Profit and Loss Statement Template For Self Employed

The use of profit and loss statement template for self employed is a very important part of their business plan. A business plan is the one thing that separates an average business from a great one.

Profit and loss statement template for self employed is a very important and fundamental part of business planning. It helps in managing the finances of a business by not only defining a business but also helps in forecasting future financial data.

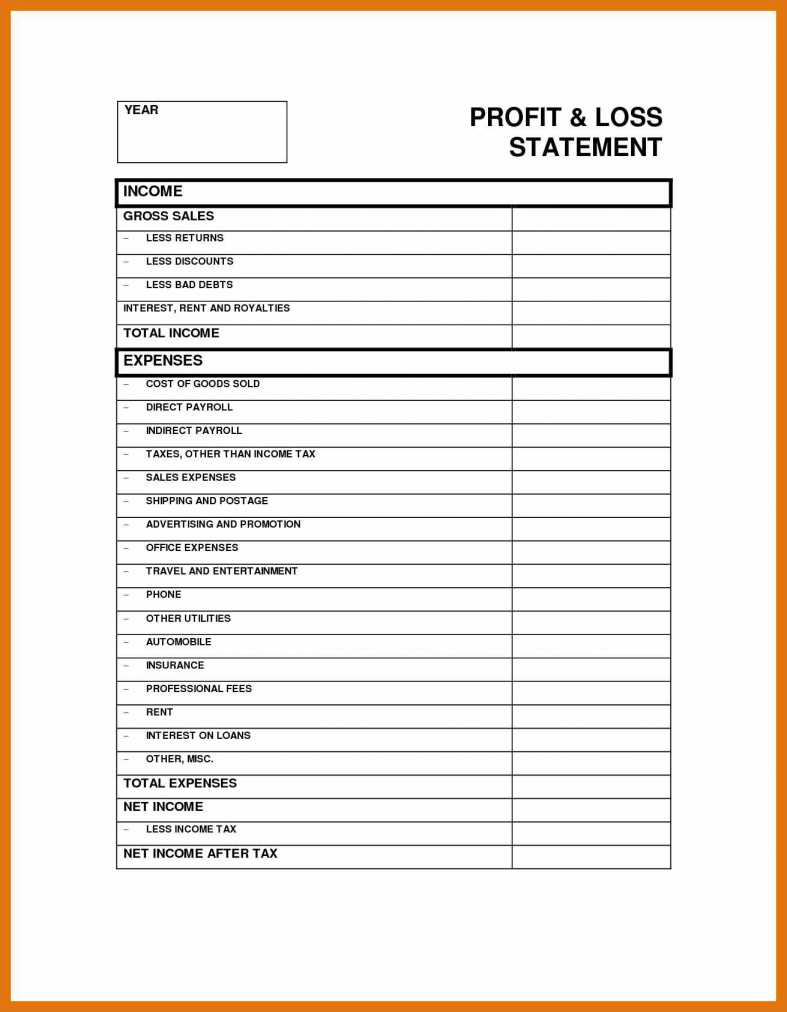

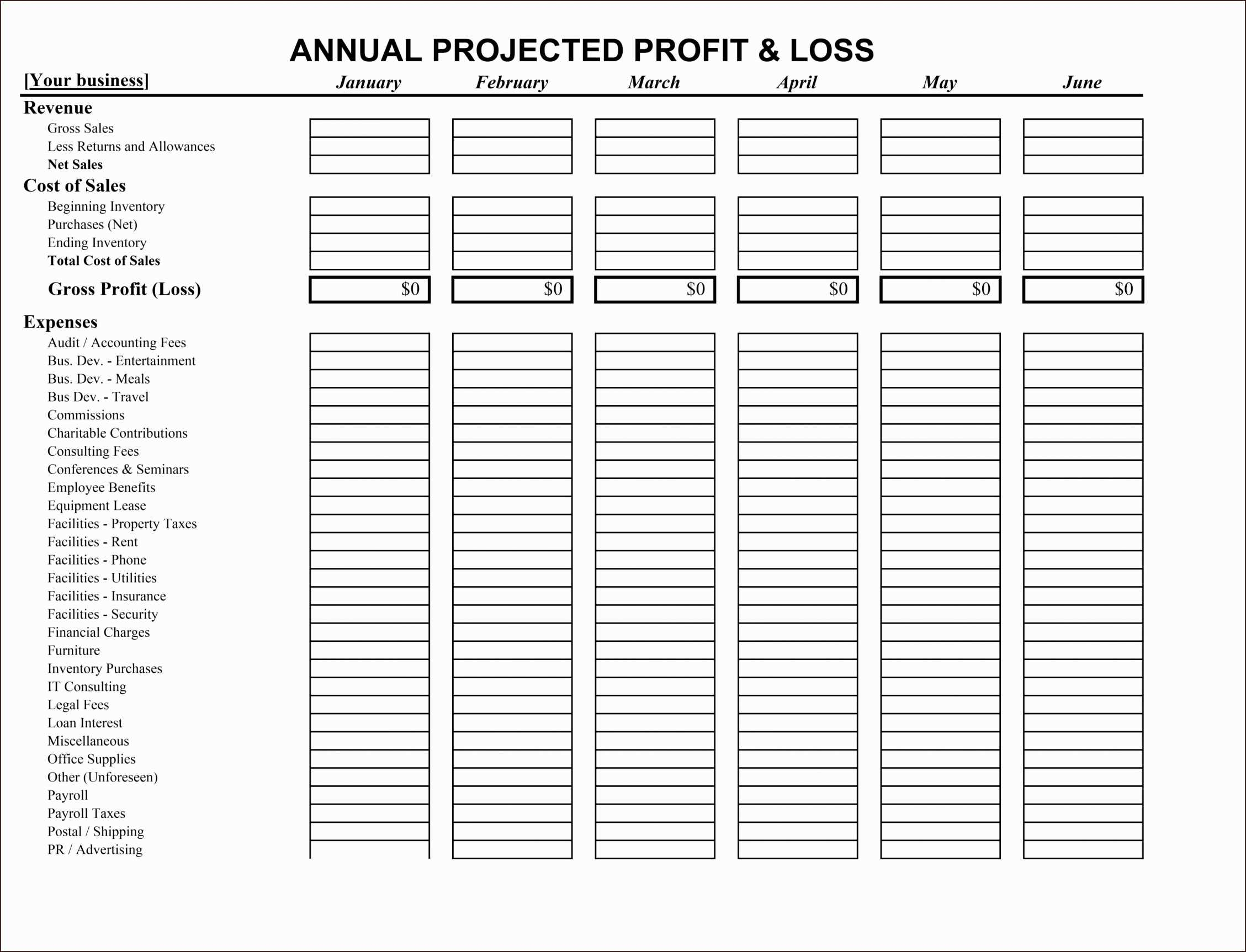

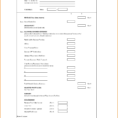

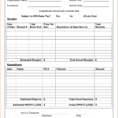

Every business plan needs a balance sheet, statement of cash flow, income statement, statement of stock ownership, and profit and loss statement. Before making any decision, it is better to consider all the points because they determine how well your business plans to spend money.

With a profit and loss statement template for self-employed, you can define business strategies and see where you are at any given time. You can make a complete budget and analyze how well it goes.

The balance sheet gives you an idea of the company’s finances. It gives you an idea of how much cash and liquid assets are available and how much is required to maintain the company’s operations. It is the key document which provides information on the financial position of a company.

The profit and loss statement are the first point to look at in the balance sheet. It shows how much money has been received by the company and the amount that it spent. To give you an idea of the difference between this number and the net profit, you can calculate the net profit and use it as a guideline.

Net profit is the profit that the company actually makes after paying expenses. So, it is not the company’s income, it is just the sum of everything that is paid to the owners of the business. The amount of profit is also known as the earnings per share (EPS).

So, when you put all the numbers into the profit and loss statement template for self-employed, you will be able to see whether you are operating at a loss or not. You will know if you have overpaid and underpaid. It helps you to know whether you can pay off your debt.

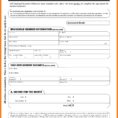

To figure out the profit and loss statement, you can also check with the IRS. If you have to pay taxes, you need to get this information. The IRS will have the information so you can decide whether you will pay the taxes or not.

You will also have to determine your taxable income and find out if you will be liable for paying tax. This is because the profit and loss statement give you an idea of how much taxes you are liable to pay and whether you are liable for paying taxes.

Profit and loss statement template for self-employed is very essential for every business owner. If you use it correctly, you will be able to understand your business better and if it is run right, you will be able to make a lot of money. YOU MUST LOOK : Production Kpi Excel Template