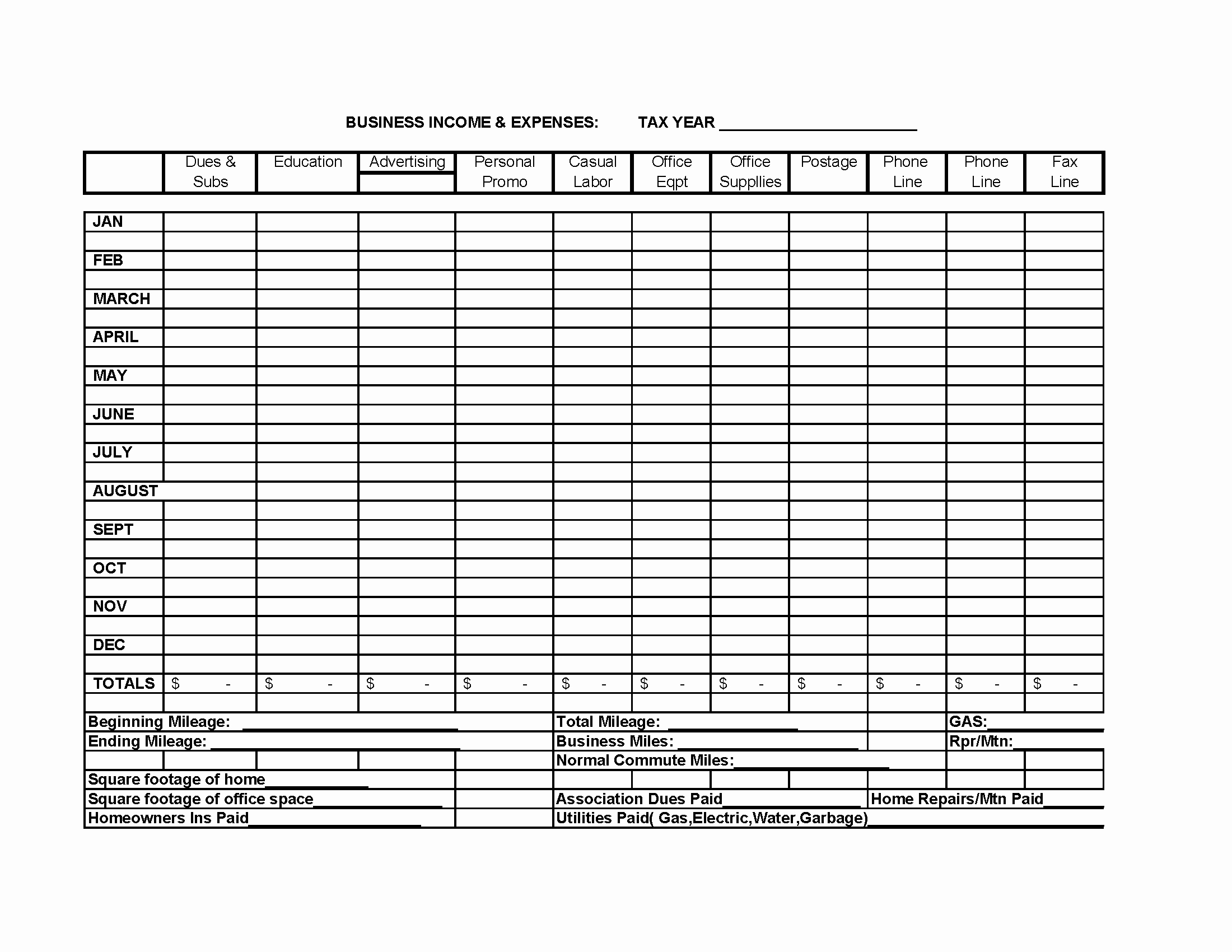

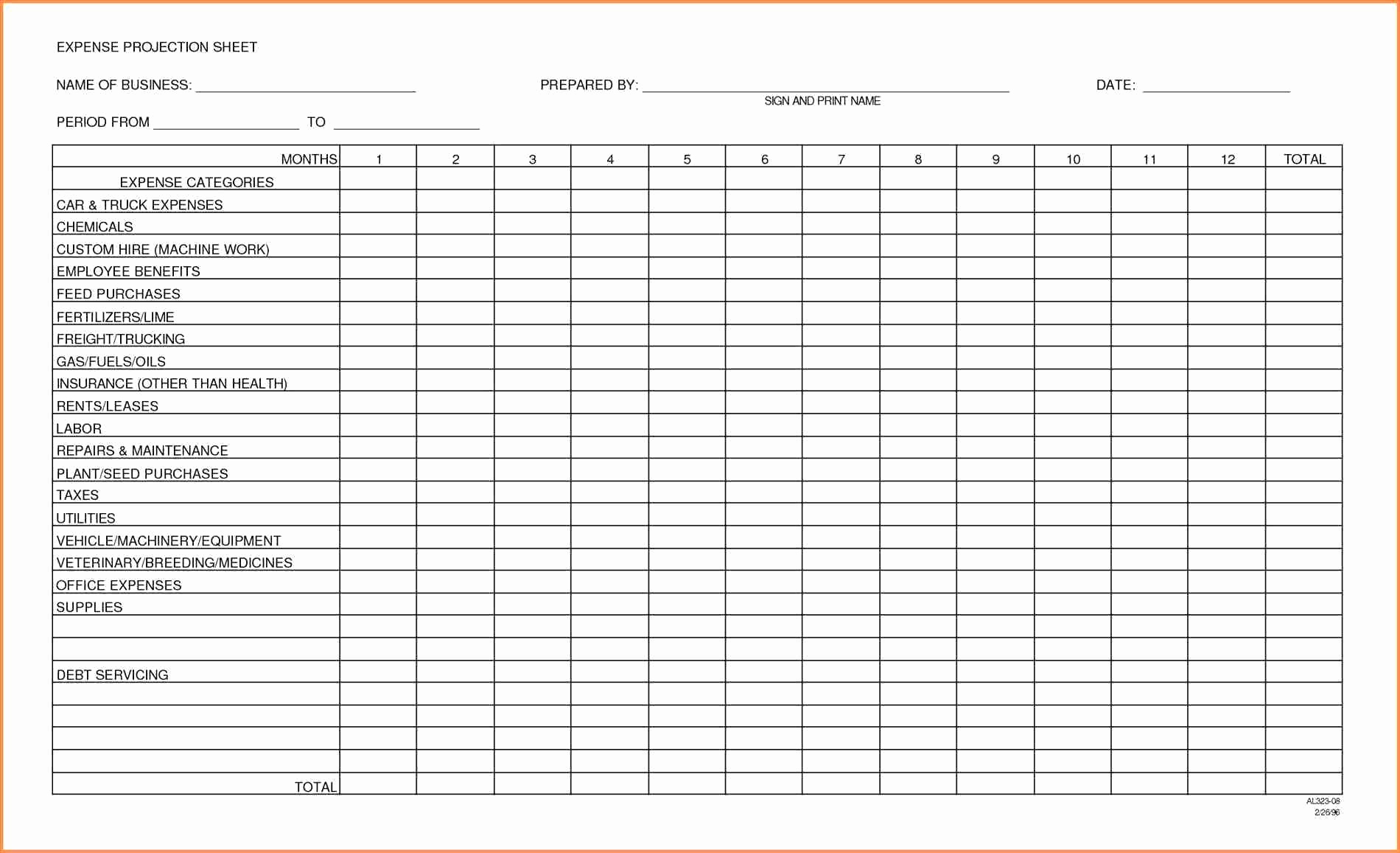

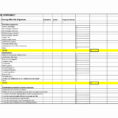

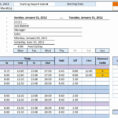

Schedule C Expenses spreadsheet is a great tool for any accounting professional to keep track of their financial dealings. A spreadsheet can easily be created and used as a schedule of the various expenses which are incurred on a particular day. Since the expenses are grouped into categories, you will be able to understand your fiscal situation better.

The advantages of using a spreadsheet are many. Schedule C Expenses spreadsheet helps you organize all your financial transactions. It also simplifies the process of bookkeeping.

The spreadsheet is useful for numerous reasons. First of all, it helps you to reduce the number of documents you have to keep by grouping the different activities under a single sheet. In addition, you can store the records as one big, simple spreadsheet file.

Using Schedule C Expenses Spreadsheet to Manage Your Financial Affairs

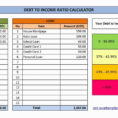

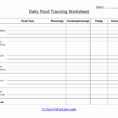

You may use the spreadsheet to design your budget. Also, it can easily be used to calculate the net income from sales, the profit you make in a year, the expenses you incur, and so on. You will get a good understanding of how you spend your money and how you earn money.

You will be able to keep a track of the expense. Schedule C Expenses spreadsheet allows you to input your own calculations. This can save you the trouble of remembering all the different data of different expenses. You only need to enter the total expenses and a certain percentage of the profit or loss of the previous year.

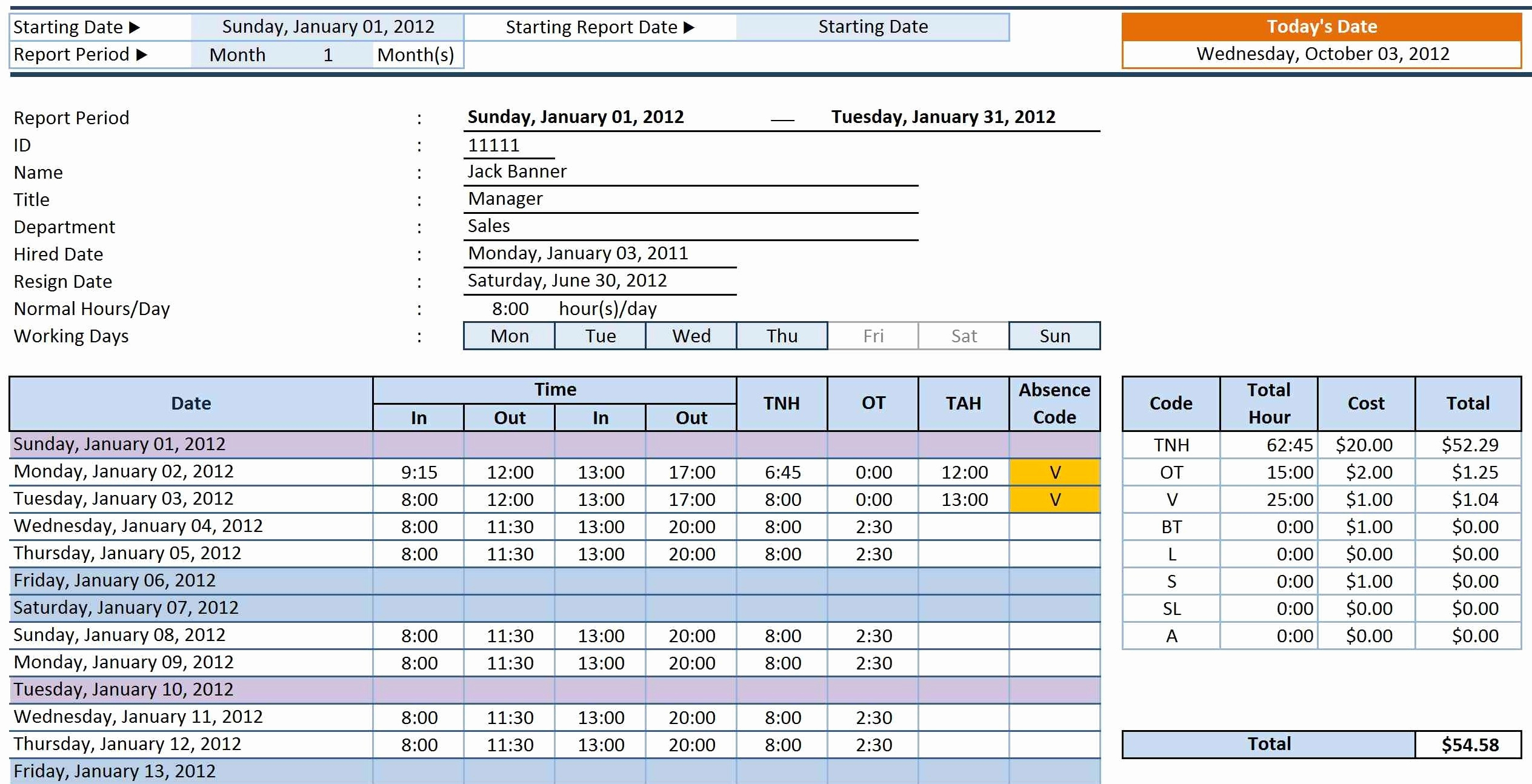

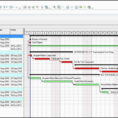

You can keep a calendar to mark the days you want to calculate. This way, you will be able to conveniently monitor your expenses. Also, you will be able to create your schedules for a particular month or a particular year. You will be able to know whether you are spending your money wisely or not.

It is important to note that you need to develop your schedules for the entire year. If you do not include expenses which are incurred in one month of the year, the results will not be accurate. For example, if you earn less in one month than you spend in the same month, your results will not be accurate.

Use of a Schedule C Expenses spreadsheet can help you avoid unnecessary expenses. You will be able to focus on your core business and lessen the amount of paperwork that you have to handle. Furthermore, your transactions will become more efficient and easier to understand.

The use of a Schedule C Expenses spreadsheet is an effective way to minimize your expenses. It is simple to use and understand. Also, since the expenses are grouped, you will be able to manage your finances more effectively.

The best part about using a spreadsheet is that it helps you avoid lots of errors. Your employees, managers, and executives will be happy to see this technique of managing expenses.

Whether you have just started accounting or you are a veteran, you should learn how to use a Schedule C Expenses spreadsheet. Even if you are not planning to retire soon, you should still have this sheet handy in order to easily analyze your financial affairs. YOU MUST LOOK : scan to spreadsheet