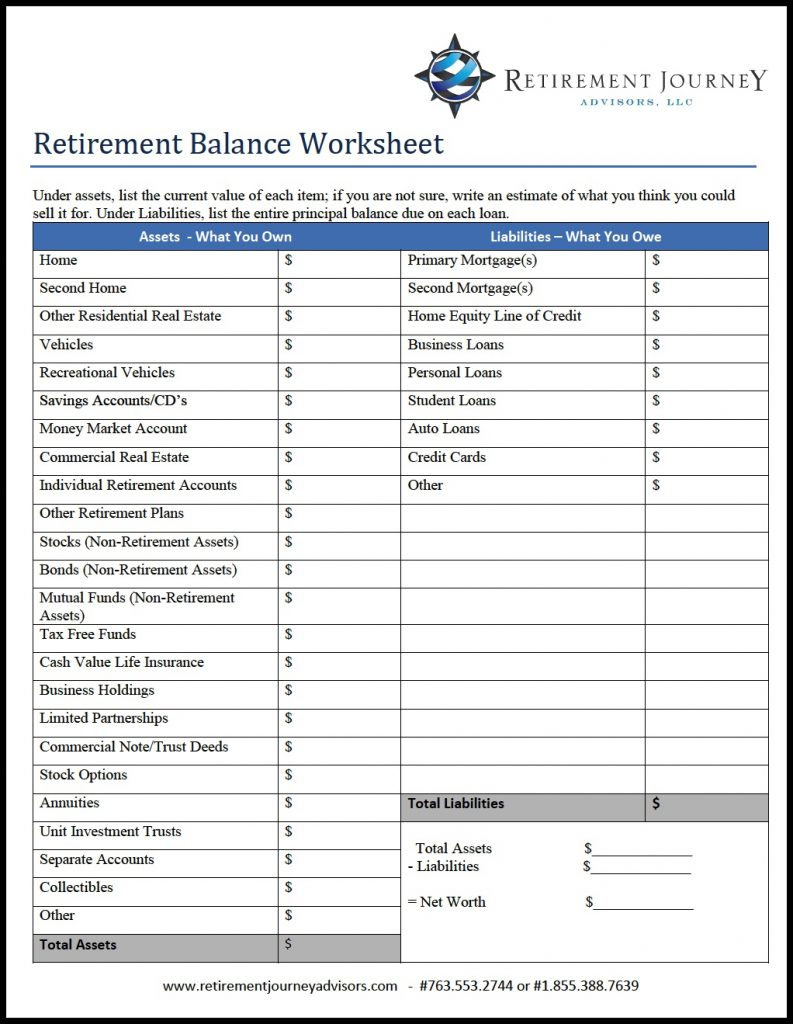

Retirement income planning sheets provide an important part of your retirement income planning toolbox. They are useful tools to keep track of your financial goals. This guide explains how to use them effectively.

The purpose of a retirement income planning sheet is to help you put a plan together that will help you achieve your financial goals. They can provide information about your current financial situation and help you assess whether your current financial situation is in need of improvement.

Is a Retirement Income Planning Sheet Necessary?

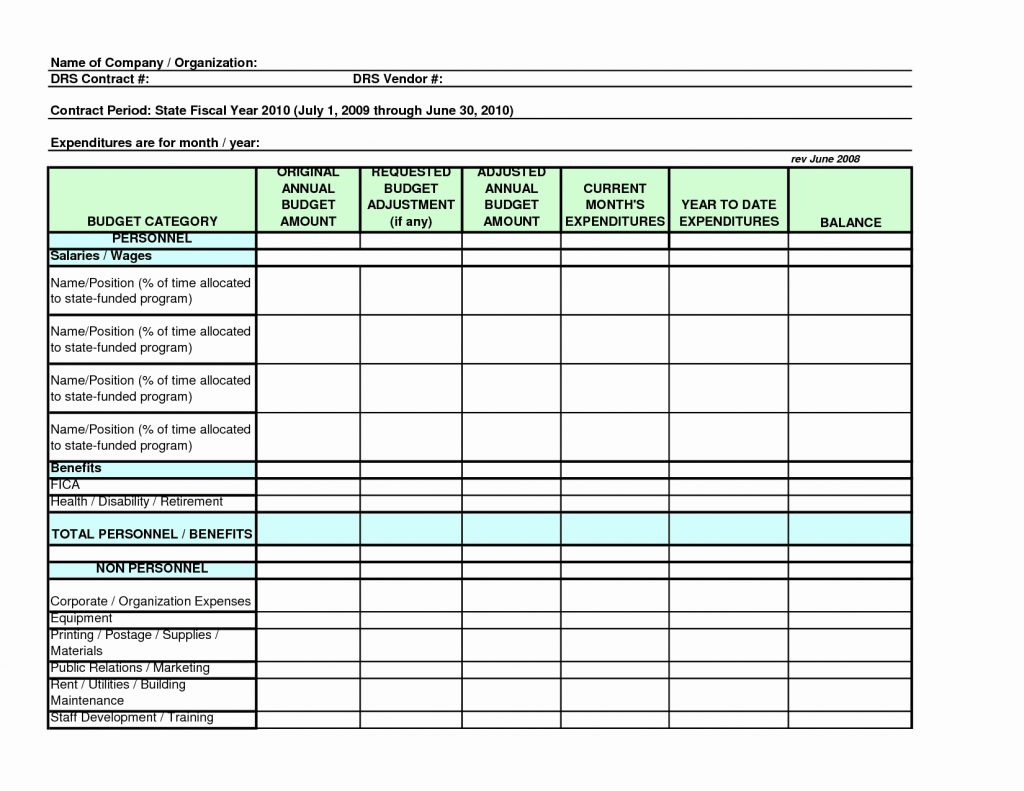

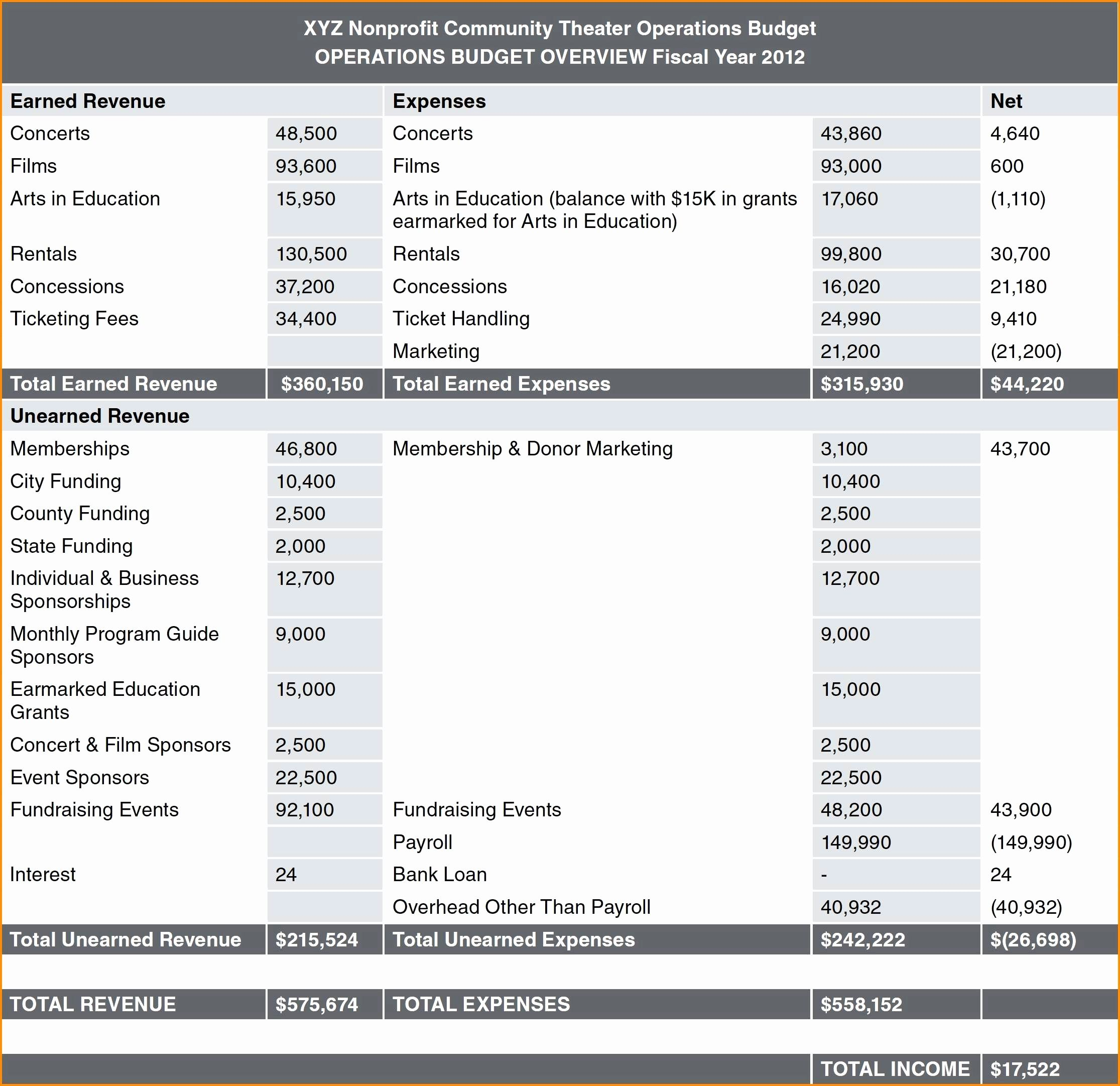

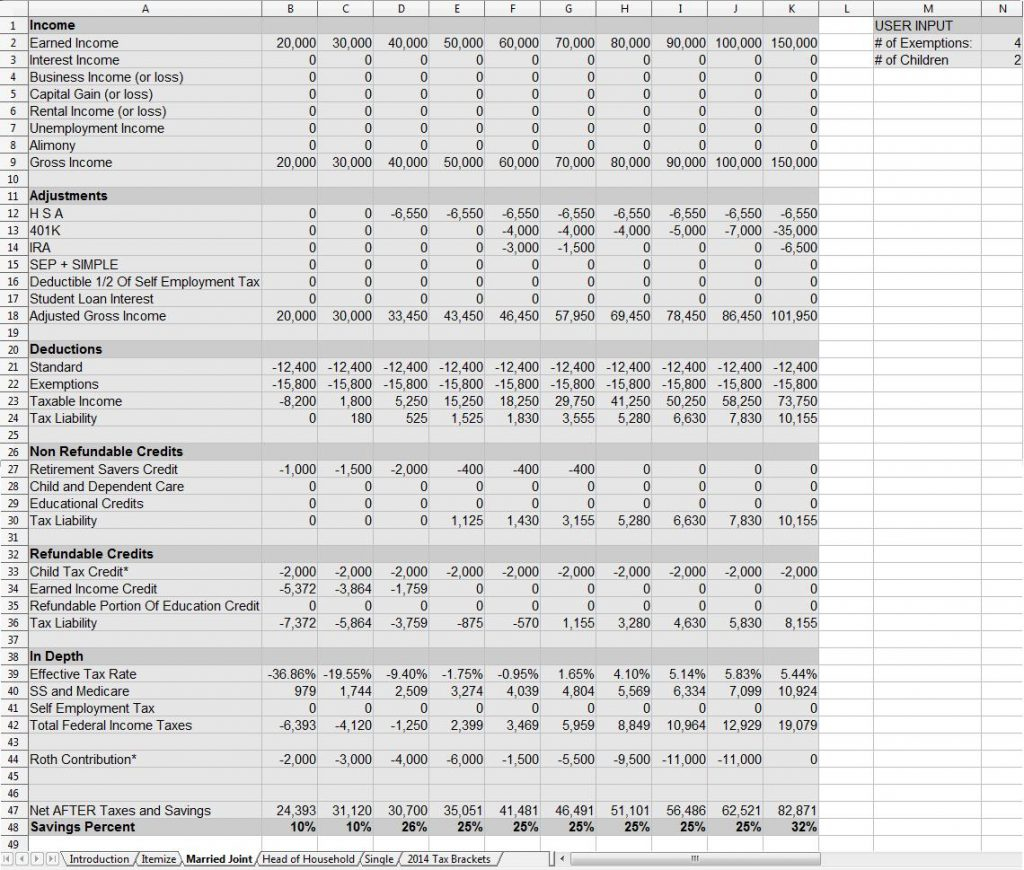

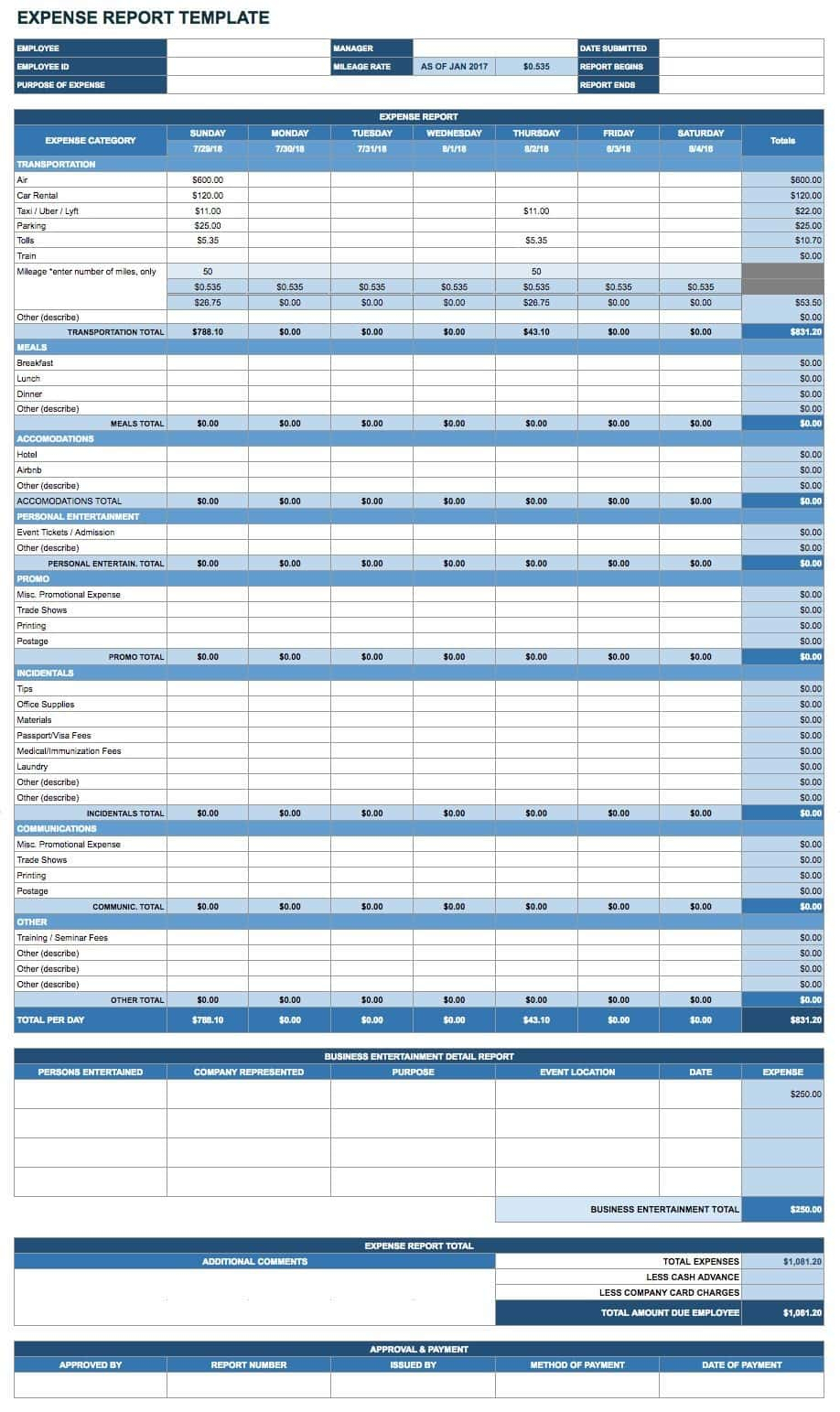

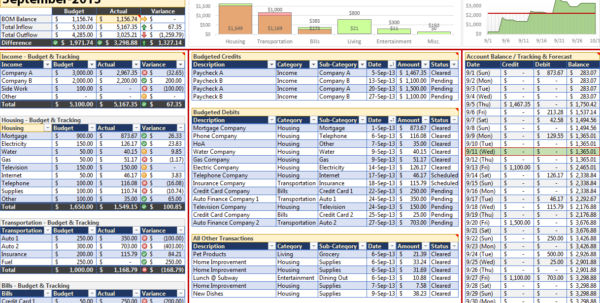

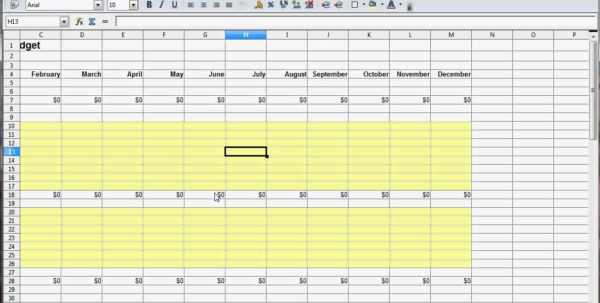

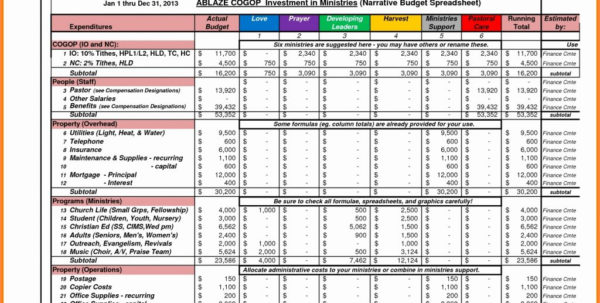

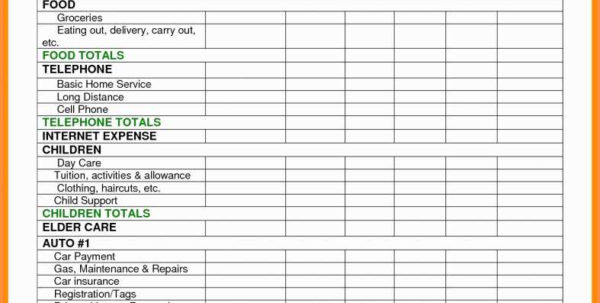

The first step in retirement income planning is to compile all of your monthly budget amounts and combine them into a single graph. Include all of your income sources and include the costs of any money that you pay out-of-pocket such as interest, taxes, insurance, and social security (if you are self-employed).

It is important to look at the monthly income before you start to think about the costs associated with that monthly income. Once you’ve figured out the monthly budget amount, go through it carefully and ensure that you have done all of the necessary things to save money and you are able to save the required amount each month.

Your retirement income planning spreadsheet is only as good as the data that you input into it. Don’t just put in anything and everything that you can think of. Your spreadsheet should have both your objective and subjective data.

The objective data is essential. The objective data will show you how much money you need to retire and how much money you need to live comfortably after you’ve retired.

The subjective data is what will tell you how you feel about your current finances. The objective data will tell you what you can realistically afford and the subjective data will tell you if you can afford that. Be sure to consider both types of data when you create your retirement income planning spreadsheet.

Once you have finished your retirement income planning spreadsheet, put it away in a safe place so that you can refer to it easily and refer back to it regularly. Save it on your computer. Put it in a file cabinet in case you need to refer to it quickly.

In order for your financial planning tool to be of the most benefit to you, you need to be consistent with it. Each time you review your spreadsheet you will want to make sure that you don’t put any more money into your savings account than you need to. However, if you find that you have more than you need each month to be comfortable, then it’s OK to do so.

This applies to your savings and your daily income. If you’re saving your money by making a quick sale or spending it with credit cards, or not being responsible with your budget, it will not do you any good in the long run.

Remember, it’s your retirement income planning spreadsheet, and you are in control of how much you can afford to spend each month, or how much you need to save each month, and all of the other factors that contribute to your overall retirement income. You can either choose to be comfortable, or you can choose to be comfortable. You can’t put two together and come up with the same number.

If you do decide to change your lifestyle or invest some of your money in the stock market, be sure to add your retirement income planning spreadsheet to your paper. Do not rely solely on your personal experience when deciding how much you can live comfortably after retirement. Use your retirement income planning spreadsheet to help you determine exactly how much you can afford to save each month to be comfortable once you’ve retired. PLEASE READ : retirement income calculator spreadsheet