If you are interested in using a mortgage amortization calculator to help with your mortgage amortization, then this article will discuss some of the benefits that can be gained from using this tool. For instance, if you have been looking at how much it will cost you to make each monthly payment on your home loan, this calculator will allow you to see exactly how much each installment will cost you. This is a great tool for many homeowners who are trying to make their monthly payments, and if you are interested in learning more about how to use this tool, then read on.

There are many benefits to using a mortgage amortization calculator when you are trying to figure out how much each additional payment will cost you. First of all, there is the amount of money that you will save on your monthly mortgage payments. This could make a huge difference in the total amount of money that you have to pay for your mortgage.

Using a Mortgage Amortization Calculator to Calculate Your Mortgage Payment

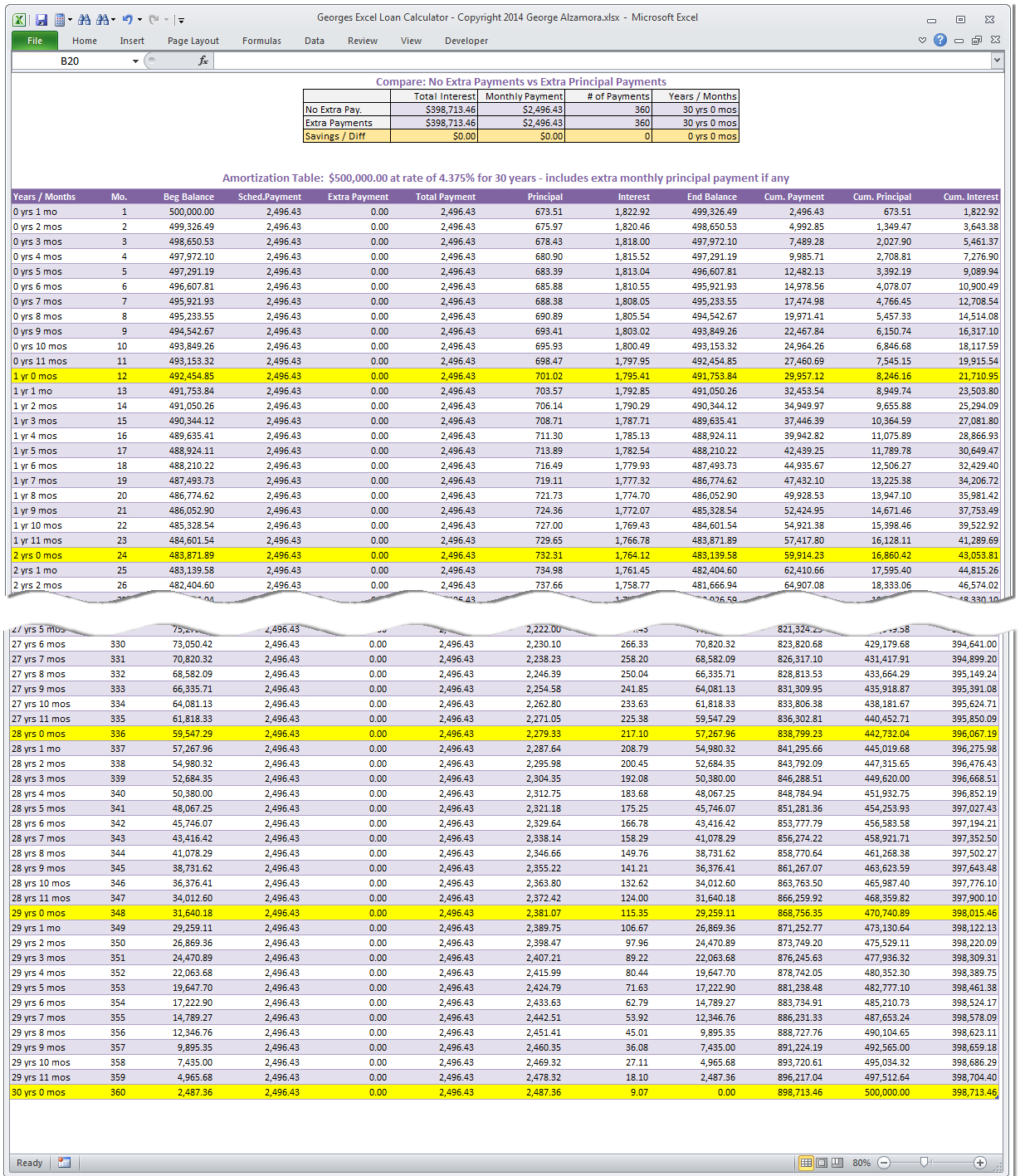

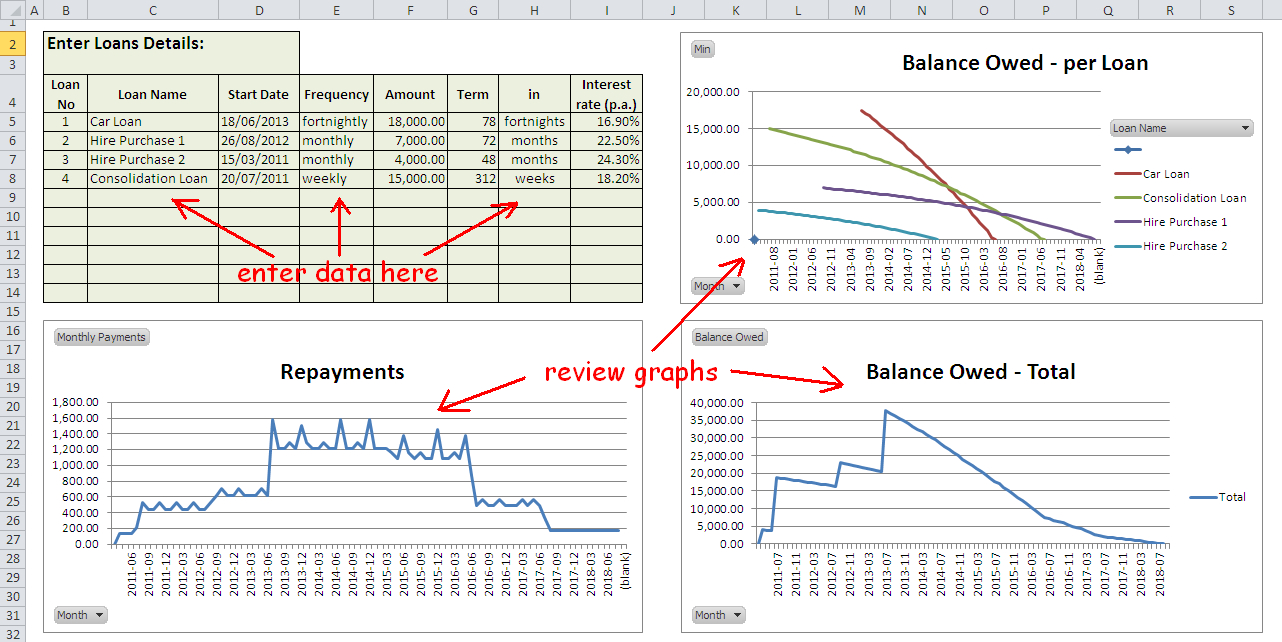

Secondly, there is the fact that you can use a mortgage amortization calculator to find out how much your mortgage payment will be for each payment cycle. You can then use this information when you start looking at your mortgage options, to figure out whether it is more beneficial to refinance or get a better mortgage loan.

Lastly, you can use a mortgage amortization calculator to work out what your monthly payment will be for a traditional home loan as well. It is possible to use this information to help you work out the best mortgage plan for your situation. This is particularly useful if you are already a homeowner, or you already have a large mortgage payment that is going to be difficult to reduce.

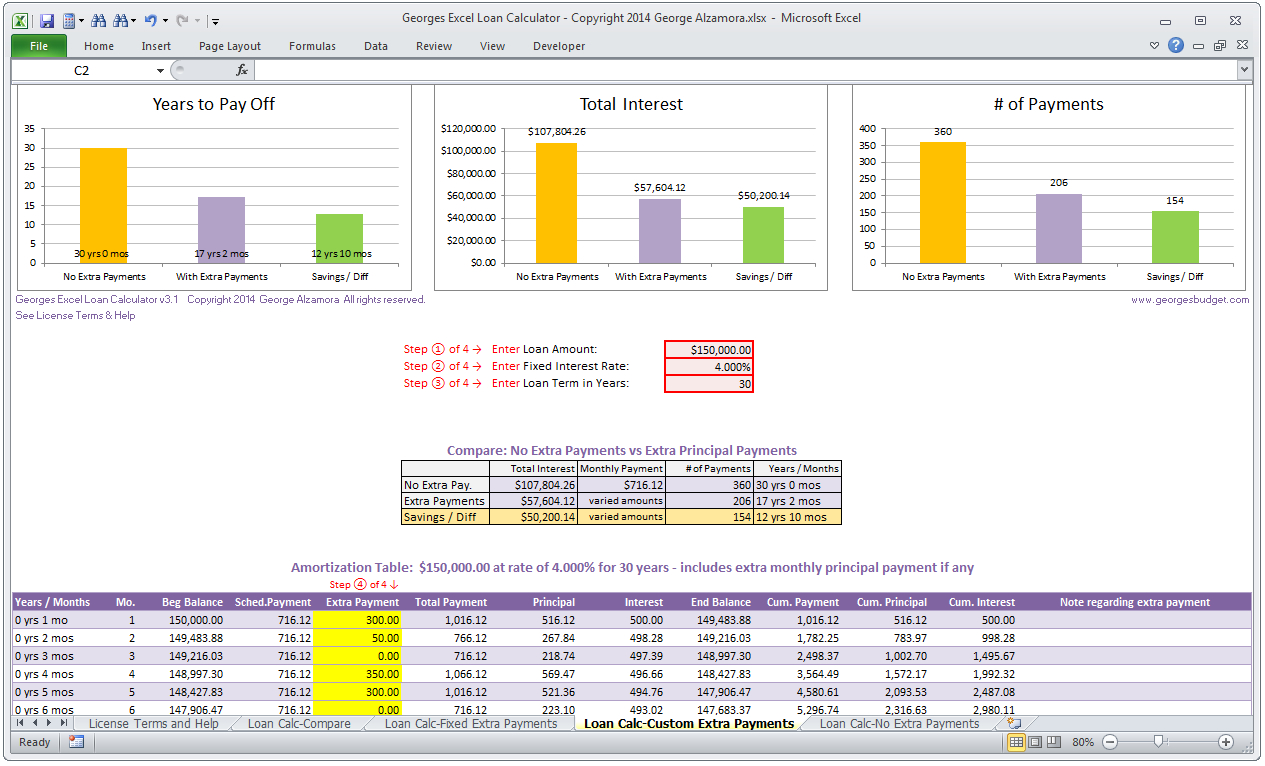

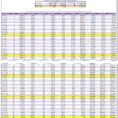

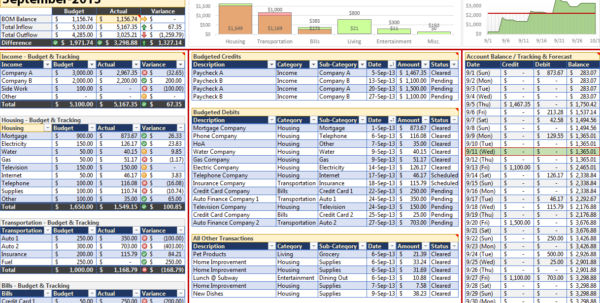

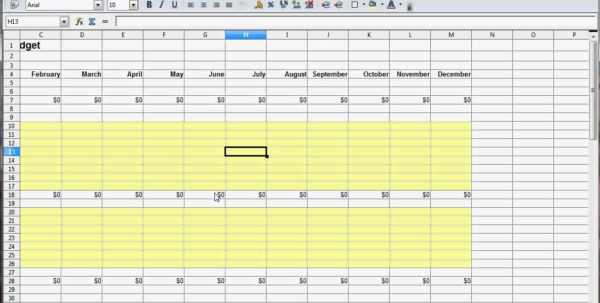

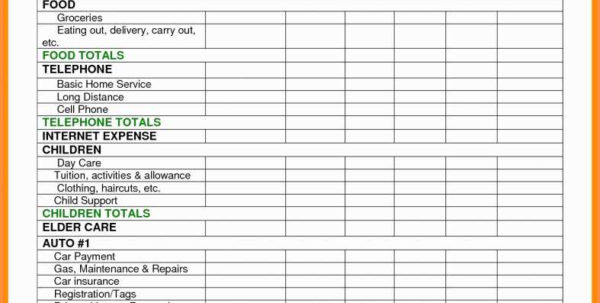

Using a mortgage amortization calculator is simple and easy to do. You need to fill in the following information: The number of months you want the calculator to run for, the number of payments you are making now, and the number of payments you are making for your existing mortgage loan.

Once you have filled in these three pieces of information, the mortgage amortization calculator will display the mortgage payments that you will be paying every month for the next two years. The calculator will give you a breakdown of the amount that each payment will cost you. This can be helpful in many ways.

Firstly, you can then figure out how much you are going to need to save each month to help you reduce your monthly mortgage payment. You can see how much your existing mortgage loan is costing you and see what you can do to reduce that cost. This way, you can see how you can get a lower interest rate and a lower monthly payment, without any added fees, penalties or taxes.

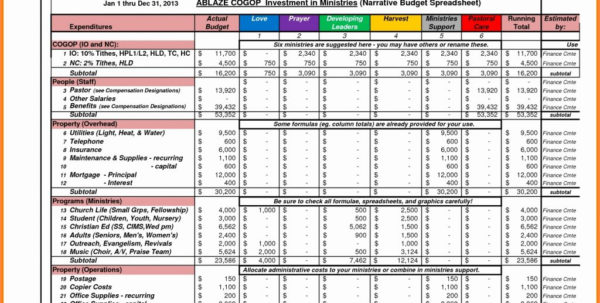

Secondly, the mortgage amortization calculator can be used to help you find out which mortgage loan will be the best for you, as far as the amount you are going to need to save each month to cover the monthly mortgage payment. This can also be helpful in figuring out what type of loan you need to have for the mortgage that you want. This can also help you when you are looking at refinancing or trying to decide which mortgage loan to choose.

Finally, the mortgage amortization calculator can be used to help you calculate the total cost of your mortgage, including any costs that you will be paying each month for additional costs. If you can help it, always try to pay your mortgage for the life of the loan, so that the lender will be able to calculate the total monthly payment over the life of the loan.

It can be a little bit frustrating, to be sure, to find yourself having to use a mortgage amortization calculator. However, if you use this tool to figure out which mortgage loan is best for you, you will be able to quickly determine the different options that are available to you, and be able to compare them in order to find the right mortgage loan.

When you are working with a mortgage amortization calculator, it is important to keep a few things in mind. The most important of these is that the amount that you are trying to figure out will change over time, and that you should not try to use the same monthly payment amount for each mortgage loan.

Also, there is a general rule that you should never try to use the same interest rate for each mortgage. loan. This can mean that you have to change your mortgage payment rate each month, instead of just switching out the mortgage. SEE ALSO : college application checklist spreadsheet